Introduction

In light of the shifting international tax landscape, businesses are focusing on establishing economic substance, cautiously considering the jurisdictions they operate from in order to safeguard their interests.

Cyprus' strategic location, full EU membership, developed legal system, competitive corporate income tax rate of 12.5%, well-educated workforce and business-friendly environment make Cyprus an ideal country to establish business presence.

In addition to the above, Cyprus offers a number of personal tax incentives that aim to attract multinational companies to relocate key personnel to perform their duties from Cyprus. The tax incentives also appeal to high-net-worth individuals who are willing to relocate to Cyprus.

Below, we present an overview of Cyprus' personal tax regime as well as the key tax benefits provided to expatriate individuals relocating to Cyprus.

Personal Taxation

Personal taxes and contributions

The main types of direct taxes applicable to an individual in Cyprus are:

- income tax

- special defence contribution on dividend, interest and rental income

- capital gains tax on gains from the sale of Cypriot real estate

An individual working in Cyprus is also subject to social insurance and other contributions.

An individual is subject to income tax and/ or special defence contribution depending on his/her tax residency and domicile status, a concept introduced in the Cyprus tax law in July 2015.

Tax residency

An individual who spends more than 183 days in Cyprus is a tax resident of Cyprus. As from 1 January 2017 an individual can be a tax resident of Cyprus even if he/she spends less than or equal to 183 days in Cyprus provided that he/she satisfies all of the following conditions within the same tax year (1 January – 31 December):

- does not spend more than 183 days in any other country;

- is not a tax resident of any other country;

- spends at least 60 days in Cyprus;

- maintains a permanent home in Cyprus that is either owned or rented;

- carries on a business in Cyprus, is employed in Cyprus or holds an office in a Cyprus tax resident person at any time during the tax year.

If the employment/business or holding of an office is terminated during the year, then the individual would cease to be considered a Cyprus tax resident for that tax year.

Domicile

An individual's domicile is that of his/ her father's domicile (at birth) or that of his/her choice. Therefore, an individual born to a non-Cypriot domiciled father is considered to be non-domiciled in Cyprus. However, a non-domiciled individual may be deemed as domiciled in Cyprus if he/ she has been a Cypriot tax resident for at least 17 out of the last 20 years prior to the relevant tax year. An individual born to a Cypriot domiciled father may also qualify as non-domiciled in Cyprus subject to certain conditions.

Taxable income

A Cypriot tax resident individual, irrespective of his/her domicile status, is subject to income tax on his/her worldwide income, subject to exemptions.

A tax resident individual who is non-domiciled in Cyprus is exempt from tax on dividend and interest income.

A non-Cypriot tax resident individual is subject to income tax on income accruing or arising only from sources within Cyprus and is exempt from tax on dividend and interest income.

Personal income tax rates

Taxable income up to €19,500 is effectively exempt from income tax. Taxable income exceeding this amount is subject to progressive income tax rates ranging from 20% to 35% (for income exceeding €60,000).

Key Tax Benefits for Expatriate Individuals

Income tax exemptions for taking up employment in Cyprus

An expatriate individual relocating to Cyprus (irrespective of his/her tax residency or domicile status) is eligible to one of the following income tax exemptions on employment income:

- 50% of the remuneration from any

employment exercised in Cyprus by an individual who was resident

outside Cyprus before the commencement of his/her employment in

Cyprus. The exemption applies for a period of ten years starting

from the first year of employment provided that the employment

income of the employee exceeds €100,000 per annum.

The 50% tax exemption would not be granted to an individual who has been a Cypriot tax resident for at least three out of the last five years immediately prior to the year of commencement of employment or to an individual who has been a Cypriot tax resident in the tax year immediately prior to the year of commencement of employment. - 20% of the remuneration or €8,550 (whichever is the lower) from any employment exercised in Cyprus by an individual who was resident outside Cyprus before the commencement of his/her employment in Cyprus. The exemption applies for a period of five years from 1 January following the year of commencement of the employment and applies for tax years up to 2020.

Income tax exemption for overseas employment

Remuneration from rendering services outside Cyprus to a non-resident employer or to an overseas permanent establishment of a resident employer for more than 90 days in a tax year is exempt from income tax.

Low social insurance contributions

Employees and employers are subject to social insurance contributions at the rate of 7.8% and 9.5% respectively, on the employees' gross employment income, subject to an income ceiling. Furthermore, employers are subject to an additional 2% contribution calculated on the employees' gross employment income. An exemption from contributing to the Cyprus social insurance scheme may be granted for a period of time to qualifying expatriate EU nationals that take up employment in Cyprus.

No tax on dividend and interest income

A non-domiciled individual, irrespective of his/her tax residency status is exempt from tax on dividend and interest income.

No tax on gains arising from the disposal of investments

Any gains arising from the disposal of shares, bonds and other similar financial instruments (including options and rights thereon) are exempt from tax.

Nil/reduced withholding tax on income received from abroad

Cyprus is a party to more than 55 tax treaties that provide for nil or reduced withholding tax rates on dividends, interest, royalties and pensions received from abroad.

No tax on retirement gratuity and special tax regime on foreign pension income

Any lump sum received as a retirement gratuity is exempt from tax.

Furthermore, a Cypriot tax resident individual receiving pension income from services rendered abroad may choose to be taxed at a flat rate of 5%, on amounts exceeding €3.420 per annum.

Exemption from capital gains tax (CGT) on sale of real estate

Gains arising from the disposal of non- Cypriot real estate are exempt from CGT.

Estate duty, wealth tax, gift tax and inheritance tax

There is no estate duty, wealth tax, gift tax or inheritance tax in Cyprus.

Sample Personal Tax Computation

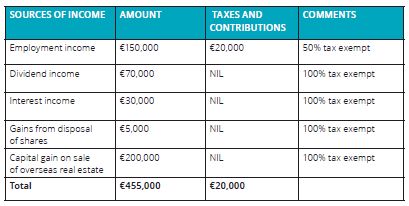

To numerically demonstrate the tax benefits available to qualifying expatriate individuals relocating to Cyprus, we calculate below the Cypriot tax liability of a Cypriot tax resident non-domiciled individual who takes up employment in Cyprus, earns income from investment sources and realizes a capital gain on the sale of real estate situated overseas.

An individual with the above profile would be liable to total Cypriot taxes and contributions of approximately €20,000 arising on his/her employment income. His/her investment income would be fully exempt from tax in Cyprus.

Find Out More...

Where an individual is considering relocating to Cyprus, bespoke advice should be obtained on both the Cypriot as well as the cross border tax implications of such relocation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.