- within Consumer Protection topic(s)

- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

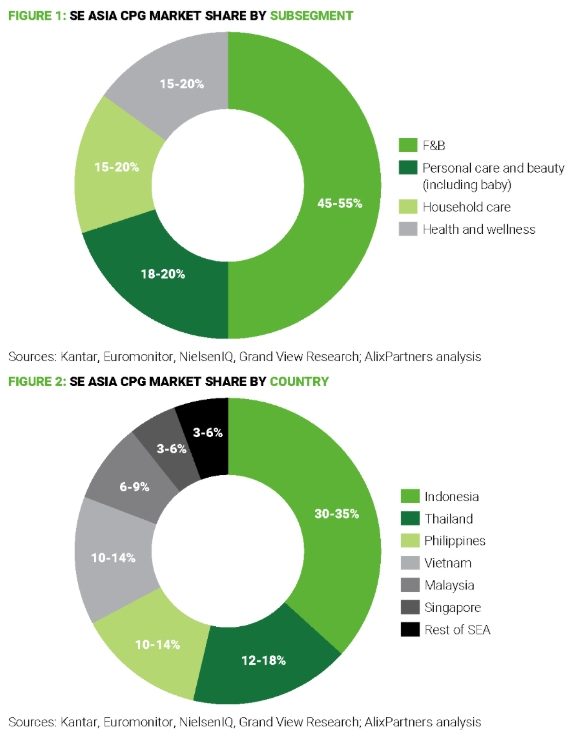

Valued at between USD 300–400 billion and with a projected compound annual growth rate of 3-5% over the next five years, Southeast Asia's (SE Asia) Consumer-Packaged Goods (CPG) market presents one of the sector's best growth opportunities globally1, 2.

Food and beverages are driving this CPG momentum across Indonesia, Vietnam, the Philippines, Thailand, Malaysia, and Singapore. At the same time, demand for premium categories—such as health-focused nutrition, beauty, and skincare—is being fueled by a growing number of affluent, urban consumers, while emerging niches like pet care are scaling rapidly thanks to shifting lifestyles across the different countries.

Operational unlocks needed along the value chain

Beneath the growth headlines are significant challenges across CPG value chains in the region's fragmented markets. Country-specific nuances add layers of complexity for multinationals: Indonesia's large population brims with potential but retailers have to grapple with acute price sensitivity and the dominant position local brands hold.

There's also more competition now from agile local and Chinese entrants, gaining market share from global multinationals through aggressive pricing, tailored pack sizes, influencer-led digital campaigns, and efficient last-mile delivery.

Consumer behavior has become increasingly polarized, as shoppers upgrade in categories like beauty or health while trading down on staples to manage tight budgets.

In this complex and fast-moving environment, operational excellence across the value chain—from product design to customer loyalty—is no longer optional but essential. A few operational challenges that need to be addressed include:

Product design and pricing

Cultural and socioeconomic factors create diverse consumer preferences across the SE Asia region, and fragmented markets drive a need for packaging variety, from premium designs for high-end segments to smaller, affordable sachets targeting lower-income consumers.

In Malaysia, beauty brands face premium pricing pressure from the rise of Chinese beauty competitors, with localized packaging used to maintain market share and margins.

The levels of market competition vary across SE Asia, which makes consistent and relevant pricing operationally complex. CPG firms must design products with varied pack sizes, tiered pricing (based on cross-channel benchmarks) and value propositions that align with local tastes and budgets.

Procurement and sourcing

Approximately 50-80% of F&B product costs can be driven by raw materials and packaging. Multinational companies (MNCs) benefit from extensive scale and empaneled sources for raw materials, yet they often struggle to compete with local brands on unit costs. This highlights opportunities to optimize procurement strategies, rationalize supplier requirements, and evaluate the balance between sourcing locally versus regionally or globally. In emerging markets like Indonesia, customers may place less emphasis on the entire supply chain's ESG compliance or the traceability of organic raw materials.

Supply chain and procurement model decisions, therefore, need to be aligned closely with the customer proposition and monetizable differentiation. We undertake a number of Design To Value (DTV) and sourcing engagements, helping clients arrive at competitive product offerings in CPG.

Supply chain and logistics

CPG firms face volatility in sales and stock. This volatility has been driven by the shift to e-commerce and social commerce platforms—such as TikTok Shop—and trend-driven spikes that can occur.

Challenges around stockout and overstocking risks around demand spikes are most acute in fast-moving perishables such as dairy and fresh produce subsectors. There is also the phenomenon of overstocking by retailers in anticipation of higher buying during festive seasons, such as Ramadan in Indonesia, that has resulted in large-scale product waste3.

Agile and accurate inventory management and precise demand forecasting drive profitability and reduce waste, but skill shortages in supply chain analytics create implementation challenges in driving manufacturing efficiencies.

Most of the region's logistics infrastructure is still underdeveloped, leaving rural and emerging markets underserved. Across SE Asia, port congestion often delays deliveries, and inadequate cold-chain facilities create food spoilage risks.

An increase in the frequency of out-of-stocks at e-commerce channels such as Shopee and Lazada—driven by inaccurate demand planning—has led to lost sales and customer dissatisfaction.

This high cost-to-serve combines with relatively expensive distribution operations, which are affected by fuel price volatility and low levels of warehouse automation. Therefore, driving operational efficiencies across the supply chain, in our view, is the highest priority area for CPG companies across the value chain.

Manufacturing

Manufacturing for most CPG products has already been automated, except for apparel, where it is still labour-intensive. The key unlock here is figuring out the right in-country model—use of contract manufacturing vs. in-house for the products.

We have seen a large global player take a segmented manufacturing model where the products and sizes targeting the price-sensitive segments in the Indonesia market are manufactured in China. On the other hand, they have also established Centers of Excellence for each product category within the SE Asian countries where they are manufactured at scale. Arriving at such manufacturing architecture requires considerable modeling and capabilities to manage the complexity.

Sales and distribution

Retail structures put pressure on margins, even as the CPG market grows. Online, marketplaces like Shopee, Lazada, and TikTok Shop foster a "discount-first" culture, pushing brands toward heavy promotional pricing, while franchise-heavy shop networks struggle to maintain standardized service levels.

Traditional trade channels, largely managed by distributors, are opaque, creating a "black box" where valuable data on consumer behaviour and sales performance is underutilized. In Indonesia, Unilever has faced issues in pricing, product range, and distribution due to a lack of visibility in emerging channels. These channels could provide a competitive edge through local preferences and demand patterns. Therefore, having the right sales and distribution architecture that delivers the right capillarity at the right commission structure is needed. CPG brands are increasingly exploring the direct-to-consumer (DTC) e-commerce channel, which requires careful ringfencing with the traditional channels driving the bulk of the revenues. The DTC channel needs to be seen not as a cost-saving mechanism but for directly understanding the customer preferences and for having control over brand positioning.

How technology can also unlock value

Technology tools are no longer just efficiency levers; they are becoming core to competitiveness and long-term resilience. From supply chain optimization to personalized consumer engagement, technology is reshaping every segment of the CPG value chain in SE Asia, with use cases that brands can design, test, and operationalize.

Product design and pricing

Technology offers opportunities to better understand preferences, target specific consumers, and tailor product ranges:

- Generative AI (Gen AI) tools can unlock multi-lingual market research and sentiment analysis. In Malaysia, for example, where Bahasa Melayu, Mandarin, Cantonese and Tamil is used, insights can be efficiently extracted from diverse sources, from TikTok to call center transcripts.

- Micro-segmentation—using socio-demographic data, point-of-sale data (where available), inventory movement patterns, and proxy correlations with other data sources—generates actionable insights to tailor SKUs.

- Store video analytics—where CPG companies stock shelves and run promotions—can play a substantial role in ascertaining customer preferences.

Procurement and sourcing

The digital use cases here are very mature and offer a high and immediate ROI. While we see most MNCs having the tools, the mid-sized and local CPG companies are yet to adopt and drive the gains. eAuction tools, spend analytics, sourcing process management, supplier relationship management solutions, and contract management tools are considered table stakes at MNC organizations, given the strong governance mechanisms in place. On the other hand, there are several emerging Gen AI and Machine Learning solutions that all players should consider, including:

- Should-cost modelling tools that track live commodity prices, import duties, and shipping costs. AlixPartners' proprietary Global Trade Optimizer (GTO) solution goes a step further and ascertains the manufacturing costs for a set of SKUs based on standard libraries

- Should-price tools that can quickly learn the historical prices paid and predict the cost for new variations in material compositions

- GenAI tools that conduct supply market assessment, identify levers, and size the prize, as well as agentic AI solutions that orchestrate the sourcing process.

Supply chain and logistics

A combination of technology tools can be implemented in supply chain and logistics to deliver tangible benefits, enabling retailers and brands to have the right product at the right place at the right time.

- A supply chain control tower can use IoT GPS trackers and API integration to gain greater visibility on cross-border material movements and on port congestion. A control tower can also help run scenarios to optimize product costs and adjust product pricing based on changes in commodity sourcing locations.

- IoT-based telematics optimize delivery routes, monitor driver behavior, and lower fuel costs. Through temperature control and telemetry, IoT can also help ensure the integrity of cold chains, delivering fresher products and timely arrivals. Distribution challenges mean investing in the right technology here that can yield faster stock replenishment and improved margins—a healthy return on investment.

Manufacturing

In the fast-paced world of CPG manufacturing, technological approaches like AI and machine learning can help manage volatility and improve productivity on production lines to drive higher productivity and lower operational costs.

- Machine learning and advanced data infrastructure add new functionality and better accuracy to demand forecasting. Manual data handling and processing reliant on spreadsheets can be replaced by the ability to capture and process unstructured data using Gen AI, adding a new depth to forecasting. With more sophisticated machine learning (ML) algorithms and computing power, granular trends can be analyzed for categories like snacks and beauty.

- IoT sensors, video analytics, cloud-based analytics, and ML can help reduce overall downtime and ensure quality products leave the factory floor.

Sales and distribution

Technology can be used to improve visibility and enable CPG firms to gain insights on highly important go-to-market channels.

- Many CPG firms are considering engaging smaller retailers—such as sari sari and warung stores—directly bypassing the distributors, while others are establishing a direct-to-consumer model to balance the growing clout of e-commerce channels. Simple mobile apps offering ordering, delivery status, promos, and brand loyalty features can provide a high level of engagement and a lower cost to serve.

- GPS tagging of outlets (where there is high density), combined with simple analytics, allows for territory planning using real-time insights into distributor performance, stock, and secondary sales.

Considerations for tech investment

The nuances across SE Asian markets are significant, as set out above. Hence, a regional approach to technology modernization is recommended. In addition to common considerations such as data quality, regulatory policy variations, and capability requirements, there are a few region-specific considerations:

- 70-80% of trade is still through traditional channels, however e-commerce channels are wielding more power and have high expectations of digital enablement. Investment should be balanced to meet the needs of the overall consumer base.

- A value and operational lens is needed to ensure technology delivers tangible results and is cost-effective. Case in point: blockchain technology failed to deliver the business case in CPG and retailing in emerging markets, as the costs outweighed the premium customers were willing to pay for traceability.

- Technology such as geo-analytics, telemetry, and ML can all be constrained by the variable infrastructure readiness across SE Asia.

Conclusion

Capturing the benefits from operational efficiencies and technology modernization requires more than following an HQ template on use cases and delivery models. Instead, a value-oriented, "zero-based" approach—justifying all costs—and rapid testing of concepts offer the greatest potential to deploy technology that can unlock the potential in SE Asia's CPG sector.

Footnotes

1. https://www.kantar.com/inspiration/fmcg/fmcg-in-asia-ends-2024-on-a-strong-footing-growing-2-7

2. https://www.statista.com/outlook/io/manufacturing/consumer-goods/southeast-asia

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.