- within Intellectual Property topic(s)

- in United States

- within Intellectual Property topic(s)

- in United States

- with readers working within the Accounting & Consultancy, Technology and Pharmaceuticals & BioTech industries

As Chinese manufacturers now control over 60% of global LCD production capacity (Omdia, 2024), the focus has increasingly shifted toward OLED technologies, where intellectual property (IP) challenges are becoming more pronounced. Recent patent lawsuits filed by Samsung and LG against BOE and Tianma demonstrate Korea's strategic use of IP to gain leverage in high-end displays. As the industry transitions to OLED and MicroLED technologies, China's shift from manufacturing dominance to technological leadership depends on overcoming significant patent challenges.

1. LG Display v. Tianma Microelectronics: Patent Litigation Analysis

On June 13, 2025, LG Display filed a patent infringement lawsuit against Tianma Microelectronics at the U.S. District Court for the Eastern District of Texas (Case No. 5:25-cv-00078). This lawsuit marks the conclusion of fourteen years of unfruitful licensing negotiations that started in 2001, when LG and NEC first entered into an LCD patent cross-licensing agreement.

The 2011 transfer of NEC's 70% stake to AVIC, which placed NLT under Tianma's control, disrupted the subsequent licensing frameworks. Key negotiation breakdown factors included:

- Management turnover at both corporations;

- Disputes over OLED patent royalty rates;

- Territorial restrictions in draft agreements.

Notably, the asserted patent portfolio comprises seven patents: four covering LCD technologies and three protecting OLED innovations. This litigation marks intensified competition among Asian panel manufacturers since Samsung's 2022 patent dispute with BOE.

2. Tianma Microelectronics' IP Risk Management Evolution

The LG litigation represents another chapter in Tianma Microelectronics' ongoing IP challenges. As a significant player in the China-Japan-Korea panel patent landscape, Tianma's history of disputes with Japan Display (JDI) highlights the competitive intensity within the industry. Below is a chronological analysis of Tianma's strategies for managing IP risks:

2016

- Filed inter partes review (IPR) against JDI & Panasonic's US7718234B2 (LCD liquid crystal orientation).

- Successfully invalidated select claims.

- Reached settlement through licensing negotiations (2022).

2018

- Collaborated with Xiaomi and CSOT to challenge Semiconductor Energy Laboratory's DE112012000828B4 (OLED emissive materials).

- Achieved complete claim invalidation.

2020

- Faced parallel infringement suits from JDI & Panasonic in U.S. and China (mobile/PAD panels).

- Countered with:

- S. IPR filings against asserted patents.

- Chinese infringement actions and invalidation petitions.

- Partial claim invalidations secured.

- Finalized cross-license agreement (2022).

2021

- Filed invalidation request against Baotugu Chemical's CN104508081B patent for OLED hole transport materials.

- Obtained full claim invalidation.

2022-2025

- Participated in IPR proceedings against Samsung Display's U.S. patents asserted against BOE.

- Filed multiple IPR petitions.

June 13, 2025

- LG Display initiated seven U.S. infringement actions against Tianma (LCD/OLED technologies).

Past cases demonstrate that Tianma Microelectronics has adopted a proactive risk management strategy in its patent battles with Japan Display Inc. (JDI). The company not only identified potential risks in key technologies at an early stage, but also took the initiative to mitigate those risks through invalidation actions and opposition proceedings. These cases have provided Tianma with substantial experience in navigating IP disputes. In its ongoing litigation with LG Display, the company is expected to maintain this proactive approach. More broadly, as China and South Korea compete in display technologies, Chinese panel makers are leveraging systematic patent strategies to break through barriers—positioning themselves to gain the upper hand in this evolving technological contest.

3. Display Technology Evolution: LCD to OLED Market Realignment

LCD, OLED, and MicroLED represent the three primary directions in the evolution of display technology. LCDs maintain a dominant position in the mid- and low-end markets due to their cost advantages and continuous technological improvements. Upgraded technologies, such as MiniLED backlighting, have alleviated the pressure for their replacement, further solidifying China's position as the industry leader.

OLED, meanwhile, has become the dominant technology in high-end applications, including mobile phones, televisions, and automotive displays, thanks to its self-illuminating properties and flexibility. The development of printing technology has significantly reduced costs, driving the wider adoption of OLED in medium-sized displays.

MicroLED is leading in performance, particularly in ultra-high-end televisions, AR/VR, and other advanced applications. However, the technology faces substantial challenges, including complex transfer, detection, repair processes, and high production costs. As a result, it is primarily used in niche segments for the time being. Nevertheless, MicroLED is expected to emerge as the ultimate display technology in the long run as these technical bottlenecks are overcome.

Over the next decade, these three technologies will coexist, gradually replacing each other in various market segments, creating a dynamic pattern of " multi-dimensional coexistence and progressive substitution." China has already secured a dominant position in both LCD and OLED production capacities, while MicroLED still needs to overcome bottlenecks in technology integration and industrial chain coordination.

With major Japanese and Korean companies shifting their focus from LCD production to OLED products and technology upgrades, intellectual property risks surrounding OLED products are expected to increase. This shift signals the growing importance of IP management in the evolving display technology landscape.

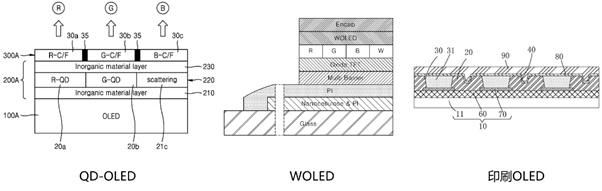

- OLED Technology Production Process

In the OLED production process, global companies are primarily divided into two camps: "evaporation" and "printing." LG Display, Samsung, and several domestic manufacturers have adopted the evaporation method. This method requires three evaporation steps and pixel alignment for creating RGB three-primary screens, and also faces challenges in manufacturing large-size masks. To address these issues, major panel manufacturers have made process improvements.

Figure 1 OLED process route

For instance, in Figure 1, Samsung has developed QD-OLED technology based on the evaporation process, where only the blue light layer requires the evaporation process, simplifying production and improving luminous performance. Currently, this technology is primarily used in large-size products, with small-size QD technology still under development. LG Display focuses on large-size OLEDs, utilizing white OLED (WOLED) technology with a color filter to avoid mask alignment issues. Additionally, in 2019, LG Display achieved the industry's first stacked OLED commercialization, which significantly improved both the lifespan and brightness of OLED displays.

TCL CSOT has independently developed the OLED printing process and strengthened its R&D and production capabilities through collaboration with JOLED. This process involves spraying raw materials directly onto the substrate using printing grooves, eliminating the need for a vacuum environment and costly masks. This innovation reduces material loss, addresses uneven deposition issues, and lowers production costs by 30%, contributing to the wider adoption of OLED displays. This process is now applied across a full range of OLED products, from 6.5-inch mobile phone screens to 65-inch 8K televisions.

- Technological Advancements in Driver Circuits and Backplanes

In addition to the OLED production process, driver circuits and backplanes are also critical technologies for achieving high-performance displays. The global competitive landscape is currently dominated by Japan and South Korea, with China catching up rapidly. These countries have accumulated advanced patents in areas such as driver ICs and high-end backplane technologies.

Korean companies have a significant advantage, controlling over 70% of the OLED driver IC market. Meanwhile, Chinese companies are accelerating breakthroughs through self-development and joint ventures, although they still rely on imports for high-end driver IC designs. In the future, with the integration of technologies and intensifying competition in Mini/MicroLED, domestic substitution will likely accelerate, reshaping the global panel industry chain.

In backplane technology, Samsung and LG Display dominate the LTPS (Low-Temperature Polycrystalline Silicon) technology used in high-end OLED displays, but large-scale production remains limited. Chinese companies like BOE are catching up, while TCL CSOT and Sharp are leading in the OLED printing field with oxide backplanes. Samsung leads in advanced LTPO (Low-Temperature Polycrystalline Oxide) backplane technology, and while LG Display has considerable technical expertise, domestic companies are still advancing in R&D but lack mass production capabilities.

- OLED Key Materials and Market Dynamics

In the realm of OLED key materials, overseas companies have historically dominated both technology and markets, benefiting from their first-mover advantage and long-term investment. However, China has made rapid progress in recent years, achieving breakthroughs in several areas and demonstrating strong momentum in catching up. Despite this, China still relies heavily on imports for organic luminescent materials, transmission materials, electrode materials, and high-end packaging materials. Companies in the United States, Japan, South Korea, and Europe maintain monopolies in their respective sub-sectors, and Chinese companies still face significant gaps in core technologies and patent development.

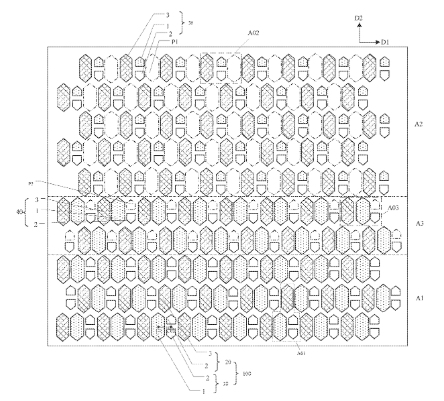

Figure 2 US12307976B2 Patent attached

- Panel Application Technology and Future Trends

Additionally, panel application technology focuses on form innovation, interactive integration, and scene customization. Form innovation includes flexible folding, curling, telescoping, and special-shaped screens. Interactive integration encompasses under-screen sensing, touch integration, and other advancements. Scene customization targets specific sectors, such as automotive, healthcare, and AR/VR, meeting diverse needs through integrated materials, structures, and algorithms.

In international competition, companies like Samsung have leveraged their first-mover advantage to dominate patents and market leadership in areas like flexible folding and interactive technology. However, domestic companies have made significant progress, achieving breakthroughs in mass production of flexible OLEDs and narrowing the gap in sub-sectors such as special-shaped screens and under-screen sensing. Notably, Chinese companies have excelled in customizing solutions for specific scenarios, such as in-vehicle displays and medical applications, thanks to their ability to respond quickly to local demand.

In May 2025, Samsung filed a patent infringement lawsuit against BOE in the United States, claiming violations related to under-screen camera technology. The four patents in question are related to the technology for increasing the screen-to-body ratio by reducing pixel density at the camera location. This lawsuit reflects the ongoing competition between panel manufacturers in this technological field.

4. Response to Intellectual Property Risks in Panel Enterprises

- IP Risks of Chinese Panel Companies

China's LCD industry has transitioned from relying on imported technology to achieving independent leadership, marking a major milestone in its development. Early in the development process, Chinese companies accumulated technology and intellectual property through strategic collaborations with Japanese and Korean companies (e.g., BOE's acquisition of Hyundai LCD technology, patent transfers between TCL CSOT and Samsung, and patent cross-licensing with Tianma Micro and JDI). Today, major Japanese and Korean companies have largely exited the LCD production sector, significantly reducing the intellectual property risks faced by Chinese manufacturers in this area.

However, in the high-end display technology market, South Korea's Samsung and LG Display continue to dominate, largely due to their strong patent portfolios in OLED and MicroLED technologies. Since 2022, Samsung has initiated multiple patent litigations and ITC investigations against BOE, alleging patent infringement and trade secret theft. This shift signals that Korean companies are increasingly strengthening their IP defense strategies in response to China's growing competitiveness.

Despite significant progress in developing robust patent portfolios in the OLED sector, Chinese companies must continue to be vigilant in addressing potential IP risks. This requires a more strategic approach to patent management, including systematic patent layouts and comprehensive risk assessments. Chinese manufacturers should focus on building targeted patent "weapon" packages and developing proactive risk response plans to safeguard their market positions.

- IP Risk Management Pathways: A Perspective on Industrial Collaboration

In the preliminary lawsuit between Samsung and BOE, it is noteworthy that BOE and domestic companies successfully initiated an invalidation petition regarding Samsung's related patents. This effort fully demonstrates the coordinated actions of Chinese display companies in combatting intellectual property risks. Moving forward, we expect domestic companies to continue collaborating closely, gathering collective industrial efforts to overcome technical barriers.

Intellectual property integration and industrial collaboration can be strengthened in two key areas: First, by promoting closer cooperation between panel manufacturers, chip developers, materials companies, and downstream applications. This will accelerate the domestic substitution process across the entire industrial chain while also forming a systematic intellectual property rights layout to avoid being subjected to foreign patent barriers. Second, Chinese companies can learn from the development of the LCD industry, engaging in intellectual property acquisition and licensing cooperation by targeting the docking of global technical resources, such as those from Japanese companies and overseas research institutions that are gradually withdrawing from the panel industry. For example, Samsung has obtained OLED core patents from U.S. companies like Orthogonal, eMagin, and Germany's Cynora GmbH through investment and acquisitions. Chinese companies can adopt a similar strategy to quickly strengthen their intellectual property capabilities.

- Empowerment and Support of IP Services Throughout the Entire Chain

As a leading professional service institution deeply embedded in the field of IP, PurpeVine IP Group has consistently embraced the mission of empowering global innovation and is committed to becoming a trusted IP solution partner for innovative enterprises worldwide. With its extensive experience and expertise in patent analysis, layout, licensing operations, and litigation, PurpeVine has developed a comprehensive service system covering the entire intellectual property lifecycle.

In the international competition against patent barriers set by global giants in the panel industry, PurpeVine is ready to leverage its professional strengths to partner with domestic companies, helping them break through intellectual property challenges and advance their global competitiveness.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.