- within Antitrust/Competition Law topic(s)

- with readers working within the Retail & Leisure industries

Day and night, new reports on alleged wrongdoings of individuals and organizations become public. Some allegations provide indications to financial institutions regarding their customers' financial crime and reputational risks. Against this background, Adverse Media Screening (AMS), also known as negative news screening, is widely regarded as a critical measure of Customer Due Diligence (CDD) in financial institutions. AMS brings to light information about a customer's behavioral aspects and is especially useful when dealing with high-profile individuals and organizations.

Regulators' expectation

Regulatory agencies, standard-setting organizations, and industry associations around the globe welcome AMS for risk assessment. Even though many regulators do not mandate AMS, they recommend its application for higher-risk customer profiles.

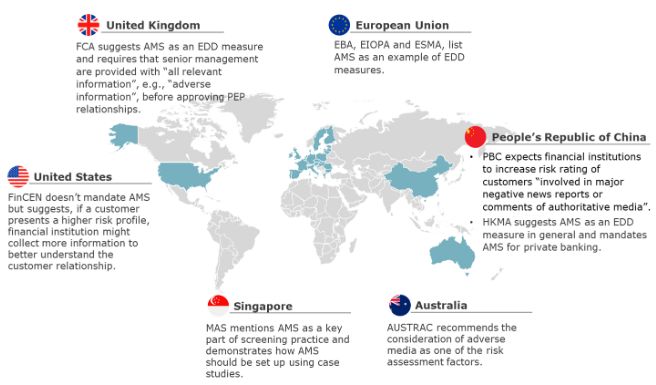

FIGURE 1: REGULATORY REQUIREMENTS OF ADVERSE MEDIA SCREENING IN SELECTED REGIONS

The Financial Action Task Force (FATF) recommends carrying out "verifiable adverse media searches" to inform customer risk assessments as one example of Enhanced Due Diligence (EDD) measures.

Leading global financial hubs have committed to the FATF Recommendations. It is unsurprising, therefore, that many financial regulators, e.g., in the European Union, the United States, and Australia, have included similar guidance for AMS in their local policies and guidelines. In some regions, local regulators have clearer, more explicit rules or have demonstrated more substantial indications for applying AMS. For example, Hong Kong Monetary Authority (HKMA) mandates AMS in private banking. The Financial Conduct Authority (FCA) in the United Kingdom requires that senior management should be provided with "all relevant information, e.g., adverse information", before approving PEP relationships. The Monetary Authority of Singapore (MAS) includes case studies to demonstrate how AMS should be set up in its information paper "Strengthening AML/CFT Name Screening Practices ." (Please refer to the appendix for specific AMS regulations.)

Recognizing the value of negative news in risk assessment and the regulators' expectations for AMS, there seems to be little doubt that multinational financial institutions are recommended to integrate appropriate AMS measures during onboarding and ongoing review of customer relationships.

Managing AMS: four key takeaways

For implementing or enhancing AMS, we have four recommendations for financial institutions.

- Avoid ambiguity in risk appetite and its top-down communication. Many financial institutions have already put AMS in place. Yet, the compliance function sometimes faces challenges to make operative decisions when configuring AMS solutions and setting governance and procedures around it. The primary root cause is that the compliance officers do not fully understand the expectation of their top management. What is the management's risk appetite? Is the compliance program expected to fulfill minimum regulatory requirements, meet the industry standards, or lead the peer benchmark? To what extent should differences between business divisions, client groups, and international branches be accommodated? Adverse media is not a zero-tolerance control. Regulators leave more room for interpretation regarding AMS compared to sanctions and PEP screening. Management is strongly recommended to clearly define expectations concerning the risk tolerance of the institution. It builds the foundation for good risk management.

- Find the right balance of unifying and diversifying AMS. Auditors or regulators often question heterogeneous AMS solutions and configurations in branches across business units, or in first and second lines of defenses. One reason is because negative news alerts may not be consistently generated within the organization. In addition, diverse solutions also lead to complexities and higher operating costs for the compliance function to enforce screening standards across jurisdictions and maintain screening effectiveness. Aligning AMS solutions across the organization can vigorously promote unified standards. Yet, it is in many cases still meaningful to keep local deviations to be effective and cost-efficient, when facing different local negative news alerts may not be consistently generated within the organization. In addition, diverse solutions also lead to complexities and higher operating costs for the compliance function to enforce screening standards across jurisdictions and maintain screening effectiveness. Aligning AMS solutions across the organization can vigorously promote unified standards. Yet, it is in many cases still meaningful to keep local deviations to be effective and cost-efficient, when facing different local languages and fulfilling market-specific requirements. Calibrating AMS solutions to meet the most stringent standards can be expensive and unnecessary.

- Don't fail on the customer data. Inaccurate AMS alert generation is another common pain-point, which inevitably inflates associated operational costs. While the root causes can vary, one issue often relates to shortcomings in customer data quality, accuracy, and comprehensiveness. It is not uncommon for financial institutions to fail to enforce clear guidelines regarding naming conventions (e.g., which alphabets to use or which ways of writing to consider) across the organization. Tuning the AMS system to work best with existing data issues can be a temporary solution. In the long term and considering the broad impact of data environment on the compliance systems beyond AMS, management needs to define a holistic compliance data strategy and enhance data management.

- Keep an eye on advanced technologies. Different AMS solutions can be found in the market, with individual pros and cons. List-based screening, for example, is designed to consider the information in a static set of media or self-maintained databases. Some solutions apply novel technologies such as natural language processing (NLP), artificial intelligence (AI), and machine learning (ML) to achieve more relevant results or more efficient alert discounting. Financial institutions need to keep an eye on technological advancements, evaluate new functionalities and decide on the best approach fitting their individual needs.

AlixPartners has deep expertise in assisting financial institutions to enhance financial crime compliance globally. Please reach out if you have any inquiries about this article or our services.

Annex: Regulatory requirements of AMS in selected countries

United States: The Financial Crimes Enforcement Network (FinCEN) does not "categorically require" AMS screening or specify AMS screening requirements. Instead, FinCEN suggests, that if a customer presents a higher risk profile, the financial institution might collect more information to understand the customer relationship better.

United Kingdom: The Financial Conduct Authority (FCA) requires senior management should be provided with "all relevant information, e.g., adverse information", before approving PEP relationships. As an example of EDD measures FCA also mentions the use of "open-source websites to gain a better understanding of the customer or beneficial owner" and the assessment of "allegations of wrongdoing or court judgment ."

European Union: The three European Supervisory Authorities, i.e., EBA, EIOPA and ESMA, list AMS as an example of EDD measures in their Guidelines on Risk Factors and Simplified and Enhanced Customer Due Diligence.

People's Republic of China: In mainland China, the People's Bank of China (PBC) expects financial institutions to increase the risk rating of customers "involved in major negative news reports or comments of authoritative media". In Hong Kong, for private banking business, Hong Kong Monetary Authority (HKMA) mandates AMS on a potential customer and any other persons associated with the customer as far as practicable. In general, AMS is shown as an option in EDD.

Singapore: The Monetary Authority of Singapore (MAS) sees AMS as part of the customer screening practice. MAS requires a bank to put in place "policies, procedures and controls" that set out the money laundering and terrorist financing information sources used for screening, including "commercial databases used to identify adverse information on individuals and entities".

In addition, a bank "should also consider filing an STR if there is any adverse news on its customers in relation to financial crimes." MAS includes case studies to demonstrate how AMS should be set up in its information paper "Strengthening AML/CFT Name Screening Practices".

Australia: The Australian Transaction Reports and Analysis Centre (AUSTRAC) recommends the consideration of adverse media as one of the risk assessment factors, especially for identifying the source of funds and wealth andassessing correspondent banking relationships.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.