When Singapore and Malaysia announced the development of a Special Economic Zone (SEZ) linking Johor and Singapore, it was widely celebrated as a bold leap toward regional integration. Designed to streamline the movement of goods, services and talent, the SEZ holds the promise of reshaping Southeast Asia's most vital economic corridor.

The growth prospects are significant. The SEZ is projected to boost Johor's economy by approximately USD 28 billion (SGD 38 billion) annually by 2030, potentially positioning Johor to rival the Klang Valley as Malaysia's economic engine. The initiative aims to attract 50 projects and create 20,000 skilled jobs within five years, focusing on sectors such as manufacturing, logistics, the digital economy and green energy. Incentives include a flat tax rate of 15% on chargeable employment income for eligible knowledge workers for a period of 10 years and a 40% stamp duty exemption on certain commercial property transactions.

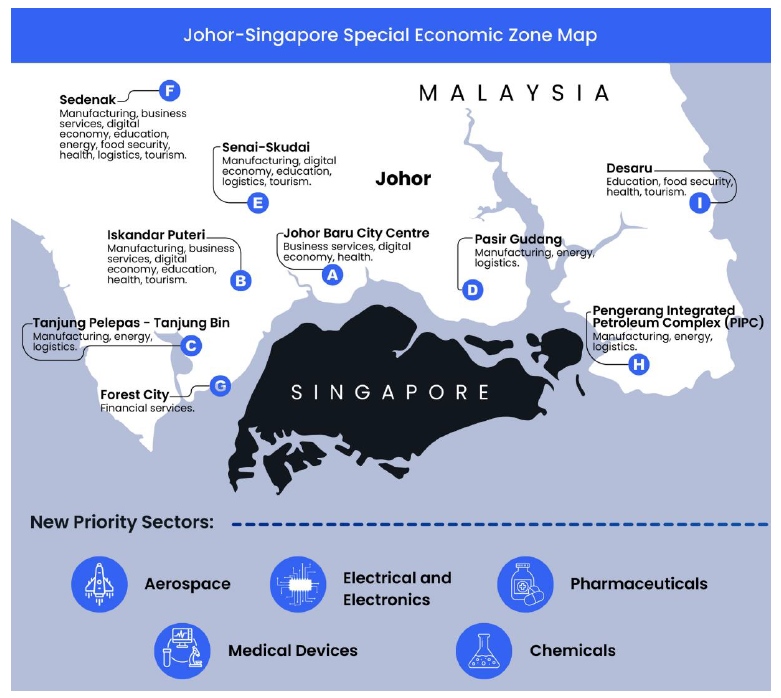

Source: PropertyGenie Sdn Bhd

This SEZ is not the first of its kind. A similar master plan was introduced in 2006 with the launch of the Southern Johor Economic Region, subsequently renamed Iskandar Malaysia. While it attracted headline investment pledges, progress was uneven, hampered by inconsistent approval standards and opaque bureaucracies.

While they can serve as powerful engines of investment and innovation, SEZs are equally capable of attracting fraud, corruption and opaque dealmaking. Beyond the ribbon-cutting ceremonies lies a complex reality—one that demands commercial savvy on top of bold vision, thorough due diligence, constant vigilance and proactive governance to ensure success.

Still, international examples show what well-executed SEZs can achieve. Batam in Indonesia leveraged proximity to Singapore to grow into a manufacturing hub with strong logistics infrastructure. Panama Pacifico transformed a former U.S. airbase into a thriving business park connected to global supply chains. Rwanda's Kigali SEZ has helped position the country as a destination for light manufacturing and tech services in East Africa. These cases demonstrate that when clear regulations, infrastructure and institutional integrity align, SEZs can deliver transformative impact.

Whether the Johor–Singapore SEZ becomes a beacon of opportunity or a cautionary tale will depend on the ability of public and private stakeholders—both local and cross-national—to cut through the fog together.

A Zone of Opportunity and Risk

The Johor–Singapore SEZ aspires to harmonize regulations and foster collaboration in strategic sectors such as manufacturing, digital trade and green energy. If executed well, the SEZ could bring meaningful benefits to both economies. For Singapore, it offers access to scalable land, labor and industrial capacity, complementing its role as a high-value services and innovation hub. For Johor, it could accelerate industrial upgrading, attract capital and talent and deepen integration with global value chains.

A well-governed SEZ can serve as a powerful engine for cross-border economic dynamism, employment generation and regional competitiveness. Yet, like many zones that offer special incentives and regulatory flexibilities, the Johor–Singapore SEZ may also invite risks that thrive in gray areas—especially if enforcement gaps emerge between jurisdictions.

Historically, zones with reduced oversight have been vulnerable to illicit finance. The Financial Action Task Force (FATF) has flagged Free Trade Zones for their susceptibility to money laundering and terrorist financing. The absence of standardized regulatory frameworks across borders can create blind spots, particularly when companies operate across Singapore's highly regulated environment and Malaysia's comparatively promising yet looser regime.

Another structural risk lies in complex ownership chains. Entities may operate through multilayered arrangements involving offshore trusts, nominee directors and holding companies, making it difficult to identify the true beneficial owners. Experts have repeatedly emphasized that such opacity facilitates tax evasion, corruption and the laundering of illicit funds. In an SEZ designed to encourage fast-moving deals, this kind of structural complexity can obstruct regulatory oversight.

This risk is compounded by the potential misuse of the zone by politically exposed persons (PEPs) or criminal networks. The 1Malaysia Development Berhad (1MDB) scandal—one of the world's largest financial frauds—involved the embezzlement of over USD 4.5 billion from a Malaysian state investment fund through a global web of shell companies, corrupt officials and complicit financial institutions. It is a stark reminder of how cross-border loopholes and opaque structures can be exploited to siphon public funds and evade accountability.

In a joint zone like the Johor–Singapore SEZ, there is an added risk of regulatory arbitrage, where bad actors can gravitate toward the jurisdiction with looser enforcement. Singapore's high regulatory standards may inadvertently displace unethical behavior across the border, increasing Malaysia's vulnerability unless enforcement capacity and transparency mechanisms are similarly strengthened. Without coordinated egulatory action and robust information-sharing protocols, SEZs can become conduits for financial misconduct rather than platforms for sustainable growth.

Large-scale land and infrastructure projects in SEZs also bring their own exposure. Procurement fraud, inflated project valuations and kickbacks are not uncommon where oversight is weak or discretionary powers are concentrated. The Basel Institute on Governance warns that infrastructure sectors are especially prone to corruption given the size, speed and opacity of dealmaking in such environments.

Business, Politics and Royalty

An understanding of the Malaysian business and political landscape is essential to ensure effective oversight and execution of due diligence processes. This includes navigating the often-fragmented dynamics between federal, state and local governments—each with distinct jurisdictions, political affiliations and regulatory practices.

In states like Johor, where the royal household also holds significant economic influence, the interplay between political power and commercial interest adds yet another layer of complexity for foreign investors and compliance teams to consider. The royal family's holdings include stakes in telecoms, retail, energy, real estate, healthcare, transport and megaprojects, most notably a major land sale and coastal reclamation for the Forest City development.

Raising the Bar for Risk Management

To operate effectively in the Johor-Singapore SEZ, companies must move beyond tick-box compliance. Integrity Due Diligence (IDD) should be a baseline requirement for evaluating partners, vendors and acquisition targets. IDD involves assessing potential red flags—such as links to sanctioned entities; previous allegations of misconduct; or environmental, social and governance (ESG) failures—that may not appear in public records.

Equally essential are fraud and corruption investigations, especially in high-stakes sectors like construction, logistics and procurement. Identifying early signs of collusion, misappropriation of funds or insider abuse can prevent reputational and financial damage downstream.

Where ownership transparency is murky, beneficial ownership mapping can be invaluable. Understanding who truly controls an entity—especially where nominee shareholders or offshore holdings are involved—helps companies avoid inadvertent exposure to criminal actors, reputational risks or regulatory breaches.

Political risk is another dimension that cannot be ignored. A reliable political risk advisory function provides visibility into shifting stakeholder dynamics, regulatory changes, Malaysia's episodic political volatility and intergovernmental priorities on both sides of the Causeway. This is crucial in a zone jointly governed by two very different political and administrative cultures. It is worth noting that Malaysia's federal general election must be held by February 17, 2028, though a snap election could be called as early as 2027.

Institutionalizing Integrity

Beyond deal-specific diligence, organizations should embed more systemic controls to guard against misconduct and regulatory violations. In high-value, government-linked projects, the use of integrity monitorships—where independent oversight is applied throughout a project life cycle—can help ensure transparency, detect issues early, identify potential legacy regulatory risks and reinforce accountability mechanisms.

When disputes arise, as they inevitably do in fast-growing cross-border ventures, firms must be equipped with litigation support spanning multiple jurisdictions. Arbitration strategies, forensic financial analysis and local legal insight all become essential to resolving conflicts swiftly and effectively.

Another critical but often overlooked area is supply chain diligence. As SEZ operations depend heavily on subcontractors and third-party vendors, companies must ensure that those they work with meet appropriate standards of integrity, labor practices, data protection and regulatory compliance.

Compliance as a Competitive Edge

Increasingly, global investors understand that strong compliance is not just about avoiding penalties—it is a competitive advantage. In environments like the Johor-Singapore SEZ, the firms that win long term are not those that cut corners, but rather those that prove trustworthy to regulators, partners and capital providers.

That Means Three Things in Particular:

- Vetting opportunities with forensic scrutiny: Surface-level assessments are no longer sufficient. Investors need to probe deeper through accounting reviews, beneficial ownership mapping and confidential source inquiries. Early intelligence reduces the likelihood of surprises later.

- Anticipating regulatory enforcement: Staying one step ahead of evolving enforcement trends in both Malaysia and Singapore is essential. A company's internal controls must be built for not just today's rules but tomorrow's expectations, particularly as anti-graft enforcement and cross-border cooperation continue to rise.

- Embedding ESG and anti-corruption into business models: Firms that integrate ethics, sustainability and governance from the outset—not as compliance afterthoughts—will be better positioned to attract funding, build public trust and withstand scrutiny. These principles must be foundational, not retrofitted.

Practical Considerations for Investors in the Johor–Singapore SEZ

For investors eyeing the Johor–Singapore SEZ, opportunity must be matched with rigor. While many risks can be anticipated and managed through regular commercial practices, certain investments—especially those involving politically exposed parties, large-scale infrastructure or sensitive sectors—demand elevated scrutiny. Here are the key steps investors should take:

Pre-Investment Phase: Setting the Foundation

- Integrity Due Diligence (IDD) Before entering into any partnership or transaction, conduct thorough IDD on counterparties—including local partners, vendors and acquisition targets. This involves assessing their background, regulatory standing, litigation history and any links to corruption, sanctions violations or ESG non-compliance. For projects involving government-linked entities or sensitive assets, IDD should be forensic in depth.

- Ultimate Beneficial Ownership (UBO) and Source of Funds Analysis Understanding who truly owns or controls a business entity is critical. Complex ownership chains involving offshore trusts or nominee directors can conceal politically exposed persons (PEPs) or criminal actors. Mapping UBO and verifying the legitimacy of funding sources ensures transparency and regulatory alignment from the outset.

- Political and Regulatory Risk Advisory Investors must navigate the dual regulatory ecosystems of Malaysia and Singapore. This means monitoring political developments, policy shifts and regulatory enforcement trends on both sides of the border. Special attention should be paid to the federal-state-local governance dynamics in Malaysia, where overlapping jurisdictions can complicate approvals, land rights and stakeholder negotiations.

- Reputational Intelligence through Source Inquiries Public domain checks are rarely sufficient in high-risk jurisdictions. Confidential source inquiries can reveal critical integrity or reputational issues—such as undisclosed business ties, informal political connections or conflicts of interest—that may otherwise go undetected.

- Land and Title Risk Review In SEZ-linked developments, investors should ensure land ownership is clear, zoning permissions are in place and no competing claims or irregularities exist. Missteps here can delay or derail projects and expose investors to legal and reputational risks.

Post-Investment Phase: Safeguarding Operations and Value

- Integrity Monitorships For high-value or government-linked projects, consider appointing independent integrity monitors to provide real-time oversight across the project lifecycle. These monitors help detect irregularities, strengthen compliance frameworks and reinforce transparency in procurement, contracting and execution.

- Continuous Monitoring and Compliance Audits Once operations are underway, maintain vigilance. Periodic reviews of counterparties, ownership structures and financial flows can help identify emerging risks and ensure compliance with anti-corruption, AML, sanctions and ESG requirements.

- Supply Chain Due Diligence Third-party risks are often underestimated. Conduct diligence not only on primary contractors but also on subcontractors and suppliers—especially in areas such as labor practices, environmental compliance, cybersecurity and data privacy. In a zone with cross-border movement of goods and services, weak links in the supply chain can quickly become liabilities.

- Litigation Support and Dispute Advisory Cross-border ventures inevitably face legal disagreements. Be prepared with access to multijurisdictional litigation support, including forensic accounting, dispute resolution strategy and arbitration expertise. Early preparation strengthens negotiating positions and protects commercial interests.

- Crisis Response and Reputational Risk Management If fraud, misconduct or regulatory action arises, swift and credible responses are essential. Having a pre-identified crisis response plan—including investigative support, stakeholder communication and reputational recovery strategy—can contain damage and restore stakeholder confidence.

Well-informed investors in the Johor–Singapore SEZ will recognize that diligence is not a one-off event but a continuous discipline. Those who embed risk intelligence, regulatory foresight and ethical operations into every stage of their investment journey will be best placed to convert opportunity into sustained advantage.

Seeing Clearly, Acting Intelligently

The Johor-Singapore SEZ is more than an infrastructure project—it is a test of cross-border governance and corporate integrity. In an environment shaped by jurisdictional divergence, political complexity and accelerated dealmaking, success will depend on visibility.

Prosperity cannot thrive in opacity. When approvals are fast-tracked and counterparties are shielded by layers of proxies and shell firms, risk multiplies. Navigating this terrain demands a new mindset—one that treats intelligence gathering, validation and continuous monitoring as essential, not optional.

In this zone of opportunity, those who succeed will be the ones who don't just move fast but see clearly. Don't just look. Investigate, validate and monitor as you prepare to achieve and sustain your competitive advantage, intelligently.

Top Five Questions Every Investor Should Ask

- Who controls my counterparty? Have I verified the ultimate beneficial owner (UBO), especially where nominee directors, offshore structures or political connections may obscure true control?

- What is the integrity track record of the people and entities involved? Have I reviewed any past allegations, legal proceedings, ESG violations or red flags through both public and discreet channels?

- Am I exposed to regulatory arbitrage between Malaysia and Singapore? Are my operations or partners navigating differing compliance expectations across the Causeway—and how might this create vulnerabilities?

- Is my land use, licensing and approval process insulated from political risk? Have I accounted for federal, state and local governance layers—especially in Johor—where decision-making power may be fragmented?

- Do I have a plan for active risk monitoring post investment? What systems do I have in place to detect emerging threats, vendor risks or changes in political and enforcement dynamics over time?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.