- within Finance and Banking topic(s)

- within Finance and Banking topic(s)

- with readers working within the Banking & Credit industries

- within Finance and Banking, Insurance and Corporate/Commercial Law topic(s)

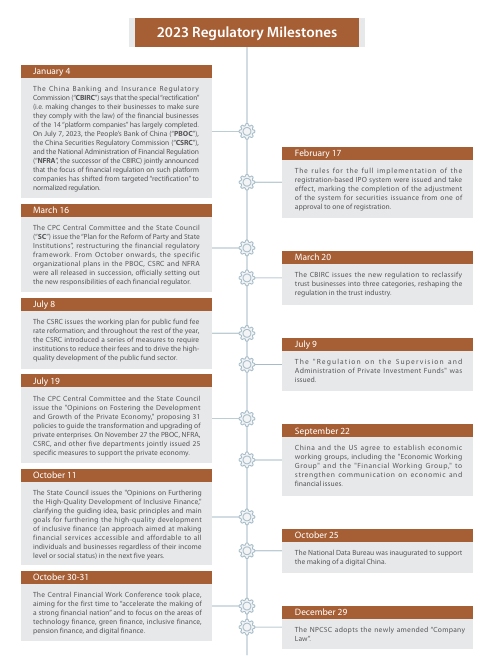

2023 Regulatory Mainline Review

01 The Financial Sector Receives Strategic Repositioning, with Top-level Direction

In 2023, China's financial services sector was accorded a new strategic importance. While previously the financial sector had been categorized as an "important national core competence", now 2023's Central Financial Work Conference positioned finance as "the lifeblood of the national economy" and, for the first time, proposed the goal of building a "strong financial nation", alongside other "strong nations" (for example, culture, manufacturing, and maritime activities).

At the same time, the systems and mechanisms regarding how the Party will manage the financial work were targeted for improvement. The "Plan for the Reform of Party and State Institutions" established the Central Financial Committee and set up the Office of the Central Financial Committee. The Plan also institutionalized the top-level role of the CPC to design, supervise and implement financial work, as well as having the power to review and make decisions about major policies and issues in the financial area.

The Central Financial Work Conference (held on October 30, 2023), unlike the previous five National Financial Work Conferences, was attended by all Members of the Standing Committee of the Political Bureau of the CPC Central Committee – the highest leadership in China – and was named the Central Financial Work Conference, indicating the unprecedented importance that the Central Party has attached to China's financial services sector. In the next stage, while maintaining the existing structure of specific financial regulators (which operate under the State Council), the Party is expected to bring new ideas and approaches to financial work through its centralized leadership.

02 Restructuring the Financial Regulatory Framework

Following the merger of the China Banking Regulatory Committee and China Insurance Regulatory Committee into CBIRC in 2018, China's financial regulatory framework underwent further restructuring in 2023. The intention is to optimize the system of financial regulation and to build a strong nation.

In addition to adhering to the core design of the Central Party's unified leadership over financial work, the establishment of the NFRA and the redivision of regulatory functions with the PBOC and the CSRC mark the adjustment of China's regulatory framework to a kind of "twin peaks" model. This model aims to promote market behavior regulation, prevent speculative behavior, and protect consumer rights, as well as to prevent risks and maintain financial stability. Following the changes to the institutional structure, the responsibilities between the regulators have been divided up as follows: the PBOC is mainly responsible for formulating and implementing monetary policy and macroprudential regulation; the NFRA is mainly responsible for micro-prudential regulation and consumer rights protection; and the CSRC is mainly responsible for capital markets regulation. The NFRA is also expanded with a role as the default regulator of all financial activities, especially illegal financial activities. At the same time, the NFRA also has the function of conducting microprudential regulation of banking and insurance sector businesses. The role of the PBOC has become clearer as a pure monetary authority.

The relationship between the central and the local authorities has also been redefined. The starting point that financial regulation essentially derives from a central authority has been re-emphasized. That means having a central financial management department with local branches. At the same time, local Party committees will establish their own financial committees and financial work committees to make sure that the financial work instructed by the Central Party is carried out. The local financial offices and financial bureaus in the local provincial government is removed the responsibility/task for financial development that was originally entitled to them.

These changes have helped to resolve functional conflicts between the central organizations and local bureaus, as well as clarifying rights and responsibilities. It is expected that with the subsequent implementation of the "Regulations on Local Financial Supervision and Management," local financial regulatory institutions will play a more active and effective role in local financial risk prevention and resolution, as well as the supervision of the "7+4" institutions, which mainly refers to non-mainstream financial organizations that are mainly local and professional companies, such as micro-credit company, financing guarantees company, and various types of local trading places.

03 New Requirements for "Political and People-Oriented" Nature of Financial Work

The Central Financial Work Conference of October 2023 reiterated the need for China's financial sector to understand the "political and people-oriented nature of financial work", by which it was meant that financial institutions should work in people's best interests. The Conference also called for the financial sector to operate to the highest standards.

In 2023, many policies were set out directly targeted at "common prosperity" and finance for the people: changes were made to how much investors are charged ("public fund fees") to "enhance investors' sense of gain"; the State Council issued the "Opinions on Promoting High-Quality Development of Inclusive Finance" in October 2023, clarifying the guiding principles and main goals for promoting high-quality development of "inclusive finance" in the next five years; the concepts of "new citizen economy" and "silver-haired economy" (which refers to the economics of serving older people) were introduced, and many policies were introduced in areas such as pensions, family trusts, and family wealth management, all with the aim of making sure that people benefited from financial products and services.

All in all, there has been a real shift in the focus of the financial sector. As indicated by the Central Financial Work Conference, finance should provide high-quality services for economic and social development. Policies and systems related to currency, exchange rates, and capital markets should serve the real economy (rather than simply being products that only benefit financial institutions themselves).

There has also been much discussion about the professional culture of financial institutions. In February 2023, an article by the Central Commission for Discipline Inspection criticized the "financial elite theory," and the Central Financial Work Conference emphasized the need to promote traditional Chinese culture in the financial system, being honest and trustworthy, and for all financial practitioners to be conscious of the need to be aware of their legal responsibilities.

04 Greater Emphasis on Financial Services Supporting the Real Economy

The Central Financial Work Conference defined unequivocally the financial sector as "the lifeblood of the national economy." Subsequent financial policies in 2023 adhered to this requirement. For example, the new rating method for the trust sector included the ability of trust companies to serve the real economy when it comes to assessing systemic risk, and the "Regulations on Capital Management of Commercial Banks" emphasized the new regulation's orientation towards better serving the real economy beyond pure capital regulation and risk management. In the money markets, in addition to various stimulative measures such as interest rate and fee reductions, the government paid more attention to the phenomenon of "capital idling" (which means funds circulating within the financial sector without entering the real economy) in 2023 and expected to invigorate such idle capital to supporting the real economy, as opposed to the "virtual economy". One bank was fined RMB225 million during the year for carrying out activities that did not serve the real economy, and that was the largest fine imposed in the banking sector in 2023.

What is meant by "serving the real economy"? The Central Financial Work Conference specifically defined the "five major articles" as being "technology finance, green finance, inclusive finance, pension finance, and digital finance," and explicitly required "allocating more financial resources to promote technological innovation, advanced manufacturing, green development, and small and micro enterprises, vigorously supporting the implementation of the innovation-driven development strategy, the regional coordinated development strategy, and ensuring national food and energy security." The Central Economic Work Conference specifically proposed "guiding financial institutions to increase support for technological innovation, green transformation, inclusive small and micro, and the digital economy."

Of the "five major articles," the one that received most attention is technology finance. In the various enumerations of the real economy field, "technological innovation, 'specialized, fine, peculiar, and new'" high-end manufacturing enterprises are given absolute priority. In the area of capital markets, technological enterprises should be given priority under what is called the "traffic light" industry orientation, giving technology entrepreneurial enterprises a high "political position". The Beijing Stock Exchange also continued to introduce various supportive policies to make it easier for specialist enterprises to secure finance.

05 Progress in Risk Resolution and Normalization of Disposal for Financial Institutions

Significant breakthroughs were made in the resolution of major financial risks in 2023. The disposal of the last batch of "Tomorrow Group" institutions was concluded, with four insurance companies being restructured and Xinhua Trust ending in bankruptcy liquidation; Huarong Asset changed ownership, with the complete withdrawal of its financial subsidiaries; and risk disposals of Evergrande Life Insurance, Sichuan Trust, some village and town banks in Henan and Anhui, and related risks of Zhongzhi Group proceeded steadily. As mentioned in our reports in the previous two years, there has been a steady disposal of high-risk financial institutions, which should mean that in future there will be greater "normalization" in the financial sector. It is worth noting that with the accumulation of regulatory experience, effective coordination between central and local authorities, and changes in resourcing, high-risk financial institutions should present less of a problem in future.

"Stability before speed" has become the common feature of disposals: in-depth investigations and sorting out of underlying assets and liabilities in the early stage; long-term weighing of schemes to maximize the gathering of risk-disposing resources and balance the interests of all parties; and then rapid execution once the scheme is determined to quickly resolve the crisis. For example, the formulation of asset clearance and risk disposal schemes for the Tomorrow Group institutions taken over in 2023 took years, but once initiated, they were implemented swiftly and decisively.

A second notable trend has been the transition from administrative coordination to letting the market determine outcomes. In the early cases of bailing out institutions such as Baoshang bank, Anbang insurance, and Hengfeng bank, that involved large-scale use of industry protection funds or funding from the central government. More recently, there has been limited administrative intervention, meaning that financial regulatory authorities and judicial organs focus more on their statutory responsibilities (rather than support more funds) and local governments fulfill their local and stability maintenance responsibilities - each performing their roles according to the principle of "stabilizing the overall situation and coordinating." There are more market participants, for example the involvement of investment funds from the insurance industry being used when it came to the disposal of Huaxia Life and Huarong Asset. At the beginning of 2024, the NFRA summarized in its work conference the need to implement the "six-party responsibility" of institutions, shareholders, senior management, regulators, localities, and the industry, which is all in line with the draft of the Financial Stability Law.

06 Restructuring Regulatory Model for Greater Science and Rigor

The restructuring of the financial regulatory system has always been an important part of financial reforms. China's traditional financial regulatory system is institution-based regulation for different institutions. The National Financial Work Conference in 2017 emphasized the function-based regulation and the behavior-based regulation. The Central Financial Work Conference in 2023 further enriched the traditional financial regulatory system into "institution-based regulation, behavior-based regulation, function-based regulation, look-through regulation, and continuous regulation," making the regulatory system more scientific and prudent.

The merger of the CBRC and the CIRC and the unified enforcement of the bond market in the past few years are examples of function-based regulation and behavior-based regulation. Look-through regulation and continuous regulation are covered by on-site inspections and the disqualification of non-compliant shareholders of small and medium-sized banking and insurance institutions in the past few years.

The regulatory model have restructured as part of the process of making regulation more scientific and rigorous. So, for example, the NFRA has set up the Department of Large Banking, the Department of Joint-Stock and Urban Commercial Banking, and the Department of Rural Small and Medium-sized Banking to supervise different types of commercial banks – in other words, covering institutions-based regulation. The Department of Science and Technology Supervision, the Department of Asset Management Institutions Supervision and the Department of Institutional Recovery and Disposal, also created by the NFRA, focus on function-based regulation. The responsibilities of financial consumer protection, previously the remit of the PBOC and the CSRC, have also been transferred to the NFRA – in other words, focusing on behavior-based regulation. The establishment of the Department of Corporate Governance Supervision and the Department of Institutional Recovery and Disposal is intended to strengthen the governance of financial institutions and promote the systematization of institutional exit and risk disposal, reflecting the idea of continuous regulation in the whole cycle and process of financial institution governance and its disposal. The principle of "substance over form" is embodied in look-through regulation and features strongly in specific regulatory rules (e.g., the qualifications of shareholders of financial institutions, verification of the underlying assets of asset management products, and the supervision of connected transactions) and regulatory measures (market access, off-site supervision, and on-site inspection).

07 More realistic system reform and more precise regulation

The process of reforming the financial sector continued unabated in 2023, which involved putting in place changes and bedding down the existing framework. This took many forms, whether it was the NFRA unifying the regulatory rules, the introduction of high-level new regulations in areas such as private funds and payment institutions, or the revision of basic regulations for commercial banks, securities companies, and trust companies, the focus was always on integrating and sorting out existing regulations, generally in line with market expectations.

While partly adjusting the registered capital subscription system, the new Company Law introduced innovative company governance systems, allowing for easier capital reductions, among other measures, as well as ascribing main responsibility for governance to boards of directors. The CSRC twice sought the market's opinions on proposed changes to the Measures on Derivatives Trading Supervision and Management and removed some provisions in the second draft that were ahead of market practice . This also indicated a desire of government departments to take a more realistic attitude to institutional reforms.

However, the regulatory authorities do continue to intervene in certain circumstances. For example, regulators issued instructions regarding product registration and business expansion in the public fund sector. Following the establishment of the registration process for IPOs, the CSRC controlled the number of IPOs approved in the second half of 2023. In the capital markets, the CSRC also issued guidance to stock exchanges to formulate new regulations on algorithmic trading, margin financing and refinancing. In other areas, such as financial risk disposal, and real estate and debt risk mitigation, regulatory authorities emphasized that there should be no one-size fits all approach to utilize measures that work for that particular sector and indeed that particular situation.

08 Financial Law Enforcement: Stronger Structures and Strict Supervision

In 2023, China's financial regulatory authorities made improvements to the structures of regulatory institutions as well as stepping up enforcement. The NFRA established an enforcement task force as a directly affiliated law enforcement authority responsible for the investigation and evidence collection.

In terms of legislation, the draft regulations for the supervision and management of securities companies and private equity funds have significantly increased the levels of penalties and broadened the scope of law enforcement. There were more large fines imposed in 2023: the banking regulators imposed penalties of approximately RMB200 million for a total of 38 violations by a large state-owned bank in February and approximately RMB 225 million for a total of 56 violations by a joint-stock bank in November. The NFRA imposed penalties on 4,750 (person-times) banking and insurance institutions and on 8,552 "responsible" persons (person-times), with penalties and confiscation of illegal proceeds totaling RMB7.838 billion. all of which represented a significant increase compared to 2022.

The CSRC also focused on combating serious violations such as financial fraud, fund appropriation, illegal guarantees, market manipulation, and insider trading, cracking down on securities and futures illegal activities, as well as counterfeiting.

The penalties imposed on large fintech companies and more broadly on those companies falling foul of the regulations have become more stringent. This is a reflection of the attitude of strict regulation and zero tolerance, as well as the result of the strengthening of the regulatory capacity of each regulatory agency and the continuous improvement of the ability to identify violations of the law based on the abovementioned ideas of continuous and look-through regulation.

2024 Regulatory Outlook

01 Stability while Progress Creating before Phasing Out Old Dynamics

The Central Economic Work Conference, held in December 2023, spoke of the need for "Stability while Progress", "Promoting Stability through Progress" and "Creating before Phasing Out Old Dynamics" in 2024. We believe that these will be the core themes of financial regulation in 2024.

"Stability" is a long-term guiding value of financial policy. "Progress" is the main policy goal of the new stage. Taken together, "Promoting Stability through Progress" means using regulations to solve problems and resolve "contradictions", particularly in areas such as risk disposal. The principle of "Creating before Phasing Out Old Dynamics" is to do with creating new industries and dynamics while phasing out old industries and dynamics.

We expect that the regulatory policies in 2024 will be more moderate and steady, focusing on stabilizing expectations and growth. Financial innovation and non-standard investments may be permitted but only in a limited way, and efforts may be made to avoid short-termizing of long-term goals, such as adjusting the pace of certain long-term goals like "dual carbon goals" and the transformation of financial institutions.

The Central Political Bureau Meeting on December 8, 2023, mentioned the need to "enhance the consistency of the direction of macro policies," so we expect there to be more consistent application of multiple financial policies.

02 Expect More Legislation and Greater Enforcement

As we progress through 2024, the process of passing legislation and implementing regulations will continue. These will include a series of foundational regulations in the financial sector, including the Financial Stability Law, the PBOC Law, the Commercial Bank Law, the Insurance Law, the Banking Supervision and Management Law, and the Securities Company Supervision and Management Regulations. Further regulations for financial holding companies are also expected to be introduced. The updated regulations either fill in the gaps and expand regulatory scenarios or keep pace with the market, including, we expect, an increase in penalties for those who are in breach of regulations.

The so-called gray areas in regulation, which gave rise either to uncertainty or regulatory "arbitrage" (which enabled institutions to play off one regulator against another) have largely been eliminated after the completion of central institutional reforms and the full settlement of central and local financial decentralization. The NFRA stated in December 2023 that financial authorities will guard their respective regulatory areas, not only regulating "licensed violations" but also "unlicensed driving." We understand that cross-border financial activities will still be a focus of financial regulation.

In terms of the law enforcement, after the adjustment of powers and the establishment of the enforcement task force within the NFRA, the NFRA will become the center of financial law enforcement. It will lead the establishment of a mechanism for claiming regulatory responsibility and a safety net mechanism, promoting the clear assignment of regulatory responsibilities for cross-departmental, cross-regional, new industries and products. Where it is not possible to allocate responsibilities, the NFRA will be responsible for assuming supervisory responsibilities.

03 The Next Stage of Financial Institution Risk Disposal: Institutionalization and Marketization

In 2024, the financial sector will shoulder the heavy responsibility of supporting local government debt and real estate risk resolution. There will also a strong focus on helping the financial sector's risk management and disposal.

So far as legislation is concerned, there will be a Financial Stability Law and legislation introduced to cover insurance funds. That will provide a more professional and predictable working framework for financial risk disposal. The newly established Institution Recovery and Disposal Department of the NFRA (referred to above) will be specifically responsible for formulating the risk disposal system, standards, and procedures for high-risk institutions. In addition, financial regulatory authorities will monitor the financial sector for high-risk situations and be proactive in dealing with those risks.

Getting down to practical measures, some provinces have been formulating and implementing reform and risk resolution plans for small and medium-sized banks, to be followed by plans to address risk resolution in non-banking institutions. The Non-Banking Supervision Department of the NFRA has stated that the priority is to initiate disposals of high-risk non-banking institutions by the end of 2024. The very significance is that China is abandoning the idea of institutions being "too big to fail", while merely protecting the interests of small investors and depositors to the extent permitted by market capacity. A good example of this was the approach to risk resolution of the Zhongzhi Group – since it has met the standard of bankruptcy, just let it be bankrupt.

04 Financial Markets: Supply-Side Reform

The Central Financial Work Conference has set the financial regulatory (supply-side) structural reform as the best means for ensuring financial services support the real economy and bringing about high-quality development. This in line with the top-level design of China's financial market development.

There will continue to be a strong focus on the large state-owned financial institutions. These measures may include encouraging state-owned asset groups to rationalize the structure of financial institutions internally, including considering granting financial holding licenses, and enabling capital to expand appropriately in the financial sector. Building first-class investment banks is sure to be discussed in 2024; some major securities firms have already included this goal in their five-year plans. The CSRC has previously stated its support for mergers and acquisitions between securities companies, and there have been many rumors and discussions in the market about which companies this is likely to include. The NFRA is studying whether to raise the threshold for institutional access and is likely to give priority to, market entities that comply with the policy of "serving the real economy".

At the beginning of 2024, the new financial leadership team has made it clear that they aim to "attract more foreign financial institutions and long-term capital to develop and thrive in China," so it is expected that there will be breakthroughs in the entry, efficiency and scope of foreign investment in the financial sector in 2024. This will continue the trend started in 2023. Regulators approved the application by a number of US financial institutions to have wholly-owned control of, or to set up, financial institutions in China. And the "Swap Connect" was officially launched in May. However, for various reasons, including geopolitical factors, some foreign financial institutions withdrew their applications to open in China, while other applications proceeded slowly. However, it should be noted that the CSRC has shortened the time it takes for foreign securities companies and fund management companies to open in Shanghai, Hainan, and other six free trade zones, from six months to 120 days.

In the coming year, industrial institutions and small and medium-sized financial institutions can expect to be subject to strict enforcement – at least those who have fallen foul of the law. Even with the official relaxation of the platform economy at the beginning of the year and some support for the private economy, the first "private financial holding" license has yet to be issued, and internet finance is subject to regular regulation, reflecting the regulatory authorities' continued cautious attitude towards private capital's investment in the financial sector. In addition, with the increasing importance of financial institution governance, the governance of small and medium-sized life insurance, reform of rural credit cooperatives, and mergers and reorganizations of small and medium-sized banks are in full swing. Although most of these institutions have "rectified" their governance procedures (i.e. brough them in line with updated regulations), the regulatory authorities still require them to be passed and approved for risk prevention.

05 Aiming for Confidence and Consistency

In October 2023, the PBOC mentioned in the report on the financial work at the sixth meeting of the Standing Committee of the 14th NPC that more efforts should be made to expand domestic demand, boost confidence and prevent risks; further measures should be implemented to activate the capital markets and boost investor confidence. In addition, the financial institutions forum jointly held by the PBOC, the NFRA and the CSRC mentioned in November 2023 that it was necessary to address the problems currently faced by the financial sector to up confidence and look to the long term.

We expect that the financial policies in 2024 will be more people-oriented, paying more attention to short-term problems directly linked to investor interests and public confidence. We expect financial regulations will be more in tune with supporting the market. Finally, we expect there to be greater consistency between financial policies.

Originally published April 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.