- within Media, Telecoms, IT, Entertainment, Environment and Corporate/Commercial Law topic(s)

- in Europe

- with readers working within the Retail & Leisure industries

1. What is the extended period for availing yourself of the Estate Tax Amnesty?

Taxpayers now have until June 14, 2023, to avail themselves of the Estate Tax Amnesty. Republic Act No. 11569, titled "An Act Extending the Estate Tax Amnesty and for Other Purposes, Amending Section 6 of Republic Act No. 11213, otherwise known as the 'Tax Amnesty Act'" was signed into law by President Rodrigo Duterte on June 30, 2021.

Section 6 of the Tax Amnesty Act now states that "[t]he executor or administrator of the estate, or if there is no executor or administrator appointed, the legal heirs, transferees, or beneficiaries, who wish to avail of the Estate Tax Amnesty shall, within June 15, 2021 or until June 14, 2023, file with the Revenue District Office of the Bureau of Internal Revenue, which has jurisdiction over the last residence of the decedent, a sworn Estate Tax Amnesty Return, in such forms as may be prescribed in the Implementing Rules and Regulations." Pursuant to Section 5 of the Tax Amnesty Act, those qualified to avail of tax amnesty are the "estate of decedents who died on or before December 31, 2017, with or without assessments duly issued therefor, whose estate taxes have remained unpaid or have accrued as of December 31, 2017," subject to exceptions provided in the Tax Amnesty Act.

SyCipLaw TIP 1:

Taxpayers who were originally entitled to avail themselves of Estate Tax Amnesty under the previous law but have not applied for amnesty due to lack of time to work on the documents may now consider applying for tax amnesty as they now have until June 14, 2023, to avail themselves of the Estate Tax Amnesty.

2. May the Bureau of Internal Revenue issue a Final Letter of Demand and Final Assessment prior to the expiration of the 15-day period given to the taxpayer to respond to a Preliminary Assessment Notice?

No. In CIR v. Lanao Del Norte Electric Coop. (CTA En Banc Case No. 2236 (CTA Case No. 8769), June 9, 2021), the Court of Tax Appeals En Banc (CTA En Banc) ruled that it is only upon the failure of the taxpayer to respond to the Preliminary Assessment Notice (PAN) within the 15-day period that the Commissioner of Internal Revenue (CIR), or his duly authorized representative, can validly issue the Final Letter of Demand and Final Assessment (FLD/FAN). Thus, the CIR is required to wait for the expiration of the 15-day period, reckoned from the date of receipt of the PAN, before it can issue the FLD/FAN. The date of receipt of the FLD/FAN is not significant even if the same falls after the expiration of the 15-day period. Instead, it is the date when the FLD/FAN was issued that is of importance because it shows when the 15-day period given to the taxpayer to respond to the PAN is observed.

SyCipLaw TIP 2:

Taxpayers should note that they are given a 15- day period to respond to the PAN. If a taxpayer (a) receives an FLD/FAN prior to the expiration of the 15-day period, or (b) receives an FLD/ FAN after to the expiration of the 15-day period, but it is dated before its expiration, the taxpayer should raise the defense of violation of its right to due process of law in its protest.

Note that a motion for reconsideration on the decision of the CTA En Banc in this case is pending. Note also that CTA decisions, while persuasive, do not become the law of the land, unlike decisions of the Supreme Court.

3. If a taxpayer pays local business tax pursuant to an assessment made on it by a local government unit, can it ask for a refund of the taxes paid under Section 196 of the Local Government Code which covers illegally collected local business tax if it disagrees with the assessment?

No. In Makati City v. Metro Pacific Tollways Corp. (CTA En Banc Case No. 2217 (CTA AC No. 204), June 14, 2021), the CTA En Banc ruled that once an assessment is issued, the taxpayer cannot choose to pay the assessment and thereafter seek a refund under Section 196 of the Local Government Code (LGC). It must comply with the provisions of Section 195 of the LGC which covers assessments.

If an assessment is protested or disputed, the taxpayer may or may not pay the assessed tax, fee, or charge. Whether there is payment or not, it is clear that the protest in writing must be made within 60 days from receipt of the notice of assessment; otherwise, the assessment shall become final and conclusive. Thereafter, the subsequent court action must be initiated within 30 days from denial or inaction by the local treasurer; otherwise, the assessment becomes conclusive and unappealable.

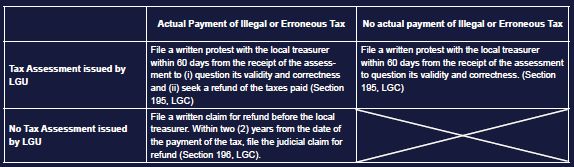

Thus, the taxpayer's remedy is dependent on two things: first, on whether a notice of assessment was issued; and second, if the taxpayer will opt to pay the assessed tax or not.

If the taxpayer receives an assessment and does not pay the tax, fee, or charge, its remedy is confined strictly to Section 195 of the LGC. Thus, it must file a written protest with the local treasurer within 60 days from receipt of the assessment. If the protest is denied, or if the local treasurer fails to act on it, then the taxpayer must appeal the assessment before a court of competent jurisdiction within 30 days from receipt of the denial, or the lapse of the 60-day period within which the local treasurer must act on the protest. Under this scenario, as no tax has been paid, there is no claim for refund in the appeal.

If the taxpayer opts to pay the assessed tax, fee, or charge, it must still file the written protest within the 60-day period, and then bring the case to court within 30 days from either the decision or inaction of the local treasurer. In its court action, the taxpayer may, seek a refund of the taxes it paid by questioning the validity and correctness of the assessment.

Section 196 of the LGC applies if no assessment notice is issued by the local treasurer, but the taxpayer has made a payment, or a tax has been collected from him. He can claim that he erroneously paid it or that it was illegally collected from him by filing a written claim for refund or credit with the local treasurer, and by filing, within two (2) years from payment of the tax, of a judicial claim for refund.

SyCipLaw TIP 3:

Please see below a summary of remedies available in case of an assessment for local business tax:

Note that CTA decisions, while persuasive, do not become the law of the land, unlike decisions of the Supreme Court.

4. May a local government unit assess local business tax based on dividend income of a holding company pursuant to Section 143(f) of the LGC?

No. In Makati City v. Metro Pacific Tollways Corp. (CTA En Banc Case No. 2217 (CTA AC No. 204), June 14, 2021), the CTA En Banc ruled that Section 143(f) of the LGC is premised on the fact that the persons made liable for the local business tax are banks or other financial institutions by virtue of their being engaged in the business as such. Section 133(a) of the LGC does not allow, and in fact forbids the imposition of local business tax, on income realized by entities not classified as a bank or financial institution. Thus, holding companies are not subject to the local business tax under Section 143(f) of the LGC.

Section 143(f) of the LGC reads:

Sec. 143. Tax on Business. - The municipality may impose taxes on the following businesses:

- Xxx -

(f) On banks and other financial institutions, at a rate not exceeding fifty percent (50%) of one percent (1%) on the gross receipts of the preceding calendar year derived from interest, commissions and discounts from lending activities, income from financial leasing, dividends, rentals on property and profit from exchange or sale of property, insurance premium.

SyCipLaw TIP 4:

Taxpayers should note that only banks or other financial institutions are subject to income taxes under Section 133(a) in relation to Section 143(f) of the LGC.

Note that CTA decisions, while persuasive, do not become the law of the land, unlike decisions of the Supreme Court.

5. Is the "sale of goodwill" resulting from the sale of shares separately subject to income tax in addition to the capital gains tax due from the sale of shares?

No. In Commissioner of Internal Revenue v. The Hong Kong Shanghai Banking Corporation Limited – Philippine Branch (G.R. No. 227121, December 9, 2020), the Supreme Court ruled that goodwill is an intangible asset derived from the conduct of business and cannot therefore be allocated and transferred separately and independently from the business as a whole.

The Court ruled that transaction involved in this case is a sale of shares subject to capital gains tax (CGT), not the regular corporate income tax (RCIT). The Hong Kong Shanghai Banking Corporation (HSBC) entered into the following two transactions:

- The transfer of its Point of Sales (POS) Terminals, other information technology assets, and Merchant Agreements of its Merchant Acquiring Business (MAB) in the Philippines, in exchange for shares in Global Payments Asia Pacific-Phils., Inc. (GPAP PH). This occurred in 2008. Accordingly, GPAP PH was incorporated, and HSBC subscribed into shares in GPAP PH in exchange for the fair market value of certain assets of HSBC and the transfer of its MAB to GPAP PH.

- The subsequent sale or assignment by HSBC of its GPAP PH shares to Global Payments Asia Pacific (Singapore Holdings) (GPAP Singapore). To implement this, HSBC and GPAP Singapore entered into a Share Sale and Purchase Agreement on July 24, 2008, for the transfer by HSBC of its GPAP PH shares. On September 28, 2008, HSBC and GPAP Singapore executed a Deed of Assignment, wherein HSBC assigned its GPAP PH shares to the GPAP Singapore.

For the first transaction, HSBC filed an Application and Joint Certification with the Bureau of Internal Revenue (BIR) on September 22, 2008, to secure a ruling on tax-free exchange under Section 40(C)(2) of the National Internal Revenue Code, as amended (Tax Code), regarding the transfer of HSBC's assets in exchange for the issuance to it of GPAP PH shares. HSBC secured a Certification Ruling certifying that the asset transfer in exchange for GPAP PH shares is a tax-free exchange that is not subject to tax pursuant to Section 40(C)(2) of the Tax Code.

For the second transaction, which involves the assignment or transfer by HSBC of the GPAP PH shares to GPAP Singapore, the CGT and DST were paid. The BIR assessed HSBC for deficiency income tax on the alleged sale of goodwill arising from the transfer of HSBC's MAB to GPAP PH (which is under the first transaction).

Both the CTA and the Supreme Court ruled that HSBC is not liable for the deficiency income taxes and stated that the second transaction (i.e., sale by HSBC of GPAP PH shares) is covered by CGT and not RCIT. The Supreme Court ruled that goodwill is an intangible asset derived from the conduct of business and cannot therefore be allocated and transferred separately and independently from the business as a whole. Thus, when HSBC transferred its MAB in the Philippines to GPAP PH in exchange for shares (as part of the first transaction), the goodwill of the business was also transferred to GPAP PH. When HSBC subsequently assigned its GPAP PH shares to GPAP Singapore, the goodwill of the MAB remains with GPAP PH. GPAP Singapore merely stepped into the shoes of HSBC as the majority stockholder of GPAP PH.

SyCipLaw TIP 5:

Note that the above case involves a structure resulting in lower taxes and friction costs. If the first transaction were characterized as a normal asset sale for cash or properties (and not an asset for share transaction that was ruled by the BIR to be a tax-free exchange pursuant to Section 40(C)(2) of the Tax Code)), the sale would have been subject to income tax. It should also be noted that under Republic Act No. 11534, or the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE), a prior tax-free exchange ruling from the BIR is no longer required and under Section 8 of Revenue Regulations No. 5-2021 dated April 8, 2021, parties are now allowed to implement the transaction, including issuance of a certificate authorizing registration by the Revenue District Office; these make mergers and acquisitions easier to consummate.

The Supreme Court also acknowledged that a taxpayer has the legal right to decrease the amount of taxes or altogether avoid them by means which the law permits, or which is referred to as tax avoidance. However, this method should be used by the taxpayer in good faith and at arms-length. In this case, when HSBC transferred the assets to GPAP PH in exchange for shares, pursuant to the tax-free exchange provision under the Tax Code, and subsequently sold such shares to GPAP Singapore and paid the corresponding CGT, HSBC simply availed of tax saving devices within the means sanctioned by law. Further, this methodology was adopted by HSBC not merely to reduce taxes but also for a legitimate business purpose.

6. Are goods imported into the Subic Bay Freeport Zone subject to import duties and taxes?

No. In Republic v. Amira Foods International DMCC (CTA En Banc Case No. 2210 (CTA Case No. 8557), June 3, 2021), the CTA En Banc ruled that the term "Philippine customs territory" must be distinguished from the geographical concept of "Philippine territory" or national territory as defined in the 1987 Philippine Constitution. Republic Act No. 7227, or the Bases Conversion and Development Act, intended to make the Subic Bay Freeport Zone (SBFZ) a freeport to be considered as a separate customs territory. While the SBFZ is geographically located within the Philippines, it is deemed as a separate customs territory and regarded in law as foreign soil. As a foreign territory, importations into the SBFZ are exempted from customs duties and taxes.

SyCipLaw TIP 6:

Taxpayers should note that, based on the CTA's decision in this case, goods imported into economic zones or freeports are not subject to any import duties and taxes.

Note that a motion for reconsideration on the decision of the CTA En Banc in this case is pending. Note also that CTA decisions, while persuasive, do not become the law of the land, unlike decisions of the Supreme Court.

The relevant provisions in CREATE with respect to freeports and/or economic zones will have to be taken into consideration for future cases.

7. Is an import permit from the relevant government agency required for regulated goods imported into the SBFZ?

No. In Republic v. Amira Foods International DMCC (CTA En Banc Case No. 2210 (CTA Case No. 8557), June 3, 2021), the CTA En Banc ruled that since the SBFZ is considered and managed as a separate customs territory or by legal fiction, as foreign territory, shipment of regulated goods into the SBFZ may not be considered as imported into Philippine customs territory. Thus, importers are not

SyCipLaw TIP 7:

Taxpayers should note that, based on the decision in this case, regulated goods require an import permit to validly enter into Philippine customs territories. However, importation into economic zones or freeports shall not require an import permit to be issued in order that the shipment is allowed entry therein.

Note that a motion for reconsideration on the decision of the CTA En Banc in this case is pending. Note also that CTA decisions, while persuasive, do not become the law of the land, unlike decisions of the Supreme Court.

8. Is the Bases Conversion and Development Authority exempt from payment of docket fees?

Yes. In Bases Conversion and Development Authority v. Commissioner of Internal Revenue (G.R. No. 205466, January 11, 2021), the Supreme Court ruled that the Bases Conversion and Development Authority (BCDA) is a government instrumentality vested with corporate powers and, therefore, it is exempt from the payment of docket fees under Rule 141, Section 21 of the Rules of Court, which provides that government instrumentalities are exempt from the payment of docket fees.

In this case, the BCDA filed via registered mail a Petition for Review with Request for Exemption from Payment of Filing Fees (Petition) with the Second Division of the Court of Tax Appeals (CTA Division). The Petition relates to its claim for refund of the creditable withholding taxes in connection with its sale of the BCDA-allocated units as its share in the Serendra Project pursuant to the Joint Development Agreement with Ayala Land, Inc. The CTA Division, through a letter sent by its Clerk of Court, acknowledged the receipt of the Petition, however, in the same letter, the CTA Clerk of Court informed BCDA that it was returning the Petition as it was not deemed filed without the payment of the correct docket fees. The BCDA maintained that it was not required to pay docket fees due to its status as a government instrumentality; nevertheless, it subsequently paid the required docket fees under protest.

The CTA Division dismissed the Petition for non-payment of docket fees and ruled that the timely payment of docket fees is essential before a court can acquire jurisdiction over the case. The CTA En Banc affirmed the CTA Division's ruling.

The BCDA appeal to the Supreme Court. The Court ruled that the BCDA is a government instrumentality as defined under the Administrative Code of 1987 (i.e., any agency of the National Government, not integrated within the department framework, vested with special functions or jurisdiction by law, endowed with some if not all corporate powers, administering special funds, and enjoying operational autonomy, usually through a charter). Despite being vested with corporate powers by virtue of Republic Act No. 7227, or the Bases Conversion and Development Act of 1992, the BCDA is considered neither a stock corporation because its capital is not divided into shares of stock, nor a non-stock corporation because it is not organized for any of the purposes mentioned under Section 88 of the Corporation Code.

The Supreme Court ruled that the BCDA is a government instrumentality organized for the specific purpose of owning, holding, and/or administering the military reservations in the country, and implementing their conversion to other productive uses. Therefore, it is a government instrumentality exempt from payment of docket fees. Its belated payment of docket fees did not strip the CTA Division of jurisdiction as it was exempt from payment of docket fees in the first place.

SyCipLaw TIP 8:

Note that Rule 141, Section 21 of the Rules of Court provides that "[t]he Republic of the Philippines, its agencies and instrumentalities, are exempt from paying the legal fees".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.