- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Banking & Credit and Media & Information industries

- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Banking & Credit and Media & Information industries

- within Environment, Family and Matrimonial and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

INTRODUCTION

Canada has a strong and well-regulated capital market with a history of funding growth companies. By going public in Canada, companies can achieve robust valuations and raise funds from an array of institutional and retail investors. Access to funding opportunities is further broadened by allowing companies to select the best option for them among the four main Canadian stock exchanges: the Toronto Stock Exchange ("TSX"), the TSX Venture Exchange ("TSX-V"), the Canadian Securities Exchange ("CSE"), and Cboe Canada ("Cboe").

A company can "go public" and proceed to obtain a listing on a Canadian stock exchange through a variety of methods, including an initial public offering ("IPO"), a reverse take-over ("RTO"), the TSXV's capital pool company program ("CPC"), the NEO's Growth Acquisition Corporation program ("GCorp"), or a special purpose acquisition corporation program ("SPAC") offered by the TSX and the NEO.

If you are considering a going-public transaction in Canada, we invite you to review the information presented in this guide which outlines some of the key issues you may wish to consider, including:

- making the decision to go public in Canada;

- which Canadian stock exchange to list on;

- methods of going public;

- minimum listing requirements; and

- the timeline and cost of going public.

THE DECISION TO GO PUBLIC

Advantages

- Easier access to capital – whether it be for specific projects or future growth, companies are able to access capital on more favourable conditions than private equity financing and without the interest costs of debt financing.

- Greater liquidity for existing and future shareholders – shares will become easier to sell; however, securities held by principals may be subject to escrow requirements imposed by statute and/or arrangements with underwriters.

- Greater liquidity options for founders – founders may sell some or all of their shares or use them as collateral for personal loans.

- Increased credibility – generally speaking, due to greater transparency and visibility, public issuer status enhances corporate image which in turn assists in developing relationships with customers, suppliers and the community.

- Ability to use equity as compensation to management – permits greater flexibility in compensation arrangements.

- Ability to use equity as compensation for purchases – enhances the ability of an issuer to complete mergers utilizing liquid stock as consideration.

- Enhanced ability to borrow – the increase in equity base creates more leverage for growth by improving a company's debt-to-equity ratio.

- Method of valuation through the market – provides a more accurate assessment of the fair market value of the enterprise.

Other Considerations

- Set-up costs – the initial costs of going public incurred, including management time and internal resources.

- Ongoing costs – additional costs on a going-forward basis will be incurred to meet continuous disclosure and corporate governance requirements of the exchanges and securities regulators.

- Decreased flexibility for founders – public companies become subject to various restrictions under listing rules and that can impact activities, including issuing securities, related party transactions, etc.

- More pressure on management – as the number of shareholders increase, meeting their expectations of continuing success and profit, as well as expectations of a broader variety of stakeholders, will require more from management.

- Loss of confidentiality – due to extensive corporate and financial reporting obligations.

- Potential for civil liability – the issuer, directors and certain advisors could all be held liable for misrepresentations in public disclosure documents.

- Potential loss of certain tax benefits – current income tax laws provide certain credits and deductions to Canadian-controlled private corporations which are no longer available to a company once it goes public.

- Increased vulnerability to hostile takeovers – especially where founders own less than the majority of the outstanding stock.

CANADIAN STOCK EXCHANGES

There are now four principal stock exchanges in Canada, being the Toronto Stock Exchange ("TSX"), the TSX Venture Exchange ("TSX-V"), the Canadian Securities Exchange ("CSE"), and the NEO Exchange ("NEO"). The TMX Group owns and operates both exchanges. Of the two, the TSX is the market for senior issuers. The TSX-V is the market for more junior issuers that have not yet met the requirements for listing on the TSX. The CSE is operated by CNSX Markets Inc. and recognized as a stock exchange in 2004 and the NEO was launched in 2015.

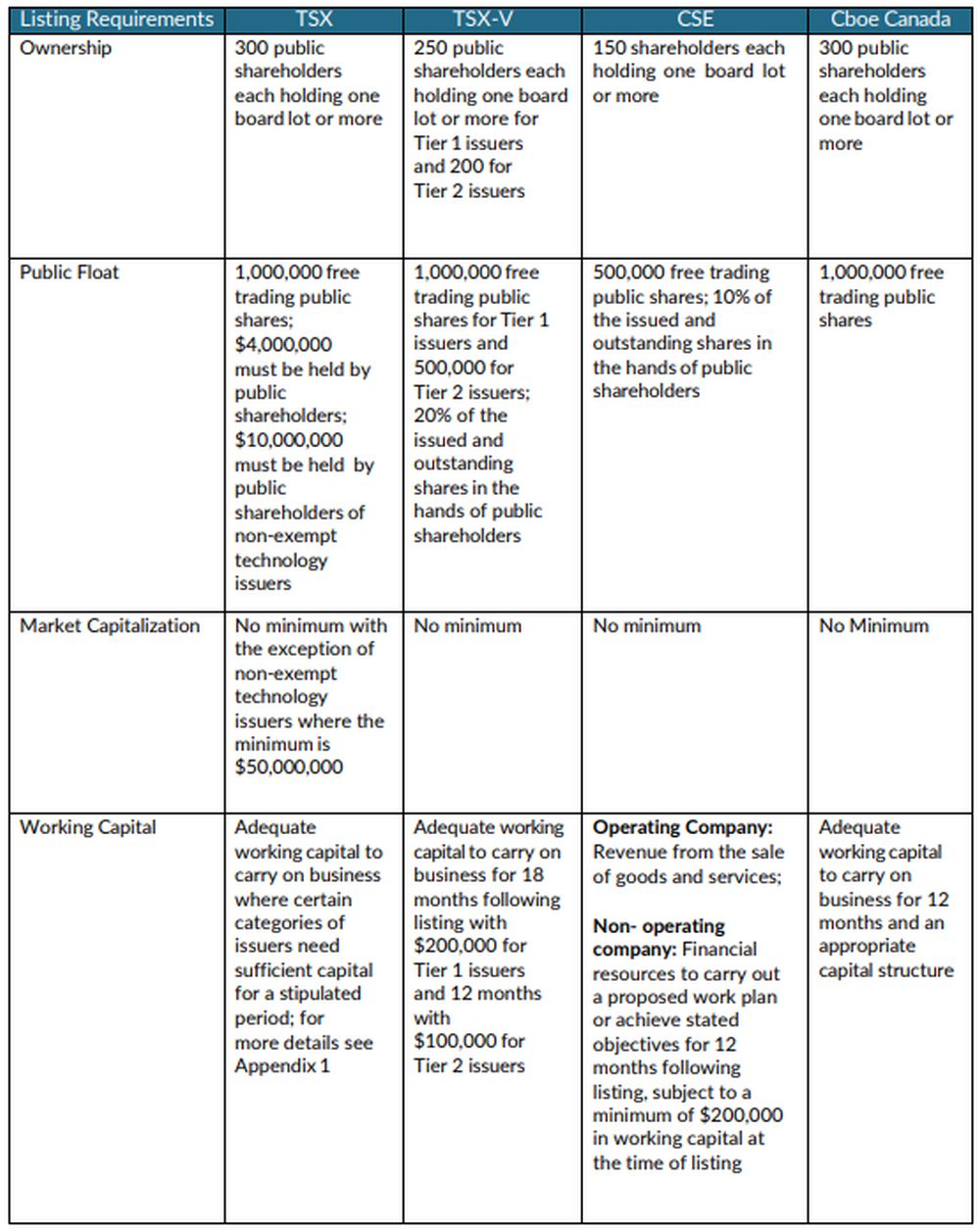

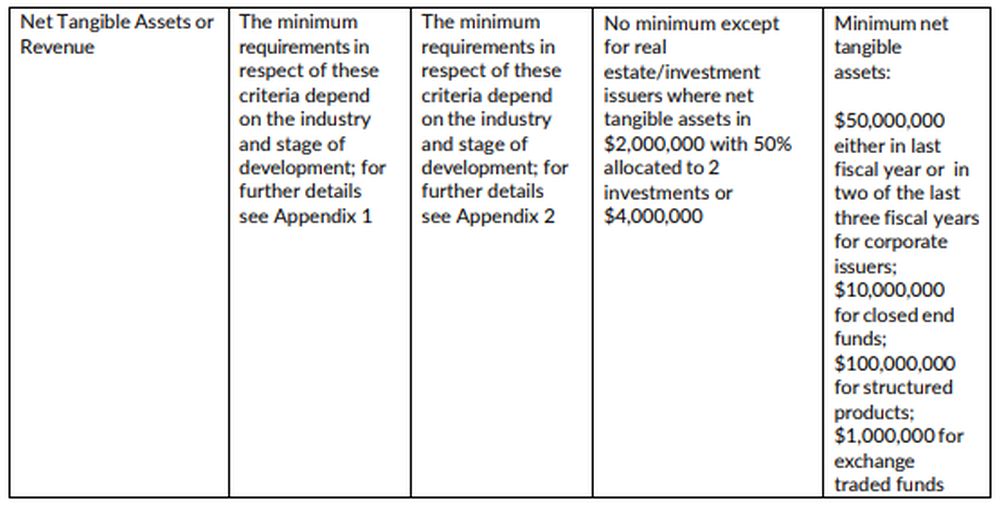

In order to secure a listing on any of these exchanges, a company must complete a listing application which, together with supporting data, must demonstrate that the issuer is able to meet the applicable minimum listing requirements of the relevant exchange.

Toronto Stock Exchange

The TSX is the largest stock exchange in Canada. It lists more than 1,500 companies with an aggregate market capitalization in excess of $2.8 trillion. In addition to traditional companies, exchange-traded funds, split share corporations, income trusts and other investment funds may be listed on the TSX.

The TSX classifies applicant issuers into one of three listing categories: (i) industrial (general), (ii) mining, and (iii) oil and gas.

- The industrial (general) category is further separated into profitable companies, companies forecasting profitability, technology companies, and research and development companies.

- The mining category is further separated into producing mining companies, and mineral exploration and development-stage companies.

For the minimum listing requirements for the TSX, please refer to Appendix 1.

TSX Venture Exchange

The TSX-V is a public venture capital marketplace for emerging companies. It provides a fair marketplace where growth companies can raise capital to develop and market their properties, products and services. For investors, this exchange provides opportunities to seek early stage investments in growth companies.

While the TSX-V continues to demonstrate its strength in attracting resource companies, its 2,000+ issuers represent a diverse mix of industry sectors, including industrial, life sciences, technology, clean technology and financial services. As the listing requirements are specifically designed for emerging companies, they focus more on the experience of the management team rather than the company's products and services.

The TSX-V classifies applicant issuers into two tiers based on historical financial performance, stage of business development and financial resources:

- Tier 1 is for issuers with greater financial resources and has more onerous minimum listing requirements and ongoing tier maintenance requirements than for Tier 2 issuers.

- Tier 2 is for early-stage companies in all industry sectors. The majority of the TSX-V listed issuers trade in Tier 2. Tier 2 issuers may obtain Tier 1 status if they later meet Tier 1 minimum listing requirements.

Issuers are further classified within each of the two tiers into industry sectors, including (i) mining, (ii) oil and gas, (iii) technology or industrial, (iv) real estate or investment, and (v) research and development. For the minimum listing requirements for the TSX-V, please refer to Appendix 2.

Canadian Securities Exchange

The CSE, formerly known as the Canadian National Stock Exchange, is an alternative for micro- cap and emerging growth companies. It offers simplified reporting requirements, a streamlined regulatory model with no transactional reviews, approvals of fees and reduced barriers to listing, including no mandatory sponsorship requirements.

Built as a solution for today's challenging market conditions, the CSE structure is designed to allow entrepreneurs to spend less time managing their listing and more time focused on growing the company's value for shareholders.

The CSE will permit for listing equity and debt securities with different requirements for each type. Debt instruments listed by the CSE include structure products (such as principal protected notes), government bonds, and corporate debentures and crown-corporation debt instruments.

For the minimum listing requirements for the CSE, please refer to Appendix 3.

Cboe Canada

Cboe Canada is a stock exchange that was launched in 2015 with the aim of helping companies, dealers and investors by eliminating predatory market behaviours, such as high-frequency trading, and offering real-time market data for its listed securities.

Cboe Canada is focused on senior companies, as their belief is that companies need to be truly ready before they go public. This belief is reflected in their stringent listing requirements and strong focus on liquidity and disclosure.

Cboe Canada markets itself as a bold, innovative, and disruptive capital markets technology firm founded on the principles of fairness, liquidity, efficiency, and service.

For the minimum listing requirements for Cboe Canada, please refer to Appendix 4.

INITIAL LISTING REQUIREMENTS

METHODS OF GOING PUBLIC

The listing of a private company on the TSX, the TSX-V, the CSE or Cboe Canada can be achieved through different routes, the most common of which include an initial public offering, completing a reverse take-over, completing a qualifying transaction, and other specific programs offered by the TSX the TSX-V and Cboe Canada. These three, along with other routes mentioned above, are discussed below. While an IPO may come to mind as the most obvious route to listing, most other options available offer quicker and less costly means towards a similar end.

Deciding which road to take should be based on the characteristics of the company, the concurrent capital raising needs of the company and the motivations for taking the company public.

Initial Public Offering

An initial public offering ("IPO") is the traditional method of going public. An IPO is typically completed via a long-form prospectus offering of shares in conjunction with an initial listing on a stock exchange.

The typical structure of an IPO is relatively straightforward. The company wishing to complete the IPO files a listing application with the selected exchange. The listing application must demonstrate that the company meets the minimum listing requirements of the selected exchange. In addition to listing, an essential element of the IPO consists of capital raising which requires the engagement of underwriters to market the offering of the securities to the public. Upon approval of the listing application and on closing of the offering, the company's shares become listed for trading on the exchange.

An IPO involves the preparation of a prospectus in accordance with Canadian securities laws. Approval of the prospectus by securities regulators in the jurisdictions in which the securities will be sold is required. The prospectus is written by the company's legal counsel and requires the participation of management, auditors, underwriters (including its legal counsel), securities commissions and the exchange. It must contain full, true and plain disclosure of all material facts relating to the shares being offered for sale to the public. Typically, a prospectus includes:

- the history of the company and a description of its business;

- a description of the company's business and investment plans;

- a description of the intended use of the proceeds raised by the IPO;

- a description of the securities being offered;

- a summary of the major risk factors affecting investment in the company;

- detailed information on management, directors and principal shareholders;

- disclosure regarding particulars of material contracts other than those entered into during the ordinary course of business;

- audited financial statements;

- a plan of distribution and distributions spread (i.e., commissions, options or other fees payable to the underwriters);

- certification of "full, true and plain disclosure of all material facts" signed by the CEO, CFO and two directors; and

- the same certification from the underwriter, with the addition of "to the best of our knowledge, information and belief".

A financing conducted by underwriters can be arranged in different ways, including on a firmcommitment basis and a best-efforts basis. When acting on a firm-commitment basis, the underwriter acts as a principal rather than agent and purchases the offered shares and then attempts to sell them to the public. An IPO underwritten on a firm-commitment basis is attractive to a company as the amount raised by the company is guaranteed regardless of the success the underwriter has in marketing the offered shares and obtaining investors. However, a firm- commitment basis IPO will likely be priced at a larger discount to market, making it easier for the underwriter to sell the shares. In contrast, an underwriter acting on a best-efforts basis may market the offered shares but the purchased shares pass directly from the company to the investors. Furthermore, the underwriter is not obliged to purchase any unsold shares. This exposes the company to the risk that the market will not have an appetite for the offering and the company may raise less than expected. Regardless of the method under which the underwriter sells the shares, both parties must be confident that the shares being sold under the prospectus will be attractive to investors.

As mentioned, a financing is an integral part of the IPO process. While an IPO provides an opportunity to raise significant equity for the company, it also results in share dilution whereby founders or major shareholders of the private company lose their controlling interest in the resulting public company.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.