- with Senior Company Executives, HR and Finance and Tax Executives

- in Canada

- with readers working within the Accounting & Consultancy and Law Firm industries

An auditor's comfort letter provides underwriters with certain assurances with respect to the financial information included in an offering document. One of the first steps of underwriters' counsel in the comfort letter process is to "circle-up" the financial information in the offering document, including certain information incorporated by reference. Underwriters' counsel will circle the numbers in the offering document on which they want comfort (i.e. the "circle-up"), which the auditors then compare against the issuer's accounting records.

Once the circle-up is complete, the auditors will then provide varying levels of comfort for these circled items in a process known as "tick and tie". Auditors will assign a certain symbol or letter (a "tick") to each procedure they perform to confirm the accuracy of the financial information. Each circled item is then assigned (or "tied" back to) a certain tick based on the procedure the auditors performed for that item. Underwriters and their counsel aim for the highest level of comfort possible for each piece of financial information.

To Circle or Not to Circle

Auditors will only provide comfort on certain financial information. When circling up an offering document, comfort is typically provided for:

- numbers derived from audited financial statements;

- numbers derived from unaudited financial statements;

- numbers derived from the issuer's internal accounting records; and

- information subject to the issuer's internal controls.

Comfort is not typically provided for:

- non-accounting-related numbers or figures not about the issuer (e.g. general industry or market data, biographical information, dates and times);

- estimates and other non-specific numbers (e.g. "approximately" or stated as a range);

- information subject to legal interpretation (e.g. number of shares beneficially owned by a party);

- contracted amounts;

- numbers with a non-financial component (e.g. average revenue per user);

- financial statements themselves, as they are covered by statements in the body of the comfort letter; and

- financial information that is not subject to the issuer's internal controls or accounting standards (e.g. number of employees or volumes sold).

The initial draft of the circle-up should be over-inclusive and request comfort on all accounting-related numbers. However, the CPA Canada Handbook limits auditors to providing comfort on information that:

- is expressed in dollars (or as percentages based on dollar amounts) and that has been obtained from accounting records that are subject to the issuer's internal controls, or that can be derived from such accounting records by analysis or computation; or

- is quantitative if it is derived from accounting records that are subject to the issuer's internal controls.

Pro Forma Financial Information

Auditors may provide comfort on pro forma financial statements. While auditors will not typically provide comfort that pro forma statements are in accordance with generally accepted accounting principles (GAAP) or "fairly present" anything, they can review the logic behind the adjustments, confirm compliance with applicable accounting requirements and verify the mathematical calculations of the pro forma numbers.

Levels of Comfort

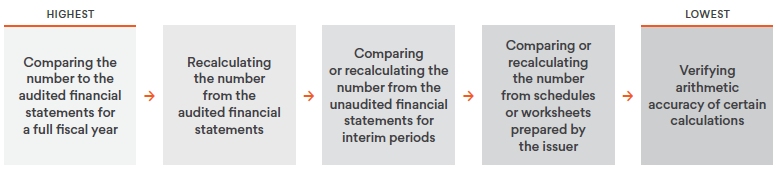

Depending on the procedure performed, the auditors are able to provide varying levels of comfort as to the accuracy of a given circled item. Generally, auditors will provide the following levels of comfort, ranked from highest level of comfort to lowest level of comfort:

When auditors provide assurances on (1) unaudited interim statements, (2) changes in material financial statement line items, and (3) the accuracy of other financial information derived from the issuer's financial records, the level of comfort is typically limited to "negative assurance". To provide negative assurance, auditors will conduct a limited review in accordance with Canadian GAAP. Negative assurance means that nothing in the review caused the auditor to believe that the financial statements or records do not comply with GAAP and applicable securities laws, or to believe that there has been a material change in certain financial statement line items, depending on the information being comforted.

Tick Tock: Timing

The comfort letter is dated and delivered by the auditors as of the offering's pricing date, and includes a cut-off date (i.e. the last date the auditors performed procedures on the financial statements and related financial information in the offering document), which is usually within three business days of pricing. At closing, the auditors provide a bring-down comfort letter that confirms that the statements made in the original comfort letter remain true. The cut-off date for the bring-down comfort letter is typically the business day preceding closing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]