- with Senior Company Executives, HR and Finance and Tax Executives

- in Canada

- with readers working within the Business & Consumer Services, Healthcare and Transport industries

In 2025, technology providers and technology users are navigating a complex landscape filled with both challenges and opportunities. Market dynamics driven by technology innovation, the push for profitability, shifting risk attitudes, a focus on environmental, social and governance (ESG) initiatives, heightened geopolitical and cybersecurity concerns and new legislative and regulatory changes are reshaping the face of IT.

To help you navigate these changes, Fasken's Technology Law team has prepared this guide highlighting key trends confronting the Canadian technology sector in 2025.

Trend #1: The technology sector will continue to be a focus for Canadian M&A activity

Technology deals are expected to remain a focal point for M&A activity in 2025. The rise in Tech M&A is expected to be driven by innovation in emerging industries, the ongoing efforts of industry players to enhance their artificial intelligence (AI) capabilities, and the anticipated loosening of regulatory constraints for the tech sector as a probable outcome of the new US administration.

EMERGING THEMES AND OPPORTUNITIES IN TECH M&A

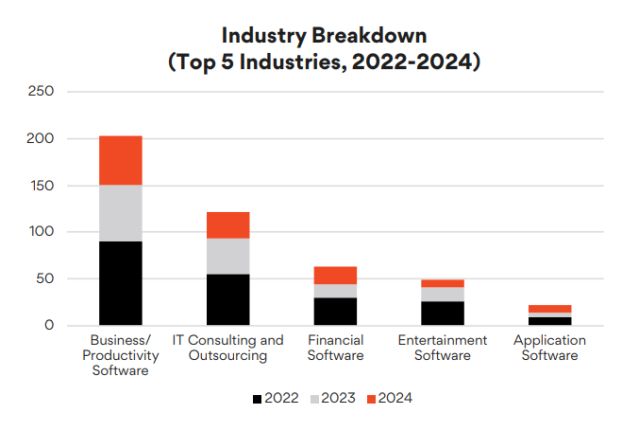

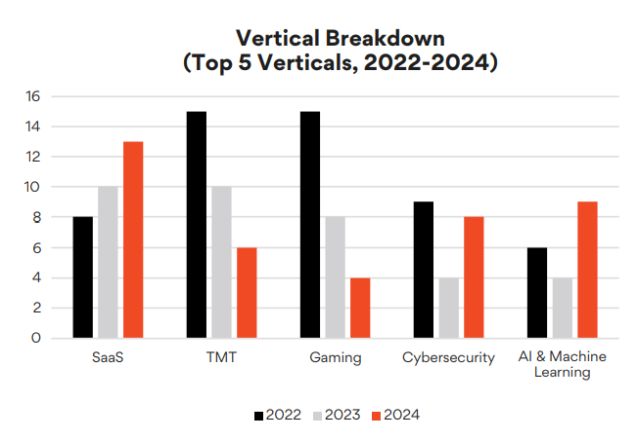

An analysis of M&A activity in the information technology sector in Canada over the past several years1 has revealed the following themes and opportunities:

- Business Productivity Software and IT Outsourcing: These areas continue to dominate deal volumes, reflecting organizations' increasing focus on tools and services that enhance efficiency and address operational complexity.

- Software as a Service (SaaS): SaaS remains the top vertical for Tech M&A, with steady growth in deal volume over the past three years. This trend underscores the sustained demand for scalable, cloud-based solutions that support hybrid work environments and enterprise-level efficiencies.

- Application-Specific Semiconductors: This industry vertical strengthened significantly in 2024. Although deal volumes are relatively low, there has been noticeable growth. This reflects the importance of semiconductors in supporting advancements in AI and other data-intensive technologies.

- Artificial Intelligence & Machine Learning: This sector continues to be a key industry vertical, accounting for 7.03% of Tech M&A in 2022, rising to 12.66% in 2023, and maintaining a strong presence at 11.79% in 2024, despite a broader decline in overall deal volume. This growth highlights AI's pivotal role in driving innovation and value creation across industries.

It is important to note that these verticals are complemented by other related verticals and are not the exclusive focus of M&A. For example, the rise in semiconductor deals will complement the continued focus on strategic minerals for the North American market.

CONSIDERATIONS FOR AI-FOCUSED TECH M&A

The integration of AI into business models has fueled M&A activity, presenting both opportunities and unique challenges. These challenges—ranging from model accountability to regulatory scrutiny—are shaping the due diligence process and the representations and warranties in acquisition agreements.

Due Diligence

The relative newness of AI necessitates a more comprehensive due diligence process to properly assess the value and risks of a target. For an AI target, tailored approaches are required to cover AI-specific issues such as data quality, data rights, and compliance with evolving regulations. This includes evaluating the integrity and legality of data used for training AI models and ensuring the models' accuracy and reliability.

The scope of AI-specific due diligence varies depending on the nature of the target. For instance, if a company provides AI infrastructure or data centres, due diligence may align more closely with standard M&A considerations, with some exceptions, such as ensuring sufficient power generation capabilities or access to specialized chips. Conversely, conducting due diligence on machine learning and generative AI providers may require a more bespoke approach to better understand the unique characteristics and risks of the company and its technology. This may include targeted inquiries into personnel and AI systems to evaluate critical areas such as data integrity, model robustness, ethical design processes, and the expertise of specialized personnel.

Representations, Warranties and Covenants

M&A transactions involving AI technologies often include representations and warranties typical of Tech M&A transactions, particularly those related to intellectual property rights, data privacy, and cybersecurity. However, recent acquirers are increasingly seeking AI-specific representations, especially when a target's valuation hinges on a specific aspect of this technology or when addressing the unique risks posed by unsettled law. Some representation and warranty insurers are also placing special attention on the qualifications and expertise of those assessing AI technologies and requiring deliberate consideration in the due diligence process. As more companies move to include AI-specific representations and warranties, we can foresee a similar rise in insurers implementing this practice or developing policies with AI-specific coverage and exclusions.

In situations where the law on AI technology remains unsettled— such as with generative AI or the use of web-scraped data—standard representations may not be sufficient. Acquirers might require specific representations to ensure that AI models were trained using permissioned data or that the AI systems align with the acquirer's risk tolerance concerning bias, explainability, and trustworthiness. They may also negotiate specific indemnities and other unique deal terms, such as AI-specific covenants that prohibit changes to a target's training data or AI vendors, models, or compliance policies between signing and closing to maintain the value of the business or asset. Conversely, targets may seek representation and warranty insurance or look to include carve-outs within representations and warranties to avoid a breach due to changes in the law that are outside of their control.

Ultimately, the unique risks associated with AI necessitate tailored due diligence, representations and warranties and covenants to adequately protect against and manage uncertainties in Tech M&A transactions.

Trend #2: Market dynamics will shift vendor pricing and customer opportunities for cost-savings

DYNAMICS SUPPORTING VENDOR PRICE INCREASES

As customers will recognize, certain changes in the market have led to increasing pressure from technology vendors to raise prices. For example:

- M&A Acquisitions have led to Increased Pressure on Vendors to Deliver Financial Returns: The technology sector has seen a significant uptick in M&A activity, particularly driven by private equity firms buying technology companies to create synergies, consolidate market positions, and ultimately drive higher margins (e.g. the Broadcom acquisition of VMware at the end of 2023). Newly acquired firms often face substantial pressure to deliver improved financial returns, contributing to across-the-board price hikes.

- Changes in Vendor Pricing Models: Technology vendors are redefining how they price their products. For example, on the licensing side, Oracle recently made the decision to price Java based on the number of employees rather than the number of licenses.

- Transition to Subscription-Based Licence Models: In a similar vein, there continues to be a marked movement by vendors from a perpetual license model to a subscription-based, and recurring payment, Software as a Service (SaaS) model. For example, (a) Guidewire, a technology vendor for the P&C insurance industry, recently transitioned from an onpremises (on-prem) license model to a SaaS model, and (b) in 2025, IBM is migrating key products such as Maximo and Cognos from perpetual licensing to SaaS. All of this is part of a broader strategy to move customers into recurring payment models. Not only do such vendor-hosted models raise new customer concerns regarding vendor security and data breach obligations, but each expiration of a subscription term becomes a further opportunity for vendors to implement price increases.

- Accelerated End of Life (EOL) Cycles: Vendors are accelerating the discontinuation of support for older software versions, effectively forcing customers to upgrade at higher costs. Under the previously dominant on-prem licensing model, software vendors had heavily relied on the maintenance support fees (which could be 20% or more of the license cost) as an ongoing annuity revenue stream. With the on-prem licensing model going the way of the dodo, vendors have sped up the EOL cycle - for among other reasons, to maintain revenue by incenting customers to purchase the upgraded successor versions.

- Increased Compliance Audits: Suppliers are conducting rigorous audits to uncover instances of licence non-compliance. These audits can lead to unexpected costs and necessitate additional investments in compliance measures. For example, the IBM audit practices remain aggressive. In 2025, IBM is expected to not only audit any customer not audited in the last four years, but also to enforce mandatory verifications – effectively audits in all but name - at the end of the term of each of their Enterprise License Agreements. Similarly, Oracle is expected to intensify its customer licence audit activity throughout 2025, having recognized audits as a critical revenue stream, with particularly increased scrutiny of OCI Cloud, Oracle Java, and on-prem software licenses.

DYNAMICS COUNTERING VENDOR PRICE INCREASES

Yet there are other dynamics at play which are countering these trends. Market uncertainties have resulted in a slowdown in the availability of RFPs/RFIs on which vendors can bid, so customers have reported that, in some cases, vendors have quickly compromised in response to customer pushback on vendor-requested price increases - based on the vendor rationale that it is better to keep some market share than to lose market share in a push for fee increases. In other sectors, plateauing revenues for customers – for example, in the insurance industry – have heightened the focus on cost-cutting, creating another dynamic to counter the technology vendor push for increased fees.

However, the ability of a customer to resist price increases depends on the materiality of the software to the customer. For example, it is easier to pivot – or to threaten to pivot – to a cheaper alternative vendor where the applicable product is more of a utility; it becomes much less of an option where the product is part of a very large and/or complex Enterprise Resource Planning (ERP) implementation.

Customers can seek to improve their ability to pivot from, and therefore negotiate better pricing with, each vendor, by implementing proactive strategies such as (a) obsolescence analysis/ EOL forecasting of their technology inventory, in order to identify in advance components for which EOL is pending, and (b) adopting a "second sourcing" strategy, wherein the customer identifies and engages an alternative, secondary vendor as a backup to the primary vendor, ensuring that the customer is not solely dependent on a single vendor.

THE CONTINUING ISSUES POSED BY TIME & MATERIAL ENGAGEMENTS

As a final comment, failed project lawsuits continue to suggest that there can be an over-reliance on time and material (T&M) engagements in the ERP and technology project space, which can present challenges. As one example only, in Hertz Corporation v Accenture LLP, 1:19-cv-03508 (SD NY 2019), the customer learned this to their detriment when they engaged the vendor to complete a digital channels engagement on a T&M basis, but after paying the vendor more than US$32 million in fees and expenses, argued that they never received a functional website or mobile app.

Customers should be very careful in considering whether to agree to T&M fee structures for large scale technology projects. In some cases, customers – knowing that contingency is built into a fixed fee price - may think that they are 'outgaming' the vendor by agreeing to a T&M engagement which avoids the contingency amount. However, this will not necessarily be the case, and can present a fundamental challenge.

From the customer perspective, a fixed fee engagement has the advantage of a more defined list of vendor justifications where a project encounters cost overruns: for example, the vendor might justify the cost overruns based on a failure of the customer to perform their obligations, or on customer scope creep. In contrast, in a T&M engagement, the vendor does not need to reference such a list of justifications, as fee expenditures are simply based on time spent.

For the customer, a second advantage of a fixed fee project is that it requires the vendor to put "skin in the game". The customer's position will be that, if a vendor is claiming to have extensive experience and expertise with respect to the technology project, then they should be able to emerge a fixed fee to accomplish such project. The vendor can still protect themselves with a crisply defined scope and a built-in contingency amount, and by enumerating specific assumptions and customer obligations in order to qualify that fixed fee, but on the whole, the fixed fee could still more fairly allocate the project risk.

From the vendor perspective, a T&M engagement may be preferable in various circumstances, including for engagements of limited scope, but with a high degree of uncertainty. For example, T&M might be more suited (a) for the initial planning phase of a project, rather than for the "build" phase, (b) for an initial due diligence "Phase 0" for a project, or (c) for a multi-vendor project where the success of the vendor will be reliant on the performance of other third party contractors outside the control of the vendor. We expect to see a continuing push by vendors for T&M engagements where the vendor faces inadequate information, or a lack of control over externalities on which the success of the project may be reliant.

Trend#3: Limitations of liability will continue to be tailored to address complex, specific risks

Limitation of Liability (LoL) clauses are a cornerstone of IT agreements, designed to allocate risk between contracting parties and cap potential liabilities. As technology continues to evolve and the scope of IT services expands, these clauses have become increasingly complex and tailored to address specific risks. This section examines recent trends in LoL clauses across various IT agreements, focusing on liability caps, the scope of exclusions, and specific LoL clauses.

LIABILITY CAPS

In 2024, caps and supercaps continued to take various structures, with the most common being based on the value of the contract or a multiple of the fees paid over a specified period. For instance, some agreements capped liability at the total fees received for the product or service, while others set caps at a negotiated amount, which bore connection to the total value of the contract, with annual adjustments. 2024 saw increased attention on cost of living adjustments (COLA) in light of inflation concerns and rising interest rates, which may taper slightly this year as the Bank of Canada predicts reduced inflation for 2025 and has since been cutting interest rates.2

The use of cap reset mechanisms also gained traction in the market. These mechanisms effectively reset the liability cap to its original quantum in the event of specific breaches, or where the payment of damages exceeds a particular threshold (50%) within a specific period of time (12-36 months).

For 2025, we expect that these clauses will continue to take on a variety of structures and quantums, reflecting the nuances in the particular nature of the relevant IT services and the varying levels of risk associated with different types of agreements.

To view the full article, click here .

Footnotes

1. Data in this analysis is sourced from PitchBook, reflecting M&A and change of control transactions in Canada within the information technology sector for 2022, 2023 and 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.