Supply chain and compliance professionals now have some clarity on the landed cost of imported goods and compliance obligations. The White House announced a new Executive Order on the evening of July 31, 2025, that modifies reciprocal tariff rates for import countries of origin, titled "Further Modifying The Reciprocal Tariff Rates" (the "E.O."). Key changes are effective on August 7 and October 5, 2025. Most imports to the US will be subject to additional duties ranging from 15% to 40%. Imports with countries of origin that are not listed below will be subject to the current 10% additional duties. Rates applicable to most countries are reduced from the country-specific rates announced on "Liberation Day" in April 2025.

This client alert provides background on this reciprocal tariff regime, the current statuses of reciprocal tariffs, and expectations for supply chain planning the months ahead.

Reciprocal Tariff "Pause" Ends

The Administration announced country-specific reciprocal tariff rates on Liberation Day and then paused their application in favor of a universal 10% tariff rate applicable to most countries. This Summer, the pause on the country-specific rates was extended. Now that pause is coming to an end. The universal 10% rate will be replaced with country-specific rates effective August 7, 2025 or October 5, 2025 for certain goods in transit. Supply chain and compliance professionals have been adjusting to the realities of this trading environment and its cost impact all year. The early days following April 2, 2025, were a great challenge for supply chains with any material imports and those domestic industries reliant on imports. However, during the pause period many importers expressed "cautious optimism" as the period afforded time to assess immediate tariff impacts and plan for both sourcing and inventory levels.

Now, the Trump Administration has announced adjustments to the original reciprocal tariff rates from Liberation Day which are lower but directionally similar. The Trump Administration has also now announced effective dates for this increase over the 10% universal tariff baseline, which did not exist prior to April 2. According to the White House these developments are the result of progress in the ongoing trade negotiations with global trading partners.

Impact on Landed Cost

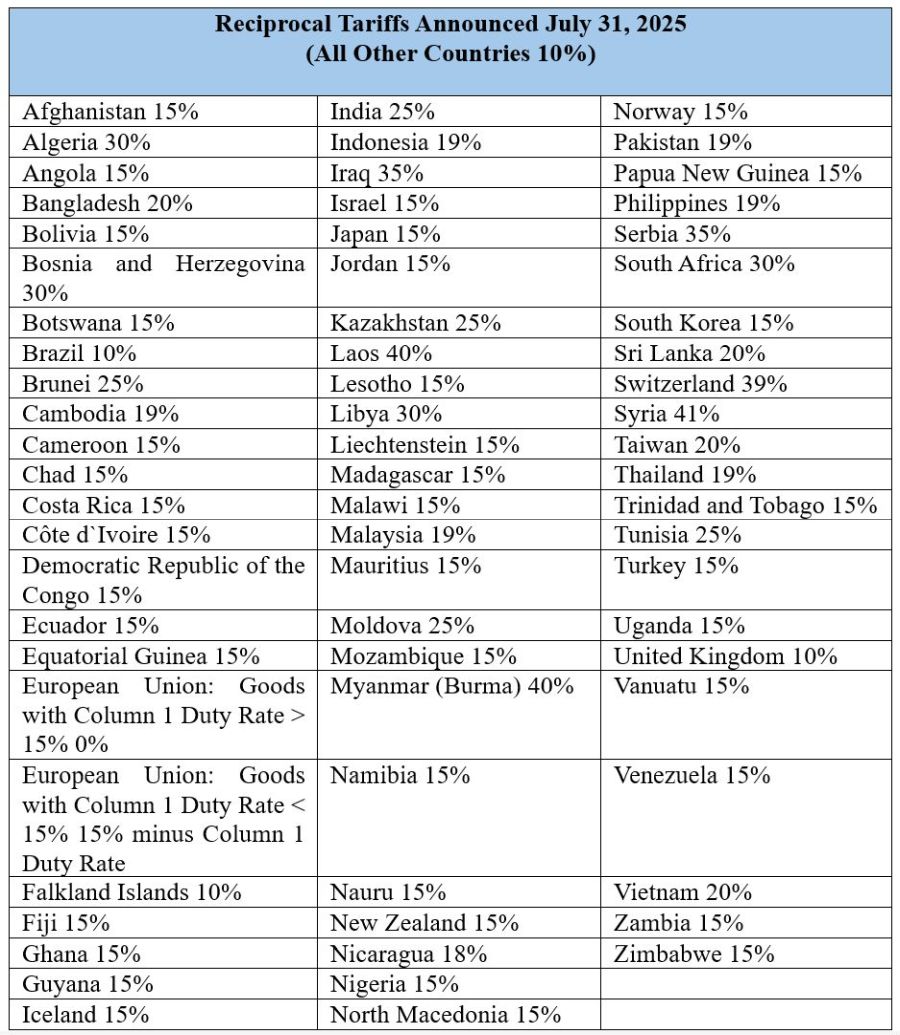

The Trump Administration announced specific new rates that domestic US importers will pay in addition to all other duties in an Annex I to the new E.O., which we included below. Imports from countries that are not listed will be subject to a 10% baseline tariff in addition to all other duties. The US will now apply a special reciprocal tariff rule for imports from the European Union ("EU") where all EU goods are subject to at least a 15% tariff. The duty for each EU product is based on its standard rate listed under Column 1 (General) of the US Harmonized Tariff Schedule. If the listed rate is less than 15%, the duty is increased to a flat 15% under this rule. However, if the product already has a duty rate of 15% or higher, no additional tariff is applied. Initial implementation guidance for these modifications to reciprocal tariffs is found in Annex II to the E.O. The E.O. allows leniency for certain goods in transit. Goods in transit will not be subject to the new duties if they are loaded onto a vessel at the port of loading and in the final mode of transit before August 7 and entered or withdrawn from a warehouse for consumption before October 5, 2025.

Trendlines Analysis for Tariff Rates

A substantial majority of country-specific tariff rates have been reduced relative to the rates announced on Liberation Day. For example, Thailand's rate fell from 36% to 19%. Conversely, some nations face increased rates. Switzerland's rate rose from 31% to 39%. Several countries, including South Africa, have maintained their existing rates. Additionally, new countries have been incorporated into Annex I and identified as subject to country-specific tariff rates that were not included in the initial reciprocal tariff framework from Liberation Day. These countries include Afghanistan, Bolivia, Brazil, Costa Rica, Ecuador, Ghana, Iceland, New Zealand, Papua New Guinea, Trinidad and Tobago, Turkey, Uganda, and the United Kingdom ("UK"). All newly added countries are subject to a 15% reciprocal tariff rate, with the exception of Brazil and the UK, which have each been assigned a 10% rate.

Transshipment and Evasion Enforcement

Transshipment is another interesting development under the E.O. As used here, the term refers to illegal transshipment by routing goods through countries other than the country of origin in order to evade lawful duties. Any person who enters an article determined by US Customs and Border Protection ("CBP") to have been illegally transshipped will be subject to: (i) an additional duty of 40%; (ii) any other applicable fine or penalty, including those assessed under 19 U.S.C. 1592; and (iii) any other duties, fees, taxes, exactions, or charges applicable to the good's country of origin. CBP will not accept mitigation or remission of the penalties assessed on imports found to be transshipped. This continues a trend of increased CBP enforcement for customs compliance violations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.