Key takeaways

| Survey data shows middle market perspectives on supply chain priorities, tariffs and more. | Amid global supply network uncertainty, using technology to improve supply chains will be key. | Supply chain decisions will continue to have implications for organizations' tax functions. |

As they navigate the evolving trade and tariffs landscape, supply chain decision makers at middle market companies are prioritizing technology investments, compliance and outsourced services to optimize supply chains further and adapt to changing regulations, according to findings from a recent RSM US LLP survey.

In the survey—conducted by Big Village Insights and fielded March 5−14, 2025—62 per cent of respondents said their organization was very effective at managing inventory levels to minimize costs, and another 33 per cent said the organization was somewhat effective at doing so.

The sample comprised 309 supply-chain decision makers and influencers (259 from the United States and 50 from Canada) across a variety of industries, working in organizations with annual revenue between $10 million and $1 billion.

Sixty-five percent of respondents described themselves as the sole supply chain decision maker within their organization, and 29 per cent said they are part of a decision-making group or committee. More than half (55 per cent) of respondents were from organizations with $50 million to less than $500 million in annual revenue, 24 per cent came from organizations with $10 million to less than $50 million in revenue and 21 per cent were from organizations with $500 million or more in revenue.

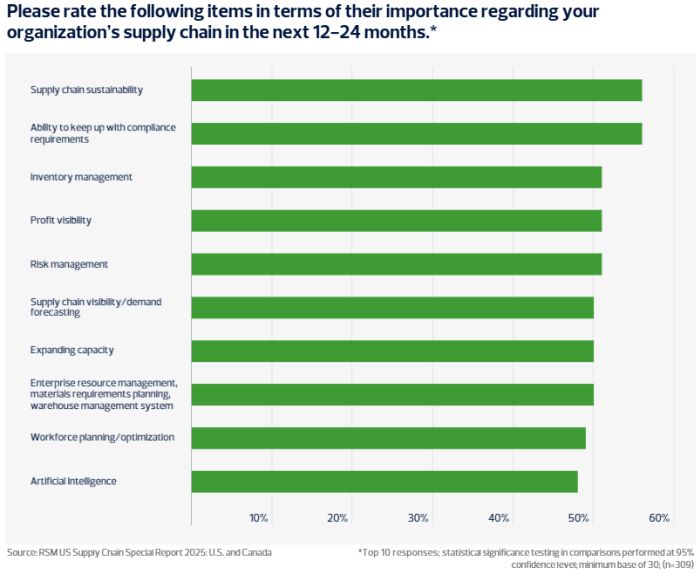

Respondents reported that the items most important to their supply chain efforts over the next 12 to 24 months were sustainability—broadly referring to supply chain resilience—and keeping up with compliance, with 56 per cent rating each a 9 or 10 on a 10-point importance scale. These were followed by inventory management, profit visibility and risk management, each at 51 per cent. Automation and cost reduction were at the bottom of the list of ranked items, with 44 per cent of respondents saying those were highly important items for supply chain efforts.

The survey results follow years of supply chain disruptions sparked in 2020. Those bottlenecks were a wake-up call for many companies, especially those in the middle market, to improve supply chain visibility and resilience overall. While larger businesses may have more resources and capital to pivot supply chains or operations quickly, midsize companies don't always have that option readily available. Now, with new factors including tariff disruptions driving some uncertainty for global supply networks, using technology to improve supply chains will become even more important.

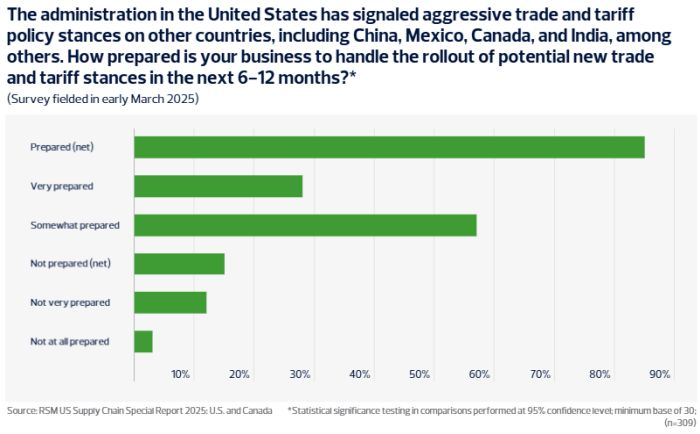

Most organizations said in the March survey that they felt ready to weather the storm; a majority (85 per cent) of respondents said they were very prepared or somewhat prepared to handle the rollout of potential new trade and tariff stances in the next six to 12 months (28 per cent felt very prepared and 57 per cent felt somewhat prepared). Still, perspectives on the impact of those trade and tariff stances vary—especially between Canada and the United States, with 76 per cent and 87 per cent of respondents, respectively, saying they were prepared to some degree—and there has been significant change in the tariff landscape since the survey was fielded.

"The pandemic forced businesses to improve supply chain data and have better information overall about where goods were coming from," says Dr. Tu Nguyen, RSM Canada economist. "While things seem to be a lot better now, the current uncertainty in the trade environment could be another wake-up call for businesses that still don't have the best transparency or visibility into their supply chain."

Respondents were asked a series of questions evaluating their current supply chain processes. While nearly all (93 per cent) expressed confidence in the accuracy of their data for decision making, nearly as many agreed they need to invest in technology to become more effective at managing operations (91 per cent). There was a strong interest in new technologies, with nearly 9 in 10 (88 per cent) agreeing they would like to explore how artificial intelligence can best be deployed to achieve success.

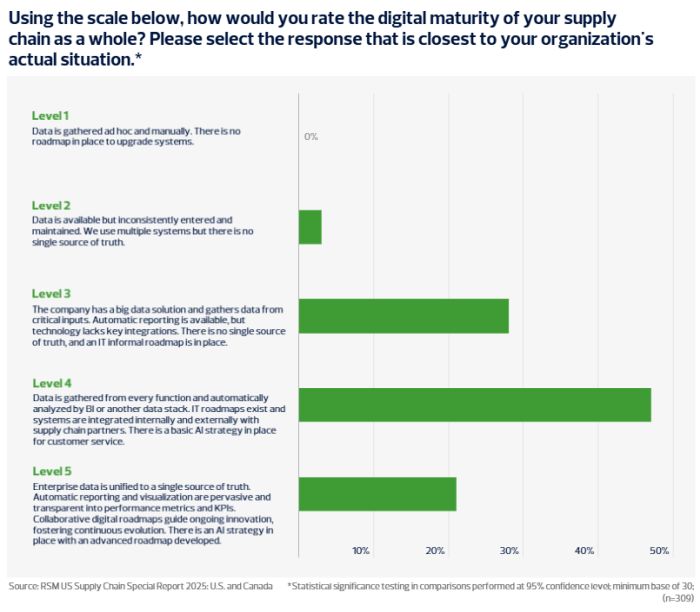

Most companies surveyed already have systems in place to harness data throughout their supply chains. On a scale of 1 to 5, respondents reported a surprisingly high level of digital maturity in their supply chains:

- 0 per cent rated their digital maturity at Level 1 (Data is gathered ad hoc and manually.)

- 3 per cent rated their digital maturity at Level 2 (Data is available but inconsistently entered and maintained.)

- 28 per cent rated their digital maturity at Level 3 (The company has a big data solution and gathers data from critical inputs.)

- 47 per cent rated their digital maturity at Level 4 (Data is gathered from every function and automatically analyzed by BI or another data stack.)

- 21 per cent rated their digital maturity at Level 5 (Enterprise data is unified to a single source of truth.)

These figures might indicate just how important supply chain visibility—and the use of data to improve that visibility—has become in the last few years, according to RSM US management consulting principal Jake Winquist.

"Far more companies have started thinking about their supply chain as a strategic asset rather than a cost center," he says. "Supply chain disruptions happen to everyone, and companies see supply chain risk and resilience as priorities now."

Access the full report now to learn more about the survey findings and related insights, including:

- Respondents' perspectives on the tariff environment

- Steps companies are taking to prepare for compliance with specific regulations

- A U.S.-Canada breakdown of the survey findings

- Respondents' tax optimization priorities and methods for mitigating risk

- Avenues companies might explore to reduce risk in their supply chains

- How outsourcing can help middle market companies navigate the complexities of global supply chains

- A sector-specific breakdown of the survey findings

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.