2024 is poised to be a pivotal year for payments and open banking in Canada, representing the culmination of many years of consultation and development of new federal regulatory frameworks in both areas.

Payments

Retail Payment Activities Act

The Retail Payment Activities Act (RPAA) is being implemented this year, starting with the requirement for all payment service providers (PSPs) to register with the Bank of Canada under the new regime during the 15-day application window between November 1 to 15, 2024. All existing PSPs carrying on payment activities in-scope of the RPAA must register during this timeframe, or face enforcement actions for failing to do so. Any individual or entity planning to start performing in-scope payment activities after the application window closes, must submit an application to register at least 60 days before they start performing any such activities.

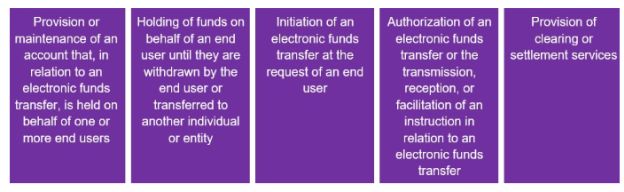

The RPAA is extremely broad and applies generally to PSPs with a place of business in Canada or PSPs located abroad if they are carrying on retail payment activities directed at, and performed for, individuals or entities in Canada. There are five payment functions defined under the RPAA as follows:

An individual or entity performing any of these five payment functions may qualify as a PSP if they are performing the function as a service or business activity that is not incidental to another (non-payment) service or business activity. The scope of these functions also applies to the performance of a service on behalf of an "end user" who is either as a payer or payee.

The Bank of Canada has published a number of resources to help individuals and entities determine if they are subject to the RPAA and required to register. These resources are available on the Bank of Canada's website here, and include the Bank's recent guidance on the "Criteria for registering payment service providers" as well as a "self-assessment tool" for PSPs.

There will be a transition period following the registration window in order for the Bank of Canada to consider the applications submitted, and the Bank has indicated it will publish its registration decisions on its website on September 8, 2025. In the meantime, the The Bank of Canada will continue to publish guidance on the interpretation and application of the RPAA, and also plans to consult on certain aspects of the new regime including risk management and end-user funds safeguarding.

For more information about the RPAA, see also Retail Payment Activities Act: The wheels are in motion.

Canadian Payments Act

Another notable development in payments this year includes the anticipated changes to the Canadian Payments Act necessary to expand eligibility for membership in Payments Canada to PSPs registered under the RPAA. These changes are included as part of the Fall Economic Statement Implementation Act, 2023 (Bill C-59) and, if passed, will lay the groundwork for certain PSPs to pursue direct access to Payments Canada's core systems once they are fully registered and regulated under the RPAA.

Open banking

The federal government recently announced plans to implement a new legislative framework governing consumer-driven banking in Budget 2024. Details of these plans were set out in a Policy Statement on Consumer-Driven Banking released by the government as part of its 2023 Fall Economic Statement, and cover five fundamental elements:

The framework will be mandatory for federally-regulated financial institutions that have a certain threshold of retail volume, and will otherwise be opt-in for other financial institutions, credit unions, and accredited parties. The plans for this new regime are ambitious. It is intended to be led by a government entity, and broadly address liability, privacy, and security risks, including a timeline for phasing out screen-scraping.

The Department of Finance aims to adopt this new legislation and fully implement the governance framework by 2025, and will continue ongoing stakeholder engagement throughout this process.

For more information on this topic, please reach out to the authors, Lisa Ford and Ana Iordache.

To read other articles in the Dentons' Pick of Canadian Regulatory Trends to Watch in 2024 series, click here.

Stay up-to-date with all insights and guidance from our Regulatory team by visiting our Canada Regulatory Review blog here and signing up for future alerts here.

About Dentons

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances. Specific Questions relating to this article should be addressed directly to the author.