- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Insurance, Technology and Securities & Investment industries

Welcome to our Big Picture for Business 2025

2025 will see the return of Donald Trump to the White House at a time of acute geopolitical tension, with a potentially radical US policy programme that ranges from aggressive global trade tariffs through to 'solving' major conflicts in Ukraine and the Middle East. Most governments and central banks are expecting stable (and in some regions, improving) economic growth, with inflation close(-ish) to target and with scope for further interest rate cuts. Innovative artificial intelligence (AI) tools will continue to challenge conventional business models and become more embedded in our everyday work and life.

Drawing these threads together, our Big Picture for Business 2025 explores:

- Five key trends shaping the business outlook

- How the landscape shifted in 2024

- The global growth map

- What is on the agenda for the C-suite to navigate times of change

1. Geopolitical power plays – led by Trump 2.0

Geopolitical uncertainty will persist into 2025 with all eyes on how the 'Trump 2.0' administration implements its potentially radical policy programme – and how other major powers such as China, Russia and the EU respond.

What changed in 2024?

Donald Trump secured a decisive victory in the US presidential election, including securing Republican control of Congress.

Global security became more precarious. The Israel-Hamas conflict expanded to include action against Hezbollah in Lebanon and direct confrontation with Iran. The Ukraine-Russia war passed its 1000th day with rising uncertainty over Ukraine's ability to sustain its defence should US support waver.

European politics became more fragmented. European Parliament elections saw the rise of populist right-wing parties, and both France and Germany closed 2024 with dysfunctional coalition governments.

Protectionism ratcheted up. China's growing dominance in electric vehicle (EV), solar panel and battery production provoked rising concern for domestic industries in the US and EU, with both imposing fresh tariffs on imported Chinese EVs. China now accounts for 80% of global solar manufacturing.

What's the big picture for 2025?

US import tariffs risk a global trade war. The incoming Trump administration is threatening punitive tariffs as a key policy/negotiating tool – with China, Mexico, Canada and Vietnam being the most vulnerable, and the US stance towards the EU highly uncertain. A global trade war should be averted (as it would damage US interests and global growth) but cannot be ruled out.

Ceasefire deals – or escalation? Trump will look to broker a 2025 ceasefire in the Ukraine-Russia conflict – which would have a positive impact on European markets in particular. Similarly, Trump will look for an early 2025 Israel-Hamas ceasefire to ease Middle East tensions – potentially linked to normalising Israel-Saudi Arabia relations. Sadly, in both regions there is the risk of escalation if Trump pivots towards a harder line against Russia (if it obstructs peace talks) and/or towards Iran in the Middle East.

Defence sector spending to surge. As global insecurity rises, and the US presses NATO members to devote at least 2% of GDP (and potentially up to 5%) to defence spending, the sector will see sustained worldwide demand and expansion.

Yet more elections to come... with the prospect of government changes in Germany, Canada, Japan and Australia during 2025.

2. Global growth patterns shift

Global growth will remain solid but unspectacular in 2025, supported by (it is hoped) fewer geopolitical flashpoints, stable inflation and falling interest rates. Growth will improve in the UK, Europe and Middle East but slow in the US and China.

What changed in 2024?

Global growth of 3.2% reflected easing inflation and interest rates.

US growth outperformed expectations at 2.8% to deliver (it seems) a successful soft landing avoiding recession and a spike in unemployment.

UK growth of c1% was positive after falling into recession in late 2023 but the uncertainties of an early general election and a challenging Autumn Budget hit business and consumer confidence, with growth stuttering in late-2024.

Major EU economies struggled – with Germany's export-led/energy-intensive economy suffering a second year in recession alongside muted growth in France (1.1%) and Italy (0.7%). Spain was the positive outlier with 2.9% growth driven by a tourism boom.

The Taylor Swift effect. Swift's record-breaking Eras Tour generated over $2 billion in tickets sales from more than 10 million concert-goers, delivering an economic lift to host cities around the world, with an estimated £1 billion boost to the UK economy alone.

What's the big picture for 2025?

Global growth will remain solid (but unspectacular) at around 3%.

European growth will nudge upwards but remain challenging. Germany is expected to emerge from recession with 0.8% growth in 2025 with France also holding steady at c1%. The EU's structural challenges to reboot stronger growth and investment – against the headwinds of high debt, increased defence spending and potential US trade tariffs – will remain daunting.

US growth will slow slightly after a bumper 2024 - but deregulation and tax cuts will drive business confidence and activity. Trump is expected to loosen rules in sectors such as energy, financial services and technology and refresh US tax cuts. GDP growth will be closer to 2% than 3% in 2025 but robust corporate and consumer confidence will drive strong momentum in the economy.

The strongest growth forecasts for 2025 include India (6.5%), UAE (5.1%), Saudi Arabia (4.6%) and the ASEAN-5 (4.5%).

China's growth rate looks set to slow further. China is increasingly struggling to maintain its 5%+ growth rate, with entrenched challenges in its property sector, significant trade pressures from the US, an ageing population, and weak domestic demand. 2025 growth is set to fall to 4.5%.

In focus: The UK in 2025

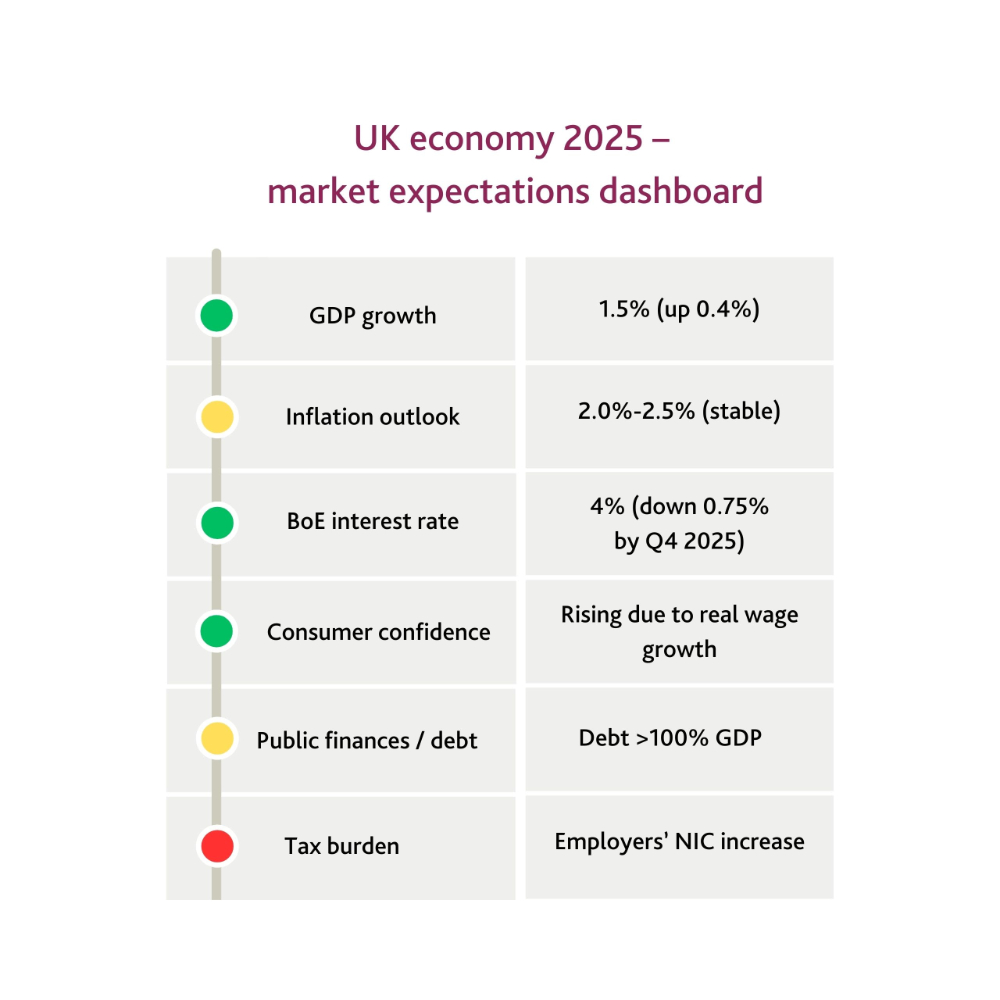

After a turbulent start for the new UK Labour Government in 2024, focused on 'fixing the foundations' through a tax-raising Autumn Budget, the focus will shift in 2025 to growth and policy delivery – helped by an improving economic backdrop.

What are the big picture issues on the UK agenda?

Boosting growth. The new Invest 2035 industrial strategy will focus on eight priority sectors: advanced manufacturing; clean energy; creative industries; defence; digital and technologies; financial services; life sciences; and professional and business services. Given tight public finances, the UK Government will be looking to (re-)build partnerships with the private sector and overseas investors to fund a bold growth agenda.

Planning reform and housing. The Government placed planning reform and housing at the heart of its manifesto commitments, including the reinstatement of mandatory local housing land supply targets and greater use of 'grey belt' land. Read more in our overview of the Living Sector in 2025.

Employment reforms. A whole raft of reforms to UK employment law have been tabled, with many moving into consultation in 2025. Find out more in our comprehensive, rolling analysis of the employment law changes .

Relationships with the US and EU. On the US, diplomatic efforts will focus on the UK being kept out of any Trump-led global tariff measures. The UK will also seek to 'reset' relations with the EU, founded on security cooperation but with the potential to relax post-Brexit trade requirements in discrete areas.

Public-private partnering – and procurement rule changes. February 2025 will herald the biggest changes to UK procurement law in a generation – with a new framework to drive quality and transparency that will impact public sector bodies and suppliers. See our practical Procurement Act toolkit for full details of how to prepare.

3. Global inflation and rates track towards 'new normal'

Global inflation is expected to remain under control in 2025, allowing for further monetary policy easing, but long-term structural challenges suggest the 'new normal' for central bank rates could settle in the 2%-3% zone.

What changed in 2024?

Inflation (finally) dropped close to target. High interest rates and lower energy/oil prices pushed inflation down to 2% in the UK, Canada and Eurozone, though the hot US economy led to stickier inflation around 2.5%. China's domestic weaknesses saw it skirt with the opposite challenge of zero/negative inflation.

The rate cutting cycle began. As economies weakened, central banks pivoted into a series of rate cuts including the US Fed (with total cuts of -1%), Bank of Canada (-1.75%), Bank of England (-0.5%) and the European Central Bank (-1%).

What's the big picture for 2025?

Inflation should track close to the 2% target – but with some risks. Underwhelming economic growth and weaker labour markets are unlikely to push inflation materially above the 2% target in the US, UK or EU in 2025. But there could be stumbles in the US (Trump tariffs increasing import prices; immigration controls pushing up wages) or the UK (expanded public sector spending; minimum wage rises).

Central banks will target multiple interest rate cuts in 2025. Central banks will remain resolutely 'data-dependent' but markets anticipate broad-based cuts:

|

Start 2024 |

End 2024 |

End 2025 Forecast |

Approach |

||

|

US |

Federal Reserve |

5.25%-5.5% |

4.25%-4.5% |

3.75%-4% |

Cautious until impact of Trump policy agenda clearer in H1 2025 |

|

UK |

Bank of England |

5.25% |

4.75% |

4.0% |

Sustained cuts to support recovery |

|

EU |

European Central Bank |

4.0% |

3.0% |

2.0% |

Sustained cuts to support recovery – and could be more aggressive if US trade action impacts EU exports |

|

Canada |

Bank of Canada |

5.0% |

3.25% |

2.25% |

Sustained cuts to support recovery |

The 'new normal' won't see a return to near-zero interest rates. Although cyclical inflation pressures (energy crisis; supply chain issues) have eased, structural challenges such as global trade frictions, green energy investment demands and labour shortages in ageing populations could keep inflation elevated for the medium-term – with interest rates held in the 2%-3% range.

4. Robust markets drive deal rebound

A more stable macro-economic backdrop will support investor confidence and deal activity in 2025, propelled by robust US market sentiment (in particular) and greater certainty over funding costs and valuations.

What changed in 2024?

Elections, geopolitics and funding costs delayed deal-making. A muted H1 2024 saw global M&A deal volumes down 25% on H1 2023 (though up 5% in value terms) as deal-makers awaited key elections, calmer geopolitics, clearer asset valuations and lower rates/funding costs. h3 saw some tentative pickup, with London a bright spot for M&A towards the end of 2024.

Stock markets boomed – led by US Tech. The 'Magnificent Seven' US stocks (Alphabet (Google), Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) drove the S&P500 index to soar by over 20% in 2024. The FTSE100, FTSE250 and STOXX Europe 600 each returned 5-6%.

What's the big picture for 2025?

Greater macro stability to drive investor FOMO. The macro fundamentals will be more stable and certain in 2025, coupled with high levels of investor 'dry powder' overdue for deployment. As the market recovers (and valuation gaps narrow), the 'fear of missing out' factor will drive deal activity.

M&A and private equity rebound. Stronger growth forecasts and improving access to debt funding should support a further recovery in M&A. Private equity portfolios that have been in a holding pattern until valuations settle are expected to kick-start a strong flow of exit and new investment deals throughout 2025.

Real estate recovery gathers pace. A broad-based recovery is expected in real estate supported by stable inflation, falling interest rates, stronger economic growth, government policy support and improved consumer spending power as wages outpace inflation. CBRE forecast a 15% increase in investment during 2025.

5. AI adventures take flight

Investor confidence in the transformational potential of AI has attracted huge waves of capital. 2025 will see corporate and consumer AI experimentation take off – with the pressure on to move from hype to mainstream adoption and benefits.

What changed in 2024?

AI investment boom. Investors piled into AI in a resurgent tech sector, benefitting key players in the AI and semiconductor space such as Nvidia in the US, TSMC in Taiwan and ASML in the Netherlands. Nvidia's specialism in AI-oriented chips saw its market cap rise to over $3.6 trillion, overtaking Apple as the world's most valuable company.

New AI capabilities and 'AI everywhere' integration. Generative AI capabilities continued to advance rapidly, with the release of ChatGPT-4o able to respond to text, images and audio and engage in real-time conversation. AI technologies became more pervasive and 'integrated everywhere' – with AI built into everyday apps and platforms, and over half of the S&P500 now touching on AI strategy in earning calls.

What's the big picture for 2025?

Microsoft CoPilot becomes ubiquitous. With CoPilot embedded into Microsoft products on desktops around the world, this is likely to be the work/business-focused entry-point for widespread AI adoption in 2025. "Other AI products are available" of course – with a big year ahead for the full launch of Apple Intelligence (its own play on "AI") and further advances for ChatGPT, Google Gemini and Meta AI.

Agentic AI? Identified by Gartner as the number one emerging tech trend for 2025, agentic AI systems can be tasked with a 'goal' and then autonomously plan and take actions to meet that goal. Coupled with generative AI capabilities and app integration, the 'agent' effectively becomes a virtual worker for day-to-day delegation.

AI regulation. Governments will continue to juggle innovation with regulation as AI technology reaches deeper into everyday life and work. The EU AI Act will be phased in from February 2025 and its concept of 'AI literacy' – in essence, employees having a core understanding of how to use AI effectively and responsibly – may become the practical starting point for many regulators and businesses.

Data, energy and sustainability. Data centres already account for more than 2% of global electricity usage and that is expected to double by 2030 (per Goldman Sachs). Widespread use of AI tools will drive demand for data centre development and efficient energy supply, including innovative onsite energy production and sustainability measures to align with ESG commitments.

What's the big picture for the C-suite in 2025?

Organisations have shown remarkable resilience and flexibility to steer through waves of challenging external forces over the last 10 years – from seismic political shifts through to a global pandemic and the tragedy and chaos of new major military conflicts. Business leaders have never faced so many overlapping and fast-moving political, economic, social, technological, legal and environmental jigsaw pieces, but have shown time and time again that with a clear vision and nimble decision making they can continue to thrive.

As the following (fictional) board gathers in January 2025, Sandy (Chief Executive) invites her team of Max (Chief Strategy Officer), Agnetha (Chief Financial Officer), Zayn (Chief Operations Officer), Matt (Chief Technology Officer), Rose (Chief People Officer), Asim (Chief Legal & Risk Officer) and Kai (Chief Marketing Officer) to share their perspectives on the year ahead...

Sandy (CEO):

"Welcome to 2025 team – and let's get going to deliver another successful year. There's certainly a lot going on in the wider world to get our heads around. How can we convert so much change and uncertainty into opportunity and growth this year?

"Max – how do you see this from a strategy perspective across our platform?"

Max (CSO):

"We'll have to be flexible to see how the new Trump presidency plays out, but it's looking like the US market will be pretty buoyant for us this year. European growth should edge up and see more activity than in 2024.

"Our public sector unit is excited about how active the UK Government could be this year with targeted spending plans and service delivery reforms. We're looking at where we could partner in areas like health, education, housing and infrastructure.

"Although there's still unrest in the wider Middle East, our expansion into UAE and Saudi is looking strong given the 4-5% growth we're seeing there and waves of government investment.

Across the board, all of our markets see opportunities in the energy transition and decarbonisation space."

Zayn (COO):

"Just to add on Trump, we're staying close to our global supply chain partners to assess how we could be affected by new US trade tariffs. We could make some strategic changes to our supply chain if there are any radical moves that disrupt trade flows.

"On the energy side, we're looking at our own decarbonisation programme as we know how important that is to our customers and our B2B partners – and they're expecting us to be reporting on progress in more detail than ever."

Sandy (CEO):

"How about the economics Agnetha, what are the financial considerations for 2025?"

Agnetha (CFO):

"In the UK, we do have a big rise in employers' NICs to manage, which will need some careful thought on recruitment and salary reviews. That will also flow into our pricing strategy. We'll have to judge how much of the NIC cost should feed into price increases while staying competitive."

Sandy (CEO):

"How about funding? This feels like the year when we can be bolder in taking forward our M&A plans, before our competitors look to consolidate and gain market share."

Agnetha (CFO):

"If inflation stays under control and rates keep coming down as we expect, that will give us more headroom for debt funding and strategic or opportunistic M&A. I'm actively looking at the best time to refinance on better terms."

Sandy (CEO):

"What's everyone's take on AI for this year? It feels like it's only going to become more important."

Matt (CTO):

"We're excited about what's ahead on AI this year. We have a lot of different AI platforms competing for our business and our focus for the next 12 months is to land on some core AI tools and solutions that add tangible value and benefits for our customers and make life easier for our people."

Rose (CPO):

"Matt and I have been working closely together on that as the people dimension to AI is going to be crucial. We're expanding our digital skills programme to cover AI and looking at our future skills and development framework with AI in mind. We know we have to excite people about change and encourage a growth mindset."

Kai (CMO):

"Our 2025 customer experience plan has an AI strand this year, and we're going to be experimenting with how AI can streamline some of our service delivery. From a brand perspective, we want to embrace AI innovatively and with substance rather than as a gimmick. We're also very focused on protecting customer trust in how we manage AI and data."

Zayn (COO):

"It's great to be working with Matt, Rose and Kai on this because you're right Sandy – AI is starting to cut across all of our operations. We're using 2025 to build our longer-term AI transformation plan because the more we look at what the technology can do, the more we can see the operating model is going to change."

Asim (CL&RO):

"No surprises, but I'm keen we roll-out AI with an eye on risk – and my Legal and Compliance team are monitoring where AI regulation might be headed.

"We're also really vigilant about cyber security risk in 2025. All the geopolitical clashes out there are increasing the risk of a major cyber incident and we're re-testing our business continuity plans. There's also an ever-expanding regulatory and compliance agenda for my Legal team to stay on top of – that never changes Sandy!"

Sandy (CEO):

"Thanks everyone. It sounds like we are on the front-foot and pulling together across departments and different areas of expertise to deliver another successful year. Let's get going..."

Every organisation will have its own unique mix of opportunity and risk to consider. Which of these themes resonate around your board table as you settle your strategy for 2025?

We hope that our Big Picture For Business 2025 is a useful guide to help you plan for the year ahead, and we look forward to supporting our clients to make the most of the opportunities that present themselves in times of change.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.