- within Law Department Performance and Criminal Law topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Healthcare industries

Canadian M&A activity was moderate in 2013. The weakened natural resources sector, which had helped Canada outperform other economies through the recession, contributed to an overall drop in M&A levels as the total number and aggregate value of Canadian deals, and Canada's share of global M&A, decreased. The total value of Canadian announced deals was C$168.5-billion, the lowest recorded value since 2009 (market statistics from Bloomberg, except as noted).

Despite a significant uptick in mega-deals in Q3, there were only 28 Canadian deals over US$1-billion announced in 2013, with an aggregate deal value of US$70.8-billion. This represents a 42 per cent and 43 per cent decrease in deal number and value, respectively, of US$1-billion-plus deals as compared to the prior year.

However, powered by a strong domestic economy, Canadian companies' outbound M&A strengthened relative to inbound acquisitions and the U.S. was again by far the most popular target country. Over 60 per cent of Canadian outbound M&A in 2013 involved U.S. targets, including the proposed US$4.3-billion Fortis acquisition of UNS Energy and the US$2.9-billion Hudson's Bay acquisition of Saks.

Looking forward to 2014, we see the following recent developments and trends impacting Canadian M&A.

INBOUND M&A ACTIVITY MAY SEE AN UPTICK

Some of the factors that have contributed to a weaker global M&A environment, including low commodity prices, slower growth in China and economic and political challenges in Europe, will undoubtedly extend into 2014. There are, however, some positive signs that inbound deal activity will rise, including a strengthening U.S. recovery, a rebound in U.S. housing activity and a weakening Canadian dollar, which as of January 2014 fell to approximately C$0.93 against the U.S. dollar, a 7.5 per cent decline from a year earlier.

As confidence in the economy grows, risk-averse companies that hoarded cash through the downturn may feel new pressure to grow earnings through acquisitions. Continuing consolidation in many sectors of the Canadian economy also means that inbound investors need to move quickly and decisively to seize remaining opportunities of scale. Supported by liquid capital markets and willing lenders both in Canada and the U.S., financial buyers are also once again ramping up activity in Canada and providing meaningful competition to strategic buyers.

RETAIL, REAL ESTATE AND RESOURCES

The retail sector was a bright light in 2013, with a number of high-profile transactions announced. In addition to the Hudson's Bay acquisition of Saks, last year saw Loblaw's proposed C$12.4 billion acquisition of Shoppers Drug Mart, the C$5.8-billion Canada Safeway acquisition by Sobey's parent Empire, and a consortium led by Canada Pension Plan Investment Board (CPPIB) acquire a majority interest in Neiman Marcus. While 2013 may have been a high water mark for retail, we expect sector activity will remain strong as confidence in consumer spending grows and retailers adjust to marketplace consolidation.

REITs were also active in 2013, with deals that included H&R REIT's C$4.6-billion acquisition of Primaris REIT and Dexus Property Group and CPPIB's A$3-billion cash-and-stock offer for Commonwealth Property Office Fund. REIT-sector M&A activity may slow in 2014, notwithstanding investor appetite for yield and the perceived safety of Canadian real estate, reflecting a recent slowdown in REIT financing activity.

While resource-sector activity softened in 2013, transactions in this sector continued to dominate public M&A in Canada. Our sixth annual Blakes Canadian Public M&A Deal Study found that 68 per cent of announced friendly transactions occurred in the oil & gas and mining industries over the 12-month period reviewed. 2013's headline transactions included the proposed C$1.5-billion acquisition of certain of Talisman Energy Inc.'s Montney natural-gas interests in British Columbia by Progress Energy (a Petronas subsidiary), Russian nuclear corporation Rosatom's acquisition of Uranium One and Pacific Rubiales' proposed C$1.6-billion acquisition of Petrominerales. In the mining sector, we expect more distressed acquisitions and roll-up strategies in 2014 in response to the struggles and capital constraints faced by many junior mining issuers.

POISON PILL HEARINGS MAY BE REPLACED BY PROXY CONTESTS

The Canadian Securities Administrators (CSA) are reviewing comments on draft National Instrument 62-105 – Security Holder Rights Plans (NI 62-105) and the alternative competing proposal from Quebec's Autorité des marchés financiers (AMF). These proposals offer divergent approaches to the treatment of shareholder rights plans (poison pills) in unsolicited take-over bids.

The CSA proposal focuses exclusively on shareholder rights plans, rather than defensive tactics generally, and would eliminate the current practice whereby securities regulators decide on a case-by-case basis whether to cease trade a rights plan in a particular transaction. Instead, to remain effective, a rights plan would require shareholder approval within 90 days of its adoption or, if the rights plan is adopted after the date that a bid is announced, within 90 days from the earlier of the commencement of the bid and the date the plan is adopted. Absent such approval, or if the issuer fails to hold a meeting in time, the rights plan would terminate.

The AMF proposal goes further than that of the CSA, addressing not only shareholder rights plans but the use of defensive tactics generally. The AMF would replace the existing defensive tactics instrument with rules addressing the conflicts of interest faced by a target's board of directors in an unsolicited transaction. Absent unusual circumstances, the AMF has suggested that regulators should limit their intervention in unsolicited situations.

Both proposals would improve a target board's ability to defend against an unsolicited offer, and both should reduce the frequency with which securities regulators will be called upon to intervene. However, adoption of either proposal will likely result in more frequent proxy contests, either at a target meeting to approve a shareholder rights plan or in an attempt to replace the target board and dismantle a defensive measure.

ANTI-TREATY SHOPPING RULE MAY IMPACT ACQUISITION STRUCTURES

In August 2013, the federal government released a consultation paper outlining possible measures to address perceived tax abuse through treaty shopping. According to the consultation paper, "treaty shopping" generally occurs where a person, such as a foreign company or private equity fund, that is not otherwise entitled to the benefits of a favourable tax treaty with Canada, forms an intermediate entity in another jurisdiction that is entitled to such benefits. In the M&A context, a foreign purchaser may incorporate a third-country holding company (a "Holdco") through which it will acquire the Canadian target. The Holdco may be able to access reduced withholding tax rates on interest, dividends or royalties from the target, or access to capital gains exemptions.

After unsuccessfully attacking these structures in court, including under the general anti-avoidance rule, the government is now considering a direct legislative response. If such changes are implemented, foreign buyers of Canadian companies may need to revisit traditional acquisition structures and assess the extent to which such changes will affect future cash flows and exit strategies for a proposed investment, and therefore the value of the target. The impact of any new rule on existing structures is not yet known and will need to be monitored when structuring future deals.

AMENDED EARLY WARNING REGIME WILL IMPACT BIDDER DISCLOSURE AND TOEHOLD INVESTMENTS

The CSA has proposed changes to the existing "early warning" disclosure regime designed to improve transparency of investor interests and voting rights in public companies. The changes, not yet scheduled for implementation, would, among other things, reduce the early warning disclosure threshold from 10 per cent to five per cent, aligning it with the U.S. and other jurisdictions.

The changes would require investors to make enhanced disclosure once they cross the five per cent ownership or control threshold. While the majority of public issuers who commented on the proposal expressed support, many investors commented that the increased reporting obligations could dampen investment in Canada.

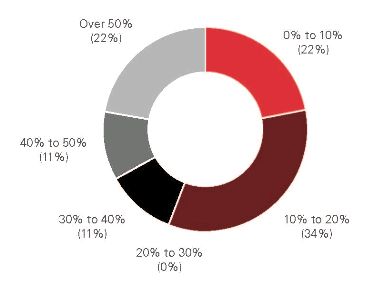

In our most recent Blakes Canadian Public M&A Deal Study, we found that 18 per cent of transactions reviewed involved a buyer that owned securities of the target before execution of the transaction agreement, up from 12 per cent in our prior version of the study. Of these purchasers, 22 per cent held less than 10 per cent of the target:

CHANGING REGULATORY LANDSCAPE

New leadership at the Competition Bureau has ushered in more timely and focused reviews of non-complex M&A transactions, particularly upstream oil & gas acquisitions. Similarly, increased coordination between the Competition Bureau and its U.S. and European counterparts has meant a more streamlined and coordinated approach to multi-jurisdictional transactions. At the same time, however, transactions between competitors have received greater scrutiny as government resources are increasingly focused on strategic mergers and acquisitions.

The government also continues to utilize the Investment Canada Act to review direct acquisitions of Canadian businesses by non-Canadians and determine if such transactions are of "net benefit" to Canada. Most parties are able to obtain clearance of their transactions under this test by providing undertakings to the Canadian government, such as commitments to preserve jobs in Canada and maintain capital expenditure levels. Going forward, we expect that fewer transactions will be subject to a "net benefit" review in the wake of recent legislative amendments that are expected to take effect in 2014, and the forthcoming Comprehensive Economic and Trade Agreement with the European Union, which together will raise the review threshold for certain transactions to C$1.5-billion.

Significant scrutiny remains, however, for investments in Canadian companies by foreign state-owned enterprises (SOEs) and transactions that raise potential national security issues. A new "national security" review power implemented in 2009 was used by the Canadian government for the first time in 2013 to block a transaction in the telecommunications sector. The subject transaction involved Egyptian-based Accelero's attempted acquisition of Allstream, which, among other things, provides enterprise telecommunications services to the federal government.

JOINT ACTOR ANALYSIS WILL BE SCRUTINIZED

A recent Alberta court decision provided new guidance on when shareholders may be considered to be acting "jointly or in concert," thus potentially triggering disclosure obligations under the early warning regime. In Genesis Land Development Corp. v. Smoothwater Capital Corporation, the court found that an activist shareholder had failed to comply with the early warning reporting system and disclose that it had been acting jointly or in concert with certain other shareholders as it sought to gain control of the target board of directors. If parties are found to be joint actors, they are required to make certain prescribed disclosures and aggregate their shareholdings for the purposes of the take-over bid rules.

The decision clarified that shareholders may be acting jointly or in concert if there is any "agreement, commitment or understanding" to "exercise voting rights" in respect of the public company. The subject matter of the agreement, commitment or understanding does not need to involve a take-over bid or other acquisition of shares. The decision also provided guidance on when parties will be considered to be acting jointly or in concert, noting that it is a question of fact and that the agreement, commitment or understanding need not be formal or written. Circumstantial evidence, such as family relationships, communications between the parties and attendance at meetings together can be taken into account in determining whether the parties were making a concerted effort to bring about a specified objective.

The question of whether a shareholder is required to aggregate its holdings with other shareholders when determining its obligations under the early warning requirements or take-over bid rules is likely to receive additional scrutiny from target boards seeking to defend against an unsolicited offer or activist proxy challenge.

SHAREHOLDER ACTIVISM WILL CONTINUE

Activist shareholders continue to agitate and wage proxy contests to effect changes in public companies, exerting substantial influence over board composition, corporate management, strategy and operations. In 2013, JANA Partners lost its bid to elect five directors to the Agrium board following a lengthy and well-publicized proxy contest, while Talisman Energy and shareholder Carl Icahn reached an agreement whereby two of Icahn's representatives were appointed to the Talisman board.

Dissidents have a number of tools at their disposal that can raise serious challenges for public companies, regardless of size. Investors continue to leverage Canada's relatively liberal corporate laws, which permit shareholders holding five per cent of the votes to call special meetings and seek to replace directors. Despite a mixed track record, we expect activist investors to continue to see Canadian issuers as potential targets for governance improvements and value maximization. The proposed reduction of the early warning disclosure threshold and associated enhanced disclosure requirements should provide issuers with better insight into when an activist has acquired an influential stake and its intentions for the company.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]