Welcome to the September issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Competition Tribunal affirms the importance of merger efficiencies as the primary goal of merger reviews in Canada by dismissing the Commissioner of Competition's application to require certain assets related to the merger of Secure and Tervita to be held separate and independently operated.

- Merger review activity remained strong through the end of the summer and the year-to-date is largely consistent with pre-pandemic levels with 146 merger reviews having been completed through the end of August. This is a seven per cent increase over the number of reviews completed through the same period in 2019 (137), and a 49 per cent increase over the number of reviews through the same period in 2020 (98), which witnessed a significant decline in merger activity through the second and third quarters as a result of Covid-19.

- China Mobile International (CMI) seeks judicial review of an August 9, 2021, order under the Investment Canada Act, requiring the divestiture or winding-down of its Canadian business, on the basis that the government could not have reasonably determined CMI poses a threat to Canada's national security.

- Canada's federal political party leaders released their 2021 election platforms, including proposals affecting Canadian competition and foreign investment laws.

Merger Monitor

August 2021 Highlights

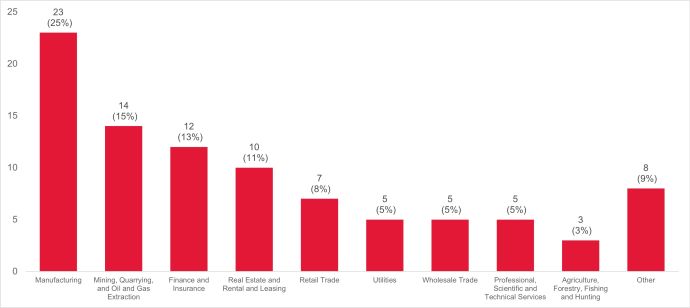

- 18 merger reviews completed

- Primary industries: manufacturing (28 per cent); mining, quarrying and oil and gas extraction (22 per cent); real estate and rental and leasing (17 per cent); retail trade (11 per cent); and finance and insurance (11 per cent)

- Zero consent agreements (remedies) filed

- 12 transactions received an Advance Ruling Certificate (67 per cent), while six transactions received a No Action Letter (33 per cent)

January – August 2021 Highlights

- 146 merger reviews completed

- Primary industries: manufacturing (23 per cent); mining, quarrying and oil and gas extraction (18 per cent); real estate and rental and leasing (14 per cent); and finance and insurance (12 per cent)

- One consent agreement (remedies) filed

- 97 transactions received an Advance Ruling Certificate (66 per cent), while 48 transactions received a No Action Letter (33 per cent)

Merger Enforcement

Competition Tribunal affirms the importance of merger efficiencies as the primary goal of merger reviews in Canada

- On August 16, 2021, the Competition Tribunal released a decisiondenying the Commissioner of Competition's application to require certain assets related to the merger of Secure Energy Services Inc. (Secure) and Tervita Corporation (Tervita) to be held separate and independently operated. The Tribunal found that the benefit to the merging parties and the efficiencies generated by the transaction were quantified, clear and non-speculative, and there was no evidence quantifying any harm to customers or consumers from the merger presented by the Commissioner. This decision emphasizes that efficiencies are of primary importance in merger reviews, and provides incentives for the merging parties and the Bureau to assess efficiencies at an early stage. For more information on the importance of efficiencies in merger review, view the Blakes Competition, Antitrust & Foreign Investment group's online publication published August 24, 2021.

Investment Canada Act

China Mobile International seeks judicial review of August 9, 2021 divestiture order

- On August 9, 2021, the Governor in Council ordered the divestiture or winding-down of Chinese state-owned entity China Mobile International's Canadian business (CMI Canada) within 90 days, citing national security grounds. Established in 2015, CMI Canada failed to file a "new business" notification under the Investment Canada Act when it was initial established and only filed a corrective notice in October 2020. On September 7, 2021, CMI Canada filed an application for judicial review of the August 9 order. CMI Canada argues the government could not have reasonably determined CMI Canada is a threat to Canada's national security because it does not have direct access to critical infrastructure, sensitive personal information or telecommunications data and does not own or operate any transmission facilities in Canada.

May 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 105 notifications filed (76 for acquisitions and 29 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (56 per cent), UK (eight per cent), China (five per cent), and Austria (four per cent)

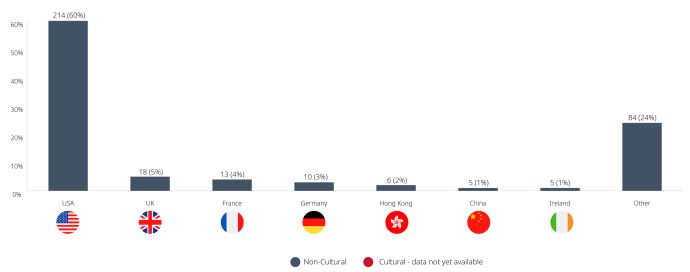

January – May 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 460 notifications filed (347 for acquisitions and 113 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (59 per cent), UK (six per cent), France (three per cent), and Germany (two per cent)

Canadian Federal Election

Canada's federal leaders pledge amendments to Canadian competition and foreign investment laws

In connection with the Canadian federal election on September 20, 2021, Canada's federal political parties released their election platforms containing various proposals to modernize and amend Canadian competition and foreign investment laws. The platforms' highlights are:

- The Conservative platformpledges to enhance and modernize Canada's competition laws with a focus on price fixing and increased scrutiny on merger review, requiring the Competition Bureau to investigate banking fees in Canada and increasing competition in the Canadian telecommunications industry. On foreign investment, the Conservatives are pledging to protect intellectual property (IP) through strengthening the Investment Canada Act by mandating national security reviews, amending the "net benefits" test to account for effects on IP and creating a presumption against take-overs by Chinese state-owned entities.

- The Liberal platformpledges to modernize Canada's competition laws to ensure fair competition for online marketplaces. On foreign investment, the Liberals are pledging to modernize the Investment Canada Act to provide additional tools for assessing economic security threats from foreign investors.

- The New Democratic Party (NDP) platformpledges to modernize Canada's competition laws to address new challenges posed by the digital economy and empower the Competition Bureau to investigate anti-competitive practices in the retail gasoline market. On foreign investment, the NDP pledges to increase the use of national security reviews under the Investment Canada Act.

For permission to reprint articles, please contact the bulletin@blakes.com Marketing Department.

© 2025 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.