- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Property and Law Firm industries

Article Summary

The basic requirements for a bankruptcy notice include:

- the debt must be a judgment debt; and

- the judgment debt must be more than $10,000.00; and

- the judgment debt must be no more that six (6) years old.

If you meet these criteria, and the judgment debtor is a human (not a company) then you can apply for a bankruptcy notice.

Debtors will have 21 days to respond to a bankruptcy notice. During this time, the judgment debtor must

- pay to the creditor the amount of the debt claimed; or

- make arrangements to the creditor's satisfaction for settlement of the debt; or

- apply to set aside the bankruptcy notice.

If the judgment debtor does not do any of these things, then they will commit "an act of bankruptcy". Using this act of bankruptcy, the creditor can apply for a sequestration order (making the debtor bankrupt).

Issuing a bankruptcy notice can be a way for you to gain some control over the situation so that you can collect at least part of the money that you are owed or commence negotiations for the settlement of those funds.

This article explains bankruptcy notices in more detail.

A bankruptcy notice is the first document served on a human judgment debtor to commence bankruptcy proceedings against that debtor.

Once served, the judgment debtor will have 21 days to:

- pay to the creditor the amount of the debt claimed; or

- make arrangements to the creditor's satisfaction for settlement of the debt; or

- apply to set aside the Bankruptcy Notice.

Failure to do any of those things, and the judgment debtor commits an "act of bankruptcy".

This act of bankruptcy lasts for six (6) months and is the prerequisite for the judgment creditor to file a creditor's petition in the Court.

In this article our insolvency lawyers and debt recovery lawyers will discuss the basics of a bankruptcy notice and what it entails so that you can decide if it is a tool that will work for you!

Why use a Bankruptcy Notice?

If you are a judgment creditor with a lot of debt, chances are that you are quite frustrated and fed up with this situation and it can be difficult to understand how to go about enforcing your judgment against the debtor.

Issuing a bankruptcy notice can be a way for you to gain some control over the situation so that you can collect at least part of the money that you are owed or commence negotiations for the settlement of those funds.

This may sound a little extreme, but it can be a very effective tool if nothing else is seeming to work. However, it is a big step to take, so it is important that you are fully informed before taking any steps towards doing so.

What is a Bankruptcy Notice?

A bankruptcy notice is a formal demand of payment sent by a creditor to a human debtor (not a company) pursuant to section 41 of the Bankruptcy Act 1966 (Cth).

A bankruptcy notice can be obtained when a creditor obtains a judgement or several judgements from a court that states that a debtor owes them an amount more than the statutory minimum.

The statutory minimum is defined at section 5(1) of the Bankruptcy Act to mean:

"statutory minimum" means:

(a) if an amount greater than $5,000 is prescribed-the prescribed amount; or

(b) otherwise-$5,000.

This allows for this amount to be changed by regulation (which it has). Regulation 10A of the Bankruptcy Regulations 2021 states:

For the purposes of paragraph (a) of the definition of statutory minimum in subsection 5(1) of the Act, the amount prescribed is $10,000.

The debt or debts must total the statutory minimum of $10,000.00 and must be less than six (6) years old. This is an important step, as you cannot serve a debtor with a bankruptcy notice unless they owe you or your business at least this amount of money and within this time limit.

Once a bankruptcy notice has been served, the debtor will have committed an "act of bankruptcy" if they have not complied with the terms of the notice or had it set aside by the court within 21 days.

Section 40(1)(g) of the Bankruptcy Act defines this act of bankruptcy to mean:

(1) A debtor commits an act of bankruptcy in each of the following cases:

. (g) if a creditor who has obtained against the debtor a final judgment or final order, being a judgment or order the execution of which has not been stayed, has served on the debtor in Australia or, by leave of the Court, elsewhere, a bankruptcy notice under this Act and the debtor does not:

(i) where the notice was served in Australia-within the time fixed for compliance with the notice; or

(ii) where the notice was served elsewhere-within the time specified by the order giving leave to effect the service;

comply with the requirements of the notice or satisfy the Court that he or she has a counter-claim, set-off or cross demand equal to or exceeding the amount of the judgment debt or sum payable under the final order, as the case may be, being a counter-claim, set-off or cross demand that he or she could not have set up in the action or proceeding in which the judgment or order was obtained.

A debtor committing an act of bankruptcy will allow a creditor to make a creditors petition for the declaration of bankruptcy.

This will mean that the debtor is declared to be bankrupt and a bankruptcy trustee is appointed to deal with debt payments and other financial responsibilities, which may be a better option for the creditors.

What is the Purpose of a Bankruptcy Notice?

So, now that we know what it is, what is the purpose of a bankruptcy notice?

A bankruptcy notice can act as a final warning to your debtor to pay the debt or face the consequences and can be great leverage in settlement negotiations.

Bankruptcy is a serious financial situation to be in. Most people will do their utmost to avoid it, seeing as it affects their finances, credit, and financial opportunities for the foreseeable future.

Serving a bankruptcy notice can also help to promote a discussion between the parties regarding negotiating a payment plan or simply payment in full, and forces a very short 21 day timeline to stop the debtor delaying further.

Some are too embarrassed to confront their financial struggles head on, so a bankruptcy notice can act as a gentle nudge in the right direction.

Regardless, having a professional trustee managing your debtors' finances can be helpful to you and all other creditors, so it is something of a win-win in some circumstances.

What Should I Consider Before I Apply?

Applying for a bankruptcy notice is a big decision that requires a lot of thought and consideration.

What is it that you should be considering exactly when you are making this decision? What are the factors that will, or at least should, have an influence on the notice and on your decision to go through with it or not?

The first thing that you must consider is if a bankruptcy notice is even a viable option for you. Does the judgment debt that you are looking to collect exceed the amount of $10,000, and is less than six (6) years old? If not, you will be unable to obtain a bankruptcy notice from AFSA regardless, so this would be the end of the road for this route.

You should also consider alternative options for collecting the debt other than a bankruptcy notice.

As you a probably aware, there are plenty of ways that you can collect a debt. All of the methods available and feasible for you to do should be exhausted before you engage in an application for a bankruptcy notice, excluding the ones that take more time, and money, or entail more serious consequences for either party of course.

A bankruptcy notice is a serious thing and should be considered to be something of a final resort.

Finally, it is important that you check to see if your debtor is already engaged in a debt or insolvency agreement before engaging in the bankruptcy notice application process. To check this, you can bankruptcy search on the National Personal Insolvency Index (NPII) for any recent insolvency actions taken by a debtor.

How Do I Apply for a Bankruptcy Notice?

So, you have made the proper considerations for the bankruptcy notice, and you are ready to begin the application process. An application can be made by either the creditor themselves or the solicitor or agent of the creditor.

If the latter is the case, it should be made known during the application process. If you wish for your solicitor/agent to apply for a bankruptcy notice for you, it is important that they are explicitly aware that this is what you want them to do and that you know what it entails, as it is expected of them to have this direct approval.

The application must be submitted to the Australian Financial Security Authority (AFSA) Online Service website.

In order for this to occur, the creditor must have created a profile so that it can be submitted and processed. They will be required to pay a fee of $470 upon application, which can be made online.

To apply online for the delivery of a bankruptcy notice, the creditor will be required to present several documents. You will have to upload a sealed copy of the judgement made, or court order issued regarding the payment of the debt exceeding the amount of $10,000.

If this process is not completed in its entirety, it will be returned to the creditor or the creditors' solicitor or agent for resubmission.

Completing a Bankruptcy Notice

Initially, before completing the bankruptcy notice paperwork, you should conduct a bankruptcy search to see if your debtor is already bankrupt or involved in a debt or personal insolvency agreement. You can find more information about bankruptcy searches - https://www.afsa.gov.au/online-services-help/bankruptcy-register-search.

If you get a clear search, then you can create an account with AFSA and start the bankruptcy notice process.

There are essentially three (3) sections to a bankruptcy notice:

- The creditor/debtor information; and

- The judgment debt information; and

- The interest/costs information.

I will explain these in more detail below.

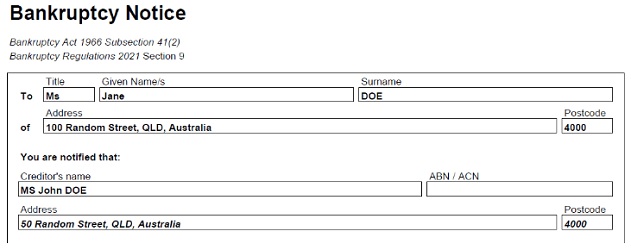

The Creditor/Debtor Information

The first step is to input the debtor and the creditor information, including title (Mr, Mrs), given name/s (the first name/s), the surname, and the address of both parties.

This must be exactly the same as contained on the judgment.

Once you have this information correct, then you will be asked to complete the debt information.

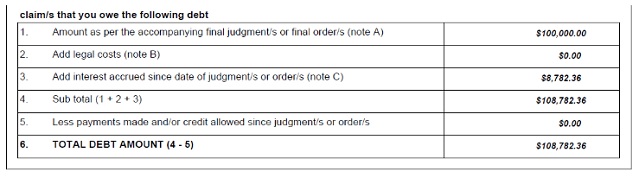

The Judgment Debt Information

This is the section where a creditor can add the judgment debt amount, legal costs (if any), and post-judgment interest.

The amount of the judgment debt is the amount of the money order on the judgment, including costs and interest (until the date of judgment).

Where any further legal costs are being claimed (not included in the judgment), a certificate of taxed or assessed costs in support of the amount claimed is to be uploaded and attached to the bankruptcy notice. In most cases, this will be $nil.

Lastly, any post-judgment interest is to be added.

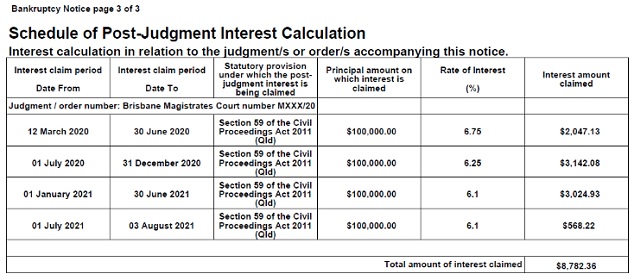

The Interest/Costs Information

The post-judgment interest is calculated from the date of the judgment to the date of issuing the bankruptcy notice. This is calculated in accordance with section 59(2) and (3) of the Civil Proceedings Act 2011 (Qld) which say:

(2) Interest is payable from the date of a money order on the money order debt unless the court otherwise orders.

(3) The interest is payable at the rate prescribed under a practice direction made under the Supreme Court of Queensland Act 1991 unless the court otherwise orders.

The practice direction for calculating interest is Practice Direction Number 7 of 2013, which says:

4. The following is the rate applicable to a money order debt:

(a) in respect of the period from 1 January to 30 June in any year, a rate six percent above the cash rate last published by the Reserve Bank of Australia before that period commenced; and

(b) in respect of the period from 1 July to 31 December in any year, a rate six percent above the cash rate last published by the Reserve Bank of Australia before that period commenced.

So, interest is calculated at 6% above the cash rate at the Reserve Bank of Australia.

The easiest way to calculate interest is to go to the Court Interest Calculator.

Submit Your Notice to AFSA

Once you complete the data entry process, and uploaded the judgment and any other relevant documents, then there is a $470.00 lodgement fee to pay.

Once this is paid then you can submit your bankruptcy notice. It will be checked by AFSA and either approved or rejected. If it is rejected, then AFSA will simply want some minor amendments to ensure it is compliant. Once you get the approved documents back, the bankruptcy notice will need to be served.

How Do I Serve a Bankruptcy Notice?

Once your application for a bankruptcy notice has been accepted, the next step is serving the debtor with it. Serving a debtor is the process of presenting them with the bankruptcy notice so that the process can begin, and they have to comply with the terms.

Upon AFSA's acceptance of the bankruptcy notice and its issue to you, the creditor, it must be served to the debtor within 6 months.

Regulation 102 of the Bankruptcy Regulations 2021 relates to the service of documents. It says:

(1) Unless the contrary intention appears, if a document is required or permitted by the Act or this instrument to be given or sent to, or served on, a person (other than the Inspector-General, the Official Receiver or the Official Trustee), the document may be:

(a) sent by a courier service to the person at the address of the person last known to the person serving the document; or

(b) left, in an envelope or similar packaging marked with the person's name and any relevant document exchange number, at a document exchange where the person maintains a document exchange facility.

Subsection (1) also has a note which says - Note 1: see also section 28A of the Acts Interpretation Act 1901. Section 28A says:

(1) For the purposes of any Act that requires or permits a document to be served on a person, whether the expression "serve", "give" or "send" or any other expression is used, then the document may be served:

(a) on a natural person:

(i) by delivering it to the person personally; or

(ii) by leaving it at, or by sending it by pre-paid post to, the address of the place of residence or business of the person last known to the person serving the document .

As you can see, there are several ways that a bankruptcy notice may be officially served to a debtor. Due to the severity of the consequence of non-compliance, being an act of bankruptcy, it is always recommended that you personally serve the debtor.

This is so you can explain what it is, what it entails, and what they must do, especially if they are not too aware of legal jargon or what bankruptcy means for them. However, you may also serve a bankruptcy notice through:

- Post, leaving it at their address, sending by courier, or sending by email.

Your lawyer, if you have one, will likely advise you on the best method of serving the notice as they will be able to assess the situation and its details.

Once it has been served to the debtor, the 21 day timeline will begin in which they must comply with the terms of the notice and pay the debt in question.

Frequently Asked Questions about Bankruptcy Notices

Below, you will find answers to common queries that we can asked by our clients regarding bankruptcy notices and their implications.

What are the requirements for a bankruptcy notice?

The basic requirements for a bankruptcy notice include, the debt must be a judgment debt, the judgment debt must be more than $10,000.00, and the judgment debt must be no more that six (6) years old.

Can a bankruptcy notice be withdrawn?

Yes, a bankruptcy notice can be withdrawn if the debtor manages to settle their debts or negotiate an agreement with the creditor. The notice must be withdrawn in writing. However, it is crucial to consult with legal professionals to ensure the necessary steps are taken to rectify the situation and prevent further legal action.

How long do I have to respond to a bankruptcy notice?

Debtors typically have 21 days to respond to a bankruptcy notice. During this time, the judgment debtor must 1. pay to the creditor the amount of the debt claimed; or 2. make arrangements to the creditor's satisfaction for settlement of the debt; or 3. apply to set aside the bankruptcy notice.

Can I negotiate with creditors after receiving a bankruptcy notice?

Yes, negotiation with creditors is possible even after receiving a bankruptcy notice. Be mindful that unless an extension of time has been requested, the 21 day time limit means 21 days only, so all negotiations must be concluded on or before this time.

Can a bankruptcy notice be challenged in court?

Yes, debtors have the right to set aside a bankruptcy notice in court if they believe there are valid grounds for doing so. A bankruptcy notice can be set aside if There is a defect in the notice; and/or the judgment debt allowing the notice is disputed; and/or the debtor has a cross-demand, set-off, or counterclaim which is equal to, or more than the judgment debt; and/or the notice is an abuse of process. Read our article of how to set aside a bankruptcy notice.

Can bankruptcy notices be issued for any type of debt?

Bankruptcy notices can be issued for various types of debts, including credit card debt, personal loans, unpaid bills, and outstanding taxes. However, the debts must be judgment debts, be for $10,000.00 or more, and not be more than six (6) years old.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.