- within Privacy, Government, Public Sector and Immigration topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit industries

The way financial advisers can give their clients a Financial Services Guide ("FSG") has been amended. These changes also apply to providers of general advice. Essentially, financial advisers may give their clients a FSG or make the FSG information publicly available on their website – known as "website disclosure information".

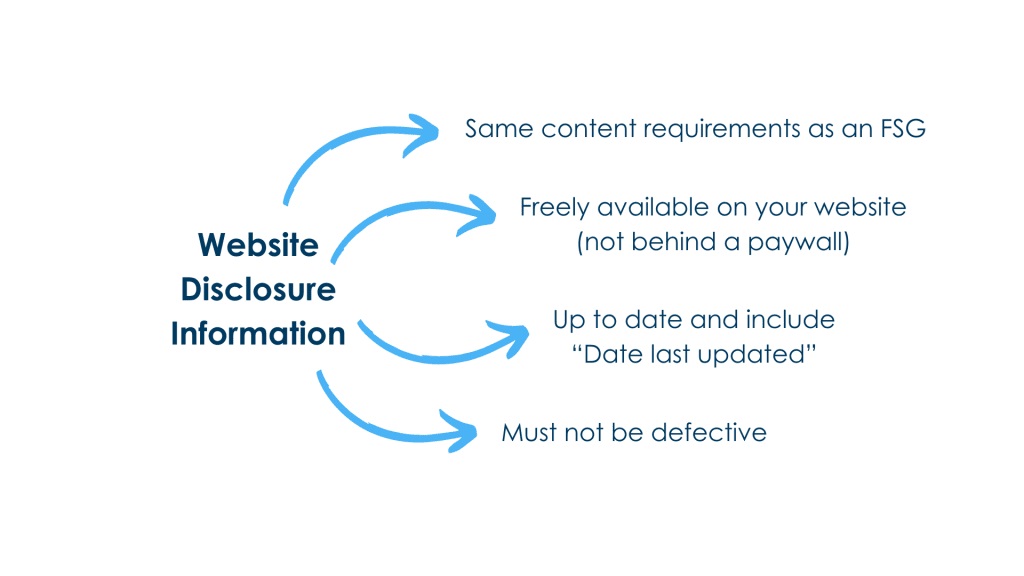

Website disclosure information must comply with the following requirements:

- contain the same statements and information that would be required in an FSG;

- can appear across different locations or parts of the provider's website, and can take any form (written or graphic, files etc.);

- be freely available to the public, meaning that it must not be password protected or accessible only to persons who have created an account or paid a subscription;

- be up-to-date and specify the day it was last updated;

- not be defective, meaning it cannot be misleading or deceptive, or omit information that is required to be included in website disclosure information;

- any alterations to website disclosure information must be authorised by the licensee. For material alterations, the website must clearly show the date on which the alteration was made; and

- If an authorised representative wants to distribute website disclosure information, it must have authorisation from the licensee to do so.

Although there is no express requirement to do so, financial advisers should notify clients that this information is available on their website, for example by including a link to the information in email correspondence to clients.

If you have any questions about how the changes can be applied to your business website, please contact us.

The ("DBFO Act") has implemented a number of changes which Sophie Grace have covered in separate articles on our website.

Further Reading

- An overview of the DBFO Package (Tranche 1)

- ASIC Info Sheet 291 – FAQs: FSGs and Website Disclosure Information

- RG175 – AFS Licensing: Financial Product Advisers – Conduct and Disclosure

- Treasury Laws Amendment (Delivering Better Financial Outcomes and Other Measures) Act 202

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.