- in United States

- within Immigration and Transport topic(s)

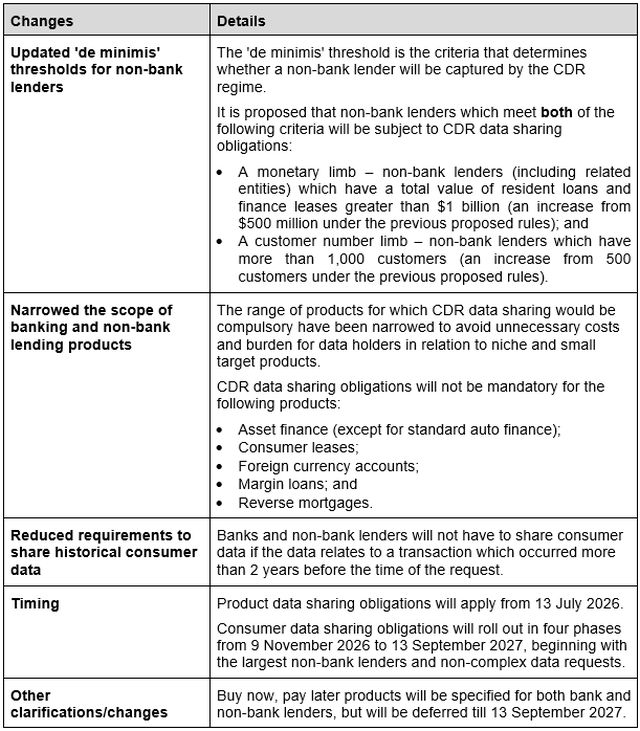

The Australian Treasury released an Exposure Draft on 26 November 2024 (Amending Rules) proposing amendments to the Competition and Consumer (Consumer Data Right) Rules 2020 (CDR Rules). Whilst the government designated the non-bank lending sector as subject to the CDR regime on 21 November 2022 and had released draft rules for consultation last year, the new proposed Amending Rules have taken into account stakeholder feedback and reflects the government's recent 'reset' of the CDR regime.

Expanding CDR to Non-Bank Lending

The Exposure Draft introduces key tranche dates for data sharing obligations. Product data sharing obligations will apply from 13 July 2026, followed by consumer data sharing obligations that will roll out in four phases from 9 November 2026 to 13 September 2027, beginning with the larger non-bank lenders and less complex data requests.

The Exposure Draft also provides updated clarity about how the CDR Rules will apply to the non-bank lending sector, while narrowing the scope of CDR data for both the banking and non-bank lending sectors.

Summary of the Key Changes

Feedback in respect of the Consultation Paper is open until 24 December 2024.

The draft rules are expected to be officially introduced from July 2026, and rolled out gradually in phases until September 2027.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.