The NTA Requirement – Latest ASIC Updates for AFSLs

ASIC has released new legislative instruments and updated its guidance in relation to the financial resource requirements that apply to some types of Australian Financial Services Licensees (Licensees). ASIC also issued Report 769 (Report), which details the key issues in the submissions received on ASIC's Consultation Paper 367.

Key Issue – the NTA Requirement

The key issue raised in the submissions to Consultation Paper 367 and the issues detailed in the Report relate specifically to the calculation of the Net Tangible Asset (NTA) requirement.

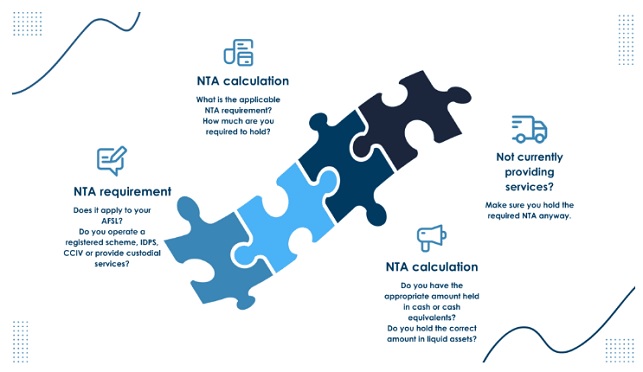

Licensees impacted by the new ASIC instruments are required to hold particular authorisations to provide services in relation to registered schemes, IDPSs, CCIVs and custody. These authorisations trigger the NTA requirement.

What is the NTA Requirement?

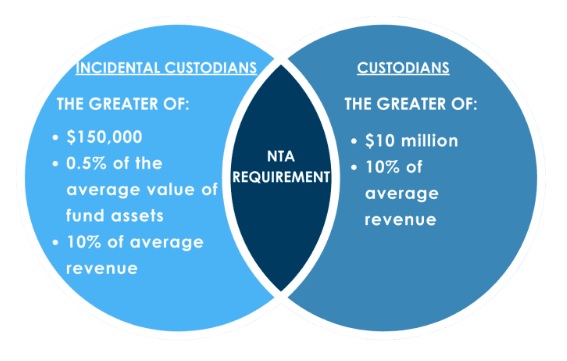

The NTA requirement is tiered, to provide for smaller Licensees, or Licensees that have lower levels of business activity under their AFSL. Depending on the specific authorisations and business operations of the Licensee, the NTA requirement which applies will be one of the following options:

- The greater of:

- $150,000;

- 0.5% of the average value of fund assets; or

- 10% of the average revenue; or

- the greater of:

- $10 million; or

- 10% of the average revenue.

Please ensure you obtain advice if you are unsure which option applies to your business.

Calcuating Revenue

When calculating revenue, it is important to note the definition in each of the new legislative instruments. For custodial providers, the definition of revenue in the new legislative instrument includes:

- the Licensee's revenue;

- any amount paid or payable (to the extent that it is not the Licensee's revenue) for the performance of the obligations imposed on the Licensee to provide custodial services, even if those obligations are performed by another entity.

The legislative instrument and ASIC's RG166 specifically note that the revenue of the Licensee will include any revenue earned by authorised representatives in respect of amounts paid or payable for performing custody services on behalf of the Licensee.

Custoidal Providers that are Incidential Providers

The NTA requirements for licensed custodial providers are:

- incidental providers; and

- do not hold physical custody of the assets, is nil.

An incidental provider is one that does not provide any custodial or depository services other than services which:

- are a need of the client to whom custodial services are provided because of, or in order to obtain another financial service by the Licensee; and

- do not form part of an IDPS.

An example of an incidental provider is a Licensee who provides custodial services in relation to a managed investment scheme that the Licensee operates.

At all times, the custodial provider must ensure that the assets are held by a separate entity that meets the higher financial requirements noted in item B above, being $10 million or 10% of average revenue.

A custodial provider must request written assurance from the separate entity that they meet the financial requirements in item B above. Where there are not any assets for the separate entity to hold, then the custodial provider must have at least entered into an agreement with the separate entity. Custodial providers should be aware that if they provide other financial services that trigger an NTA requirement, they must meet that NTA requirement.

ASIC's Position – When is the NTA requirement triggered?

As soon an authorisation that triggers the NTA requirement is granted by ASIC, the NTA requirement takes effect. ASIC did not agree with the submission to Consultation Paper 367 that the NTA requirement should not take effect if the Licensee is dormant or is not currently utilising the authorisations that trigger the NTA requirement.

This is an important consideration for Licensees authorised to operate registered schemes, IDPSs, CCIVs and provide custodial services. It means that any Licensee which is subject to the NTA requirement by way of the authorisations included on its AFSL, must meet the NTA requirement from the date the authorisations take effect. For many Licensees, and those looking to apply for or acquire an AFSL, this will mean future planning to ensure the appropriate cash reserves are held.

Affected Licensees are required to hold at least 50% of the required NTA in cash or cash equivalents (with a minimum of $150,000). Depending on the specific authorisations, some or all of the required NTA must also be held in liquid assets.

ASIC's Position – Are financial requirements cumulative?

It's also important for affected Licensees to consider ASIC's comments in RG166 in relation to whether the NTA requirements described for various licensees in the appendices of RG166 are cumulative.

ASIC notes that where the NTA requirement applies to a Licensee under one legislative instrument, the Licensee can count those assets for another applicable financial requirement. This means, for example, the assets a Licensee utilises to meet the NTA requirement can also be used to meet the Surplus Liquid Funds requirement.

ASIC further noted that some Licensees may be subject to two NTA requirements and that in this case, the highest requirement applied, meaning the NTA requirements are not cumulative. For example, a custodial and depository service provider is subject to the NTA requirement under ASIC Instrument 2023/648 and Appendix 4 of RG166. However, the custody provider may also be subject to another NTA requirement under a different appendix and legislative instrument. In this case, the highest dollar value NTA requirement will apply.

What Next?

Affected Licensees should review their NTA calculations, including the proportion that is held in cash or cash equivalents. For Licensees that operate registered schemes, IDPSs, CCIVs and provide custodial services and have not yet considered the NTA requirements – it's time to do so. ASIC will not look favourably on Licensees to which the NTA requirement applies but have failed to meet this financial obligation.

Legislative Instruments

The new legislative instruments are:

- ASIC Corporations (Financial Requirements for Responsible Entities, IDPS Operators and Corporate Directors of Retail CCIVs) Instrument 2023/647: This applies to responsible entities of registered schemes, investor-directed portfolio service (IDPS) operators and corporate directors of retail corporate collective investment vehicles (CCIVs).

- ASIC Corporations (Financial Requirements for Custodial or Depository Service Providers) Instrument 2023/648: This applies to licensed custodians.

Further Reading

ASIC Consultation Paper 367 – Remaking ASIC class orders on financial requirements

ASIC Regulatory Guide 166 – AFS Licensing: Financial Requirements