- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Securities & Investment and Law Firm industries

The Federal Court's decision and ASIC's regulatory action against Rent4Keeps is a warning for licensees issuing credit contracts (loans) to consumers.

The Federal Court found that Rent4Keeps and its largest franchise Darranda Pty Ltd, had attempted to style the selling of everyday goods, such as furniture, electronics and whitegoods as "consumer leases" when in fact they were credit contracts. The court found that as a result, Rent4Keeps contravened the 48% annual rate cap and other requirements under the National Credit Act.

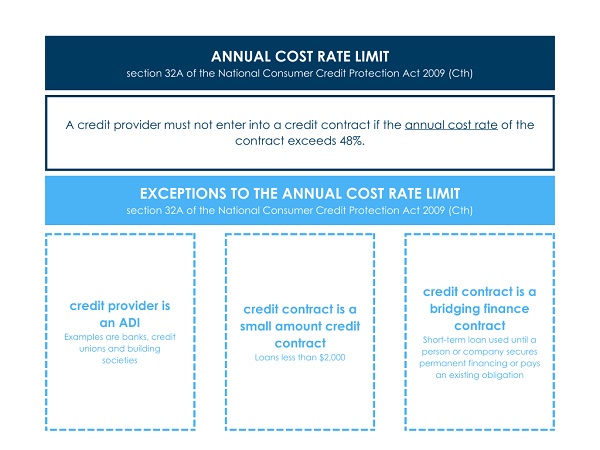

Under section 32A of Schedule 1 of the National Credit Act ("National Credit Code"), credit providers cannot charge consumers an annual cost rate that exceeds 48% ("the 48% cap"). There are exemptions from the annual cost rate cap, including for:

- the credit provider is an ADI; or

- the credit contract is a small amount credit contract (there are other limits on the fees and charges for these types of loans); or

- the credit contract is a bridging finance contract.

The Rent4Keeps case shows that ASIC will continue to take action against credit licensees it considers are causing significant harm to consumers. Credit providers must ensure they do not intentionally attempt to take advantage of financially vulnerable consumers, by:

- a lack of honesty;

- a failure to have systems in place that effectively monitor the terms and conditions of the credit contracts that a credit provider is issuing to customers; and

- a failure to explain or advise on the nuances in the terms and conditions of the credit contracts.

These can be reasons for a credit provider to have failed to engage in credit activities "efficiently, honestly and fairly".

It is also important to keep in mind that at the time Rent4Keeps contravened section 32A of the National Credit Code, the 48% cap did not apply to consumer leases. However, the law has since changed which means rate cap also applies to lease arrangements. The cost rate is determined by a formula that takes into account fees and charges and the timing of repayments.

Further Reading

- ASIC wins against Rent4Keeps for overcharging vulnerable consumers on essential household goods

- Section 32A of the National Consumer Credit Protection Act 2009

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.