Certain Financial Institutions in Ireland are obliged to file both Foreign Account Tax Compliance Act ('FATCA') and Common Reporting Standard ('CRS') reports by 30 June 2021 with Revenue.

Those with a reporting obligation, that is "Reporting Financial Institutions" ('RFIs') should compile and validate the reportable account information for inclusion on both the FATCA/CRS reports.

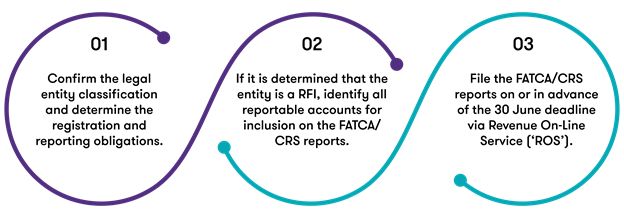

What should FIs do?

In advance of the deadline, FIs should take the following steps to ensure compliance with FATCA and CRS:

To ensure compliance and avoid fines and/or penalties, it is vital that the information is accurate and complete and the reports are filed on time.

Other Considerations for Reporting

The Internal Revenue Service ('IRS') and the Organisation for Economic Co-operation and Development ('OECD') often issue updates to the FATCA and CRS report filing guidelines respectively, which may be subsequently implemented by Irish Revenue. One such recommendation is the release of an update to the XML schema by the OECD that RFIs are required to use when submitting CRS reports for the 2020 reporting period, which have been incorporated into the CRS filing guidelines by Irish Revenue. Therefore, it is important that RFIs keep up to date and be familiar with the latest FATCA and CRS reporting guidance issued by Irish Revenue.

Originally Published 3 June, 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.