Author: Brizida Alani, CONVINUS global mobility solutions

In Switzerland, a special provision in the Foreign Nationals and Integration Act (AIG) allows wealthy nationals from non-EU/EFTA countries to obtain a residence permit if they can demonstrate a "significant public interest." This practice, often referred to as a "golden visa," is facing increasing criticism. This is because "significant public interest" is commonly interpreted as the payment of a certain annual tax amount.

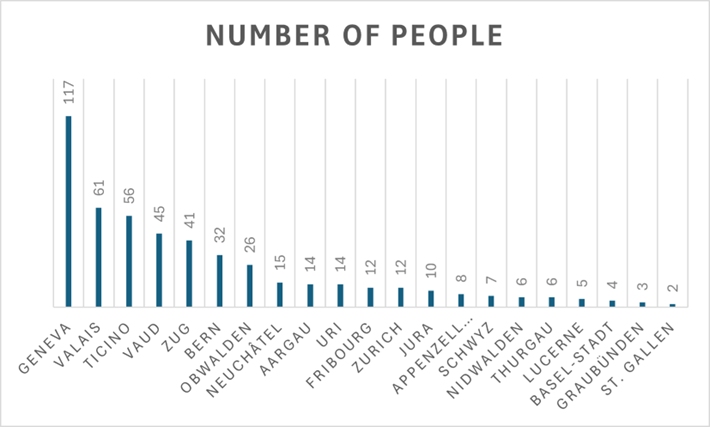

According to media reports, the number of these visas has risen from 354 in 2021 to nearly 500 – an increase of over 30 percent. The following overview shows the exact number of residence permits granted in 2024 by canton:

A particularly controversial point is that the most frequent applicants come from Russia and China.

A Green Party member of the National Council criticizes this practice, claiming it poses a reputational risk for Switzerland and calls for the abolition of the regulation. Other politicians also question whether additional tax revenues alone justify being labeled a "significant public interest."

In contrast, a member of the Swiss People's Party (SVP) defends the regulation, emphasizing that Switzerland needs immigration, especially when it benefits society and the economy.

taxation agreement between Canada and Switzerland, there can (as a rule) be no double taxation.

The debate over "golden visas" highlights the tension between economic interests and the principle of equal treatment in immigration law. It remains to be seen whether political initiatives will lead to changes in the current practice.

So how can non-EU nationals obtain a residence permit in Switzerland?

While there is officially no "Golden Visa" program, Switzerland still offers two well-established paths for wealthy non-EU nationals: lump-sum taxation (as explained above) and entrepreneurial investment.

1. Residence Permit through Lump-Sum Taxation

Wealthy individuals who do not engage in gainful employment in Switzerland can apply for a residence permit through a lump-sum tax agreement with a canton. This tax is based on living expenses and ranges from CHF 250,000 to CHF 1,000,000 annually, depending on the canton.

One of the most expensive is the canton of Zurich, with a minimum annual tax of CHF 1 million. Requirements include a clean criminal record, a residence in Switzerland, and sufficient financial means.

2. Residence Permit through Investment

Those who wish to engage in business activities may obtain a permit by founding or investing in a Swiss company. The minimum investment amount is around CHF 1 million. A key condition is that the company must create or maintain jobs for Swiss citizens. This option is particularly suitable for committed entrepreneurs with viable business ideas.

Good to know:

Both options can lead to naturalization after at least ten years of lawful residence, provided certain conditions are met. Since cantonal regulations vary significantly, expert advice from tax and immigration specialists is essential.

Conclusion:

Switzerland offers attractive options for wealthy investors seeking residency – not through a classic "Golden Visa" program, but via compelling alternatives. Anyone looking to settle in Switzerland long-term should carefully explore these pathways.

For the German version, please read here>>

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.