- within Tax topic(s)

- in European Union

- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Metals & Mining industries

I. Individuals

1.1 Personal Income Tax

An individual is subject to income tax on his/her total net income in Greece and abroad. Net income sourced in Greece is taxed irrespective of the residence of the individual. Income arising abroad is taxed if the relevant individual is a tax resident of Greece. The tax year is the calendar year. For income tax purposes, the income derived by individuals is divided into certain categories. Taxable income is calculated based on the rules of each category and the total taxable income of the individual is the aggregate of the categories.

1.1.1 Income from Employment, Pension Income Freelance Activities

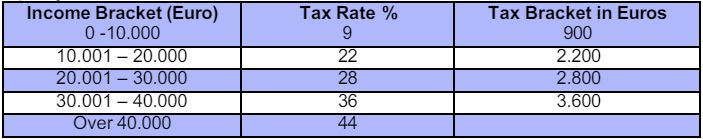

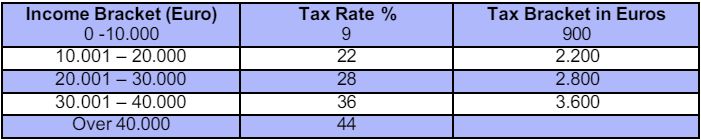

Employment & Pension Income

Under conditions there are some tax reductions such as number of children, amount of total income.

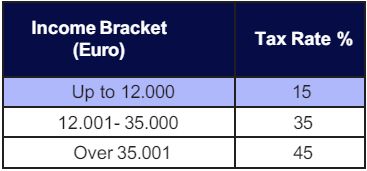

Freelancers

Tax reductions for employees and pensioners do not apply, whereas as for the income of freelancers for the year 2023 and onwards a deemed minimum income is taken into account for income tax purposes (tax on notional income) according to recently introduced tax provisions.

1.1.2 Solidarity Contribution

As of January 1, 2023, the solidarity tax has been abolished for all private and public sector employees, as well as for pensioners.

1.1.3 Income from Immovable Property

*Taxable base: 95%

1.1.4 Social Insurance Contributions ("SIC")

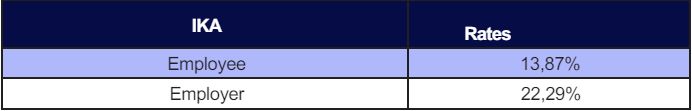

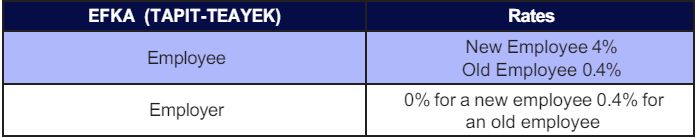

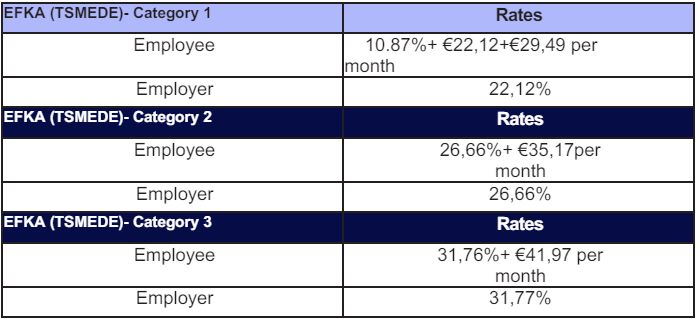

All salaries are subject to social insurance deductions. There are numerous social insurance foundations, each one competent for a different professional specialty. The most common Social Insurance Foundation is IKA. Most of the foundations have now been unified under the "umbrella" foundation of EFKA.

SIC Rates

The above percentages apply when both pension and health deductions are covered by IKA. In cases when extra social insurance deductions are required (e.g., such as TEAYEK -social insurance foundation regarding employees working in stores) the above percentages differ as follows:

All percentages are calculated on the gross salary with a pre-set limit of deductions. All percentages are indeed calculated on the gross salary as long as the salary doesn't exceed the amount of € 7373,53 per month.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.