Avoiding the New $2,000 Surcharge May Raise Compliance Risks for Larger Petitioners that Now Restructure into Several Smaller Units Each with Less than 50 Nonimmigrant Employees

Introduction:

Outsourcing Business Model Targeted by Congress for Fee Increase

Chairman Schumer's H-1B Anti-Outsourcing "Intent of Congress" Speech

A. ENFORCEMENT: A Variety of Legal Standards Might be Applied to Investigations

B. THE USCIS FRAUD DETECTION & NATIONAL SECURITY (FDNS) "ARTICULABLE FRAUD INDICATORS" - Will Restructuring Make the Petitioner Suspect and Result in Audits and Investigations?

STANDARDS OF LEGAL PROSECUTION

THE USDOL LCA "WILLFUL VIOLATION" MODEL

THE ICE IMMIGRATION FRAUDS MODEL

TAX EVASION MODEL - A Question of Motive: Fee Avoidance or Fee Evasion?

SARBANES-OXLEY (SOX) INVESTIGATIONS

Introduction:

Under the Emergency Border Protection Act signed into law Friday, August 13, 2010, filing fees will go up $2,000 for H-1b and $2,250 for L-1, as an increase in the USCIS Fraud Prevention fee. The measure will sunset September 30, 2014.

In passage of this Bill, comments by Congressional leaders clearly signaled DHS and other agencies that Congress supports administrative measures already in place to roll-back the offshore outsourcing industry, and to eliminate the cost advantage attached to the dual-tier offshoring model, and that it stands ready to pass these restrictions into legislation.

This has become a very aggressive and risky regulatory

environment for foreign IT consulting and staffing firms. Under the

circumstances, USCIS, ICE and other interested agencies may easily

take this latest action by Congress as a green light to monitor

targeted firms for evasion of this new law, including steps that

might be construed as an effort to evade new discriminatory fees.

At the very least, evasion could be penalized as a "willful

violation" of LCA requirements, and potentially raises further

fraud issues. In what some will view as a bitter coincidence, on

August 13 the U.S. District Court for D.C. dismissed with prejudice

an injunction request brought by H-1B staffing firms seeking the

court's protection of their business model.

In this environment, there may be little protection and some very

harsh consequences for companies that attempt to evade the fee

surcharge. Larger staffing companies that employ the traditional

outsourcing model may face enforcement action for alleged fraud if

they restructure into business units smaller than 50 employees

solely to avoid paying the new fees. Those found to do

so may be identified under the FDNS-DS "articulable

fraud" criteria. FDNS is the unit within USCIS that currently

conducts worksite audits of petitioning employers, and it also runs

a database system (DS). A wide variety of USCIS I-forms and the

accompanying documents are run through the FDNS Data System (DS)

which identifies patterns of what agency administrators consider

fraud indicators. The system is essentially a giant data-mining

operation, which is shared with other federal agencies. The FDNS-DS

has developed a set of "articulable fraud indictators"

that are the basis by which USCIS selects petitioners for site

audits. There are 21 known FDNS-DS indicators, the top three

are:

- (Petitioner)Gross annual income less that $10 million.

- Company claims less than 25 employees.

- Company established for less than 10 years.

Any company that matches those 3 indicators is subject to a "100 percent referral" policy for follow-up investigation, according to USCIS documents.

Altogether, these indicators are far more expansive than the legal standards for immigration-related fraud that might be used in a criminal prosecution in a court of law. Any larger company employing 50 percent H-1B and L-1 non-immigrants – even if they are not subject to H-1B dependent classification -- that now restructures into smaller business units employing less than 50 workers is likely to trigger a red-flag at the FDNS-DS unit which is now operating at every USCIS Service Center. That may lead to enforcement actions by several agencies, including ICE and UDOL Wage & Hour Division (WHD).

In cases where an LCA violation is found by WHD, an appeal may be lodged with a USDOL Administrative Law Judge and the Administrative Review Board (ARB). There is a sizable body of administrative law precedent regarding willful misrepresentation of the LCA attestations along with failure to create and retain accurate records that may be applied. One should expect that similar evidentiary standards and case law establishing willful violations would be applied to any sanctions arising from improper evasion of the LCA fee surcharge.

While it is not clear at what point evasion of the surcharge would rise to a criminal fraud violation, it is likely to result in some very close administrative auditing and investigation, along with questioning of motives at points of contact by USCIS, USDOL, and Consuls. Evasion of the surcharge may be considered cause for investigation if federal officers determine that there was no legitimate purpose behind a restructuring other than intent to evade compliance with the law. Any evidence of intent to defraud the U.S. is a strongly aggravating factor in the sentencing phase under federal sentencing guidelines.

As this paper shows, firms that already have compliance problems should be very, very careful about how they proceed in this environment.

Finally, we will discuss the investigative and prosecutorial frameworks which federal agencies may apply to these issues. The most likely potential prosecutorial models can be drawn from ICE investigations, IRS tax evasion cases, SOX fraud matters, and money laundering prosecutions.

Chairman Schumer's H-1B Anti-Outsourcing "Intent of Congress" Speech

On August 13, President Obama signed the Emergency Border Security Supplemental Appropriations Act (H.R. 6080/S. 3721)1 that imposes steep fee increases upon H-1B and L-1 petitions submitted by some employers.

According to Congressional leaders, the measure is intended to directly target large foreign staffing firms. Senate Immigration and Homeland Security Committee Chairman Charles Schumer, the principal Senate sponsor, stated his view of the intent of Congress upon introducing the Bill2 for the Senate vote which carried by unanimous consent. Schumer made it clear that he and others in Congress see the business model of such firms as harmful and contrary to the original intent of American nonimmigrant visa programs that are used by these firms:

The business model of these newer companies is not to make any new products or technologies like Microsoft or Apple does. Instead, their business model is to bring foreign tech workers into the United States who are willing to accept less pay than their American counterparts, place these workers into other companies in exchange for a "consulting fee," and transfer these workers from company to company in order to maximize profits from placement fees. In other words, these companies are petitioning for foreign workers simply to then turn around and provide these same workers to other companies who need cheap labor for various short term projects.

The President made no reference in his signing statement to objections raised by the Indian government and trade groups which view the move as discriminatory and directed at large, successful global outsourcing firms based in that country.3

Outsourcing Business Model Targeted by Congress for Fee Increases

Sec. 402 of the Act imposes large hikes in filing fees for H-1B and L-1 petitions from companies having 50 or more employees with 50 percent of their workforce made up of non-immigrants in those categories. Filing fees are slated to go up $2,000 for H-1b and $2,250 for L-1, as an increase in the USCIS Fraud Prevention fee, the proceeds to go to pay for additional Border Patrol manpower and infrastructure improvements it the Southwest. The measure will sunset September 30, 2014.

Chairman Schumer's H-1B Anti-Outsourcing "Intent of Congress" Speech- Target Larger, Newer Foreign Staffing Agencies that Don't Market Their Own Proprietary Products and Processes.

Congressional leaders clearly intend that USCIS apply this fee increase in such a way that it particularly targets larger, newer foreign staffing agencies that do not market their own proprietary products and processes. Schumer (D-NY) stated that it is his intention to introduce significant additional restrictions on H-1B outsourcing in a proposed Comprehensive Immigration Reform (CIR) measure that he says will be pushed through next year.

The Bill, which originated as a House measure co-sponsored by border state Democrats, received rare bipartisan support in both houses, and may be a good indicator of where U.S. immigration policy is headed.

House Speaker Nancy Pelosi stated that she views HR 6080 as the first leg of CIR, and the House as well as Senate version of that larger immigration package contain measures that would carry into law current administrative restrictions on the outsourcing model.

In his prepared remarks on the Senate floor before the vote Thursday4, Chairman Schumer made some unusually harsh remarks about H-1B and some of the companies and workers that use the program. He said that the H-1B program has been exploited by "multinational temp agencies" that "undercut U.S. wages and discourage students from entering tech fields."

Sen. Schumer also made it clear that the next round of Comprehensive Immigration Reform (CIR) legislation coming from Congress will back up existing USCIS administrative measures restricting L-1 and H-1B. Some agency actions – such as the 2008 GSTechnical Services AAO decision and the January 2010 H-1 directive, the Neufeld memo -- have been criticized as substantially deviating from existing legislation. The pending CIR Bills already contain sections addressing these measures.

There is additional reason for outsourcing firms to be alarmed. Simultaneous with the President's signature of the surcharge measure on Friday August 13, the U.S. District Court for the District of Columbia dismissed with prejudice a federal law suit that had been filed in June by several IT staffing groups and firms challenging the Neufeld memo. That decision clears the way of legal obstacles to further implementation of USCIS rules that outsourcing firms must establish that they fully control the employment of nonimmigrant workers assigned to third-party client sites, a requirement that Plaintiffs had claimed was inimical to their business model. U.S. District Court Judge Joan Kessler rejected that argument, and refused to extend APA protection to that business model, holding that the Neufeld memo is not inconsistent with existing USCIS regulations.

Schumer Pledges that Business Model of Global Staffing Firms Will No Longer Enjoy a Cost Advantage - Green Light Signaled for Further Fee Increases and Restrictions

Sen. Schumer concludes by stating that he considers the traditional global staffing firm business model to be antithetical to the intent of Congress:

"Congress does not want the H-1B visa program to be a

vehicle for creating multinational temp agencies where workers do

not know what projects they will be working on—or what

cities they will be working in—when they enter the

country."

The fee is based solely upon the business model of the company, not

the location of the company. "

Of course, this does not bode well for the future of the H-1B and L-1 nonimmigrant programs, and those companies which have utilized them to staff third-party projects in the U.S. While Schumer expressly singled-out H-1B for criticism, the Act also penalizes multinational firms that employ a high percentage of L-1 Temporary Workers. L-1B employers are already restricted from placing their workers at most third-party client sites by a 2004 law, and H-1B employers are now required to similarly document the element of common law "control" over their workers by a USCIS administrative directive, the Neufeld memo, imposed in January. Schumer did not reference these measures or explain why they may have been inadequate to stem the perceived problems with outsourcing of non-immigrant workers.

Sen. Schumer concluded his speech by acknowledging that it is the intent of this law's sponsors "that our bill will make it more expensive to bring in foreign tech workers to compete with American tech workers for jobs here in America. That means these companies are going to start having to hire U.S. tech workers again." The Senator cites a recent article in The Economic Times of India that quotes Jeya Kumar, a CEO of a top Indian IT company, who said that this bill would "erode cost arbitrage and cause a change in the operational model of Indian offshore providers.

It may also have a negative impact on the decisions made by multinationals, if they find they are blocked from hiring global talent or cannot do so a cost-effective way, to locate research and development jobs outside the United States.

The U.S. Chamber of Commerce has released an American Council of International Personnel (ACIP) study that makes a case for the H-1B program. That report concludes, "In the global economy, investment follows the talent and attempts to restrict the hiring of talented foreign-born professionals in the United States encourages such hiring to take place overseas, where the investment dollars will follow."

C. ENFORCEMENT: A Variety of Legal Standards Might be Applied

THE USCIS FRAUD DETECTION & NATIONAL SECURITY (FDNS) "ARTICULABLE FRAUD INDICATORS" - Will Restructuring Make the Petitioner Suspect of Fraud and Subject to Additional Audits?

Fraud Now Presumed for Many Routine H-1B Petitions

In recent years, the federal government has spent billions of dollars hooking up databases and creating software tools used by DHS fraud investigators. USCIS Service Centers now have sophisticated data-mining to pinpoint patterns of document and benefits fraud, but that system has serious problems, according to a DHS Inspector General's review.

A redacted portion of the IG report reveals that DHS has created a system – the National Security Fraud Detection Data System (FDNS-DS) -- that automatically classifies characteristics common to many applicants as "articulable fraud." Previously, discretion was allowed examiners, as uneven as it sometimes was, to determine which cases USCIS referred to ICE for fraud investigations. The IG report found the result was to overload and slow the system of USCIS adjudications, deterring access and reducing the numbers of petitions, which the author hints may have been a long-term goal of these changes, according to the IG review.

As most immigration lawyers have noticed in recent years, the Service Centers have issued thousands of Requests for Evidence (RFEs) for cases that were previously routinely approved. Increasing numbers of companies and lawyers are being investigated. The FDNS system was expanded in 2009 to include site inspections and audits by teams of investigators. In some cases, the result has been unfair labeling of applications by companies -- particularly smaller firms, start-ups, along with information consulting firms -- as fraudulent. Fraud is now equated with national security threat, and both are reviewed for the same criteria by FDNS-DS.

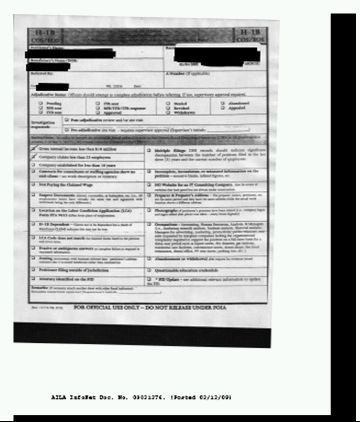

The USCIS H-1B Fraud Referral Sheet

In March, 2009, a copy of a single-page excerpt of an internal USCIS H-1B Petition Fraud Sheet was released by USCIS, apparently inadvertently, to an immigration lawyer. That was subsequently posted by AILA and reproduced by others 5 Research performed for Fakhoury Law Group (FLG) reveals that the document is actually part of a four-page redacted portion of a 2008 DHS Office of Inspector General Review of the USCIS Benefit Fraud Referral Process (Redacted ...

That DHS review exposed problems with a then new fraud detection program known as the Fraud Detection National Security Detection System (FDNS-DS)6. The OIG report was critical of how the program was being managed, and questioned its strategic goals.

Fig. 1, above, shows the referral sheet and the 21 fraud indicators (page reproduced in full at Appendix 1, below).

Fig. 2, below, reproduces the page of the 2008 OIG report that references the decision-tree employed in fraud referrals in case where the USCIS FDNS-DS system develops evidence of suspected benefits and document fraud at the examinations stage.

Singled out for criticism in the OIG report is a USCIS policy that required "100 percent referral" to ICE investigations of applications that match criteria for "articulable fraud." The OIG found that the policy of referring all application with certain indicators was delaying and diverting attention from actual major frauds investigations that ICE should be pursuing, and had created a large backlog of cases awaiting investigation before they could have been approved. Much of the delays in adjudication and huge increase in RFEs seen in recent years is due to FDNS-DS policies, which include more intensive background checks and referring for investigation every application received at the Service Center that has "articulable fraud" factors.

The OIG review further reveals that cases referred from the FDNS-DS unit to ICE were often ignored by ICE investigators, who felt that FDNS managers were not well-qualified to make fraud determinations. Considerable friction arose between USCIS and ICE over these referrals, and it bogged down the systems of both Exams and Investigations:

Based on a February 2006 Memorandum of Agreement, USCIS was required to refer all articulable fraud cases to ICE. As described in Figure 2: FDNS Referral Flow Chart, the referral process is long and complex. Procedures require adjudicators reviewing benefit applications to use a four-page Fraud Referral Memorandum to send all cases with articulable fraud to the local FDNS office . . .

Despite these problems, FDNS-DS became a central part of the transformation of USCIS from a relatively business-friendly government benefits administrator into a zealous investigative arm of DHS. Under FDNS procedures, the Fraud Sheet and Memorandum becomes part of any petitioner's record, and it triggers an initial fraud investigation at the Service Center. Fig. 2 shows that can result in two results, either "Denial/Notice to Appear/RFE/Approval" or "100% referral" to ICE. Any application that scores high enough in the FDNS-DS system is referred to ICE investigation. If ICE finds what it considers probable cause of criminal activity, the case goes to ICE HQ for review and possible prosecution by the U.S. Attorney.

The Sheet and its findings are shared with other federal agencies, including the State Department, under an information-sharing agreement. If such a case later reaches the Consul, consular officials may do further investigation for the same factors. While FDNS-DS has been integrated into the everyday part of processing immigration petitions, and backlogs have been cleared, the system operates today essentially as it was outlined, above.

21 "Articulable Fraud" Indicators Revealed

Unfortunately, this system brands as fraud indicators some factors that are common to a large percentage of applicants in particular industries. Some of these identifiers, such as smaller firms with less than 25 employees, and companies in existence less than 10 years, are not in themselves anything at all resembling fraudulent practices. See, Appendix 1 for complete list. But, the FDNS-DS associates them with fraud, so all petitions from companies with these characteristics are now treated as suspect and subjected to at least the initial level of escalating investigation.

The H-1B fraud referral sheet lists 21 "articulable fraud" indicators. The fraud referral sheet has a notation referring to "the 10/25/10 criteria" – two out three of these will trigger a "100 percent" referral requirement. (More about that, below)

Any application that has been referred by an USCIS examiner is run through the FDNS data system, where it is potentially designated for a full ICE field investigation. ICE may work with a Benefits Fraud Task Force of several federal agencies and local law enforcement inside the U.S. An investigation may also be carried out abroad by State Dept. Diplomatic Security (DS) agents attached to Embassies working with foreign police services. The case may finally be assigned for priority prosecution by the US Attorney's office. You do not want to be a company that climbs that ladder.

An ICE investigation will also entail running the application through ICEPIC, a data mining and predictive analysis system used to probe suspected terrorist networks and criminal immigration violations, alike. The 21 "articulable fraud" indicators are so broad and encompassing that they potentially validate and initiate the application to almost any H-1B petition of ICEPIC, a highly intrusive system that DHS originally justified as necessary in the so-called Global War Against Terrorism. In practice, virtually any FDNS case now meets the standard for system utilization: "All ICEPIC activity is predicated on valid and ongoing law enforcement investigations."7

Even if the petition is eventually approved by USCIS, but FDNS or ICEPIC has tagged problems associated with the case, the Consul may take a close, independent look at the application. Field investigations abroad are commonplace at certain "high fraud" designated posts.

On September 18, 2008, DHS published notice in the Federal Register of implementation of FDNS-DS and the intent to exempt the program from the Privacy Act requirements.

USCIS has also entered into a Memorandum of Understanding with the Department of State providing it with read-only access to the FDNS-DS. http://www.dhs.gov/xlibrary/assets/privacy/privacy_pia_cis_fdns.pdf

FDNS-DS remains a core component of the overall DHS strategy for restructuring USCIS benefits programs, and this poses yet another cause for concern for petitioners, particularly those who may inadvertently and unavoidably fall into the "articulable fraud" criteria.

Some Types of Employers Get Investigated More Often Than Others

Certain types of employers automatically get close review by USCIS, ICE and the Consul. Any H-1B or L-1B that suggests the possibility that the beneficiary is going to be assigned to client sites requires extensive documentation that the petitioner is not a "job shop", and will control the employment of its workers at all times. The H-1B referral sheet list, for instance, starts with small and recently established (or restructured) firms:

- (Petitioner)Gross annual income less that $10 million.

- Company claims less than 25 employees.

- Company established for less than 10 years.

It then goes on to single-out consulting firms:

- Contracts for consultants or staffing agency show no end-client (no work description or itinerary).

Unfortunately, nothing can be done by smaller, newer companies to avoid being designated under these criteria. The January 2010 Neufeld memo has made disclosure of end-user contracts all but mandatory, so this criteria may have been somewhat modified. The presumption of fraud for consulting firms is agency dictum that can only be overcome with very specific contracts that document the terms of control over the workers assigned to client sites. These should be accompanied by persuasive documentation – such as tax and payroll records -- that assignments are generally short-term and that employees are paid full wages and benefits during assignments and any layoffs. Petitioners can expect that such documents will be compared with records held by the Treasury Department and other agencies, as well as with public sources, the Internet, and records such as credit histories obtained from commercial data aggregation companies.

Other petitions are also tagged as "articulable fraud" indicators based on FDNS profiles, including:

- Occupations – Accounting, Human Resources, Analysts, and Managers, (i.e., marketing research analysts, business analysts, financial analysts, managers for advertising, marketing, and promotions, public relations and sales requested by marginal companies lacking organizational complexity required to support the position on a full-time basis for a three-year period such as liquor stores, dry cleaners, gas stations, residential care facilities, convenience stores, donut shops, fast food restaurants, dental office, 99 cent stores, parking lots, etc.)

Again, these smaller, less capitalized firms and start-ups are not inherently fraudulent, but the FDNS-DS referral sheet operates to designate all small businesses as such. It has always been a challenge to win approval for petitions submitted by small businesses, and agency case law and regulations state the factors that can show a legitimate need for employment of H-1B worker. Nonetheless, smaller companies and start-ups are now put in the cross-hairs for investigation. Any larger firm that is highly-reliant on non-immigrants that restructures into smaller business units to avoid the August 13 surcharge should expect that it will match FDNS fraud indicator criteria, and may be treated accordingly by several federal agencies.

A related risk is the fact that the FDNS-DS contains a sub-directory, dubbed FID (likely, "Fraud Investigation Database") with a "black-list" of attorneys who are suspected of involvement with fraud or related serious crimes. That is itself a separate "articulable fraud" indicator on the referral sheet, the legal standard for which is nebulous. If an attorney's name gets on that list, his or her cases are likely to have a startlingly high denial rate.

To that list, in addition you should expect that any client who has past compliance problems – even non-immigration – such as tax, labor, import/export control violations – are also going to get close scrutiny, as examiners with access to a variety of other government data bases will be alerted to this.

Finally, companies and beneficiaries in defense, nuclear energy, high-technology, or other fields with potential military or national security applications are likely to require a Security Investigation before a petition can be approved or a visa issued. Certain nationalities are also subject to automatic security checks. The background check for those can be very intensive, and stretch on for extended periods. In addition to outsourcing firms, companies in such high-risk categories should also be wary about restructuring to avoid the additional fees, and should consult counsel with expertise in these compliance issues.

C.LEGAL STANDARDS AND PROSECUTION

The USDOL LCA Willful Violation Model

There are three types of civil penalty a company may face for violations regarding an LCA attestation and the Public Inspection File (PIF): 1) civil monetary fines; 2) restricted H-1B program to additional H–1B workers; and 3) the payment of back wages. In addition, there is the possibility of criminal prosecution and penalties for various forms of fraud, Perjury, or Obstruction of Justice for false statements to a federal investigator, misrepresentation of a material fact, or the falsification or destruction of records in the PIF or otherwise presented to a government agency.

I. CIVIL MONETARY PENALTIES

There are three levels of civil fines attached to LCA violations. Each level requires a different sort of misconduct. Fines increase depending on which level the violation falls into.

Level One: The least serious violations include substantial omission of fact pertaining to the notification regulations, inaccuracy or negligent misrepresentation in a filed LCA, or a substantial failure to adequately recruit U.S. workers if the firm is H-1B Dependent. A firm that is required to pay the $2000 surcharge may also be H-1B Dependent, but the standards are different. For instance, H-1B workers paid more $60,000 or with higher degrees are not counted toward H-1B dependency, whereas the Surcharge law makes no such distinction, and further makes no distinction between L-1 and H-1B workers for the purpose of assessing the surcharge (other than the amount of the surcharge). Additionally, a failure to maintain accurate and complete records for full amount of time that an LCA file must be retained constitutes a level one violation. These "paperwork violations," inadvertent or isolated violations, are the most commonly found and sanctioned by USDOL investigators. A petitioner that failed to provide or post the required notice for a single H–1B employee likely would be fined for a level one violation. The maximum fine for each level one violation is $1,000.00.

Level Two: The nature of these violations is the same as for the first level. The distinction is that a violation found at level two is one that was "willful." Willful violations are imputed when the record shows the employer had knowledge of repeated violations, formed or carried out a plan to violate LCA regulations, or had a prolonged history of commission of any of the above violations. If the investigator determines that records have been altered or false documentation created knowingly to evade the regulations, a willful violation is presumed. A maximum fine of $5,000.00 per violation may be imposed for Level Two violations.

Level Three: This level of violation involves actions that are identical to the second level. The sole distinction is that Level Three violations are invoked when a company has terminated or downsized a U.S. employee 90 days before and 90 days after the filing of an H–1B petition in connection with any of the violations. The H–1B worker must replace the U.S. worker in essentially the same position. The violation must have been willful relating to that H–1B worker. A maximum fine of $35,000.00 may be assessed per Level Three violation.

Aggravating and Mitigating Circumstances. USDOL has wide discretion when determining the amount of a civil fine in all levels of violations. The statute requires that USDOL consider several factors in making their determination: an employer that openly acknowledges an error is less likely to incur a heavy fine than one that contests or obfuscates. Employers which refuse to accept responsibility or attempts to alter or withhold evidence will incur maximum penalties. The regulations list the following factors:

- Any previous history of violations.

- The number of workers involved in violations.

- The severity of the violations.

- Good-faith efforts made by the employer to comply with the regulations.

- The plausibility of the employer's explanation of the violation.

- The apparent commitment of the employer to gain future compliance.

- The extent of financial gain due to the violation, or the potential financial loss, potential injury or adverse effect with respect to other interested parties, which may include the government.

II. SUSPENSION OF LCA APPROVALS FOR ADDITIONAL H–1B WORKERS

The next level of penalty USDOL may impose is suspension or debarment of an employer from from approved LCAs. Such an employer is prevented from hiring additional H–1B workers for a period of time. The duration of such a "suspension", which may last up to three years, depends on the level and seriousness of the violation as outlined in Subsection I, above.

A company found to have committed a Level One violation is potentially disqualified from LCA approval for one year, as well as non-approval of pending H-1B petitions. A Level Two violation may result in disqualification from additional LCAs and H-1B approvals for two years. A level three violation may entail disqualification from having additional LCAs and H-1B petitions approved for three years.

III. MANDATORY PAYMENT OF BACK WAGES

USDOL may order a company that has paid below the actual prevailing wage because of an LCA violation to pay back wages to affected H-1B employees, in addition to any fines that may be imposed.

IV. FEDERAL CRIMINAL OFFENSES

In addition to civil penalties under the INA, a company or individual may be prosecuted under other federal laws related to frauds, obstruction of justice, tax evasion, money laundering, or related offenses. Altering or postdating documents, lying or making misleading statements to a federal investigator, defrauding the government or unlawful enrichment can and does result in long prison terms, as the next section shows.

ICE Immigration Frauds Prosecution Model

Continuing an ongoing trend, recent ICE investigations show that the agency is now involved in federal task forces investigating a wide variety of crimes that are only distantly linked to immigration matters. The frame of legal reference for investigators working these cases is drawn from a variety of federal criminal and civil statutes, each of which suggests a widening variety of strategies for prosecuting firms that are viewed as evading the law.

Immigration practitioners and employers, alike, should keep in mind that ICE views its mission broadly and pursues cases aggressively. Immigration-related actions that may have been once treated as technical violations by legacy INS are more likely today to be treated as criminal fraud or as a potential national security threat. The agency describes itself in the following terms:

"U.S. Immigration and Customs Enforcement (ICE) is the

largest investigative arm of the Department of Homeland

Security.

ICE is a 21st century law enforcement agency with broad

responsibilities for a number of key homeland security

priorities.

Money laundering along with various financial and wire fraud charges, as several of the ICE investigative reports show in Appendix II, below, is a favored prosecutorial tool in many of these cases, as it carries penalties that far exceed those that may be attached to underlying immigration offenses. Any evidence of intent to defraud the U.S. is also a strongly aggravating factor in the sentencing phase under federal sentencing guidelines.

Attorneys for client firms that are targeted by multi-agency government task forces are themselves a target for prosecution as accessories to a variety of crimes, and have been subjected to conspiracy as well as money laundering convictions for accepting tainted fees.

THE TAX EVASION MODEL - A Question of Motive: Fee Avoidance or Fee Evasion?

It must be noted that the U.S. Internal Revenue Code contains a specific tax evasion offense, Sec. 7201. There is no such statute that applies specifically to evasion of payment of government agency fees, such as the surcharge on the I-129 filing fee. However, a willful and deliberate attempt to evade payment of a government fee by restructuring a business could be considered a criminal fraud, as well as a willful violation of LCA requirements, if the same elements of fraud that attach to tax evasion – actual evasion of assessment or payment of a tax due, an affirmative act evidencing guilty conduct, and mental willfulness or criminal intent -- were shown to apply to a restructuring to evade payment of a government filing fee.

Definition of tax evasion in the United States

The application of the U.S. tax evasion statute may be illustrated in brief as follows, in order to illustrate how U.S. Internal Revenue Code distinguishes tax evasion, which is criminal, from tax evasion or "tax mitigation," which is an accepted and legitimate practice.

The pertinent statute is Internal Revenue Code, Section 7201:

Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall, in addition to other penalties provided by law, be guilty of a felony and, upon conviction thereof, shall be fined not more than $100,000 ($500,000 in the case of a corporation), or imprisoned not more than 5 years, or both, together with the costs of prosecution.

Under this statute and related case law, the prosecution must prove, beyond a reasonable doubt, each of the following three elements:

1. "attendant circumstance" of the existence of a tax deficiency — an unpaid tax liability; and

2. the "actus reus" (i.e., guilty conduct) — an affirmative act (and not merely an omission or failure to act) in any manner constituting evasion or an attempt to evade either:

- the assessment of a tax, or

- the payment of a tax.

3. The "mens rea" or "mental" element of willfulness — the specific intent to violate an actually known legal duty;

An affirmative act "in any manner" is sufficient to satisfy the third element of the offense. That is, an act which would otherwise be perfectly legal (such as moving funds from one bank account to another) could be grounds for a tax evasion conviction (possibly an attempt to evade "payment"), provided the other two elements are also met. Intentionally filing a false tax return (a separate crime in itself) could constitute an attempt to evade the "assessment" of the tax, as the Internal Revenue Service bases initial assessments (i.e., the formal recordation of the tax on the books of the U.S. Treasury) on the tax amount shown on the return.

Sarbanes-Oxley (SOX) Enforcement Model

Further civil penalties may apply if the fraud is shown to have had a deleterious effect upon stockholders of public companies. Sarbanes-Oxley Act (SOX), 18 USC § 1514A

Under the Corporate and Criminal Fraud Accountability Act, Title VIII of the Sarbanes-Oxley Act (SOX), employees of certain publicly traded companies, companies with certain reporting requirements with the Securities and Exchange Commission (SEC), and their contractors, subcontractors, and agents may file complaints with a number of federal agencies for a variety of frauds. Furthermore, whistleblowers enjoy the protection of USDOL Occupational Safety & Health Administration (OSHA) if they believe that they have experienced discrimination or retaliation for reporting alleged violations of the federal mail, wire, bank, or securities fraud statutes, any rule or regulation of the SEC, or any other provision of federal law relating to fraud against shareholders.

Fraud against shareholders can be broadly construed to include any improper, misleading, or unethical action by responsible officers of any public company that erodes the value, actual or reputational, of shareholder equity. While tax evasion is not an included offense under SOX, willful failure to meet government filing regulations or related misconduct – including, potentially, willful evasion of requirements to pay filing fees and related misrepresentations or errors in LCA preparation -- may be considered a possible SOX violation. Officers of public companies also need to be aware of that potential liability.

APPENDIX I

The FDNS-DS fraud referral sheet lists the following items as significant indicators of fraud, for which any H-1B petition can be sent to ICE for follow-up investigation. Among the factors USCIS treats as indicating fraud are the following:

1) (Petitioner)Gross annual income less that $10 million.

2) Company claims less than 25 employees.

3) Company established for less than 10 years.

4) Contracts for consultants or staffing agency show no end-client (no work description or itinerary).

5) Not paying the claimed wage.

6) Suspect documents - altered, counterfeit, or boilerplate, etc. (i.e., All employment letters have virtually the same text and signatures with letterheads being the only difference)

7) Location on the Labor Condition Application (LCA) ETA 9035 differs from the place of employment.

8) H-1B Dependent – Claims not to be dependent but check of CLAIMS mainframe reveals may not be true.

9) LCA Code does not match the claimed duties listed in the petition and cover letter.

10) Evasive or ambiguous answers or complete failure to respond to requested information.

11) Zoning inconsistent with indicated business internet data – petitioner's address indicates zoned residential rather than commercial.

12) Petitioner filing outside of jurisdiction.

13) Attorney identified on the FID [Likely acronym for "Fraud Investigation Database"].

14) Multiple filings: DHS records should indicate significant discrepancies between the number of petitions filed in the last three (3) years and the current number of employees.

15) Incomplete, inconsistent, or misstated information in petition – excessive blanks, inflated figures, etc.

16) NO website for IT Consulting Company. Also be aware of websites that look good but are always under construction.

17) Preparer and Preparer's Address – The preparer, notary, petitioner, etc. are the same person and they have the same address while the actual work location shows a different location.

18) Photographs of petitioner's premises have been altered (i.e., company logos and signs have been added after the picture taken, may times digitally).

19) Occupations – Accounting, Human Resources, Analysts, and Managers, (i.e., marketing research analysts, business analysts, financial analysts, managers for advertising, marketing, and promotions, public relations and sales requested by marginal companies lacking organizational complexity required to support the position on a full-time basis for a three-year period such as liquor stores, dry cleaners, gas stations, residential care facilities, convenience stores, donut shops, fast food restaurants, dental office, 99 cent stores, parking lots, etc.)

20) Abandonment or withdrawal after Request For Evidence issued.

21) Questionable educational credentials.

22) FID Update – see additional relevant information to update the FID.

Accompanying instructions read:

"In order to insure an actionable fraud referral is sent to the Center Fraud Detection Facility (CFDO), all petitions that possess 2 of the 3 10/25/10 criteria must be referred to the CFDO."

The "10/25/10 criteria" is not defined on the released page, which appears as part of a redacted portion of a report published by DHS OIG, Review of the USCIS Benefit Fraud Referral Process (Redacted ...(April 2008).8

NOTE: To some degree, these criteria appear to match up

with the results of the 2008 USCIS "H-1B Benefit Fraud

& Compliance Assessment" September 2008.

APPENDIX II

RECENT ICE IMMIGRATION FRAUD INVESTIGATIONS

Some Recent ICE Enforcement Actions – Prosecution Immigration Fraud and Fraud Against Gov't

June 22, 2010

Sholom Rubashkin sentenced to 27 years in federal prison

CEDAR RAPIDS, Iowa - The former CEO of Agriprocessors Inc. was sentenced on Tuesday to 27 years in federal prison. This sentence resulted from a two-year investigation by U.S. Immigration and Customs Enforcement (ICE).

Sholom Rubashkin, 51, from Postville, Iowa, received his sentence after jury verdicts found him guilty of 86 counts of financial fraud and related offenses Nov. 12, 2009. Evidence at trial showed Rubashkin inflated Agriprocessors' sales to fraudulently obtain millions of dollars in bank loans that were not backed by any collateral.

Rubashkin also diverted millions of dollars in customer payments that were supposed to go to Agriprocessors' primary lender. He committed money laundering by running tens of millions of dollars through bank accounts at a Postville grocery store and a religious school. The trial evidence showed Rubashkin was personally involved in harboring hundreds of illegal aliens at Agriprocessors, and unlawfully delaying payments to Agriprocessors' cattle suppliers. He paid for fabricated identity documents for illegal aliens, and he personally inspected those documents. Evidence showed Rubashkin's fraud resulted in over $26 million in actual loss to Agriprocessors' lenders.

Over a two-year time period, when money was being fraudulently obtained from a lender, Rubashkin funneled about $1.5 million from Agriprocessors'accounts to his personal bank accounts. The money was used, in part, to pay for the following items:

- about $300,000 on his credit card bills,

- about $200,000 for a portion of the remodeling of his residence,

- about $76,000 for his personal state and federal income tax,

- about $41,000 for his mortgage payments on his personal residence,

- about $25,000 for jewelry,

- about $20,000 for sterling silver,

- $1,245 per month for life insurance,

- and $365 per month for his car payment.

"This prosecution and lengthy sentence resulted from an extensive two-year ICE worksite enforcement operation and follow-up investigation," said Claude Arnold, special agent in charge for the ICE office in Chicago which oversees Iowa. "This case serves as a warning to employers that, if you build your business on the backs of an illegal workforce, ICE and other federal resources are there to make you pay the price."

"Sholom Rubashkin expended enormous efforts to hide his many crimes from the public and law enforcement. On top of that, there have been orchestrated efforts to spread false information intended to elicit sympathy for him. It is a tragedy that many people were misled by this misinformation calculated to distract the public from the truth. The truth came out at trial and sentencing," said U.S. Attorney Stephanie M. Rose. "No one won anything today as the damage caused by Mr. Rubashkin cannot be fully tallied. However, today the house of cards he constructed finally was brought down. When something is built on lies, it should be no surprise when it collapses under the weight of those lies."

Rubashkin was sentenced in Cedar Rapids by U.S. District Court Chief Judge Linda R. Reade. His sentence was based, in part, on his leadership role in the crimes and his efforts to obstruct justice by testifying falsely at his trial. Rubashkin was sentenced to 324 months' imprisonment. Special assessments of $8,600 were imposed, and he was ordered to make $26,852,152.51 in restitution. He must also serve a five-year term of supervised release after the prison term. There is no parole in the federal system.

The U.S. Attorney's Office works to ensure victims are made whole as quickly as possible and is seeking the public's assistance in locating or identifying Rubashkin's assets. If anyone has information regarding Rubashkin's assets with a significant value, they are urged to call 319-731-4080.

Rubashkin is being held in U.S. Marshals custody until he can be transported to a federal prison.

The investigation began in October 2007 and continued after ICE executed search warrants at Agriprocessors on May 12, 2008.

The case was prosecuted by Assistant U.S. Attorneys Peter Deegan, C.J. Williams, and Matthew Cole. The investigation has been led by U.S. Immigration and Customs Enforcement and the FBI. Prior assistance was provided by the following agencies: U.S. Marshals Service, U.S. Postal Inspections Service, Iowa Department of Public Safety, Iowa Department of Transportation, Federal Protective Service, Internal Revenue Service's Criminal Investigations, U.S. Department of Labor, Public Health Service, U.S. Department of Agriculture, U.S. Environmental Protection Agency, Iowa Department of Natural Resources, Drug Enforcement Administration, Waterloo Police Department, and Postville Police Department.

Court file information is available at: https://ecf.iand.uscourts.gov/cgi-bin/login.pl. The case file number is CR 08-1324 LRR.

Read the U.S. Attorney's statement on the Agriprocessors case.

June 15, 2010

17 individuals charged and 12 locations searched in major health care fraud and money laundering prosecution

BROOKLYN, N.Y. - U. S. Attorney Loretta E. Lynch announced today four separate indictments charging 17 individuals for their participation in health care fraud and money laundering schemes in the Eastern District of New York. In addition, agents of U.S. Immigration and Customs Enforcement (ICE), the FBI and Internal Revenue Service (IRS) searched offices of 12 durable medical equipment retail companies located in South Brooklyn that were operated by the defendants and seized assets from bank accounts maintained by the defendants' retail companies.

According to the indictments, the defendants filed fraudulent claims with private insurance companies with no-fault insurance plans. Specifically, the defendants - through their retail companies - allegedly submitted false invoices to the insurance companies for reimbursable expenses for durable medical equipment at prices well in excess of the price paid by the defendants, as well as for durable medical equipment that was never obtained. The indictments allege that it was also part of the defendants' schemes to engage in financial transactions to conceal the identity, source, and destination of the fraudulent proceeds by "laundering" them through checks they issued to the same wholesale companies. The checks were then negotiated at check cashing stores and the resulting cash was delivered back to the defendants.

"The charges announced today, which have resulted in the arrests of several operators of medical equipment companies that allegedly engaged in schemes to defraud insurance companies, are the product of a coordinated effort by federal and local law enforcement agencies," stated Lynch. "Those who engage in such schemes are on notice that they will be met with the full force of law enforcement."

"The type of health care fraud and money laundering scheme these individuals allegedly constructed and engaged in affects all Americans and directly impacts America's health care system," said James T. Hayes, Jr., special agent in charge of ICE's Homeland Security Investigations in New York. "Our office is determined to find criminals who seek to illegally profit from fraud no matter how sophisticated the scheme."

FBI Acting Assistant Director in Charge George C. Venizelos stated, "Health care fraud is a multibillion-dollar plague on the U.S. economy annually, and it affects the cost and availability of private and public insurance for everyone. Durable medical equipment fraud is a large part of the problem. The cure is the continuing commitment by the FBI and our partners to ferret out those who engage in these frauds, whose prognosis is a possible 20-year prison term."

IRS (New York) Special Agent in Charge Charles R. Pine stated, "IRS Criminal Investigation investigates health care fraud perpetrated against the federal and state governments, as well as private insurance companies. We investigate money laundering when either illegally obtained funds from health care fraud are used to purchase assets or when the perpetrators of the schemes devise elaborate methods to conceal their fraudulent proceeds.

Money laundering occurs in a wide range of fraudulent health care schemes, including durable medical equipment fraud. Typical health care fraud investigations are lengthy, labor intensive, and involve complex issues. To assist in combating health care fraud, IRS CI participates with multiple agencies by documenting that the perpetrators of these schemes financially benefitted from their fraudulent activities. IRS CI will continue to participate in all types of health care fraud investigations. If there is a money trail, we will follow it."

If convicted, each of the defendants faces up to 20 years' incarceration.

The government's case is being prosecuted by Assistant U. S. Attorneys Daniel Brownell and Evan Weitz.

http://www.ice.gov/pi/nr/0909/090918norfolk.htm

September 18, 2009

Immigration Attorney Pleaded Guilty to Conspiracy Charge

NORFOLK, Va. - Beth Ann Broyles, 30, of Evanston, Ill., pleaded guilty in Norfolk federal court on Friday to conspiracy involving visa fraud and inducing aliens to come to the United States illegally. This case was the result of an investigation by U.S. Immigration and Customs Enforcement (ICE) acting as part of a larger task force.

Broyles is scheduled to be sentenced Dec. 14, 2009, and faces a maximum penalty of five years of imprisonment, a fine of $250,000, full restitution, a special assessment, and three years of supervised release.

According to court documents, Beth Ann Broyles, an immigration attorney based in Chicago, served as immigration counsel for the Viktar Krus organization in Virginia Beach. Krus was recently sentenced to 87 months imprisonment after being convicted on conspiracy, visa fraud and tax evasion charges. As Krus's lawyer, Broyles prepared successive fraudulent immigration petitions, which she submitted to the Department of Labor and thereafter to the Department of Homeland Security. Once approved by these agencies, these fraudulent petitions allowed Krus organization to recruit for and bring approximately 1,000 alien workers into the United States illegally on H2B visas, where they were allowed to work for periods of up to nine months. The majority of these aliens were from eastern European countries and from Jamaica. As a result of having access to this large pool of illegal workers, the Krus organization was able to generate over $35 million in gross income from 2003 to 2009.

This case was investigated by a dedicated task force focused on dismantling the Krus criminal organization. The task force investigating this case included ICE, the IRS Criminal Investigation, the U.S. State Department's Bureau of Diplomatic Security, the U.S. Department of Labor, the U.S. Department of the Treasury's Financial Crimes Enforcement Network, the U.S. Postal Inspection Service, the FBI's Norfolk Field Office, the Naval Criminal Investigative Service and the Virginia Beach Police Department.

Immigration fraud poses a severe threat to national security and public safety because it creates a vulnerability that may enable terrorists, criminals, and illegal aliens to gain entry to and remain in the United States. ICE uproots the infrastructure of illegal immigration by detecting and deterring immigration fraud.

Individuals and criminal enterprises often use fraudulent documents to obtain drivers' licenses and social security cards. Traffickers and alien smugglers use these documents to facilitate movement into and within the United States and they are also used to shield illegal aliens from detection within our society. Fraudulent documents may be used to obtain financial benefits and entitlements intended for U.S. citizens or lawful permanent residents and to obtain unauthorized employment.

Footnotes

1. See, Making emergency supplemental appropriations for border security for the fiscal year ending September 30, 2010, and for other purposes, http://www.govtrack.us/congress/bill.xpd?bill=h111-6080

2. See, See, Senator Charles E. Schumer's speech on border Security bill and ...

3. See, Despite Indian concerns, Obama to sign border security bill, 13 Aug 2010, 0453 hrs IST,PTI, http://economictimes.indiatimes.com/articleshow/6302669.cms

4. See, Senator Charles E. Schumer's speech on border Security bill and ...

5. http://www.aila.org/content/default.aspx?docid=8412 ; also, available at, http://forums.immigration.com/blog_attachment.php?attachmentid=8&d=1237507390

6. http://www.dhs.gov/xoig/assets/mgmtrpts/OIGr_08-09_Apr08.pdf

7. USICE News, Immigration and Customs Enforcement (ICE) Pattern Analysis and Information Collection System (ICEPIC), January 2008, http://www.ice.gov/pi/news/factsheets/ icepic.htm

8. http:// www.dhs.gov/xoig/assets/mgmtrpts/OIGr_08-09_Apr08.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.