Over the past five years, we repeatedly predicted that the IRS would increase its audit efforts. According to IRS data released earlier this year, our predictions have unfortunately come true and IRS enforcement efforts have increased in virtually every area. The IRS has issued its annual data book, which provides statistical data on its fiscal year 2006 activities, including how many tax returns it examines (audits) and on what categories of returns it focuses its resources.

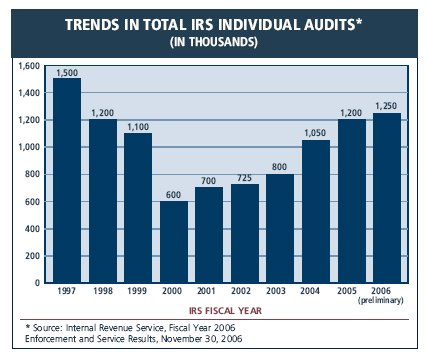

In fiscal year 2006, IRS enforcement revenues (from collection, examination and document-matching activities) increased to a record $48.7 billion. Out of a total of 132 million individual returns filed in 2005, approximately 1,284,000, or .97%, were audited, which, while low, is more than double the number examined for tax year 2000. Audits of S corporations and partnerships also increased substantially since tax year 2000, by 34% and 15%, respectively.

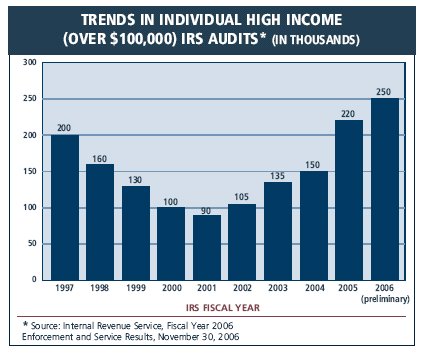

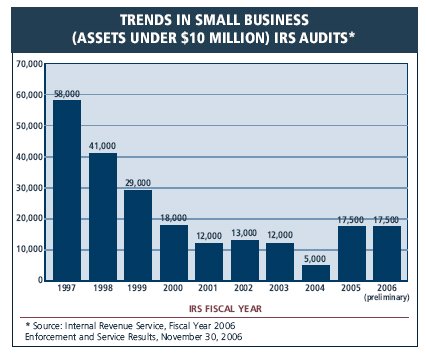

The charts below highlight the trends in audits for these types of returns as well as for selected others.

Individuals

A key target of the IRS’ enforcement efforts has been highincome taxpayers. Audits of individuals with incomes of $1 million and higher increased by nearly 33% in just one year, and one in every 16 faced audits in fiscal year 2006. Audits of individuals with incomes over $100,000 increased by 18% from 2005 and more than doubled from fiscal year 2001.

Most of the increase in individual audits is attributable to "correspondence audits," which are less intrusive than "face-toface" audits and take little time to complete, making them very cost effective. In fiscal year 2006, more than three out of four audits were correspondence audits. When the IRS reorganized five years ago, it eliminated face-to-face audits for most taxpayers because the wage and investment division had, and continues to have, no field auditors. Taxpayers who report business-type transactions on Schedules C, E, F or Form 2106 still face the risk of a potential face-to-face audit, since these audits are handled by the Small Business/Self-Employed Division (SB/SE). Even so, 60% of the fiscal year 2006 audits handled by the SB/SE were correspondence audits.

Although correspondence audits have become the principal method for generating additional taxes from individual taxpayers, these audits can only identify discrepancies apparent from the information submitted by the taxpayers in their returns or from third party information provided by employers, banks and other sources. Therefore, these audits can fail to detect areas of under-reporting. However, for fiscal year 2006, 83% of correspondence audits resulted in a recommended tax change.

Business Taxpayers

The IRS is placing more emphasis on the growing area of pass-through entities. Audits of S corporation returns are at their highest level since 2000 and have increased by 34% since fiscal year 2005. Audits of partnership returns have also increased significantly (by 15%) and are at their highest level since 1998. Additionally, audits of small businesses organized as corporations have more than doubled since 2004. Perhaps due to the increase in S corporation and partnership audits, audits of large C corporations are down from fiscal year 2005, and IRS revenue agents are spending substantially more of their time on corporate audits that produce no more revenue for the government than they have in the past. Although correspondence audits are utilized, field audits are the most common type of small business audit.

What All of This Means and How It Affects Your Risk

The IRS uses a variety of methods to select returns for examination, including computer scoring, identification of potential participants in abusive tax avoidance transactions, information matching and random sampling. If you are a high-income taxpayer, are self-employed, receive flowthrough income from a partnership, S corporation or limited liability company and/or claim business deductions, you have an increased risk of audit as a result of the IRS’ increased enforcement efforts and its methods for selecting returns.

One of the IRS’ primary methods for selecting returns is a computer program called the Discriminant Index Function, or DIF. Under the DIF, your return is scored by mathematical formulas. The higher the "score," the higher the chances of an audit. Some of the items that may increase your DIF "score," and therefore increase your audit risk, include:

- Higher income, greater than $100,000;

- Income other than basic wages (contract payments, etc.);

- Income from a flow-through entity, such as a partnership, S corporation or limited liability company;

- Large casualty losses;

- Large business meals and entertainment deductions, or other business deductions;

- Excessive business auto use;

- Self-employment income, or a low gross profit margin from self-employment income;

- Low income with large business deductions;

- High non-cash charitable contributions;

- Hobby losses; and,

- Little or no profit from a business operation.

Another primary method used in selecting returns is the Market Segment Specialization Program (MSSP). The MSSP focuses on the industry the taxpayer is in rather than on what type of return the taxpayer files, the amount of gross income reported, or the ratio of deductions to income. Compliance activity is organized around market segments, where practical. A market segment can be an industry such as manufacturing, a professional group such as attorneys or an issue such as passive activity losses. The IRS currently has released audit guides on 87 industries, professions and issues. Individual market segments are then assigned to examiners with auditing experience, training and research responsibilities in that area.

Additionally, returns may be selected because of information received from media sources, public records or individual informants (such as an ex-spouse or disgruntled employee or vendor). However, because these sources may be unreliable, the IRS evaluates the reliability and accuracy of the source before using such information as the basis for an examination.

Once a return is selected for examination under a risk-based audit system, revenue agents and group managers exercise professional judgment on whether the returns should simply be surveyed or examined. Additionally, revenue agents utilize public information to assist them in determining the audit potential of a return. For example, an agent may check public records to see the average price of homes in a taxpayer’s ZIP code. If the average cost of a home is $500,000 and the return shows inadequate income to sustain such a lifestyle, it is likely to be scrutinized further. Revenue agents also engage in pre-audit planning, which includes communication with a taxpayer’s accountant, which helps to reduce the number of issues under examination. Agents are also encouraged to consult with divisional counsel for guidance on tax law matters and on issue development, which helps to reduce or eliminate bad issues from moving forward due to an agent’s misunderstanding of the law.

What You Can Do

It is certain that the IRS is continuing the trend of its increased enforcement efforts, and it is important for you as a taxpayer to bring your files up-to-date in an organized fashion to avoid any proposed adjustments to your tax return. Additionally, taxpayers may wish to engage a professional to conduct a "simulated audit" for the purpose of reviewing record-keeping policies and existing tax positions and obtaining advice on correcting problems or deficiencies that would be likely targets in the event of an actual IRS examination. We have received many requests to conduct "simulated audits" over the years and are currently conducting such audits for select clients. Feel free to contact us for a discussion of your risk and the benefits of a "simulated audit" in your specific situation.

In the event you are contacted by the IRS and informed that your return is being audited or that an adjustment is being made to your return, please contact us. Even if the IRS is correct in making the adjustment, there may be an error in the recalculation of tax, an error we have found on many occasions. We have also successfully reduced multiple IRS assessments, including the reduction of a $2 million assessment to $110,000 and a $25,000 assessment to a $15,000 refund, plus interest.

For additional information regarding this topic, please contact Michael Gillen at 215-979-1635 or one of the other members of the Tax Accounting Group of Duane Morris LLP with whom you are regularly in contact.

As required by United States Treasury Regulations, you should be aware that this communication is not intended by the sender to be used, and it cannot be used, for the purpose of avoiding penalties under United States federal tax laws.

This article is for general information and does not include full legal analysis of the matters presented. It should not be construed or relied upon as legal advice or legal opinion on any specific facts or circumstances. The description of the results of any specific case or transaction contained herein does not mean or suggest that similar results can or could be obtained in any other matter. Each legal matter should be considered to be unique and subject to varying results. The invitation to contact the authors or attorneys in our firm is not a solicitation to provide professional services and should not be construed as a statement as to any availability to perform legal services in any jurisdiction in which such attorney is not permitted to practice.

Duane Morris LLP, one of the 100 largest law firms in the world, is a full-service firm of more than 600 lawyers. In addition to legal services, Duane Morris has independent affiliates employing approximately 100 professionals engaged in other disciplines. With offices in major markets, and as part of an international network of independent law firms, Duane Morris represents clients across the United States and around the world.