- with Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy and Property industries

Key Takeaways:

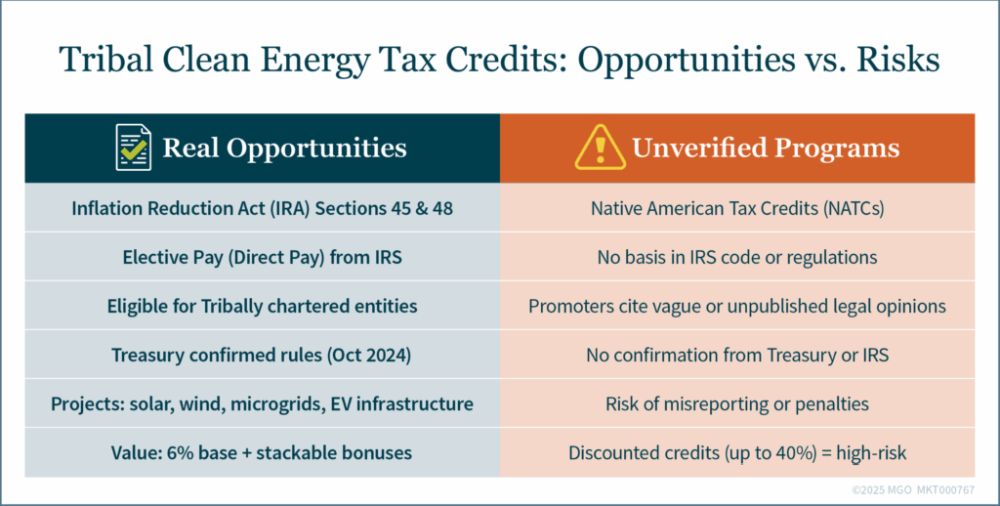

- Federal clean energy tax credits under the Inflation Reduction Act are available to Tribal governments and wholly owned Tribally chartered entities through elective pay.

- Unverified "Native American Tax Credits" (NATCs) promoted by third parties are not recognized by the IRS and present compliance and audit risk.

- Tribal leaders should evaluate all credit opportunities with care and rely on updated federal guidance when considering energy development partnerships.

Clean energy tax credits have opened a new chapter of opportunity for Tribal governments and their wholly owned business entities. Under the Inflation Reduction Act (IRA), Tribal nations can now receive federal funding through elective pay (also called direct pay), even though they are not subject to federal income tax. However, as new opportunities appear, some promoters are marketing tax credit structures that remain unsupported by current law or IRS guidance.

Understanding the difference between valid credit pathways and unverified offers is essential for protecting Tribal resources and advancing long-term development goals.

Confirmed Path: Elective Pay for Tribal Governments and Entities

The IRS introduced elective pay to allow tax-exempt entities — including federally recognized Tribal governments — to receive help from clean energy tax credits. This provision supports a range of clean energy and infrastructure projects aimed at improving sustainability and economic resilience.

In October 2024, the U.S. Department of the Treasury and IRS issued proposed rules confirming that wholly owned Tribally chartered entities — formed under Tribal law and fully owned by one or more Tribes — share the same federal tax status as their owning Tribes. These entities are therefore not subject to federal income tax and are eligible for elective pay under the IRA.

The proposed rule also clarifies that:

- Entities wholly owned by multiple Tribes are also eligible.

- These entities may directly register and claim IRA clean energy credits.

- The rule applies retroactively to tax years before the publication date.

- No new federal reporting requirements are imposed by the rule.

This clarification removes a significant barrier that had limited access to funding for many Tribally owned business entities.

What Projects Qualify

Under these rules, Tribal governments and their wholly owned entities can receive payments from the IRS for qualifying clean energy investments. These payments are equal to the value of the credits otherwise available to taxable entities.

Eligible investments include:

- Solar, wind, geothermal, and hydropower systems

- Fuel cells, energy storage, and microgrid controllers

- Electric vehicle charging infrastructure and clean transportation

- Energy efficiency upgrades for community-use buildings

The base value of these credits starts at 6% of qualified costs and can scale up significantly based on project characteristics — such as compliance with domestic content requirements, prevailing wage rules, or location in Tribal or low-income communities. Alternative applicable percentages of up to 30% or more of qualified costs can apply if certain criteria, as discussed above, are met.

Tribes as Strategic Energy Partners

As clean energy credits expand, Tribal governments are increasingly viewed as strategic partners for infrastructure development. Developers may look to work with Tribes to access enhanced credit values or take advantage of elective pay mechanisms through collaborative project structures.

Some consulting firms are offering to help Tribe's file direct pay claims with the IRS — often on a contingency-fee basis. While many of these services may be legitimate, finance and tax leaders should assess each proposal carefully — particularly about the legal basis, compensation structure, and potential long-term impact.

A Cautionary Note on Unverified "Tribal" Credits

Some promoters are offering "Native American Tax Credits" (NATCs), which they claim can be bought at a discount and used to reduce federal tax liability. These offerings have raised serious concerns:

- NATCs are not found in the Internal Revenue Code.

- The IRS and Treasury have not issued guidance confirming their legitimacy.

- Legal opinions referenced in promotional materials are not publicly available.

- These programs rely on broad interpretations of Tribal sovereignty and grant law (not tax law).

- Promoters often provide unsupported instructions to claim these credits on IRS forms.

The lack of transparency, combined with steep discounting, suggests increased audit and compliance risk.

What Tribal Governments Should Keep in Mind

As Tribal governments explore energy investment opportunities, it is important to note the Treasury and IRS have confirmed that wholly owned Tribally chartered entities — formed under Tribal law and owned entirely by one or more Tribes — are eligible for elective pay under the IRA. In contrast, NATCs remain unverified and are not supported by current tax law or federal guidance. Tribes should carefully evaluate developers and consultants offering elective pay services, prioritizing transparency and regulatory compliance. Other guidance from the IRS is expected — including procedures for pre-filing registration and claiming payments.

Supporting Tribal Self-Governance and Long-Term Growth

Clean energy tax credits are a powerful opportunity to strengthen Tribal infrastructure, support community energy goals, and advance self-determined development. With new federal guidance in place, Tribally chartered entities now have a clear, reliable path to funding participation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.