- within Real Estate and Construction and Law Practice Management topic(s)

- with readers working within the Accounting & Consultancy industries

Key Takeaways:

- Immediate R&D expensing may return in 2025, but many companies haven't modeled the impact or updated their budgets to reflect the change.

- Heightened IRS scrutiny of the Employee Retention Credit is prompting CFOs to audit past claims and tighten documentation to avoid penalties.

- Accelerated clean energy credit deadlines are forcing businesses to fast-track investments and project timelines to maximize available incentives.

The 2025 tax landscape is shifting dramatically — and mid-market CFOs and tax leaders are being forced to rethink their planning in real time. In a recent webinar hosted by MGO, hundreds of finance professionals weighed in on how three major areas are impacting their strategy: Section 174 research and development (R&D) treatment, IRS enforcement around the Employee Retention Credit (ERC), and the accelerated rollback of clean energy tax credits.

Here's what your peers are saying — and what you should be doing now to stay ahead:

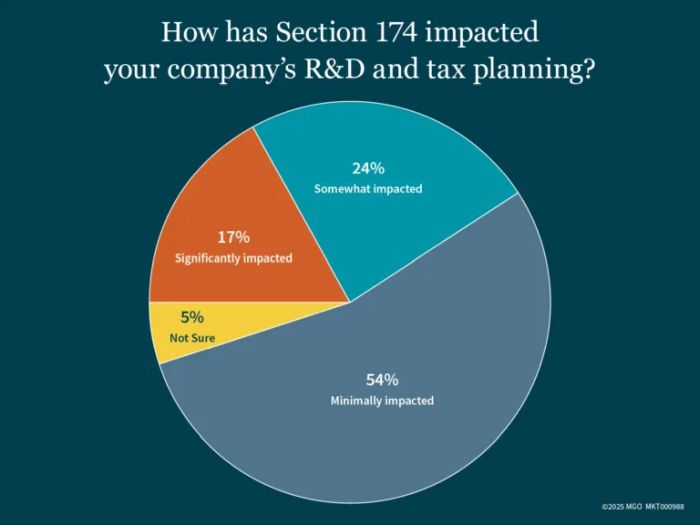

Key Insight #1: Section 174 Relief Is Coming — But Not Everyone Is Ready

Takeaway:

The upcoming allowance for immediate expensing of domestic R&D starting in 2025 offers cash flow relief. Yet many companies still haven't modeled the impact — or taken advantage of transition-year elections.

Action items:

- Model multi-year R&D tax savings now

- Explore amending 2022–2024 returns under new rules

- Build R&D forecasting into 2025–2026 budgeting

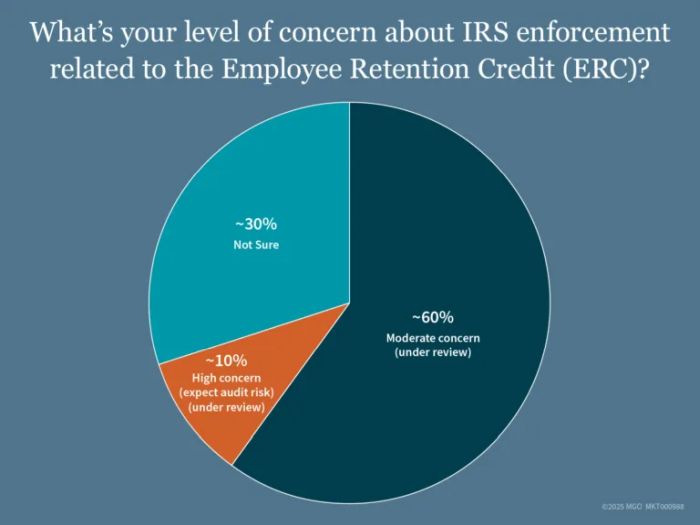

Key Insight #2: ERC Enforcement Concerns Are Rising

Takeaway:

With expanded penalties, longer statutes of limitation, and uncapped promoter fines, the IRS is sending a clear message: ERC compliance is a top audit priority.

Action items:

- Conduct an internal audit of any ERC claims

- Review Q3 2021 filings for risk exposure

- Tighten documentation — especially for eligibility support

- Monitor communications from IRS for pre-audit activity

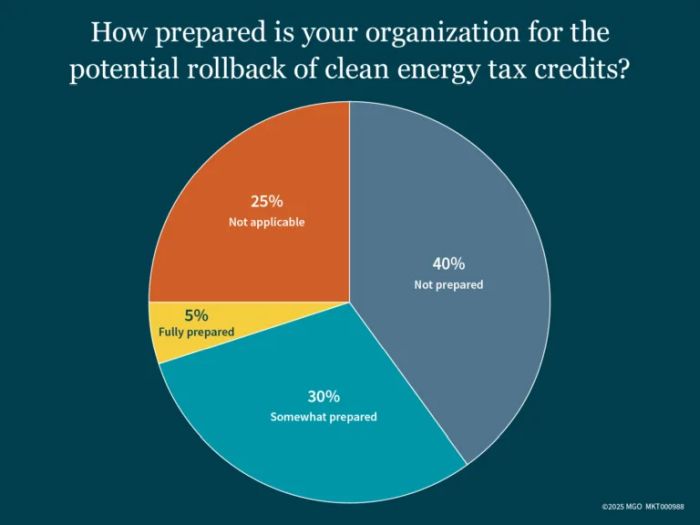

Key Insight #3: Clean Energy Credit Deadlines Require Immediate Action

Takeaway:

New end dates for §45W and §30C credits create urgency around construction, delivery, and placed-in-service deadlines. Many companies still haven't adjusted timelines to capture full benefits.

Action items:

- Accelerate capital expenditure for EVs and charging infrastructure

- Confirm placed-in-service dates for Q3 and Q4 2025

- Consider design changes to meet prevailing wage rules

- Review supply chain for prohibited foreign entity risks

Proactive Beats Reactive in a Shifting Tax Environment

The 2025 tax landscape is a moving target, but that doesn't mean you need to wait in limbo. CFOs and tax leaders who act early — by reassessing R&D strategies, auditing ERC positions, and accelerating energy investments — stand to gain the most. With cash flow, compliance, and credit all on the line, now is the moment to turn insights into action. Whether you're facing uncertainty or opportunity, a proactive approach will help you lead with confidence and clarity in the year ahead.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.