- with readers working within the Transport industries

- within Criminal Law, Family and Matrimonial, Government and Public Sector topic(s)

Key Takeaways:

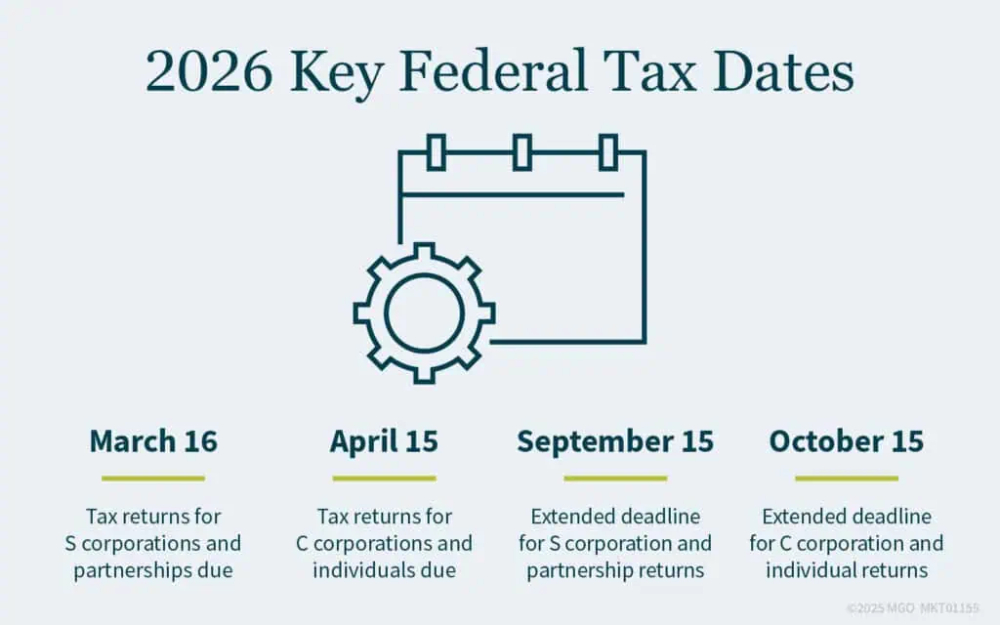

- Knowing and preparing for key federal tax deadlines helps your business avoid penalties and keep cash flow steady throughout the year.

- Your filing requirements and due dates depend on your business structure — and may shift for weekends, holidays, or state-specific rules.

- Consistent recordkeeping, early preparation, and regular communication with your tax advisor can help you stay compliant and stress-free.

—

Staying ahead of key tax deadlines is one of the simplest ways to keep your business financially healthy and compliant. Missing a filing date or payment deadline can lead to penalties, cash flow challenges, and unnecessary stress during tax season.

Whether you're a sole proprietor, partnership, S corporation, or C corporation, your tax timeline will look a little different — but being proactive with tax planning can help you avoid surprises. This calendar highlights the most important federal tax deadlines for 2026, helping you stay organized and focused on running your business.

2026 Federal Tax Deadline Calendar

Note: These are federal deadlines. State and local filing dates may vary, so it's always smart to double-check your specific requirements. When a deadline falls on a weekend or federal holiday, the due date moves to the next business day (as noted).

January 2026

January 15

- Fourth quarter estimated tax payment for 2025 due (Form 1040-ES)

January 31 (Saturday → Due Monday, February 2, 2026)

- W-2 forms due to employees

- 1099 forms due to contractors

- Copy B of Form 3921 due to employees (for ISO exercises)

- Form 940 (Federal Unemployment Tax Return) due

February 2026

February 2

- File W-2 and 1099 forms with the Social Security Administration

- Provide Affordable Care Act (ACA) forms to employees

February 28 (Saturday → Due Monday, March 2, 2026)

- Paper filing deadline for Forms 1099-MISC, 1099-NEC, and W-2

- Paper filing deadline for Form 3921

March 2026

March 16 (March 15 is Sunday)

- Tax returns for S corporations (Form 1120-S) and partnerships (Form 1065) due

- Furnish Schedule K-1 to partners/shareholders

- Deadline to elect S corporation status for 2026 (Form 2553)

March 31

- Electronic filing deadline for Form 3921

April 2026

April 15

- Tax returns for C corporations (Form 1120) and individuals (Form 1040) due

- First quarter estimated tax payment for 2026 due

- Deadline to file for an automatic extension (Forms 4868 or 7004)

June 2026

June 15

- Second quarter estimated tax payment for 2026 due

September 2026

September 15

- Third quarter estimated tax payment for 2026 due

- Extended deadline for S corporation and partnership returns

October 2026

October 15

- Extended deadline for C corporation and individual returns

December 2026

December 15

- Fourth quarter estimated tax payment for corporations (fiscal year ending December 31)

January 2027

January 15

- Final estimated tax payment for Q4 2026 due

Tips to Stay Ahead of Tax Deadlines

The best way to manage your tax calendar is to plan ahead and keep your records organized throughout the year. Here are a few ways you can stay proactive:

- Automate reminders: Use a digital calendar or accounting software to alert you a few weeks before each deadline.

- Keep documentation current: File W-9s, receipts, and payroll reports as you go — not at the end of the year.

- Revisit your estimated payments: If your business income shifts significantly, you may need to adjust your quarterly estimated tax payments.

- Coordinate with your tax advisor: Your business structure — whether you're an LLC, S corporation, or partnership — determines which deadlines apply to you. Having the right advisor helps you stay aligned with IRS requirements.

- Stay aware of state differences: States often have their own filing schedules and forms, so confirm dates for income, franchise, or sales tax filings early in the year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.