- within Tax topic(s)

- in United States

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy and Insurance industries

Key Takeaways:

- The new $40,000 state and local tax deduction is helpful but insufficient for those that own and operate pass-through entities. These taxpayers should look at pass-through entity tax (PTET) planning.

- PTET elections remain a key strategy for maximizing state tax deductions for federal tax purposes.

- Pass-through owners should have their tax advisors model multi-year tax exposure across state PTET rules.

—

The 2025 tax reset isn't just about federal rates — it's reigniting state and local tax (SALT) strategy discussions for pass-through businesses and their high-earning owners.

With the SALT deduction cap rising from $10,000 to $40,000 and optional pass-through entity tax (PTET) regimes still in play across most states, CFOs and tax advisors need to re-examine how entity-level elections and personal income tax deductions on an owner's 1040 Schedule A interact with one another. The decisions you make now could materially change both business and personal cash flow.

Key Takeaway #1: SALT Cap Now at $40,000 — But With a Catch

The increased cap allows for up to $40,000 of state and local tax deductions — a significant jump from the $10,000 limit placed on Schedule A deductions under the Tax Cuts and Jobs Act (TCJA) of 2017. But for most mid-market business owners and executives, it won't make a huge dent without more planning.

Also keep in mind that with the SALT cap being raised to $40,000, this may make some or all of your state tax refund taxable on your federal return. This requires planning as well to determine the impact of the increased SALT cap. Additionally, there is a phase out of the $40,000 cap for taxpayers with modified adjusted gross income (MAGI) over $500,000. At $600,000 in MAGI, the SALT cap phases back down to $10,000. This phase out has been labeled the "SALT torpedo".

Action tip:

- Confirm which state tax payments are eligible under the new definition (income, property, sales).

- Consider timing payments to maximize deduction value across years.

- Consider potential of federal taxability of any state tax refunds.

- Consider whether you may be subjected to the SALT cap phase out if your income is between $500,000–$600,000.

Key Takeaway #2: PTET Still Has Teeth — Especially in States Like California, New York, and Hawaii With the Highest State Tax Rates

Despite the higher SALT cap, the PTET remains a powerful tool — especially since entity-level taxes are generally not subject to the SALT cap at all.

In California, for example, the PTET election was extended through 2030, offering owners of S corps, LLCs, and partnerships a continuing opportunity to shift tax liability from personal to business returns.

Action tip:

- Take a hard look at PTET election scenarios for 2025–26 now with the new SALT structure in place retroactive to January 1, 2025.

- Consider combined strategies that include SALT cap maximization plus PTET layering.

- Model cash flow implications.

Key Takeaway #3: State-by-State PTET Strategy Still Matters

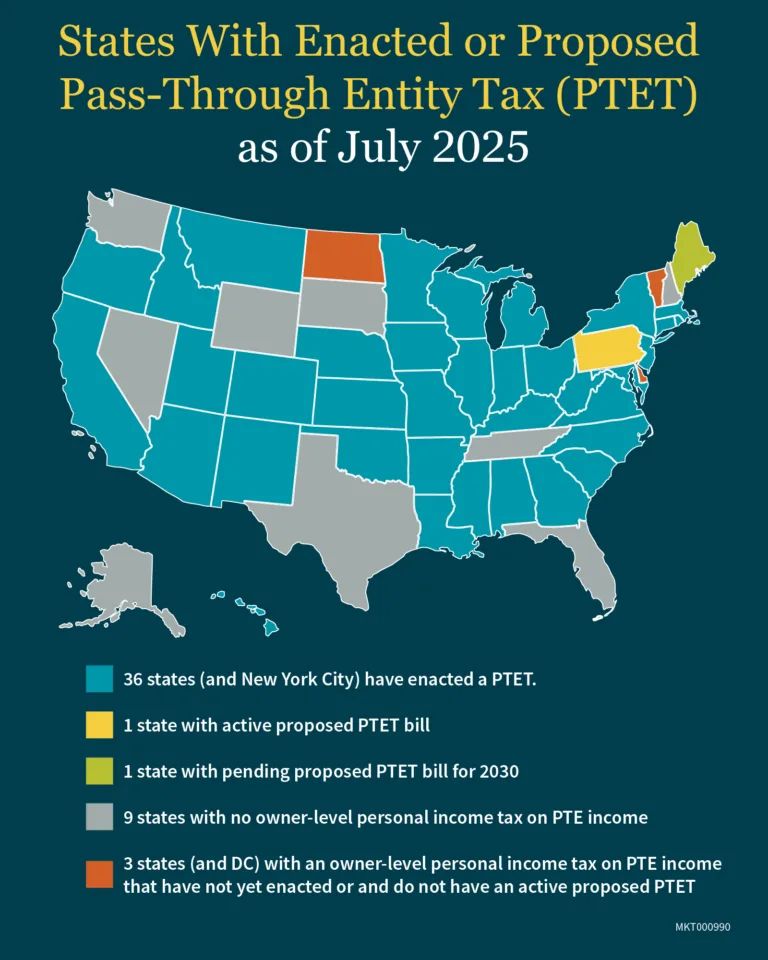

Not all state PTET programs are equal. Some states need annual elections, some require mid-year deposits, some are retroactive, and others carry risks of double taxation if owner-level credits aren't managed properly.

Action tip:

- Review your state's PTET mechanics and deadlines (especially if you operate a pass-through entity in multiple states).

- Coordinate with all of the business owners on credit carry forwards and reporting obligations. Verify the tax credit needs at the individual levels each year before making an election.

Case Study: How a California S Corp Owner Could Save up to $44,000

A California-based S corporation owner with $1.2 million in annual passthrough income faced a common dilemma: How to navigate state tax liabilities under the newly expanded SALT deduction while maximizing federal deductibility.

Before PTET:

The owner pays ~$130,000 in California income tax. Under the SALT

cap — even raised to $40,000 — this would be phased

back down to just $10,000 due to MAGI being over $600,000. The

owner would technically lose out on a state tax deduction of

$120,000+, increasing their federal tax burden by between

$36,000-$44,000.

With PTET election:

The S corp elects to pay California's pass-through entity tax.

This shifts the majority of the state tax liability to the business

level, allowing the owner to deduct $111,600 as a business expense

and $10,000 on Schedule A, leaving only less than $10,000.

Net effect: Depending on the taxpayer's bracket and other factors, this move could generate up to $44,000 in federal tax savings.

Take a Proactive Approach to Salt Cap and PTET Planning

The SALT cap increased itemized deduction is a welcome change — but it doesn't cut the value of PTET planning. The most tax-efficient path in 2025 will likely involve stacking strategies: Using the $40,000 SALT deduction where applicable and electing the PTET to capture other deductions at the entity level. Each state's rules vary, so a proactive approach is key.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.