- in United States

- with Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy and Property industries

Key Takeaways:

- Many architecture, engineering, and design-build firms qualify for valuable R&D tax credits, even if they don't realize it.

- To claim credits, your projects must meet a four-part test and be supported by clear documentation showing experimentation and innovation.

- Recent tax law changes and IRS scrutiny make it important to review your contracts, track project activity, and work with knowledgeable tax professionals.

—

If you operate an architecture, engineering, or design-build firm, you might assume research and development (R&D) tax credits are reserved for people in white lab coats working in biotech or software. That's a common — and costly — misconception.

Many of the projects you take on every day may qualify for substantial federal (and even state) R&D tax credits, putting real money back in your business and freeing up resources to keep innovating.

This guide breaks down what qualifies, how to calculate your credit, the documentation you'll need, and recent changes you need to be aware of — so you can start turning your design ingenuity into tax-saving power.

Understanding the Four-Part Test: Your Gateway to R&D Credits

To qualify for R&D credits, your activities must pass a four-part test that applies to each business component or project. Here's what you need to demonstrate:

1. Permitted Purpose

Your work must serve a legitimate business purpose aimed at generating profit. This includes developing pilots, models, processes, certain engineering designs, certain building designs, or potentially specific components of larger projects.

2. Technological in Nature

You must utilize engineering, biological, chemical, or other hard sciences in your work. For architecture, engineering, and design-build firms, this typically involves engineering sciences applied to structural, mechanical, or environmental challenges.

3. Elimination of Uncertainty

There must be uncertainty in capability, method, or design at the project's outset. If you know everything from the start, there's no innovation involved. This uncertainty often exists in how to meet specific building codes, achieve proper tolerances, or address unique site constraints.

4. Process of Experimentation

You must engage in an iterative process through modeling, simulation, trial and error, or systematic testing. This doesn't always require formal hypothesis testing — it's about experimentation and trying different approaches to see what works.

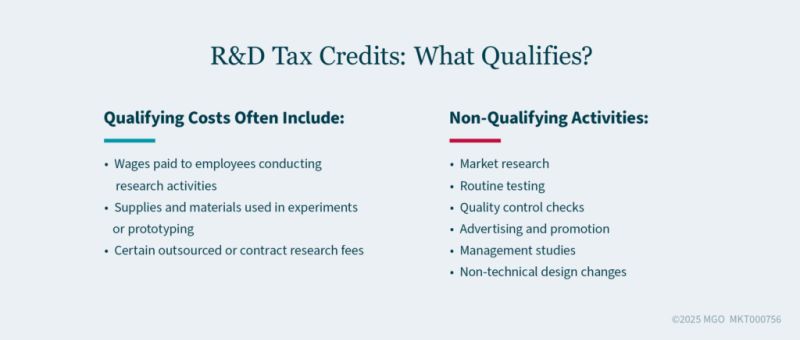

What Qualifies: More Than You Think

Your everyday work likely includes numerous potentially qualifying activities, such as:

- Energy-efficient designs: Exploring materials that retain heat, affect structural loads, or meet Leadership in Energy and Environmental Design (LEED) certification requirements

- Alternative design concepts: Developing innovative solutions for unique geographical or structural constraints

- Advanced modeling techniques: Using computer-aided design (CAD) or building information modeling (BIM) software for experimental design modeling and analysis

- Innovative material use: Testing alternative materials for durability, sustainability, or specific performance characteristics

- Environmental and structural analysis: Optimizing water flow, ventilation systems, or designing for extreme weather conditions

Creating an optimal design for a healthcare facility to satisfy specifications regarding airflow rate and humidity rating may be a qualifying activity. So might proceeding through multiple iterations of CAD designs. Both of these examples could pass the four-part test.

Calculating Your Credit: Two Methods to Consider

You have two calculation methods available:

1. Regular Credit Method

Compares your current-year R&D costs to a historical fixed-base percentage of gross receipts and R&D expenses. This method is complex and best for firms with long histories of research expenses that have been documented.

2. Alternative Simplified Credit

Compares current-year costs to the average of the past three years. Most firms today use this method due to its straightforward approach.

Each tax year, you can choose the method that yields the higher benefit — but once chosen for that year, you're locked in. Work with your tax advisor to evaluate both options annually.

Critical Pitfall: Contractual Provisions and Funded Research

Here's where many firms stumble — the IRS scrutinizes whether your research is "funded" by someone else. Two key standards determine eligibility:

1. Risk of Loss Standard

Who bears the financial risk if the project fails to meet specifications? Cost-plus contracts typically don't qualify because the client assumes financial risk. Fixed-fee contracts generally qualify because you bear the risk of cost overruns.

2. Substantial Rights Standard

Do you retain intellectual property rights to your designs and methodologies? Can you use knowledge gained from one project on future projects without paying licensing fees?

The IRS examines the "four corners" of your contracts — what's written matters more than your typical business practices. If your contracts are silent on these issues, your actual business practices may be considered (but this creates less certainty).

Documentation: Your Defense Strategy

Proper documentation is crucial for surviving potential IRS scrutiny. Maintain detailed records of:

- Project files: Keep all design versions showing your iterative process

- Employee activity logs: Track who worked on R&D activities and for how long

- Design evolution: Document changes from version one to version two, explaining why modifications were necessary

- Testing data: Preserve results from any outside testing or certification

- Meeting notes: Record discussions about project challenges and innovative solutions

The key is demonstrating your experimentation process: showing uncertainty existed at the project's beginning and tracking your attempts to eliminate that uncertainty.

The Section 174 Challenge: New Complexities

Recent tax law changes have complicated R&D credits. Under current law (effective 2022), research expenses must be amortized over five years for domestic activities instead of being deducted immediately. This significantly impacts cash flow, as you can only deduct 20% of qualifying expenses in the first year.

Legislation is currently being discussed to restore immediate expensing of R&D costs through 2029. While the return of the full immediate deduction would provide cash-flow benefits, these credits remain valuable despite the amortization requirement.

Special Opportunities for Smaller Firms

If your firm has less than $5 million in gross receipts over the tax year and your firm had no gross receipts for any tax year preceding the five-tax-year period ending with the current tax year, you may be able to offset R&D credits against payroll taxes rather than income taxes. This payroll tax election provides immediate cash flow benefits up to $500,000 annually — particularly valuable for startups or firms without significant tax liability.

Form 6765: What's New and Complex

The R&D credit form has expanded significantly, now requiring detailed disclosure of:

- Each business component (project) claiming credits

- Officer wages included in calculations

- Specific breakdown of wages, supplies, and expenses by component

- Documentation of how each project meets the four-part test

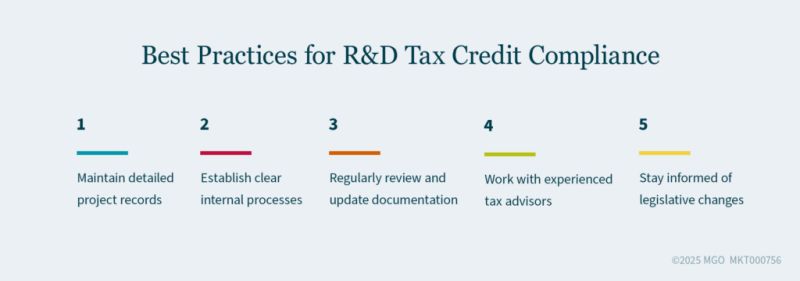

This complexity underscores the importance of working with experienced R&D credit specialists rather than attempting DIY compliance.

Taking Action

R&D tax credits represent one of the most overlooked opportunities for architecture, engineering, and design-build firms. If you're designing innovative solutions, addressing unique challenges, or using iterative processes to solve complex problems, you may likely qualify for substantial credits.

Don't let misconceptions about "real R&D" cost your firm hundreds of thousands in tax savings. The combination of federal credits, potential state credits, and complementary incentives like cost segregation and energy efficiency deductions can dramatically improve your bottom line.

Start by reviewing your current projects through the lens of the four-part test, examine your contractual provisions for rights and risk allocation, and establish documentation systems to capture your innovation processes. With proper planning and experienced guidance, R&D tax credits can become a significant competitive advantage for your firm.

How MGO Can Help

Navigating the evolving rules around R&D tax credits requires a team that understands the complexities of Section 174, the importance of contract structure, and documentation that satisfies IRS requirements.

Our Tax Credits and Incentives professionals work closely with architecture, engineering, design-build, and planning firms to help you identify eligible activities, calculate your credit, and build documentation to support your claim. We also help align your credit strategy with your broader tax and cash flow planning.

Curious if you're leaving money on the table? Take our R&D tax credit self-assessment to uncover potential savings opportunities. By answering a few simple questions, you'll gain insights into whether your company could qualify for valuable R&D tax credits.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.