- with readers working within the Accounting & Consultancy industries

- within Criminal Law, Strategy and Family and Matrimonial topic(s)

- in United Kingdom

Key Takeaways:

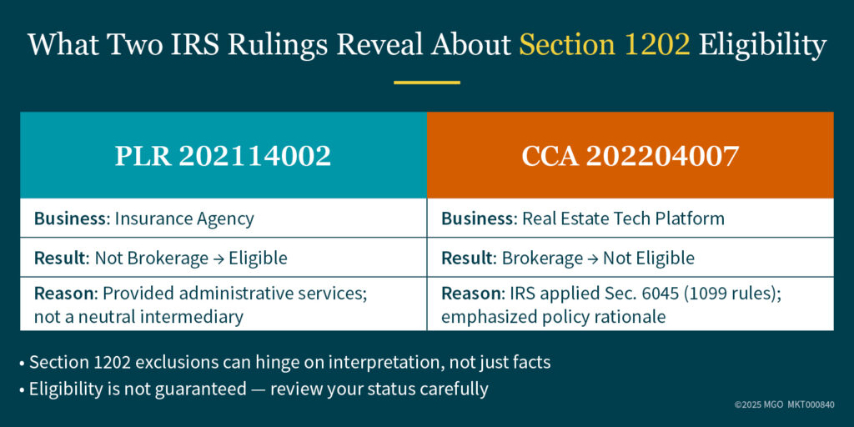

- In 2021, the IRS issued two rulings with opposite outcomes on whether businesses qualified under Section 1202.

- The IRS ruled an insurance agency did not perform brokerage services — but found a real estate platform did.

- These cases highlight the ambiguity in IRS guidance and why businesses should review their status with a tax advisor.

Section 1202 of the Internal Revenue Code offers one of the most powerful tax incentives available: the potential for a 100% exclusion of capital gains on the sale of qualified small business stock (QSBS).

But qualifying is not always straightforward. Two rulings released in 2021 highlight how the IRS is interpreting a key exclusion — brokerage services — with surprising differences. This matters for companies operating near the edge of excluded industries (certain business types that are specifically disqualified from receiving the tax benefit, such as health, law, finance, and brokerage services).

What the IRS Said in 2021

In April 2021, the IRS issued PLR 202114002, addressing whether a taxpayer's insurance agency qualified under Section 1202. The company operated under two models: direct appointments with insurance carriers and wholesale intermediary agreements. In both models, the agency provided administrative services like client advising, claims reporting, and support.

Even though insurance is an excluded industry, the IRS did not disqualify the business. It concluded the agency was not engaged in brokerage services, a category that would otherwise make the stock ineligible for QSBS treatment.

Later in 2021, the IRS issued Chief Counsel Advice memorandum CCA 202204007. This internal IRS guidance focused on a tech-enabled platform that allowed non-binding reservations of rental properties. The platform processed payments and kept a property database, but did not finalize leases or represent either party. The business also held real estate broker licenses.

In this case, the IRS found the platform was engaged in brokerage services and did not qualify for Section 1202 gain exclusion. Instead of using a narrow or industry-specific definition of "brokerage," the IRS applied reporting rules from another part of the tax code — Section 6045 — and introduced policy reasoning to support a broader exclusion.

Why This Contrast Matters

These two rulings reached opposite conclusions about what counts as brokerage. The insurance agency, which might normally be seen as excluded, was considered eligible. The tech platform, which arguably operated more like a software company, was disqualified.

The difference is more than just factual nuance. The Chief Counsel Advice introduced policy rationale, saying that "brokerage" should be interpreted broadly to limit eligibility under Section 1202. That's a new development. None of the 12 known private letter rulings have taken that approach.

The takeaway? IRS interpretation is evolving — and not always in the taxpayer's favor.

What This Means for Your Business

Most companies assume they qualify for Section 1202 simply because they're structured as C corporations and meet the asset and holding period requirements. But those are just the starting point.

The most complex and overlooked test is whether your company is engaged in a qualified trade or business. That's where the real analysis begins. The law excludes broad categories like health, finance, law, consulting, and brokerage — many of which increasingly overlap with high-growth, tech-enabled industries. Think digital health platforms, fintech services, or AI-powered advisory tools.

Whether your business qualifies doesn't depend on how the IRS "chooses" to interpret your model — it depends on how clearly your advisors position and support your case based on the facts. In these gray areas, a well-documented narrative can make the difference between full gain exclusion and a missed opportunity.

Why the Qualified Trade or Business Test Stands Alone

Other elements of Section 1202 are factual and can be reviewed with documentation, such as whether:

- Stock was issued directly by the company

- Gross assets were under $50 million at the time

- The stock has been held for five years

But the qualified trade or business test is different. It requires understanding how the IRS views certain industries, analyzing operational facts, and building a position that can be held under review.

Checklists are not enough. This is the part of Section 1202 that requires deeper legal and tax analysis, not assumptions.

Final Thought

Your business may already be promising shareholders or investors that it qualifies under Section 1202. But as these IRS rulings show, that promise only holds if it's backed by a solid and defensible position.

Now is the time to assess where your business falls — and whether you're properly documenting your eligibility before it's challenged.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.