- in United States

- in United States

The IRS CP2000 notice is sent to US taxpayers—from crypto investors and stock traders to regular employees—who the agency has identified as having discrepancies on their federal tax returns. The notice will state a proposed amount due, but the amount isn't final at this stage.

If you've received one of these letters, you may be scared and unsure of what to do next—especially if you know the amount of proposed tax due is wrong. But you don't have to face this problem on your own! Gordon Law's seasoned crypto tax attorneys have successfully fought many CP2000 bills.

In this article, we'll explain what a CP2000 notice is, why you received it, what it means for crypto investors and regular taxpayers, and how to respond.

What Is a CP2000 Notice?

The CP2000 notice is a letter US taxpayers receive from the IRS' Automated Underreporter (AUR) unit, whose computer system automatically spots discrepancies in reported income. It is also called an underreporter inquiry.

A CP2000 notice states the amount the IRS believes the recipient owes, which includes accrued interest.

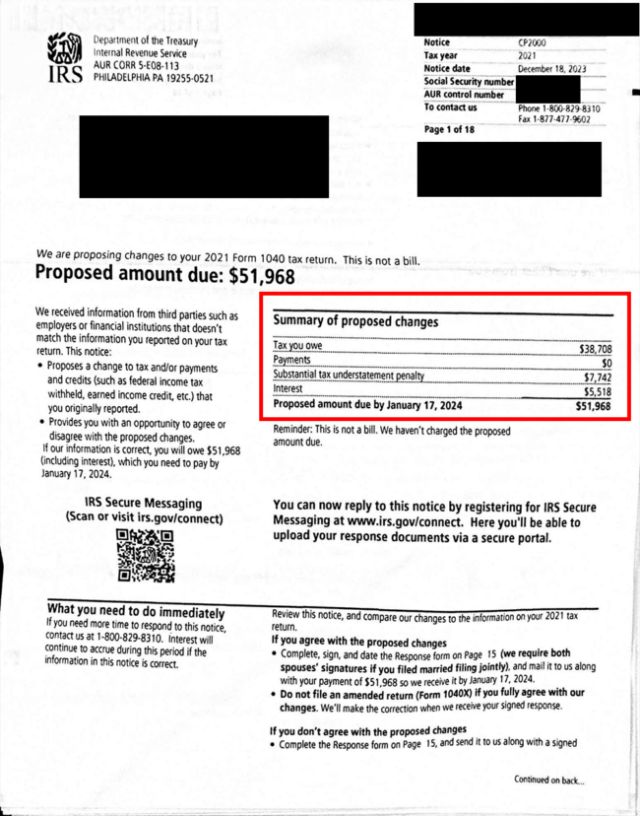

Here's an example of a CP2000 letter for crypto trading:

However, the IRS CP2000 notice is not reserved for cryptocurrency traders; anyone with a discrepancy on their federal tax returns could receive the letter. According to the IRS, this disparity may result in your taxes increasing, decreasing, or remaining the same.

As illustrated in the above example, the CP2000 notice specifies the proposed amount due and explains what information the IRS used to determine these proposed changes.

CP2000 is similar to IRS Notice CP2501, which is also sent to taxpayers with a mismatch between the information reported on their tax returns and the information third parties reported to the federal agency. The main difference between the two notices is that while CP2000 includes a proposed amount due to the IRS, the CP2501 letter doesn't.

Why Did I Receive an IRS CP2000 Notice?

If you received a CP2000 notice, it's because the IRS has information about your income from third parties, and this information doesn't match what you've reported on your tax return.

The IRS has powerful data comparison tools, and it routinely checks the information on your tax returns against information from other sources, including employers, banks, stock brokers, digital asset brokers, and more.

For example, if your employer sends you a W-2 form at the beginning of the year, they must also send the same form to the IRS. The IRS will compare the income reported by your employer to the income you report on your tax return. The same is true of capital gains acquired through cryptocurrency trading, stock investments, real estate sales, and other activities.

However, the IRS may not be correct in some instances. Every CP2000 notice includes an AUR control number, referring to the Automated Underreporter (AUR) function the agency uses to identify potential discrepancies. Instead of a human IRS agent or auditor, your CP2000 notice is generated by an automated system, which might create more room for error in certain cases.

For cryptocurrency investors, in particular, CP2000 letters can be notoriously inaccurate; keep reading or watch this video to learn why.

What Does the CP2000 Crypto Letter Mean for Digital Asset Investors?

Increasingly, crypto exchanges are sending information about their users' trading activity to the IRS using Form 1099-MISC, 1099-B, or (coming soon) 1099-DA. But these forms are incomplete.

The good news is that if you received an IRS letter CP2000 related to cryptocurrency, you probably owe much less than the letter states. In some cases, we've actually found that clients were owed a refund instead! Read on to see common issues and case studies related to crypto.

Form 1099-MISC

Form 1099-MISC only reports certain types of ordinary income, not capital gains. This income could be offset by capital losses from cryptocurrency, but without a full crypto tax report, it looks like you owe more tax than you really do.

Form 1099-B

Form 1099-B is the most accurate, but often lacks cost basis information, especially if you use more than one wallet or exchange. Plus, moving your crypto from one wallet to another could be recorded as a taxable transaction when it's actually not.

So, if the IRS has received Form 1099-MISC or 1099-B reporting your crypto activity from a company like Coinbase, and you did not fully report crypto on your tax return, then you're a prime target for a CP2000 notice claiming that you owe additional tax.

Form 1099-DA

Soon, crypto exchanges will report users' taxable transactions to the IRS via Form 1099-DA. This is the first tax form created specifically for digital assets, which aims to make reporting easier for investors. However, investors can still expect many reporting challenges.

Disputing a CP2000 Notice for Cryptocurrency

Our team has responded to dozens of CP2000 letters related to cryptocurrency trading. Because the IRS uses inaccurate data to calculate your taxes owed, we often uncover thousands or even millions of dollars in tax savings.

- $400,000 notice down to $15,000: One of our clients received a CP2000 notice stating that he owed more than $400,000 in tax on his cryptocurrency (including penalties and interest). We disputed the notice and showed that our client owed closer to $15,000 in taxes—saving him more than $350,000!

- CP2000 resulting in a refund: One client received an IRS CP2000 notice for cryptocurrency stating that he owed more than $35,000. After reporting his crypto correctly, we found that the IRS actually owed him $400!

Need help disputing your notice? Call Gordon Law at (847) 580-1279!

How to Respond to the IRS CP2000 Notice?

If You Agree

If you receive a CP2000 notice, think the amount is correct, and you want to pay the debt and be done with it, then fill out the form and remit it with a check. Voila. That's it.

While this may sound like the easiest solution, it may not be the most effective. If the IRS' notice is inaccurate—a common scenario for crypto investors—you'll be paying more taxes than you actually owe.

If You Disagree

If you disagree with the amount the IRS claims you owe, be sure to hang onto the CP2000 notice and contact our experienced tax lawyers right away. You have 30 days to prepare a response.

We'll get to work responding to the IRS, and creating all supporting documentation, by the deadline stated on your notice.

Cryptocurrency Traders:

If you're a digital asset investor, we'll build your complete crypto tax report for the year(s) in question (we can amend a previous report or start from scratch). This includes recording every single cryptocurrency transaction that you made. We've been working with crypto taxes for years and have built hundreds of these reports, so you'll be in good hands.

Other Types of Income:

As a regular taxpayer, you can rely on us to find out the root cause of your CP2000 notice and calculate the precise amount of taxes you owe to the IRS based on your tax returns, bank statements, receipts, and other documentation.

In case the IRS' proposed amount due is higher than the actual sum you owe, we'll write a CP2000 response letter to the IRS on your behalf. It will include an accurate description of the items you disagree with and the tax forms we used for calculating your taxes.

Find Straightforward, Experienced Help With Your IRS CP2000 Notice Response

The worst thing you can do with a CP2000 notice is ignore it; the IRS can, and eventually will, take extreme collection measures like filing a lien on your property, garnishing wages, or even levying your bank account.

Don't wait until it's too late. Our experienced tax professionals can help you resolve this issue with minimal stress and expense. Reach out today to schedule your consultation with a seasoned attorney.

Frequently Asked Questions (FAQ)

What Is the IRS' Phone Number for CP2000?

The IRS' contact information is displayed on the CP2000 notice in the top right corner of the letter:

- Phone number: 1-800-829-8310

- Fax: 1-877-477-9602

However, you should be aware that correcting mistakes that may increase or decrease your taxes can only be made in writing instead of over the phone.

Where to Mail Your CP2000 Response?

You should mail your CP2000 response to the return address displayed on the enclosed envelope. Alternatively, you can fax your notice to the fax number in the top right corner of the letter via a fax machine or an online fax service.

In any case, don't forget to hold onto a copy of the notice for your records.

How to Pay a CP2000 Notice Online?

It's important to highlight that the proposed amount due in your CP2000 letter is not a bill. After responding to the notice, you'll receive a separate tax bill.

When you have your tax bill ready, follow the instructions on the IRS' website to pay the amount due for your CP2000 notice online via a bank account, digital wallet, or debit/credit card.

How Do I Check the Status of My CP2000 Notice?

You can check the status of your CP2000 notice by calling the IRS. We recommend calling the number displayed in the top right corner of the letter (1-800-829-8310).

How Long Does it Take for the IRS to Respond to CP2000?

According to the IRS, the complexity of the matching process may require months to conclude. Based on this information and our team's own experience, it could take between one and six months for the agency to follow up on your CP2000 response.

Will a CP2000 Notice Delay My Refund?

The CP2000 is not a bill, but a notice to solve potential issues and adjust your taxes based on discrepancies between your tax returns and third-party information. It's not a demand for immediate payment, and the amount on the letter is not yet final. Even when the IRS does assess a balance due, you'll receive a notice before they offset your federal tax refund.

Considering the above, your CP2000 won't likely delay your tax refund.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.