- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Business & Consumer Services, Pharmaceuticals & BioTech and Law Firm industries

Key Takeaways:

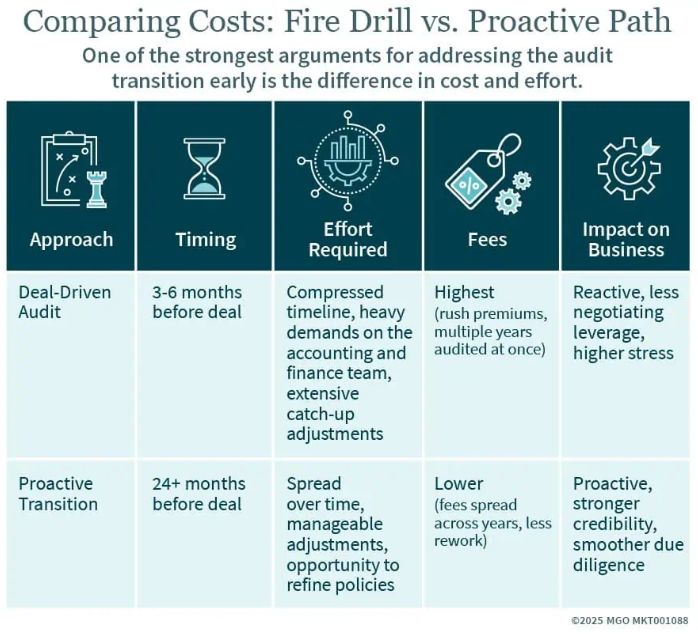

- Relying on income tax-basis financials can create costly challenges when entering a merger or acquisition.

- Transitioning to GAAP early reduces last-minute rushed work ahead of a liquidity event and can lower fees.

- Audited financial statements build credibility with buyers, lenders, and investors and may support higher valuations.

Many middle-market companies don't get an annual financial statement audit. Instead, financial reporting revolves around tax returns. It's a practical and cost-effective approach for day-to-day operations. However, that convenience becomes an obstacle the moment a sale, outside investment, or other liquidity event enters the picture.

Buyers, lenders, and investors often expect or even demand audited financial statements prepared under Generally Accepted Accounting Principles (GAAP). Transitioning from tax-basis financials to GAAP under a tight deal deadline is stressful, expensive, and risky.

That's why we recommend starting the transition well before a liquidity event is on the horizon. By engaging advisors and auditors early, your company can convert financials on its own timeline, reduce long-term costs, and arrive at the negotiating table with stronger, cleaner financials.

The Hidden Risks of Last-Minute Audits

For many business owners, the sale of their company represents the culmination of a lifetime of work. It is often their one opportunity to turn years of effort into financial security for retirement. Yet too often, owners only begin preparing audited GAAP financials when a transaction is imminent, creating a "fire drill" scenario we counsel clients to avoid.

In these situations, auditors must complete multiple years of financial statement audits on a very tight timeline — often while the company's internal finance team scrambles to respond to buyer requests and due diligence questions.

Financial statements prepared on the tax basis often require significant restatements because they lack prepaids, receivables, payables, accrued expenses, and deferred revenues required under GAAP. That means the company must make adjustments across multiple periods — work that is both time-consuming and expensive.

Beyond fees, the internal cost of staff burnout, distraction from operations, and weaker negotiating power can be far greater. Most supporting documentation wasn't prepared with GAAP in mind, so the internal accounting team must recreate schedules from scratch.

All of this happens under the pressure of a looming transaction deadline, which leaves little capacity for answering questions or resolving discrepancies. The result is higher engagement fees; strained relationships between management, auditors, and buyers; and less negotiating leverage than you might have had if the work had been done in advance.

The Benefits of an Early Start

When companies start the audit process well in advance, they put themselves in control of the timeline. Instead of scrambling to get everything done in a few months, the team can spread work out over a year or two — giving them time to adapt without overwhelming day-to-day operations.

This approach also tends to reduce long-term costs since audit and advisory fees can be spread across multiple years and there's less need to chase down old records or redo prior work.

Perhaps most importantly, clean, audited financials give buyers confidence by telling a consistent and reliable story, which often translates into stronger valuations. Along the way, the move to GAAP also tends to improve how the business runs — strengthening internal controls, tightening documentation, and producing financial reports leaders can rely on.

Founders who have gone through this process often describe the peace of mind it gave them, knowing they were presenting their company's financial story to potential buyers in the strongest light possible.

Making the Transition From Tax-Basis to GAAP

Making the move from tax-basis financial statements to GAAP doesn't have to be overwhelming. A phased approach helps companies prepare over an extended period.

The process includes:

- Diagnostic review: Your advisors will assess the current state of tax-basis reporting and identify differences between tax-basis and GAAP. Some common areas where tax and GAAP diverge include revenue recognition, leases, and accruals.

- Adjustments and adoption: You will need to implement new accounting policies, update supporting schedules, and make necessary restatements.

- Baseline audit: Complete a first-year audit that establishes GAAP-compliant opening balances and creates a foundation for future reporting.

- Ongoing refinement: Use each year-end audit to strengthen processes and internal controls, and further align reporting with strategic goals.

This gradual process eases the workload on the finance team and reduces the likelihood of costly surprises later.

Long-Term Value Beyond the Deal

Many companies find that preparing audited GAAP financial statements provides value beyond serving a future transaction. It can offer greater access to credit and financing opportunities, increased confidence among shareholders and board members, and improved governance and risk management.

Even if a liquidity event is years away, adopting GAAP and establishing a regular audit process helps management run the business with greater insight and accountability.

How MGO Can Help

Shifting from tax-basis reporting to GAAP audits can feel daunting, but the choice of when to make that shift makes all the difference.

Waiting until a merger or acquisition is imminent leads to costly, high-pressure fire drills that put both the business and the transaction at risk. Conversely, taking a proactive approach allows you to spread costs over time, strengthen internal controls and financial reporting, and prepare for negotiations on your own timeline.

Now is the time to act if you anticipate a sale, investment, or liquidity event in the next few years. To start the conversation, reach out to MGO today. Together, we can build a proactive plan that prepares your business for stronger valuations and smoother transactions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.