- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy and Securities & Investment industries

On June 4, 2025, the U.S. Securities and Exchange Commission (the "Commission" or "SEC") issued a concept release soliciting public comment on the definition of foreign private issuer ("FPI"), particularly on whether the current definition should be amended in an effort to protect U.S. investors while continuing to facilitate capital formation. The SEC is focused on the significant changes in the global capital markets and characteristics of foreign private issuers since the last SEC review of the FPI regulatory framework in 2008.

BACKGROUND

Traditionally, U.S. policymakers encouraged foreign companies to access the U.S. capital markets by providing certain accommodations for disclosure, reporting and corporate governance. However, in recent years, particularly under the prior administration, there has been a gradual reduction of regulatory accommodations provided to FPIs. At the 2024 U.S.-China Symposium hosted by Harvard Law School, SEC Commissioner Uyeda commented on this policy change, highlighting the SEC shift toward treating U.S.-domiciled reporting companies ("domestic issuers") and FPIs similarly with regard to more recently adopted disclosure requirements. In his remarks, Commissioner Uyeda proposed two actions to address "the confusion and inconsistency that plagues the SEC's recent decisions on [FPI] disclosure." First, he suggested that the SEC release a white paper or concept release to gather public input on ideas for future rulemaking. Second, he recommended that the eligibility criteria for FPIs should be reevaluated, possibly restricting it to companies listed on both U.S. and foreign stock exchanges. He suggested guiding principle ought to be establishing a coherent disclosure philosophy that both remains relevant with the passage of time and transcends political pendulum swings. The goal of such concept release, according to Commissioner Uyeda, is to ensure that the SEC's treatment of foreign companies reflect today's global capital market and does not place domestic issuers at a competitive disadvantage or deprive investors from receiving appropriate disclosure. It appears many of these thoughts underlie the recent concept release, as discussed below.

In the concept release, the SEC notes that current FPI accommodations and exemptions were established based on its understanding that (i) most FPIs would be subject to meaningful disclosure and other regulatory requirements in their home country jurisdictions and (ii) FPIs' securities would be traded in foreign markets as well as on U.S.-based exchanges. However, based on detailed data in the concept release, the characteristics of FPIs have changed dramatically over the last two decades. In light of these changes, the SEC is seeking public comment on whether current accommodations for FPIs should continue or whether the definition should be amended to better reflect today's FPI population.

The concept release includes 69 requests for comment, divided into various categories, including several possible approaches to amending the FPI definition. This Legal Update highlights the broad categories of the comment requests and some of the more interesting questions raised. The comment period is expected to run until at least mid-September.

CURRENT FPI DEFINITION AND FPI ACCOMMODATIONS

The concept release includes a detailed discussion of the history of the FPI definition and the regulatory framework, with a particular focus on the framework's purpose—to preserve appropriate investor protections while addressing FPIs' need for accommodations to reduce burdens on issuers that might arise from duplicative or conflicting domestic and foreign disclosure requirements. As the release notes, the SEC established the foundation of the current FPI definition in 1983 when it adopted the bifurcated test to determine a foreign issuer's status depending upon its percentage of U.S. ownership and the location of its business operations.

An FPI, as defined in Rule 405 of the Securities Act of 1933, is an issuer that is domiciled in any foreign country that is not a foreign government, unless more than 50% of its outstanding voting securities are held directly or indirectly of record by U.S. residents and any of the following applies: (i) a majority of its executive officers or directors are U.S. citizens or residents, (ii) more than 50% of its assets are located in the United States or (iii) its business is administered principally in the United States.

FPIs benefit from a number of specific accommodations. For example, FPIs are not subject to Section 16 beneficial ownership reporting, the SEC's proxy rules, Regulation FD, and say-on-pay requirements, and benefit from longer reporting deadlines, no requirement to file quarterly reports or Forms 8-K, and an ability to report their financial statements in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), among others.

CHARACTERISTICS OF FPIs

The concept release provides the results of a broad review by the SEC Staff of reporting FPIs between 2003 and 2023, and an analysis of FPI global equity trading volume between 2014 and 2023. Based on the release, the majority of FPIs that file Annual Reports on Form 20-F, or "20-F FPIs," have equity securities that are almost exclusively traded in the U.S. capital markets. The Staff also observed that these 20-F FPIs have relatively small market capitalizations. The concept release concludes that the 20-F FPIs driving the trends identified by the Staff represent a smaller percentage of the overall population of 20-F FPIs in terms of aggregate global market capitalization than in terms of absolute number. This should not be surprising considering general capital markets trends over this same period, the overall decline in the number of public companies listed on U.S. securities exchanges, and the many years within that time of poor performance of the initial public offering market and the equity capital markets generally, which negatively affected the population of FPIs.

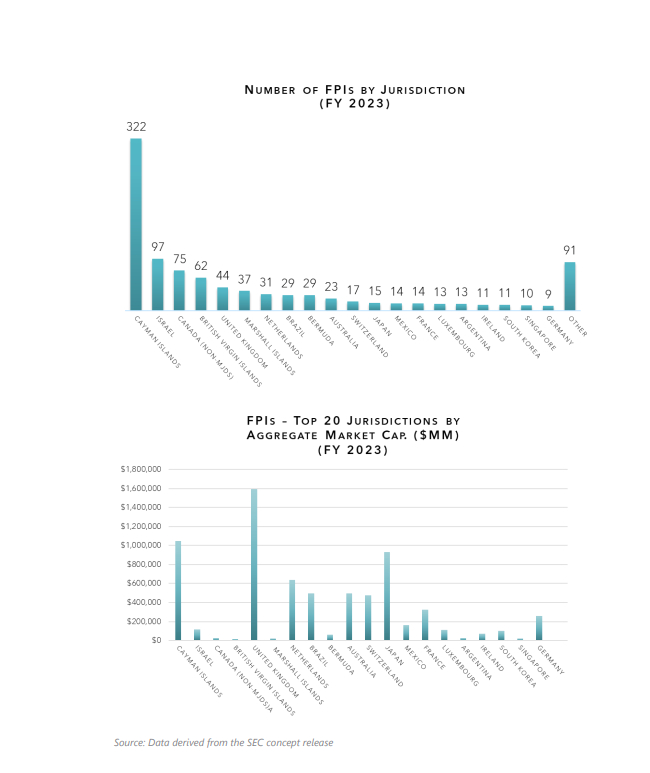

Overall, the number of FPIs declined from 2003 to reach a low point of 656 issuers in fiscal year 2016, and has since increased steadily to 967 issuers in fiscal year 2023, the latest year included in the Staff's analysis. The analysis did not specifically include SPACs and former SPACs; however, the jurisdictions of incorporation of the FPIs included indicates an increase in Cayman-domiciled issuers, suggesting that the increase in SPAC related activity may, at least in part, account for the increase in number of FPIs in recent years. It would similarly account for some of the increase in the number of small cap FPIs and FPIs with most or all of their trading on a U.S. securities exchange.

The Staff excluded MJDS issuers and FPIs that elect to file on domestic forms from its analysis. In summary:

- 967 FPIs filed annual reports on Form 20-F for fiscal year 2023.

- 146 FPIs filed annual reports on Form 40-F under MJDS for fiscal year 2023.

- By jurisdiction of incorporation, the composition of FPIs has changed significantly. In fiscal 2003, the most common jurisdictions for both incorporations and headquarters for 20-F FPIs were Canada (non-MJDS issuers) and the United Kingdom. However, in 2023, the most common jurisdiction of incorporation for 20-F FPIs was the Cayman Islands and the most common location for headquarters was mainland China. The second most common jurisdiction of incorporation and headquarters for 20-F FPIs in 2023 was Israel.

- In recent years, there has been a substantial increase in the number of 20-F FPIs' with jurisdictions of incorporation that differ from the jurisdictions of their headquarters. Much of this divergence, according to the data, is attributable to the increase in China-based issuers who are incorporated in the Cayman Islands or the British Virgin Islands, but headquartered in mainland China, Hong Kong or Macau.

- An increasing percentage of 20-F FPI's equity securities trade almost entirely in U.S. capital markets, rather than foreign markets. In fiscal year 2023, a large majority of 20-F FPIs had more than 50% of their equity securities trading in U.S. capital markets. Even in fiscal 2014, a large fraction (approximately 44%) of 20-F FPIs traded almost exclusively in U.S. capital markets, and this number has continued to increase over time. As noted above, these tend to be smaller capitalization companies. Specifically, according to the concept release, the "aggregate global market capitalization of FPIs that trade exclusively in the United States is only a small fraction (9%) of the total aggregate global market capitalization of 20-F FPIs, despite representing a majority of the 20-F FPIs."

REQUESTS FOR COMMENT

The SEC requests public comment on several large regulatory questions, such as whether the shift in the characteristics of the FPI population warrants a reassessment of the FPI definition, and whether, under the current framework, U.S. investors in the securities of FPIs are sufficiently protected and receive appropriate information. The concept release also explores whether the current framework may put domestic U.S. companies at a competitive disadvantage. It may be difficult to consider these questions in isolation without taking into account views on disclosure requirements for smaller reporting companies and views regarding whether disclosures should be scaled depending on company size and maturity.

UPDATES TO THE FPI DEFINITION

The concept release includes requests for comment with respect to a variety of potential updates to the FPI definition, including specific requests for input on the following possible approaches to amending the FPI definition:

- Updating the existing FPI eligibility criteria. The SEC raises the possibility of updating the existing bifurcated test, such as by lowering the existing 50% threshold of U.S. holders in the shareholder test and revising the existing business contacts test by either adding new criteria or revising the existing threshold for assets located in the United States.

- Adding a foreign trading volume requirement. The SEC requests comment on potentially revising the FPI definition by adding a foreign trading volume test, either as an alternative or in addition to updating the existing eligibility criteria. For example, an amended definition could require that FPIs assess their foreign and U.S. trading volume on an annual basis to determine continued eligibility for FPI status. The SEC also requests comment on the appropriate threshold (e.g., 1%, 5%, 10%, etc.) for the foreign trading volume test, and noted that, based on its estimates, the adoption of the lowest 1% threshold would result in over half of current reporting FPIs losing their FPI status.

- Adding a major foreign exchange listing requirement. The SEC also requests feedback on requiring FPIs to be listed on a major foreign exchange, particularly in connection with a trading volume requirement, as described above. Potentially, the SEC would maintain a list of foreign exchanges with listing requirements that meet specific criteria in order to be considered a "major foreign exchange."

- Incorporating an SEC assessment of foreign regulation applicable to the FPI. The concept release explores the possibility of requiring that each FPI be (i) incorporated or headquartered in a jurisdiction that the SEC has determined to have a robust regulatory and oversight framework for issuers and (ii) subject to such securities regulations and oversight without modification or exemption.

- Establishing new mutual recognition systems. The SEC also raises the possibility of developing a system of mutual recognition, with respect to Securities Act registration and Securities Exchange Act periodic reporting, for issuers from selected foreign jurisdictions, similar to the MJDS system for Canadian issuers. The concept release asks a series of questions about how such a system would be developed and administered.

- Adding an international cooperation arrangement requirement. The SEC requests comment on the possibility of requiring an FPI to certify that it is either incorporated or headquartered in, and subject to the oversight of the signatory authority of, a jurisdiction in which the foreign securities authority has signed the IOSCO Multilateral Memorandum of Understanding Concerning Consultation, Cooperation, and the Exchange of Information or the Enhanced MMoU.

TRANSITION FROM FPI STATUS AND CONSEQUENCES

The SEC also requests comment relating to the potential consequences associated with changes to the FPI definition that cause issuers to lose their FPI status. In this context, the SEC asks which additional disclosure requirements are likely to be most burdensome as these issuers transition to domestic filer status, whether these issuers are likely to change their listing or exit the U.S. markets, the potential effects on U.S. investors if foreign issuers were to exit the U.S. markets, and related knock-on effects.

CONCLUSION

The concept release comes at an interesting time, given that SEC Chair Atkins has emphasized his intention to focus on promoting capital formation and the number of public companies listed on U.S. securities exchanges has declined in recent years. There are a number of legislative initiatives underway that aim to promote capital formation by, among other things, extending the benefits provided by the JOBS Act to additional issuers and making these benefits available for a longer period of time. The concept release, therefore, might provide an opportunity to address changes in the FPI population while still promoting capital formation, though its tone in this regard is quite measured. Commenters might nonetheless find an opportunity to provide useful perspectives that balance the access to information and investor protection concerns raised by the Staff with more creative approaches than a mere narrowing of the FPI definition or a cumbersome mutual recognition, substituted compliance or similar approach.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2025. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.