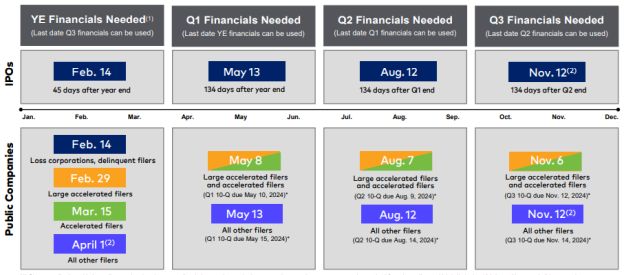

(1) Close coordination with the auditors and underwriters regarding timing may be required to ensure that negative assurances can be received from the auditors, which is limited to 134 days without any holiday extension.

(2) Reflects a permitted extension to the next business day as the date would have otherwise fallen on a weekend or holiday. See Securities Act Rule 417.

* Special accommodation for timely filers

Staleness dates may not always correspond with the filing deadlines for the Form 10-Q, resulting in a potential gap period in which a company's financial statements have gone stale even though the filing deadline for Form 10-Q has not passed. If a registrant wishes to go effective during this gap period, the Securities and Exchange Commission generally provides an accommodation if the company has otherwise timely filed all Exchange Act reports in the last 12 months and will declare registration statements effective during this gap period. The staff may condition such accommodation upon confirmation that the quarterly report will be timely filed after effectiveness, and that no material trends, events or transactions have arisen after the date of the latest balance sheet included in the filing that would materially affect an investor's understanding of the registrant's financial condition and results of operations. (See FRM Section 1220.5.)

A Large Accelerated Filer has an aggregate worldwide market value of its voting and non-voting common equity held by nonaffiliates (public float) of at least $700 million as of the last business day of its most recently completed second fiscal quarter, has been subject to the reporting requirements of Section 13(a) or 15(d) of the Exchange Act for at least 12 months, has filed at least one annual report under the Exchange Act, and is not eligible to use the requirements for smaller reporting companies (SRCs) under the revenue test in paragraph (2) or (3)(iii)(B), as applicable, of the SRC definition in Rule 12b-2 under the Exchange Act (SRC revenue test). Once a company is a large accelerated filer, to lose this status, either its public float must fall below $560 million as of the last business day of its most recently completed second fiscal quarter, or the company must become eligible to use the requirements for SRCs under the applicable SRC revenue test.

An Accelerated Filer has a public float of at least $75 million but less than $700 million as of the last business day of its most recently completed second fiscal quarter (or less than $560 million, but $60 million or more if previously a large accelerated filer), has been subject to the reporting requirements of Section 13(a) or 15(d) of the Exchange Act for at least 12 months, has filed at least one annual report under the Exchange Act, and is not eligible to use the requirements for SRCs under the applicable SRC revenue test. Once a company is an accelerated filer, to lose this status, either its public float must fall below $60 million as of the last business day of its most recently completed second fiscal quarter, or the company must become eligible to use the requirements for SRCs under the applicable SRC revenue test.

A Loss Corporation does not reasonably expect to report income for the most recently completed fiscal year, or it did not report income in at least one of the last two fiscal years.

Determination of the filing statuses described above takes place at the end of the company's fiscal year.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.