Executive Summary

Recognizing investors' increasing interest in environmental, social, and governance matters, the Securities and Exchange Commission is taking action to standardize ESG disclosures. Our Securities Group unpacks what filers can expect from the SEC's construction of a concrete legal framework for disclosure of climate-related obligations, risks, and data.

- The proposed rules spell out examples of required climate-related disclosures

- Materiality is an important component of determining what must be disclosed

- Phase-in periods vary according to filer status

On March 21, 2022, the Securities and Exchange Commission (SEC) proposed rule amendments that would "enhance and standardize" climate-related disclosures. These proposed amendments are the next step in the Biden Administration's ongoing push for heightened climate-related disclosure obligations and represent a significant step toward heightened disclosure obligations.

The SEC proposed amendments to Regulations S-K and S-X that would require foreign and domestic registrants to provide more information about climate risks, greenhouse gas (GHG) emissions, and energy transition activities in the disclosures included in both periodic reports and financial statements. The proposed amendments would require disclosure of Scope 1, Scope 2, and, if material, Scope 3 GHG emissions. The commissioners voted 3 to 1 to propose the amendments discussed, with Hester Peirce voting in opposition.

Background

Climate change has become an increasingly large concern of the SEC, investors, and the public at large. The Biden Administration and the SEC have encouraged companies to provide higher degrees of climate-related disclosure to better inform investors about climate risks. On February 24, 2021, acting chair Allison Herren Lee directed the Division of Corporation Finance (DCF) to enhance its focus on such disclosure, and a few weeks later, the SEC announced the creation of the Climate and Environmental, Social, and Governance (ESG) Task Force.

On September 22, 2021, the staff of the DCF released a sample comment letter containing examples of potential comments the staff may leave requesting certain climate risk information in SEC filings.1

These proposed amendments are the SEC's next step in constructing a concrete legal framework for disclosure of climate-related obligations, risks, and data. Although a substantial number of companies voluntarily provide similar disclosures under other standards, such as the Task Force on Climate-Related Financial Disclosures (TCFD) and the Greenhouse Gas Protocol, the proposed amendments-which build off the TCFD framework and GHG Protocol-would mark a significant departure from the current legal landscape by standardizing and mandating requirements for all registrants and require a significant amount of new information for registrants.

Summary of Proposed Rule Amendments

- The proposed amendments would require disclosure of information about direct GHG emissions (Scope 1) and indirect emissions from purchased electricity or other forms of energy (Scope 2).

- Recognizing the challenges in calculating, verifying, and disclosing Scope 3 emissions (GHG emissions from upstream and downstream activities in a registrant's value chain, which come largely from third parties), the SEC is proposing a tailored liability safe harbor for Scope 3 emissions disclosure, as well as delayed compliance dates.

- A registrant that is not a smaller reporting company would also be required to disclose Scope 3 emissions if material or if the registrant has set a GHG emissions target or goal that includes Scope 3 emissions.

- The proposed amendments would require a registrant to:

-

- Provide climate-related disclosure in its registration statements and Exchange Act annual reports.

- Provide Regulation S-X climate-related financial statement metrics and related disclosures in a note to its consolidated financial statements.

Examples of climate-related disclosures that a registrant would be required to provide include:

- A description of material climate-related risks and their actual or likely material impacts on the registrant's business (over the short, medium, and long terms), as well as the processes a registrant uses to identify, assess, and manage such risks.

- A description of a registrant's governance of climate-related risks and relevant risk management processes.

- Assessments of how climate change and climate policy will affect a registrant's financial results, operations, and business strategy.

- Costs, risks, and impacts of energy "transition activities," to the extent companies and the government pursue a transition into a climate-neutral economy.

- Information about scenario analysis, if a registrant uses such analysis to evaluate its business strategy pertaining to climate-related risks.

- Information about a registrant's internal carbon price, if used, such as for assessments of climate-related risks and opportunities, energy efficiency measures, and capital investments.

- Scope 1 and Scope 2 GHG emissions, disaggregated by GHGs and aggregated, in absolute terms exclusive of offsets, and in terms of intensity.

- Scope 3 GHG emissions if material or if a registrant's goal includes such emissions.

- Physical and financial effects of climate-related events.

- The registrant's climate-related and emissions goals, as well as associated strategies, timelines, and progress metrics, including:

-

- The scope of activities included.

- Relevant data to indicate progress status and updates.

- Certain information about carbon offsets or renewable energy certificates, including the associated carbon reduction, if used as part of a net emissions reduction strategy.

Materiality Determinations

Materiality ostensibly is the lens through which a company should view the impact of climate change on its business under the proposed amendments, including whether Scope 3 emissions are material to its business.

Although the proposed amendments point to the traditional definition of materiality,2 the SEC believes there is a substantial likelihood that a reasonable investor would consider the impact of climate change to be important when determining whether to buy or sell securities or how to vote. Thus, the SEC has placed significant focus on a registrant's individual materiality assessment. The materiality determination is largely fact-specific and requires quantitative and qualitative considerations. A materiality determination for uncertain future events requires an assessment of both the probability of the event occurring and its potential magnitude or significance to the registrant, which is particularly problematic for climate change potentialities over vast time horizons. Therefore, a registrant ultimately has discretion over whether certain climate risks, Scope 3 emissions, or other pieces of information rise to the level of materiality that would warrant disclosure.

While many of the proposed amendments turn on the question of materiality, other sections would be categorically required, such as the disclosure of Scope 1 and Scope 2 GHG emissions.

Phase-In Periods and Compliance Dates

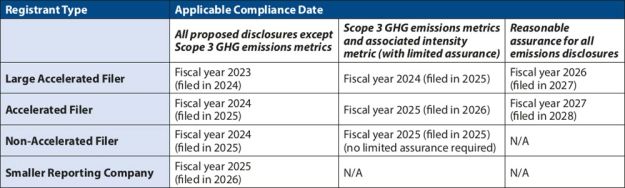

The following table lays out the phase-in periods and compliance dates for companies of each filer status if the proposed amendments are adopted. If adopted, the final rule would become effective one year after the adoption date. The proposed transition periods would provide existing accelerated filers and large accelerated filers one fiscal year to transition to providing limited assurance and two additional fiscal years to transition to providing reasonable assurance. The dates below assume an adoption date of December 2022.

Next Steps

It will likely be months before any final rules are adopted, and the proposals are predicted to trigger vigorous pushback, including legal challenges. The proposed amendments will be open for public comment until the later of May 20, 2022 or 60 days after publication in the Federal Register.

After the comment period, the proposed amendments may be revised before going to another vote. Regardless of the final outcome, companies should review their climate-related disclosure policies and ensure that they are prepared to meet heightened disclosure thresholds if needed.

Footnotes

1. For more information about the SEC's climate change efforts and the sample comment letter, please see our advisories "SEC Filers Can Expect a New Climate from the Biden Administration" (March 5, 2021) and "SEC Issues Sample Comment Letter to Companies Regarding Climate Change Disclosures" (October 1, 2021).

2. See 17 CFR 240.12b-2 (definition of "material").

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.