- within Energy and Natural Resources, Law Department Performance and Environment topic(s)

- with readers working within the Technology industries

Through our Viewpoints series, Riveron experts share their opinions on current topics, business trends, and industry news.

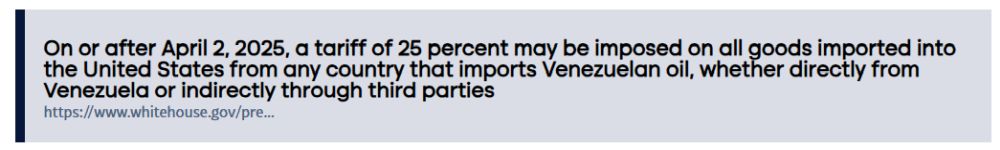

Today, on "Liberation Day", the 25% secondary tariffs on countries that import heavy, sour Venezuelan oil (directly from Venezuela or indirectly through third parties) went into effect.

Markets expected volatility and Brent prices reached their highest point in 2025 with the Brent-WTI spread at a two-month low.

Gulf Coast refineries are often (partially) dependent on this heavy, sour crude, which is now either more expensive and/or supply is curtailed. It will be interesting to see which strategies Gulf Coast refineries are implementing to adapt to these new challenges in an already challenging refinery environment. Unfortunately, we might see compressed margins for Gulf Coast refiners and higher gas prices for consumers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.