- within Technology, Transport and Antitrust/Competition Law topic(s)

Read any news these days and you will almost certainly find an article on artificial intelligence, particularly Generative AI (GenAI), and its impact on daily life, employment prospects, businesses and the world in general.

Unsurprisingly, therefore, AI is increasingly relevant to M&A – influencing both acquisition decisions and deal execution. Yet uncertainty remains about how advanced AI will actually become and about its sustainability, fuelling concerns about investment bubbles and scepticism about its real impact.

Issues for buyers: Is AI an opportunity or a risk?

For some prospective buyers, AI may be a transaction driver. Strategics may be looking for target businesses that will help them adapt to the changing tech environment, while sponsors may target companies operating in industries ripe for disruption by AI, offering opportunities for cost reductions and profitability upside. Conversely, others may be more hesitant to buy legacy businesses which are not sufficiently future-proof to withstand potential disruption.

Meanwhile, assets such as data centres, power providers and others with significant 'compute' power are experiencing tailwinds from booming investment in AI.

But AI is now a sector-agnostic consideration; whether a target is in manufacturing or retail, its exposure to AI-driven disruption – or its failure to adopt it – will directly impact its long-term viability.

The difficulty however is the speed with which AI is evolving, making it hard to predict how far it will go and which businesses and industries will be winners and losers. Buyers must think about:

- Cost uncertainty, including the current levels of subsidies given to customers.

- Sustainability.

- Obsolescence risk, as the AI model currently used in the target's business may become obsolete or be overtaken by new, improved models.

- Adoption costs, including the cost of adopting and implementing new technology and driving change in business.

- The dataset – an AI tool is only as good as the data it is trained on, and a target's value may lie in the data it owns rather than the AI software itself.

Regulatory scrutiny is another key factor – around the world, regulators are not just looking at current market size/turnover but also the future potential market size. They have had an increasing focus on so-called "killer acquisitions", where large companies acquire smaller targets in highly innovative sectors to prevent competing products from reaching the market or eliminating an early-stage competitor. AI is one of their key areas of focus in this area. Regulators are also increasingly concerned about data monopoly – where acquisitions are driven primarily by access to data.

AI issues in legal and other due diligence

Beyond commercial considerations, including those discussed above, issues that need to be considered when doing due diligence on a transaction include:

- Compliance: Has the business complied with relevant law, regulation and contractual obligations in its use of AI (for example has it obtained the consent of customers to use their data in the AI being deployed by the business, and has it appropriately restricted cross border flows of information)?

- Contractual risk: What are the contractual arrangements between the business and the AI provider, and in particular who is liable if something goes wrong?

- Reputational risk: Are there any reputational or ethical issues that may arise from the use of AI in the business (for example any bias in the training or algorithm)?

- IP: Is there, or might there in future be, any risk of intellectual property infringements in how AI is used in the business?

Looking ahead to 2026, AI will only become more important as companies adapt to the new AI environment, and all buyers will have to assess its use in, and potential impact on, a target business when exploring and executing M&A.

AI in deal execution: Opportunities and risks

As with all things AI, it can be a useful tool in M&A – offering significant potential for greater efficiencies and enhanced insights driven by data – but its limitations need to be understood and it remains essential that there is a 'human in the loop' appropriately trained on the use of AI, with the ability to quality control its outputs.

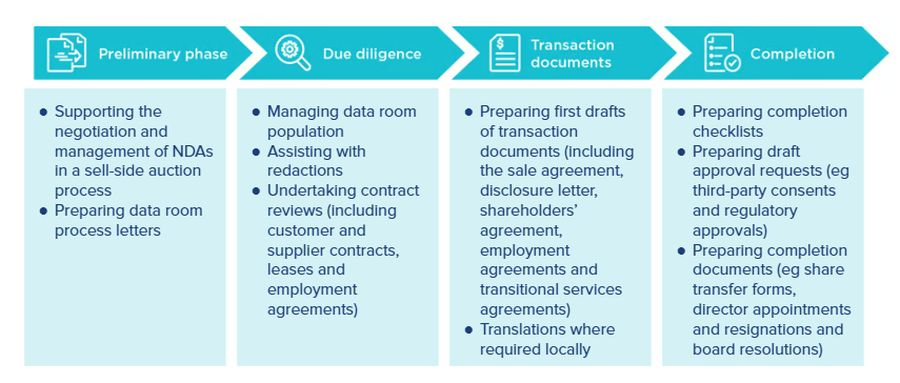

Examples of how AI could be used at the different stages of an M&A transaction

The most immediate and visible use case for GenAI in an M&A context is due diligence – where large volumes of existing information must be summarised, analysed and distilled. The legal market has been using AI and other legal‑tech tools for more than a decade, particularly across due diligence and other volume‑heavy aspects of deals, and GenAI represents the next major evolution in that trajectory.

However, the impact of AI will extend far beyond due diligence. Although GenAI brings a genuine step‑change in capability, the efficiencies it unlocks will continue to expand across the full M&A lifecycle and it will enhance not just due diligence workflows but also the personal productivity of lawyers, from drafting and analysis through to reporting and day‑to‑day project management.

But AI is not a 'plug and play' tool in legal services. GenAI still requires structured, human‑led workflows to ensure safe and effective delivery. A qualified and well‑trained lawyer must actively guide, supervise and validate outputs – shaping prompts, addressing contextual gaps, and correcting misinterpretations. Without this oversight and the right investment in prompt engineering and workflow design, due diligence that relies too heavily on GenAI can contain significant errors.

Diligence influences valuations and deal terms, as well as the ability to purchase W&I insurance, so partnering with a team that can get the best of both worlds – utilising GenAI technology for efficiency gains whilst not compromising on quality – remains essential.

As systems continue to mature and AI tools become better trained, the level of human review required may reduce. However, at present, achieving the most efficient and risk‑aware use of AI still involves combining several tools and workflows, each bringing different strengths. This fragmentation should lessen over time as models and platforms become more integrated.

What next?

The AI landscape is constantly evolving, and AI will only become more useful in an M&A context – it has the potential to streamline various routine tasks on a transaction and deliver greater insights. For practitioners, the skill will be to capture the benefits of GenAI by ensuring that the most appropriate AI (and other tech) tools are being used in accordance with best practice, while keeping appropriate guardrails and human supervision to ensure there is no compromise for the parties to a transaction.

Note – this article was not written by AI...

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]