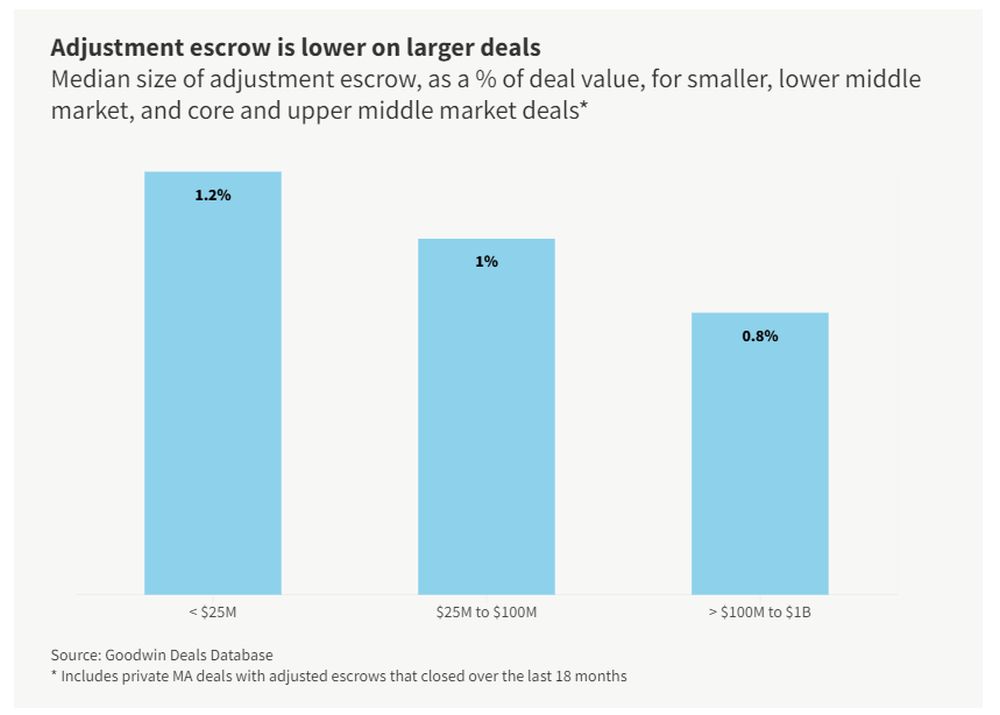

Our data shows that adjustment escrows are lower on high-value deals — but variability in adjustment escrows is higher across lower-value deals.

What is the typical size of an adjustment escrow? A common rule of thumb is 1% of overall deal value, but the size varies depending on deal value and the underlying characteristics of the business (including the net working capital trailing average).

Analysis of the Goodwin Deals Database shows that the median adjustment escrow is less than 1% on larger deals. The median is more than 1% on smaller deals, but variability in adjustment escrows is higher across deals in this group.

This makes sense because many companies that are sold for $25 million or less are fast-growing startups that may not have developed the level of sophistication across internal functions that is common in more mature companies, which often achieve higher valuations. Therefore, in lower-value deals, buyers may be more likely to demand higher adjustment escrows to hedge against the possibility that the target's financial reality, particularly with regard to net working capital, may differ from what the seller estimated prior to the close of the deal.

Moreover, net working capital is usually smaller as a percentage of overall enterprise value for companies that are purchased at higher valuations, which means that buyers can cover net working capital needs on these deals with relatively lower adjustment escrows.

Our database also shows that there is considerable variability in the size of adjustment escrows across smaller deals, with some reaching as high as 14% (well above the median size). As deal value rises, variability declines. On deals valued at $100 million or more, adjustment escrows are usually below 1% — and very rarely exceed 2% — of overall deal value. This reflects the fact that, in lower-value deals, even a small adjustment to the net working capital target represents a larger percentage of the purchase price, whereas in higher-value deals, the same dollar amount change has a much smaller impact relative to the total deal value.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.