Ropes & Gray LLP are most popular:

- within Insurance, Media, Telecoms, IT and Entertainment topic(s)

Read our latest insights into the U.S. private equity market. We cover monthly deal activity and size, fundraising, exits, leveraged loans, and a look ahead. To receive our private equity thought leadership, please join our mailing list.

Key Takeaways from August

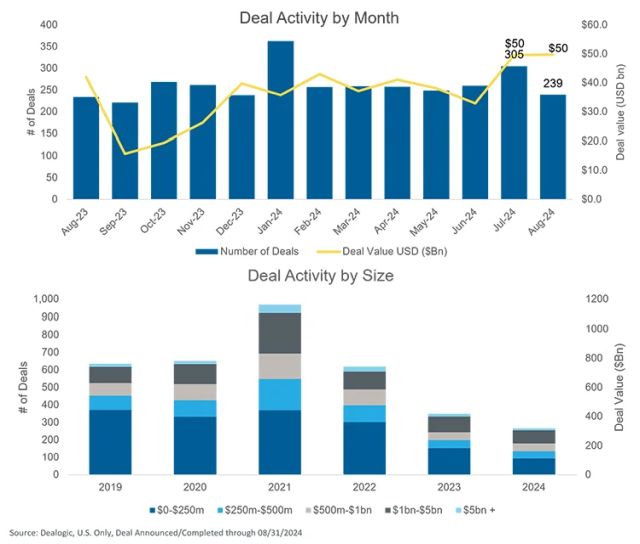

- Deal activity: While deal count was down 22%

in August, deal value reached its highest level over the past

twelve months. YTD deal count remains down 4% and YTD deal value is

up 10%. Meanwhile, the trend of larger average deal sizes

continues.

- Transaction types: The number of both take-private deals and cross-border investments in U.S. companies are on track to finish above their 2023 levels.

- Outlook: Dealmakers anticipate an uptick in M&A deal activity following the first rate cut expected later this month, but have pushed expectations of an IPO market bounce-back to 2025.

U.S. PE Deal Activity

- Deal count is down but value is up: Deal count is down on both a MoM and YTD basis by 22% and 4%, respectively. Deal value continued to come in strong and is up 10% YTD after reaching its highest level over the past twelve months in August

- Deal size trending up: Deal size has been

increasing over the past five years with deals $500m+ making up 49%

of deals in 2024 YTD, up from only 28% of deals in 2019

Take-Private Activity

- Increase in take-private deals: 2024 has seen an uptick in take-private deals with 27 deals YTD

- Growing popularity: Large take-private deals

have been popular in 2024 as PE shops continue to seek

opportunities to deploy high levels dry powder

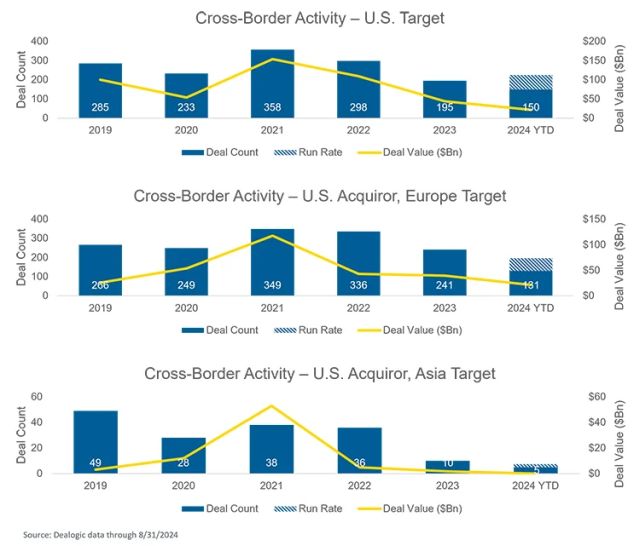

Cross-Border Activity

- Cross-border investments are rising in U.S.: The U.S. continues to attract cross-border investments from acquirors outside of the country; 2024 cross-border activity is tracking higher than 2023 levels

- UK and Germany popular targets: The most

common targets in Europe are the UK and Germany, accounting for 41%

and 15% of deals in 2024 YTD, respectively

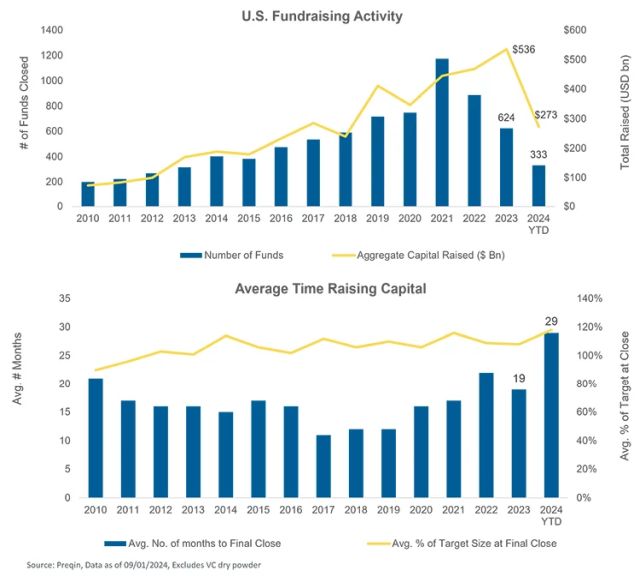

PE Fundraising Trends

- Fundraising still down: Fundraising remains down on both a fund count and capital raised basis, and the funds closing continue to be concentrated among larger and established managers

- Time fundraising: It is taking PE firms a

record high of 29 months to fundraise in 2024 YTD, up from 19

months in 2023

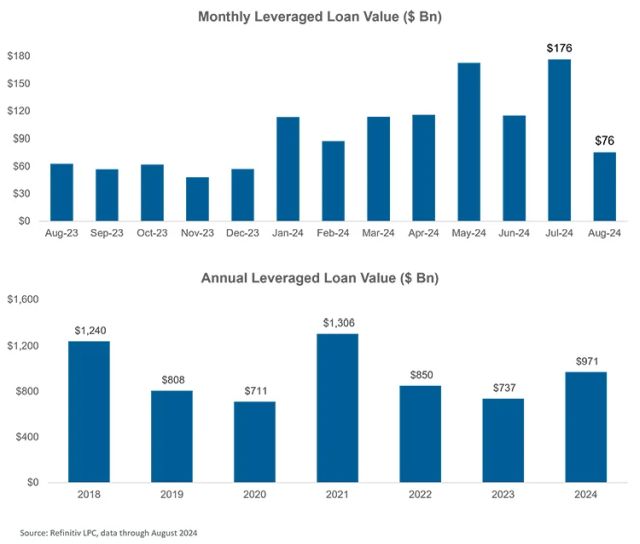

U.S. Leveraged Loan Issuance

- Summer slowdown: Monthly issuance levels decreased to $76 billion in August, down 57% from the $176 billion issued in July

- Volatile market: The leveraged loan market

experienced a wave of volatility in August as investor demand

cooled amid withdrawals from retail loan funds

A Look Ahead

- IPO market outlook shifts: Recent market

volatility has led dealmakers to shift their expectations of an IPO

recovery to 2025

- Many companies with plans to IPO are increasingly deciding to wait until next year, citing concerns over recent volatility, uncertainty around the upcoming presidential election, and how much the Fed will cut rates this year

- Despite a few bright spots in the IPO market this year, many post-IPO companies haven't been performing well, with a majority of those that have debuted in the last 2 ½ years trading below their IPO prices

- Sports sector continues to entice: The sports

industry continues to offer a growing scope of investment

opportunities available for PE firms

- The NFL was the last major sports league to open itself to institutional investors after team owners voted in August to allow for PE investment in franchises. They have initially named only a select group of firms as preferred buyers

- Women's, youth, and amateur sports are all subsectors within sports that share the same attractive demand drivers of men's professional sports, but are in earlier growth phases, offering high potential upside

- PE exit activity yet to fully rebound: Many

GPs continue to wait in hopes for a better exit climate, resulting

in low distribution rates back to LPs despite strong returns in the

public markets

- PE firms continue to seek and evaluate liquidity alternatives such as continuation funds, NAV loans, partial sales, and dividend recaps to provide liquidity and distribute capital back to LPs

- Anticipated rate cuts to drive activity: PE executives are gearing up for a dealmaking comeback with rate cuts from the Fed expected later this month

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.