- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

PREAMBLE

This Manufacturing Overview report marks the first in a quarterly series designed to offer readers a concise evaluation of the current financial performance of manufacturers across industries and the underlying macro indicators and challenges influencing these firms. With this report, we aim to equip readers with strategies to proactively address and navigate the constantly evolving challenges faced by manufacturers.

SUMMARY - Q3 2024

Manufacturing businesses are experiencing significant cost pressures due to lower revenue compared to the previous year, prompting a need to enhance operational efficiency and optimize footprint. Uncertainty from tariffs and taxes are top of mind for manufacturers.

MODEST GROWTH TREND:

Manufacturers experienced a slowdown in demand in Q2 with a modest rebound in Q3. The slowdown was driven by economic uncertainty and changing consumer preferences. In Q3, new orders picked up from the previous quarter

EXCESS/OBSOLETE INVENTORY ISSUES:

Manufacturers continue to face challenges with excess and aging inventory due to unpredictable demand and excess purchasing of raw materials.

INTEREST RATE CONCERNS:

High interest rates raised the cost of goods sold for manufacturers. Manufacturers experienced decreased profits if they did not pass the increased costs on to consumers.

WORKFORCE CHALLENGES:

Attracting and retaining skilled labor remains the top challenge for manufacturers. This issue is exacerbated by rising healthcare costs and an increasingly competitive labor market.

REVISING NETWORK STRATEGY POST-COVID:

Manufacturers are rethinking their network strategies to adapt to new consumer behaviors and geopolitical risks. Building a footprint to gain security in their supply.

FOCUS ON COST AND PRODUCTIVITY:

With high interest rates limiting capital investment, manufacturers are prioritizing operational improvements to enhance productivity

KEY TRENDS AND CHALLENGES IN MANUFACTURING

01 DEMAND FLUCTUATIONS

Economic uncertainty and shifting consumer trends are forcing manufacturers to evaluate their flexibility with existing assets. The uncertainty in demand makes scaling production for specific products challenging.

02 PRICING POWER

In addition to rationalization of products, certain businesses such as consumer product companies have raised prices on core products to beat high interest rates.

03 SUPPLY CHAIN RESTRUCTURING

Given current geopolitical risks, businesses are restructuring their respective supply chains to ensure availability of material.

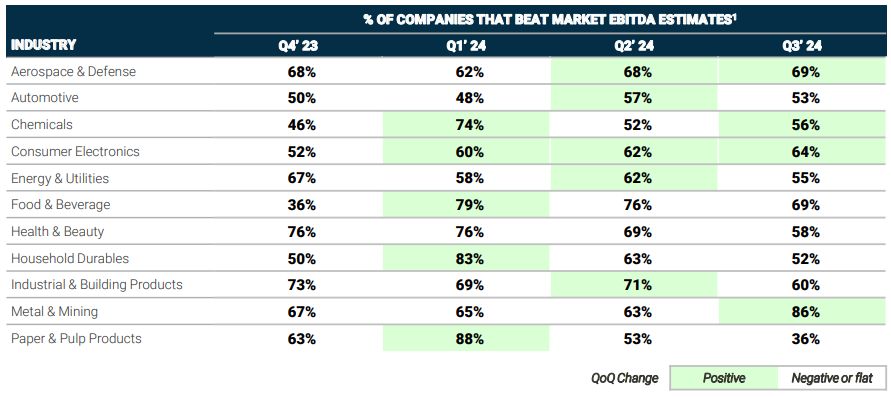

Source: Companies within Industries include Top 40 global public

companies by Revenue, (1) based on market consensus on EBITDA

estimates vs actuals, calculation based on only companies with

available data.

Manufacturing Overview: CY2024 - Q3

KEY TRENDS AND CHALLENGES

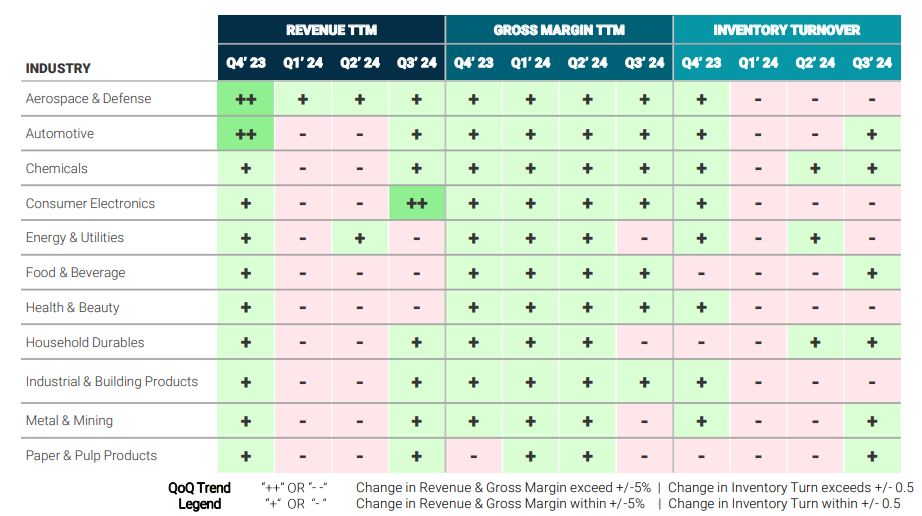

COMPANIES ARE STARTING TO SEE A MODEST REBOUND IN REVENUE WITH A STABLE GROSS MARGIN

COMMENTS

- Most industries saw a modest recovery in revenue, despite being pressured by market uncertainty

- Gross margin across industries are generally trending upward, likely driven by the recovery of commodity prices, and the passing on of costs to customers, particularly in the consumer goods sector.

Source: Companies within Industries include Top 40 global public

companies by Revenue; metric trend based on median in industry

group

Manufacturing Overview: CY2024 - Q3

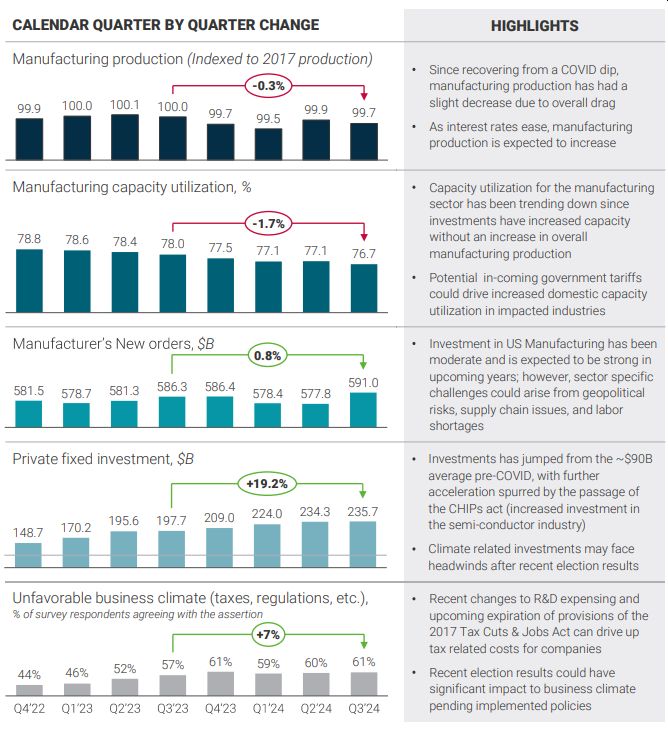

MACRO KPI (USA) - PRODUCTION AND CAPACITY

WHILE PRODUCTION OUTPUT REMAINED FLAT, Q3 WITNESSED A SLIGHT INCREASE IN NEW ORDERS

Source: National Association of Manufacturers (https://nam.org/manufacturers-outlook-survey/),

Federal Reserve Economic Data (https://fred.stlouisfed.org/)

Manufacturing Overview: CY2024 - Q3

MACRO KPI (USA) - LABOR

LABOR COSTS AND WORKFORCE RETENTION CHALLENGES PERSIST WITH SLIGHT SOFTENING

Source: National

Association of Manufacturers (https://nam.org/manufacturers-outlook-survey/),

Federal Reserve Economic Data (https://fred.stlouisfed.org/)

Manufacturing Overview: CY2024 - Q3

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]