The economy has been awash with mixed messages in recent months – throwing a wrench into many employers' workforce planning for 2023.

Even as inflation persists and layoffs at major companies continue to drive headlines, this January saw unemployment fall to a 53-year low and consumer spending increase more than it has in nearly two years. While some economists say mounting interest rates could still lead to a "painful recession," others suggest that if companies cut back on new hires and raises, the labor market could cool down without more job losses.

This complex picture raises important questions for employers in the months ahead. Do they continue hiring as normal? Prepare for a downturn? Implement reductions in force (RIFs) or layoffs?

To understand how uncertain economic conditions are impacting workforce management and planning, Littler surveyed more than 450 in-house lawyers, C-suite executives and human resources professionals in February 2023. Respondents were based across the United States and represent a variety of industries, including technology, manufacturing, retail and hospitality, and healthcare.

Here's what we found.

Confidence in their own businesses remains high, but employers remain concerned about broader economic conditions

The majority of employers we surveyed appear to be responding to what The Wall Street Journal called the economy's "surprising vigor" with resounding optimism in the state of their businesses.

Asked to describe their current level of confidence in their own businesses, 47% said "somewhat high" and 29% said "very high." That upbeat assessment carries through to the year ahead, with nearly identical percentages among respondents concerning the state of their businesses 12 months from now – 47% said "somewhat high" and 28% said "very high."

Larger employers (those with more than 10,000 employees) are slightly more confident than smaller companies (those with less than 500 employees) in the future state of their businesses: 78% of the former say they are somewhat or very confident, compared to 72% of the latter.

Confidence levels varied between industries, with a surprising 77% of technology respondents saying they are somewhat or very confident in the current state of their businesses. A lower percentage of employers in the retail and hospitality (63%) and healthcare (70%) industries said the same. The confidence expressed by tech industry respondents, even as layoffs in this sector continue to dominate headlines, could suggest that companies believe taking steps now to address previous over hiring will prepare them to thrive amid economic headwinds. On the other hand, it could lend credence to the idea that some tech-sector layoffs could be driven by "copycat" behavior rather than necessary cost-cutting.

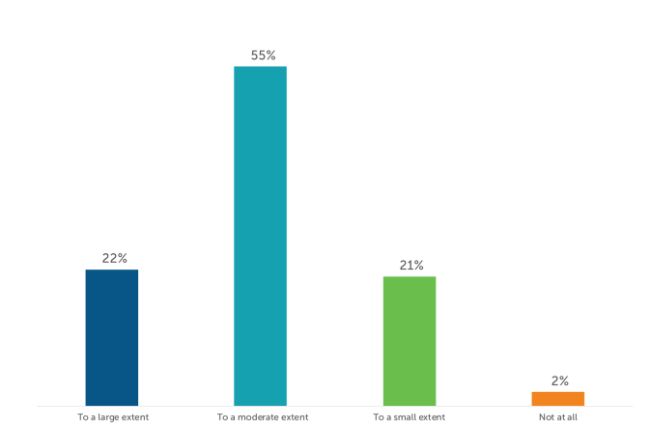

To what extent is the uncertain economic outlook and/or a potential economic downturn a concern of your organization as it relates to workforce management and planning?

Despite confidence in their own businesses, respondents are worried about how the uncertain economic outlook and/ or a potential economic downturn will impact their workforce management and planning. More than three-quarters (77%) of respondents expressed concern on that front – either to a large (22%) or moderate (55%) extent. Tech industry respondents expressed more concern than any other sector, with 87% concerned to a large or moderate extent (30% and 57%, respectively). Healthcare and retail and hospitality respondents weren't far behind, with 82% of both groups saying they are concerned to a large or moderate extent.

nterestingly, fewer manufacturing executives (70%) expressed concern about economic conditions. Since, as one economist says, "manufacturing is typically where recessions start," this could be seen as a positive indicator – though mixed economic data complicates the picture, with one key measure of manufacturing activity in February showing a slowdown in output but improving demand.

Economic uncertainty drives caution in hiring, but layoffs not yet widespread

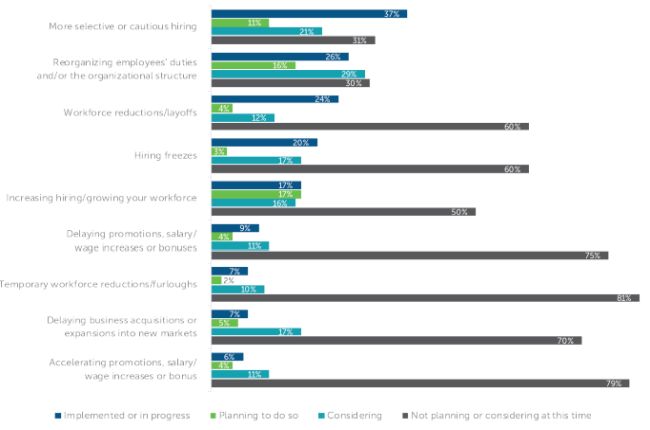

While nearly a quarter of respondents (24%) say they have implemented workforce reductions / layoffs or are in the process of doing so, the more interesting finding may be the lack of layoffs: 6 in 10 respondents say they are not planning or even considering them

More large companies have conducted layoffs (36%) than their smaller counterparts (14%), as well as hiring freezes (28% versus 16%). Smaller businesses appear more keen on increasing their workforces (35% say they are currently looking or planning to do so, versus 28% of large companies).

As a result of economic uncertainty and/or a potential economic downturn, what is your organization's status when it comes to the following actions?

The apparent dissonance between our findings and the prevalence of layoffs in the headlines could be in part due to so-called "loud layoffs," as cuts by tech companies with household names generate outsized media attention while other industries hold off – or even ramp up – hiring. Our data supports this notion. Sixty percent of tech professionals we surveyed say their organizations have conducted or are conducting workforce reductions or layoffs. That compares to 29% in healthcare, 21% in retail and hospitality, and 19% in manufacturing. More tech industry respondents also say their organizations have instituted hiring freezes (29%, compared with 20% of all respondents).

That 60% of all respondents are not planning or considering layoffs could also reflect lessons learned from the pandemic and a fiercely competitive talent market. During the first few months of the initial COVID-19 outbreak, thousands of employers engaged in mass furloughs or layoffs due to business shutdowns. As Littler shareholder Terri M. Solomon points out, "many employers have clear memories of being short-staffed and unable to hire up again quickly when businesses began to reopen in mid-2020.

A New York Times article also highlights the recent difficulty in recruiting and retaining employees, as well as staffing shortages that many industries are still facing, as among the reasons why many companies have not taken the step of conducting layoffs. Indeed, our survey found that 94% of respondents see recruiting and retention as a high (69%) or medium (25%) priority, while 95% are placing a high (68%) or medium (27%) priority on employee engagement.

"Some companies that are content with their current workforces have decided to try to avoid layoffs in favor of maintaining stability of their workforces, and instead try to reduce excess overhead through controlled spending and natural attrition of their workforces," said Solomon. "Others have announced voluntary separation programs where employees who wish to resign may be given a severance package in exchange for signing a release of claims. We are also seeing, though, an increase in RIFs during the last six months, particularly in business sectors that substantially ramped up their hiring to cater to the needs of consumers during lockdowns. We have also seen many companies make business decisions to discontinue certain lines of business that have proven to no longer be profitable, and pursue other lines of business, thus leading to reductions in staff serving the discontinued businesses."

The manufacturing industry appears to be one that is more inclined to take other actions around employment levels to avoid layoffs. In comparison to all respondents, a higher percentage of manufacturing industry respondents have instituted hiring freezes (30%, versus 20% of all respondents), delayed promotions and wage increases (22% versus 9%, respectively), and conducted temporary workforce reductions / furloughs (13% versus 7%, respectively).

The resulting picture is one of employers caught between navigating economic headwinds and recognizing a need to retain talent and grow to position their businesses for future success. For instance, even amid numerous signs of caution in workforce planning, 50% of respondents say they are either currently, planning on or considering growing their workforces.

For employers that have persevered through novel issues created by a global pandemic, a fundamental transformation of the way we work, and one of the most competitive job markets in generations, the uncertain economic climate is the latest example of the complex and nuanced challenges that come with managing a workforce today.

Methodology and Demographics

From February 8-24, 2023, 455 professionals from a variety of industries completed Littler's survey via an online survey tool.

Respondents were based across the U.S. and included:

- General counsel/in-house attorneys (51%)

- Human resources professionals (43%)

- C-suite executives or other professionals (6%)

Companies represented were of a variety of sizes:

- More than 10,000 employees (31%)

- 5,001 to 10,000 employees (12%)

- 1,001 to 5,000 employees (24%)

- 501 to 1,000 employees (8%)

- 101 to 500 employees (19%)

- 1 to 100 employees (6%)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.