- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- with readers working within the Pharmaceuticals & BioTech industries

- within Law Department Performance, Insolvency/Bankruptcy/Re-Structuring and Criminal Law topic(s)

Introduction and Executive Summary

The next 12–18 months will be pivotal for hospitals and health systems as the current healthcare landscape is being shaped by regulatory, operational, and financial pressures that demand transformative strategies.

Successful organizations will treat 2026 as an inflection point—simplifying enterprise portfolios, restructuring operations, and determining how to continue serving communities in a financially sustainable manner. Health systems that embrace this moment as an opportunity will emerge stronger and more resilient, positioned to thrive in a changing market.

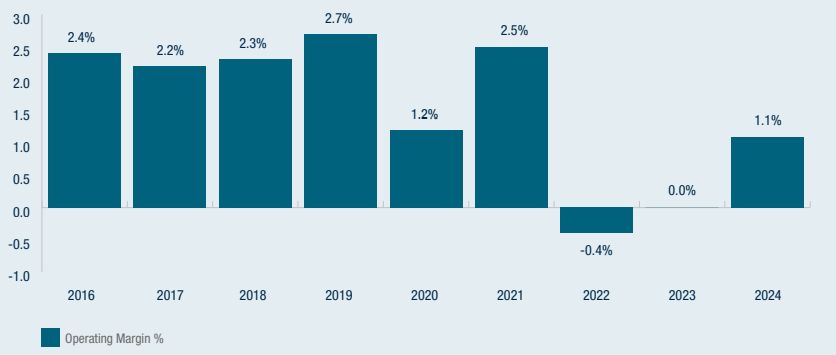

S&P US Not-for-profit Healthcare System Medians

Industry Pressures Setting the Strategic Agenda for 2026

The healthcare industry has been operating on razor thin margins in a challenging environment for many years, as illustrated above.1 Looking ahead to 2026, several powerful forces are emerging that demand heightened strategic focus and coordinated action:

Regulatory Landscape

The "Big Beautiful Bill" (BBB) is expected to increase the number of uninsured patients due to cuts to Medicaid and to the ACA Marketplace provisions forcing hospitals to absorb the costs of treating these patients. The BBB threatens to deepen financial instability and unleash major operational disruptions, pushing many hospitals and health systems beyond their capacity to absorb the impact.

Payer Dynamics

Expanding risk contracts, Medicare Advantage pressures, and rising denials necessitate stronger payer strategies. Changes to existing Medicaid programs will reshape funding and compliance requirements. Even historically favorable commercial contracts must be reexamined to determine whether they can withstand the mounting cost pressures facing hospitals and health systems.

Provider-Sponsored Health Plans (PSHPs)

Many health systems own or sponsor health plans with the intent of capturing premium dollars, diversifying revenue, and advancing integration. While a small handful of systems have achieved scale and stability, the majority of PSHPs have become financial anchors rather than strategic bridges. Reported losses at many health systems illustrate how subscale plans can drain liquidity, freeze hundreds of millions in reserves under risk-based capital rules, and weaken system credit outlooks. Rating agencies now routinely cite PSHP performance in negative reviews, recognizing that hospital and plan economics are not offsetting, but cumulative. The fundamental tension is structural: Hospitals generate margin from volume, while health plans seek to limit utilization. For most systems, PSHPs are consuming capital at the very moment hospitals face their greatest margin pressures in decades. Decisions about whether to double down, partner, consolidate, or exit are no longer optional—they are urgent capital allocation choices that will determine enterprise viability.

Margin Pressures

Hospitals and health systems are facing unprecedented margin pressures driven by a perfect storm of rising labor, drug, and supply costs. At the same time, access to capital has become increasingly limited, making it harder for organizations to invest in infrastructure, technology, or growth. These financial headwinds are compressing already thin margins and threatening the long-term viability of hospitals and health systems across the country. Additionally, care delivery is shifting from inpatient to outpatient settings, requiring hospitals to rethink traditional operating models and adapt to a lower-reimbursement environment particularly as site neutrality policies expand and drive down reimbursement in hospital outpatient departments.

Data and AI Inflection

While emerging technologies offer transformative potential—automating workflows, reducing care variation, and enhancing financial operations—the challenges lie in adopting them effectively as transformation enablers and in not creating additional organizational distractions. Organizations must integrate AI into clinical and administrative processes without disrupting care delivery and while ensuring data quality, interoperability, and compliance. The stakes could not be higher: Without effective use of data and AI, health systems will be challenged to keep up with rising operational complexities and risk negative impacts to both care delivery and financial performance. The reality is that effective data and AI adoption is a requirement to compete in an increasingly data-driven market.

Pillars of Transformation

To address these challenges, four major pillars of transformation will define success in 2026:

1 Financial Resilience and Enterprise Management

Evaluate and optimize assets while aligning financial and operational performance to the new reimbursement and cost realities of the industry. Rationalize service lines, streamline supply chain, structure pharmacy operations for cost-effectiveness, and pursue shared services optimization through new business models and partnerships. Apply discipline through "invest, fix, exit" decision-making and aggressive enterprise portfolio management to protect longterm solvency

2 Payer Strategy and Consumer-Centric Innovation

Beat the trend of unfavorable shifts in reimbursement and payer mix, prioritizing sustainable payer partnerships that create value and advance patient-centric innovations. Advance winning strategies for Medicare and Medicaid while addressing the increasingly price-capped and transparent commercially insured market. Align operations with the expectations of purchasers and payers to deliver high-quality, efficient, and coordinated service to position for success in the value-based landscape.

3 Care Delivery Optimization

Deploy a Right Care, Right Place, Right Time strategy to shift low-acuity care to ambulatory, clinic, and home settings. Align clinical operations and capacity management strategies to minimize leakage and support patient placement. Consolidate underperforming sites, expand access points, and redesign workforce models with automation and teambased care to reduce costs while maintaining quality

4 Digital Adoption and Operational Transformation

Leverage digital tools and AI to automate workflows, strengthen revenue cycle management, and enhance efficiency. Prioritize proven use cases such as clinical documentation, supply forecasting, financial services, and predictive denial management. Consolidate RCM functions into shared services supported by AI-driven workflows.

Phased Execution Roadmap

In 2026 organizations will need to evaluate opportunities within their current operating models and assess whether alternative business models are required to unlock a path to transformational change. Organizational transformation requires disciplined execution across three major phases of work as summarized below.

Rapid Diagnostic Review (Months 1–2)

The objective of this phase of work is to identify and begin prioritizing a range of opportunities across the organization with estimated financial impact. Key activities include establishing a fact base, evaluating current initiatives, and benchmarking against peers. It is also imperative to create a transformation office, which will set accountability structures and align leadership on priorities.

Implementation Plan Design (Months 2–4)

A critical part of this phase of work is putting as much rigor as possible behind the financial sizing and realization timing projections of the prioritized initiatives. Developing multiple plans based on a range of assumptions will position organizations to respond effectively to potential market and policy changes. This scenario planning will help identify and prioritize business cases by impact and feasibility. Realization forecasts will be used to set goals (financial achievement and timing) for the organization and design performance tracking systems.

Implementation Plan Execution (Months 4–12+)

In this phase of work, a structured governance framework will be established to oversee all implementation efforts across workstreams, guided by the prioritized business cases developed. A centralized project management team will drive accountability, track milestones, and ensure alignment with systemwide strategic goals. Progress will be monitored in real time through standardized reporting tools, enabling timely identification of risks and escalation where needed. A targeted communications strategy will be implemented to share early wins, sustain engagement, and build organizational momentum throughout the transformation.

Metrics That Matter

Financial metrics serve as the vital signs of a hospital or health system, providing leaders with clear visibility into the organization's operational health and highlighting resources that are being used efficiently and where critical gaps exist.

For hospitals facing financial distress, these metrics are more than just numbers—they are tools for diagnosis and levers for change. By closely monitoring measures such as revenue cycle performance, labor productivity, service line margins, and liquidity, health systems can pinpoint root causes of financial strain and prioritize interventions that drive stability and long-term sustainability.

Crucially, metrics must move beyond siloed reporting. Provider-sponsored health plan (PSHP) results cannot be evaluated in isolation from the provider enterprise. What may appear as neutral on paper—plan losses offset by hospital inflows—often masks deeper enterprise deterioration once leakage, reserve lockups, and administrative costs are factored in. Boards and CFOs should demand integrated enterprise PMPM reporting that connects plan and provider performance, quantifies reserves frozen under RBC requirements, and translates these impacts into days cash on hand and credit metrics. Without this enterprisewide visibility, capital allocation decisions risk being distorted and liquidity silently eroded.

Profitability

- Operating Margin

- Net Income Margin

- Revenue per Patient Day

Liquidity

- Days Cash on Hand

- Current Ratio

Solvency

- Debt to Equity Ratio

- Interest Coverage Ratio

Market Share and Diversification

- Market Penetration by Service Line

- Revenue Stream Count

- Revenue Diversificatio Ratio

Operational Efficiency

- Average Length of Stay

- Bed Occupancy Rate

- Worked Hours per Adj. Patient Day

- Work Relative Value Units (wRVU)

- Supply Expense per CMI Adj. Patient Day

Quality

- 30 Day Readmission Rate

- Mortality Rate

- Hospital Acquired Infections

- Patient Safety Indicators

Provider-Sponsor Health Plans

- Operating Margin / PMPM Margin

- Medical Loss & Administrative Cost Ratios

- Risk Adjustment Accuracy (RAF capture)

- In-System Utilization & Risk Adjusted Accuracy (RAF)

- System Net Revenue from Plan Members

- Total Cost of Care (TCOC) vs. Benchmark

- Constituent Experience (CAHPS/NPS)

Risks and Mitigations

Large-scale transformation can carry inherent risks, including initiative fatigue among staff, disruption from service line rationalization, and resistance from clinical teams.

Mitigating these challenges requires a deliberate approach: Initiatives should be sequenced and staged with clear, measurable outcomes to demonstrate progress and maintain momentum. Establishing shared governance and defined accountability ensures alignment across leadership, operations, and clinical stakeholders.

Conclusion: A Defining Moment

This is a defining moment for hospitals and health systems. The path forward requires bold leadership, disciplined decision-making, and full engagement of boards and management teams.

Organizations must name accountable executives for each transformation pillar, fund a transformation office, and establish governance structures to ensure progress. Systems that simplify, standardize, and scale with intention won't just survive 2026—they'll thrive well beyond it.

Footnote

1 "U.S. Not-For-Profit Health Care System Median Financial Ratios—2024," S&P Global, August 7, 2025, accessed August 13, 2025.

Originally published on 13 November, 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]