- within Real Estate and Construction, Consumer Protection and Cannabis & Hemp topic(s)

CALENDAR OF EVENTS

Greater New York Dental Meeting

NOVEMBER 28-DECEMBER 3, 2025

New York

The 101st Annual Greater New York Dental Meeting invites attendees to participate in one of the largest Dental Congresses in the world. At the 2024 Meeting, the conference hosted over 37,631 dental professionals, including:

Dentists - 13,470

Dental Assistants - 2,200

Dental Hygienists -2,226 International Countries - 148

For more information, please click here.

Becker's Healthcare's 13th Annual CEO + CFO Roundtable

NOVEMBER 3-6, 2025

Hilton Chicago

This event brings together C-level executives

for dynamic discussions and debates on critical topics, including rural healthcare, digital transformation, health equity, C-suite diversity and

more.

For more information, please click here.

Private Equity trends show continued interest in DSOs and specialty dental practices

Private equity investment in dental practices and DSOs remains robust, with deal volume notably high in recent years despite broader economic uncertainty.

There are several key takeaways from recent PitchBook outlooks and private equity (PE) industry updates that directly apply to dental organizations-particularly DSOS (Dental Service Organizations) and specialty dental practices. These VC trends highlight the accelerated shift toward data-driven, tech-enabled practice management and care delivery that are central to DSO growth and sustained profitability.

Healthtech VC investment reached $7.9 billion in H1 2025, on track for a multiyear high despite fewer deals overall. Median deal size has climbed to $33.8 million, indicating greater capital concentration in later-stage, high-potential companies-often those leveraging Al and digital tools that can scale across provider networks, like DSOs. Mega-rounds for companies such as Transcarent and Abridge, plus high-profile IPOs by digital health platform leaders Hinge Health and Omada Health, highlight a renewed confidence in digital infrastructure and tools that enable scalable care delivery and operational efficiency.

Implications for DSOS

Al Scribes and Documentation Automation: VC enthusiasm around Al scribes, including (Ambience, Abridge), signals a rapid growth in the adoption of Al-powered clinical documentation, which is directly applicable for DSOs looking to cut administrative time, standardize records and reduce burnout. These tools can enhance provider productivity, improve revenue cycle accuracy and elevate compliance in multi- location DSO environments.

Revenue Cycle Innovation: Abridge's expansion into revenue cycle capabilities exemplifies the wave of Al innovation transforming claims processing and payment posting-two pain points for growing DSOs. Automated RCM (Revenue Cycle Management) translates to faster collections and more reliable cash flow.

Focus on Scalable Enterprise Solutions: The Hinge and Omada IPOs demonstrate investor preference for digital health platforms with proven, enterprise-class B2B2C models, mirroring how larger DSOS now evaluate healthtech partners. Solutions must deliver measurable clinical outcomes, integrate across sites and improve operational margins.

Competitive Landscape in Digital Health: As companies enter the market with free and increasingly sophisticated offerings, DSOS must regularly appraise tech vendors for innovation, integration and ongoing adaptability. Al and digital solutions will quickly evolve and organizations must avoid technology lock-in or stagnation.

Operational Excellence, Not Just Growth: The trend of later-stage funding and successful exits for mature, operationally excellent companies (rather than early-stage speculative ventures) favors DSOs that have invested in advanced tech infrastructure and standardized workflows.

Sources: Pitchbook, MedCity News, Canada Health Infoway, Trulark, BOLA AI, Overjet

Study highlights rising dissatisfaction among U.S. dental hygienists Experts say systemic change is required for a sustainable workforce model, which includes equitable pay and benefits, defining advancement pathways, supportive management structures, and streamlining office processes.

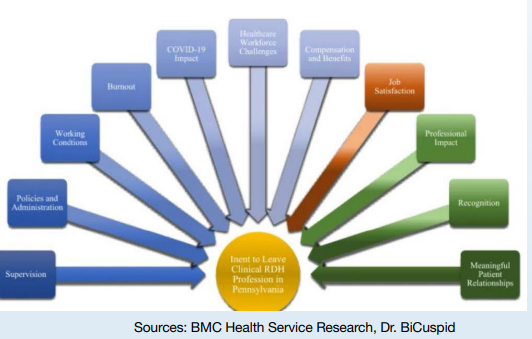

A recent study published in BMC Health Services Research highlights rising dissatisfaction among U.S. dental hygienists, a group already strained by long-standing workforce shortages exacerbated during the COVID-19 pandemic. While hygienists expressed pride in their work and reported having strong coworker relationships, many also reported feeling undervalued, underpaid and lacking in career advancement opportunities. The findings raise concerns that systemic dissatisfaction could exacerbate workforce instability, with ripple effects that extend to patients, communities and healthcare delivery. The study distributed a 36-question survey in 2024 to 328 licensed hygienists in Pennsylvania, most of whom were women (98%), older in age (53% were 55+) and employed in private practice (72%). Results revealed that hygienists rated pride in their work and teamwork highly (mean scores of 5.31 and 5.06, respectively) but expressed significant frustration with extrinsic factors. Nearly 61% disagreed that they were fairly paid and 87% reported few opportunities for advancement. Many also noted that practice rules and administrative barriers hindered their ability to work effectively. These findings suggest that salary dissatisfaction alone does not fully explain tumover and that meaningful career ladders and organizational support are also necessary.

The workforce shortage in dentistry predates the pandemic but has not shown meaningful recovery since. Its impact extends beyond job dissatisfaction, creating strained practice operations and compromising access to oral healthcare services. The study highlights that structural challenges, including limited pay equity, a lack of supervisory support and administrative inefficiencies, must be addressed in conjunction with recognizing the motivating factors that keep hygienists engaged. Without intervention, turnover risks may intensify, deepening the shortage and weakening patient care delivery.

The authors concluded that a sustainable workforce model requires systemic change. Solutions include adopting equitable pay and benefits, defining advancement pathways, building supportive management structures, and streamlining office processes to minimize workplace frustrations. Although limited by self-reported survey data and potential bias, the study highlights that enhancing professional satisfaction through both financial and non-financial factors is crucial for stabilizing the profession and ensuring access to dental care.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.