- in Asia

- within Insurance, Wealth Management and Tax topic(s)

Healthcare Services Transactions Update — Q3 2025

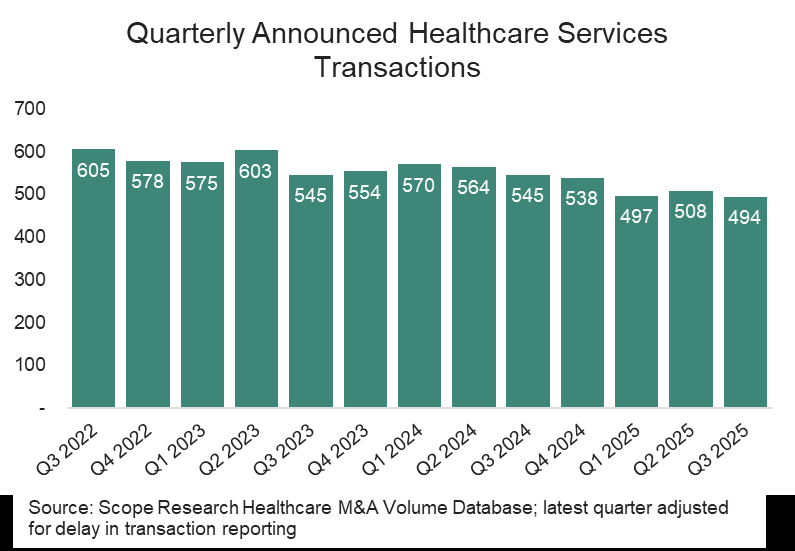

Ankura is pleased to present an overview of healthcare services transactions announced or closed during Q3 2025 in the United States. Total transactions decreased by 2.7% in the third quarter of 2025 after increasing by 2.2% in the second quarter. Compared to Q3 2024, transaction volumes for Q3 2025 were down by 9.3%.

Notable Transactions Announced or Closed in Q31

- Knighthead Capital Management and Marathon Asset Management entered into a definitive agreement to acquire ATI Physical Therapy, Inc. on August 1, 2025, for approximately $2.85 per share. The purchase price implies a $523.2 million enterprise value, or a 0.7x price to revenue multiple and an 11.2x price to EBITDA multiple.ATI provides outpatient physical therapy services through its clinics in the U.S.

- Optum, a subsidiary of UnitedHealth Group (NYSE: UHG), closed its acquisition of Amedisys, Inc. (NASDAQ: AMED) on August 14, 2025. Announced in June 2023, the transaction faced several regulatory challenges before a settlement was reached with the U.S. Department of Justice (DOJ) requiring the divestiture of 164 home health and hospice locations. The purchase price implies a $3.85 billion enterprise value, or a 1.7x price to revenue multiple and a 15.4x price to EBITDA multiple. Amedisys provides home health and hospice services throughout the U.S.

- Cardinal Health (NYSE: CAH) entered into a definitive agreement to acquire a 75.0% interest in Solaris Health on Sept. 15, 2025, for $1.9 billion, implying a 1.6x price to revenue multiple and a 19.2x price to adjusted EBITDA multiple. Solaris Health has partnered with more than 750 providers who provide urology services across 14 states.

- Patient Square Capital entered into a definitive agreement to acquire Premier, Inc. (NASDAQ: PINC) on September 22, 2025, for $2.6 billion, implying a 2.7x price to forward revenue multiple and an 11.0x price to forward EBITDA multiple. Premier, Inc. provides supply chain and technology solutions, including GPO services, to healthcare providers in the United States.

- Privia Health Group entered into a definitive agreement to acquire Evolent Care Partners on September 23, 2025, for $100 million, implying a 10.0x price to EBITDA multiple. Evolent Care Partners previously operated as the value-based primary care division of Evolent Health (NYSE: EVH).

- GTCR entered into a definitive agreement to acquire Dentalcorp (TSX: DNTL) on Sept. 26, 2025, for an implied 2.0x price to revenue multiple or an 11.0x price to EBITDA multiple. Dentalcorp acquires and partners with dental practices throughout Canada.

Key Observations

Total transaction activity in the third quarter of 2025 decreased slightly over the prior quarter for the healthcare services industry. While inflation remained relatively steady and the Federal Reserve cut rates at its September meeting as expected, these positive economic indicators were not enough to spur mergers and acquisitions (M&A) activity in the quarter.

Healthcare operators received mixed news with the passage of the One Big Beautiful Bill Act (OBBBA) on July 4, 2025. While the tax provisions included are generally beneficial to corporations, the OBBBA cuts $1 trillion from federal healthcare funding over the next decade, which will have a significant impact on certain healthcare sectors. For more insights on the OBBBA, explore Ankura's article diving into the implications of the OBBBA for the healthcare industry.

Federal regulatory scrutiny of healthcare transactions remained active in Q3, though certain developments signaled a more balanced approach. In August, President Donald Trump revoked the 2021 Executive Order on Promoting Competition in the American Economy, suggesting a shift toward a more business-friendly regulatory posture, particularly for hospital and health system M&A. UnitedHealth Group also closed its acquisition of Amedisys in August for $3.3 billion after two years of regulatory challenges. However, federal agencies such as the DOJ and Federal Trade Commission (FTC) continue to closely examine transactions involving private equity-backed platforms and roll-up strategies, with a focus on community impact and competitive dynamics.

State-level regulatory barriers increased meaningfully during the third quarter, with a growing number of states implementing or expanding requirements for healthcare transactions. At least 15 states have introduced or enacted legislation requiring pre-closing notifications, public disclosures, or ongoing reporting post-closing. These requirements tend to focus on deals involving a management services organization (MSO) structure and private equity involvement in healthcare. For example, California's AB 1415, which was signed into law in October, expanded the notification requirements to encompass private equity investors and MSOs.

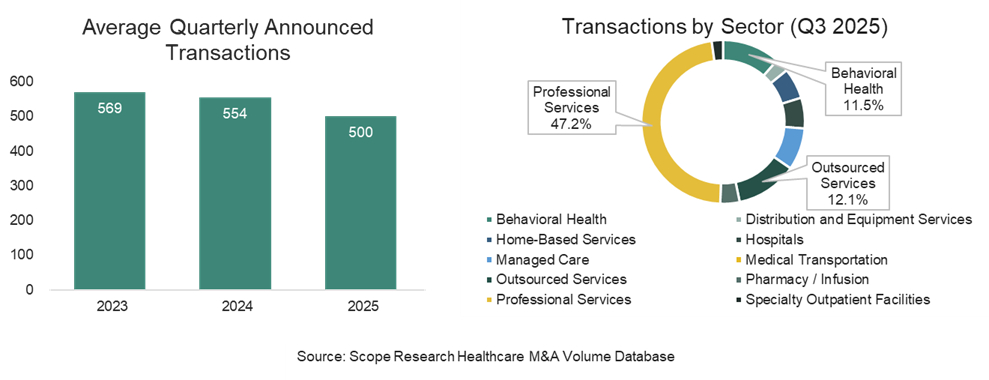

As shown in the figures below, recent healthcare acquisitions continued to be dominated by three sectors making up 70.8% of transactions in Q3: Professional Services2, Outsourced Services2, and Behavioral Health. The Professional Services sector remained the most active sector in terms of total transactions as a result of continued interest from health systems and private equity buyers alike, accounting for 47.2% of total deal volume.

While Professional Services remained the most active sector, Q3 was the first quarter since 2022 where Professional Services represented less than 50% of total transactions. This decline in transaction activity was driven primarily by a 50% decrease in Dentistry, while Physician Practice acquisitions remained relatively steady.

Hospital transaction activity recovered in Q3, reflecting a 92.9% increase over the prior quarter. Much of this transaction activity was driven by acquisitions by not-for-profit operators and divestitures by distressed organizations.

During the quarter, Ankura's transaction advisory practice provided guidance on a diverse range of deals across the sector, including transactions in acute care hospitals, dentistry, behavioral health (spanning autism services, addiction treatment, and psychiatry), physician practices, and long-term care services.

Future Outlook

Looking toward the end of the year, healthcare investors will closely monitor economic indicators, including inflationary pressures, borrowing costs, and regulatory requirements at both the federal and state level. The Federal Reserve is generally expected to cut rates in its final two meetings of the year, which could spur transaction activity. Operators will also observe the impact of new regulatory barriers as states implement notification or approval requirements.

We anticipate an increase in transaction activity, with a more focused approach on specific geographic regions and healthcare sectors due to anticipated impacts from the OBBBA and regulatory scrutiny.

About Ankura Healthcare Transaction Advisory Services

Healthcare transactions are inherently complex. With deep industry experience, Ankura delivers insights to make informed investment decisions in mergers, acquisitions, and partnerships.

Ankura's healthcare transaction advisory team is deeply rooted in the healthcare sector, leveraging extensive industry knowledge and expertise to anticipate critical financial accounting aspects of transactions while also understanding the operational drivers. This enables us to proactively address critical financial accounting aspects and operational drivers of transactions.

What sets us apart is the collaboration between our financial accounting due diligence experts and Ankura's specialized teams in healthcare valuation, healthcare operations, tax, information technology, commercial strategies, and human capital. This collaboration ensures a seamless, integrated reporting process for you, combining diverse expertise to provide a holistic view of every transaction. Our approach guarantees that you receive nuanced, actionable insights in a unified and strategic manner.

With senior deal professionals engaged in every transaction phase, we provide immediate updates on significant deal factors and a dedicated analysis of any critical issues, ensuring a thorough understanding and resolution of underlying concerns.

Connect with one of our healthcare transaction advisory experts

to navigate the complexities of healthcare with confidence. Meet

our dedicated professionals at the link below and reach out to us

for more information.

Footnotes

1 Sources: Scope Research Healthcare M&A Volume Database, published by Scope Research; Capital IQ

2 The Professional Services sector includes dentistry, physical therapy, physician practices, urgent care, veterinary, and other clinics. The Outsourced Services sector includes billing, revenue cycle, management services organizations, marketing, staffing, and other services commonly outsourced by medical practices.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.