- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- with readers working within the Oil & Gas and Pharmaceuticals & BioTech industries

- within Compliance topic(s)

Here's a new word I heard today that I will awkwardly insert into my next conversation – "transrupt." It is what happens when you have simultaneous disruption and transformation that both damages the existing system and creates (hopefully) a new and better system. Using it in a sentence: "Amazon transrupted how books are sold." Or perhaps more apropos to this week – "Someone needs to transrupt the orthopedic/ MSK (musculoskeletal conditions) sector."

"Sticks and Stones will break my [budget?]"

As those of us who work with private equity funds know, the MSK sector is a hot area for investment. Why is that? As noted in both the Ascension and Hinge Health presentations this week, 1 in 2 adult Americans suffer from MSK conditions which now are costing annually about $400 billion. MSK claims have doubled over the last decade, and MSK and behavioral health conditions are the leading two causes of disability in the U.S. So, aside from the above and the fact that as seniors live longer they will need more MSK care, why would private equity be interested in MSK?

MSK is heavily procedure based, and until recent times dependent on inpatient surgery and care/recovery. That, however, is changing. Susan Diamond, Humana's Chief Financial Officer, noted a trend in late 2022 in Humana's senior members for orthopedics and musculoskeletal disorders transitioning from inpatient care and procedures to outpatient. Kaiser Permanente has been working for some time now on its same day hip replacement program, with no inpatient days at all. We continue to see more and more complex procedures moving into ambulatory surgery centers (ASCs), with ASCs also becoming a more critical strategy component for health systems as noted in the Ascension presentation.

Daniel Perez, CEO of Hinge Health, also shared the interesting insight that MSK has high variability in clinical pathways with limited or still evolving clinical guidance. When and how to do a spinal surgery or joint replacement is the judgment call of the provider, which according to Perez is less evidence-based than it should be. He also shared that their analysis of their large dataset showed that 5% of members drive 85% of MSK expenses. That's reminiscent of the well-known Medicare Advantage statistic that about 4% of Medicare Advantage members drive 40% of Medicare Advantage total expenses. So, as we have seen in successful management of seniors, wrapping care around high-risk/high-utilizing members can improve their health and reduce the total cost of care.

Hinge has developed an interesting hybrid (virtual and in-person), multiple line of business model that is offered to both employers and health plans and is provided through a subscription model, with guarantees for the employer of clinical outcomes, employee engagement and return on investment. The Hinge model uses a care team of physical therapists, health coaches, doctors and orthopedic surgeons to actively manage patients and also provides both virtual physical therapy and a wearable pain management/nerve stimulation device, Enso.

The physical therapy model delivers virtual rehabilitation services using motion technology through a mobile phone or iPad that tracks 87 unique points on the patient's body and therefore allows close management of the virtual physical therapy. The patient services are commenced through an in-person physical therapist visit to establish the relationship, set up the opportunity for virtual treatment and complete onboarding activities. This program, which is aimed at high- risk members, is launching first in Chicago and then will expand nationally. The pain management device, Enso, was acquired by Hinge in 2021 and reportedly is able to achieve a much more robust therapeutic effect than the standard TENS machine, without having to use surgical implants as has been the case. Perez reported an over 50% reduction in pain and functional improvement. Given the above, it's not surprising to see that Medicare is a fast growing line of business for Hinge, as is employer-based business.

Thinking Outside the Box

Both Ascension Health and Sutter Health highlighted the important strategy for health systems of focusing on and growing their ambulatory networks. Those networks, which can include ASCs, urgent care centers, outpatient imaging centers and physical therapy clinics, are important to provide access to community members for the services they want and where they want, while maintaining care coordination and quality. Put together a robust ambulatory network with continued growth in proprietary physician networks, and the health system's ecosystem reduces patient leakage, improves the patient experience and captures more of the premium dollar. If inpatient services (i.e., services within the hospital "box" or tower) are going to continue to transition to outpatient, then a health system must own or partner on ambulatory services, or they will risk losing both patient revenue and loyalty.

The other interesting note from Ascension was their successful ongoing implementation of Salesforce in multiple capacities. Ascension found that the use of Salesforce allowed for better standardization of workflows, resulting in more efficiencies and lower costs. When used in clinical patient engagement, such as to track and initiate the closure of care gaps, they reported a stunning 30% response rate by patients. That was measured by a patient scheduling an appointment following the Salesforce guided outreach and engagement process. This is a much higher engagement rate than the traditional single digit percentages seen using older approaches. That percentage, incidentally, mirrors the level of Cologuard colonoscopy-alternative response rate achieved by Oscar Health reported several years ago at an earlier J.P. Morgan Healthcare Conference presentation, which patient engagement occurred through an app and included a patient discount incentive.

Warner Thomas, the new CEO of California's Sutter Health, reported on an interesting structural initiative to transform (transrupt?) Sutter's organizational structure by moving from a traditional parent holding company structure to an integrated operating company model. Thomas indicated that he believed this integrated structure would allow Sutter to run faster and leaner. Given the prevalence of holding company structures in the hospital/health system sector, it will be interesting to track Sutter's progress and see if this is a lesson that can be generalized.

The Game of Risk

Following up on yesterday's deeper dive into Medicare risk and risk adjustment, multiple presentations this week have discussed the need to teach doctors how to take risk, to prepare health systems for taking risk, or to change the mindset to one that supports risk and the like. But, in a recent presentation at another conference by Ford Koles of the Advisory Board, many so-called risk arrangements are missing a critical element – putting downstream payments from health plans and the government to physicians and hospitals at actual downside risk, rather than just providing traditional fee for service payments or value-based payments that are fee for service with a "kicker" or upside incentive. With downside risk, there is good alignment of incentives to maintain or improve the patient's health – the provider makes more if the patient remains healthy and/or stable and the total cost of care is reduced. Ford shared some very interesting statistics that show we still have a long way to go to "transruption" of the fee for service model.

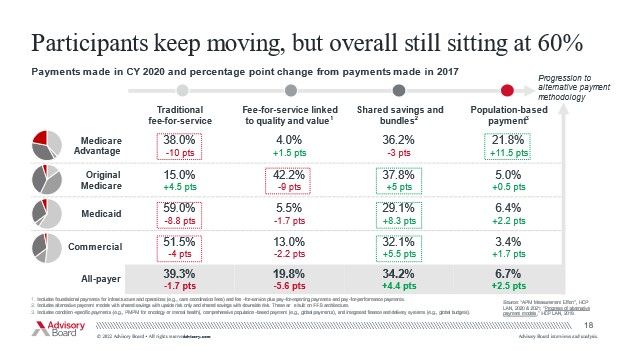

As seen in the below Advisory Board analysis, over 75% of Medicare Advantage payments to downstream providers still are some form of fee for service linked payment and not capitation, population health management or risk-based. Given the amount of market attention on companies taking global risk, you would think the amount of risk-based downstream payments would be much higher – but that is not yet the case nationally. And my view is that for risk – or a population-based payment – to be effective, the providers must also be at risk, with both meaningful downside and upside resulting from their own activities.

The fee for service component of so-called "managed" Medicaid is even higher than Medicare Advantage, with well over 90% of payments not being at risk. Commercial insurance clearly still is focused on fee for service. We certainly have seen strong movement, per the below, toward shared savings, but many of such programs don't have downside risk for providers, or enough meaningful upside dollars, that can drive behavior change.

CMS wants to have every Medicare beneficiary in some form of value-based program by 2030, but will those value-based programs be meaningful and structured to drive improved outcomes and reduction in total cost of care? Or will they merely be another ineffective step in the long list of programs trying year after year to reduce healthcare costs? Wasn't it the famed healthcare economist who, when recently evaluating total cost of care reduction, said: "Tomorrow, and tomorrow, and tomorrow, Creeps in this petty pace from day to day, To the last syllable of recorded time." As we have been hearing this week at the J.P. Morgan Healthcare Conference, we can do better.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.