- within Criminal Law, Strategy and Family and Matrimonial topic(s)

Key Takeaways:

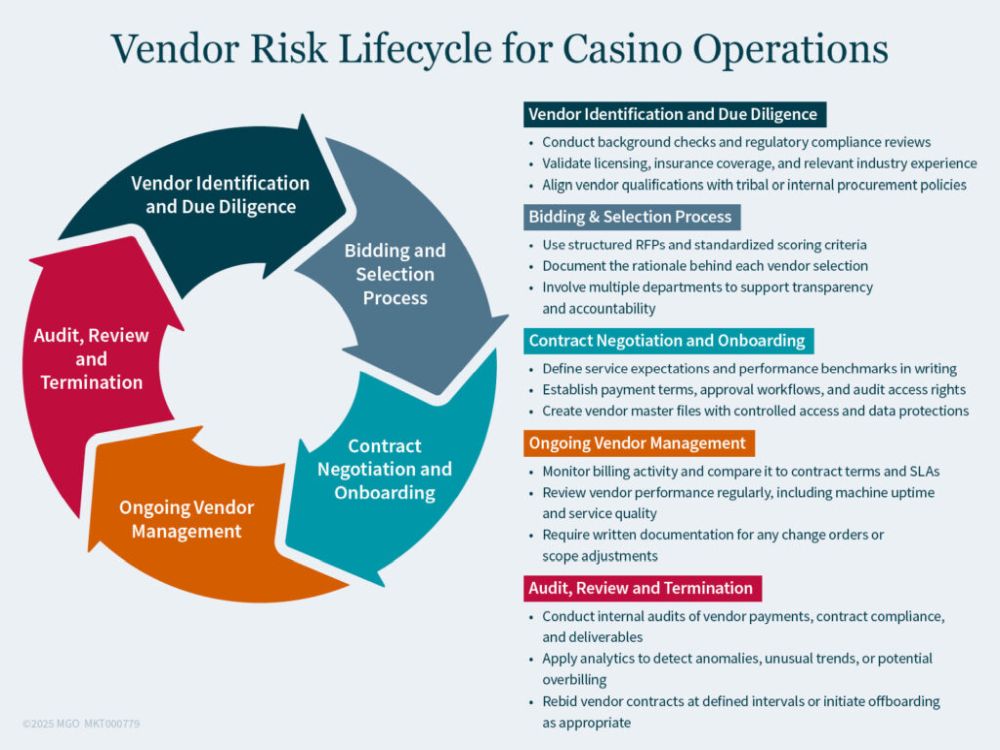

- Strengthening casino vendor oversight with due diligence and clear contracts helps reduce the risk of billing errors and fraud.

- Comparing vendor performance and financial data over time can reveal patterns of overbilling or potential collusion.

- Implementing formal procurement policies and periodic vendor audits improves transparency and protects casino operations from third-party risk.

—

Casino operations rely on a web of third-party vendors: gaming equipment providers, maintenance companies, information technology (IT) vendors, food and beverage suppliers, and more. These relationships are critical — but also a potential source of financial risk and fraud.

Without proper oversight, casinos may face overbilling, favoritism, or even collusion between employees and vendors. Strong third-party risk management supports vendor relationships that are transparent, fair, and aligned with your operational goals.

Where Vendor Risk Starts

Risks often originate in the procurement process — during bidding, vendor selection, or contract negotiation. If policies are vague or inconsistently enforced, it becomes easier for fraud to go undetected.

Common issues include:

- Inflated or duplicate invoices

- Vendors repeatedly selected without competitive bidding

- Undisclosed relationships between staff and vendors

- Lack of performance reviews tied to contract renewal

Implementing Due Diligence

A strong vendor risk management program begins with how vendors are evaluated and brought into your casino operation. Strengthening this onboarding process means looking beyond just pricing or convenience — it involves examining each vendor's qualifications, background, and long-term fit.

Start with foundational due diligence: verify business licensing, confirm current insurance coverage, and review the vendor's performance history. These steps are particularly important when working with slot machine suppliers, IT service providers, or contractors who will interact with sensitive systems or customer environments.

Establishing a clear and consistent selection process helps reduce subjectivity and increase transparency. Formalizing your RFP approach, using documented scoring criteria, and involving multiple departments in vendor decisions can help your organization minimize bias, compare proposals fairly, and keep a well-documented trail of how and why each vendor was chosen.

Due diligence isn't just about checking boxes — it's about laying the groundwork for secure, compliant, and productive vendor relationships.

Monitoring Performance and Billing Trends

Ongoing oversight is just as important as front-end screening. Use internal data analytics to compare:

- Vendor performance versus floor output (e.g., slot machine efficiency)

- Billing trends over time by vendor

- Purchase patterns by department or employee

- Any anomalies — such as consistently underperforming vendors who continue to receive high billing — may call for closer review

Reinforcing Accountability Through Segregation of Duties

One of the most effective ways to reduce vendor-related risk is through thoughtful segregation of duties. When a single individual has control over multiple steps in the procurement process — such as selecting vendors, approving invoices, and managing reconciliations — it becomes easier for mistakes or misconduct to go unnoticed.

Strengthening internal controls in these areas supports better oversight and creates natural checkpoints within your vendor lifecycle. For higher-risk areas, implementing dual-approval workflows for vendor payments can provide an added layer of review. Placing defined limits on discretionary spending, along with routine, independent reviews of vendor contract, helps reduce the potential for conflicts of interest or control gaps.

While these protocols support compliance, they also reflect a broader commitment to operational integrity. By building transparency into day-to-day workflows, your organization sends a clear message that accountability matters at every level.

A Real-World Scenario

One casino discovered a long-standing vendor relationship that had never been competitively reviewed. Slot machine lease terms were uncoordinated with floor performance, and billing anomalies had gone undetected for years.

After a targeted vendor audit and analysis of machine revenue, the casino renegotiated terms and implemented stricter selection policies — saving hundreds of thousands annually.

Supporting Better Oversight

At MGO, we help casinos and gaming operators strengthen their third-party risk frameworks through internal audits, analytics, and policy advisory. From vendor selection to billing review, we support your team with objective insight and scalable solutions. Contact us today to learn how we can help your business better manage risk.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.