- within Finance and Banking topic(s)

- with readers working within the Banking & Credit and Securities & Investment industries

- within Insolvency/Bankruptcy/Re-Structuring and Law Department Performance topic(s)

Americans are deeply concerned about their financial futures—and our recent research highlights the urgency of addressing retirement income security.

In a recent survey of retirement plan participants aged 40–60, a top concern emerged: the fear of outliving retirement savings. This anxiety received an average rating of 4.29 out of 5, with many respondents asking the troubling question:

"What happens if I run out of money in retirement?"

There is also a strong demand for guaranteed income:

Despite this overwhelming interest, only 3% of participants had heard of in-plan annuities — a product specifically designed to meet this need.

This gap between consumer desire and product awareness signals a significant market opportunity.

What Are In-Plan Annuities?

In-plan annuities are annuity products offered within employer-sponsored retirement plans such as 401(k) or 403(b) plans. They allow participants to allocate a portion of their retirement savings to purchase an annuity directly within the plan. The result? A guaranteed stream of income during retirement, which can help protect against longevity risk.

In-plan annuities function similarly to their retail counterparts: they may be immediate or deferred, fixed or variable. Increasingly, they are also integrated into target date funds (TDFs)—with a portion of the participant's contributions automatically allocated to fund the annuity component over time.

Why Now? A Tipping Point for Growth

The concept of in-plan annuities isn't new — but the environment has shifted in their favor. A combination of factors is driving renewed momentum:

These conditions position in-plan annuities as a key growth area for insurance carriers and retirement plan providers alike.

Digging Deeper: A&M's Research Approach

To better understand the landscape, A&M conducted a mixed-methods study, including:

Reframing the Conversation: From the Three C's to SPACE

In conversations with industry stakeholders, a consistent theme emerges: the "Three C's" – Cost, Complexity, and Choice. These concerns are particularly relevant for plan sponsors evaluating in-plan annuities.

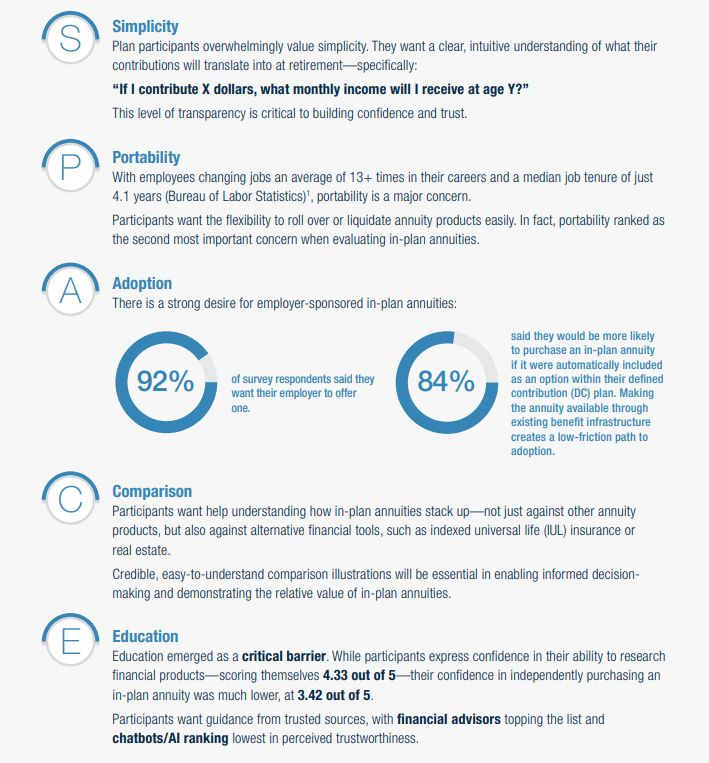

However, our research with plan participants revealed a different set of priorities—what we call the "SPACE" framework:

The Disconnect: Strong Demand, Slow Adoption

As these insights show, there is a clear and growing demand among employees for guaranteed lifetime income through in-plan annuities. Yet, despite this interest, market adoption remains sluggish. Why are new entrants struggling to gain traction?

The answer lies in a series of persistent and interconnected market challenges:

Key Challenges in the Market

1. Plan Sponsor Adoption

Plan sponsors remain hesitant to implement in-plan annuities due to perceived cost, complexity, and fiduciary risk.

Even with the SECURE Act offering safe harbor provisions, concerns about potential Employee Retirement Income Security Act (ERISA)-related litigation—including lawsuits targeting board members—continue to pose barriers. Many sponsors are risk-averse, and the lack of precedent in this space amplifies that caution.

2. Participant Education and Benefit Communication

Most employees have limited awareness of in-plan annuities and struggle to understand their benefits, especially the value of guaranteed lifetime income.

Compounding this is the fact that many plan sponsors themselves lack expertise in annuity products and are not equipped to educate participants effectively. This lack of understanding on both sides leads to low enrollment and weak product penetration—critical metrics for success.

3. Product Complexity

Annuities are inherently complex products, and in-plan annuities add another layer of difficulty due to administrative and recordkeeping requirements.

Carriers and asset managers are tasked with designing solutions that are flexible enough to meet participant needs, yet simple enough to be understood and implemented without friction. Striking this balance remains a major challenge.

4. Capital Intensity

Offering in-plan annuities requires significant capital reserves to meet regulatory requirements and ensure long-term financial strength.

5. Distribution and Sales Challenges

Traditional annuities are often sold through financial advisors, and even self-directed consumers frequently consult a planner before purchasing.

The absence of a clear, proven distribution pathway continues to hinder growth.

The Way Forward for Asset Managers

The in-plan annuities market represents one of the most significant untapped opportunities in retirement planning, with 92% of participants wanting employer offerings despite only 3% current market awareness. For asset management firms, success requires navigating three critical challenges: product development, distribution strategy, and asset management integration.

The Build vs. Partner Decision

Asset managers face a fundamental strategic choice that will determine their competitive positioning and time to market. While developing proprietary in-plan products offer greater control, it requires building entirely new organizational capabilities—particularly in group benefits and annuity product expertise that fall outside traditional asset management core competencies.

The Partnership Path Offers Compelling Advantages:

This strategic decision fundamentally shapes capital allocation, competitive positioning, and success metrics in what remains a largely greenfield market.

Distribution Strategy: The Critical Fork in the Road

The choice between mass market defined contribution (DC) penetration and advisor-led high-value sales creates entirely different product architectures and success frameworks. Survey insights reveal that product design must be distribution-channel specific to maximize effectiveness.

Mass Market DC Approach: Simplicity Drives Adoption

The choice between mass market defined contribution (DC) penetration and advisor-led high-value sales creates entirely different product architectures and success frameworks. Survey insights reveal that product design must be distribution-channel specific to maximize effectiveness.

Product Characteristics for DC Success:

Success metrics shift dramatically in this approach. Traditional AUM-focused KPIs become secondary to participant enrollment velocity. Asset managers should target their first 500,000 plan participant enrollments before optimizing for individual asset growth—a fundamental departure from conventional asset management metrics.

This mass market strategy creates sustainable competitive advantages through plan-level relationships and first-mover positioning while market awareness remains nascent.

Advisor-Led Distribution: Customization for Higher Value

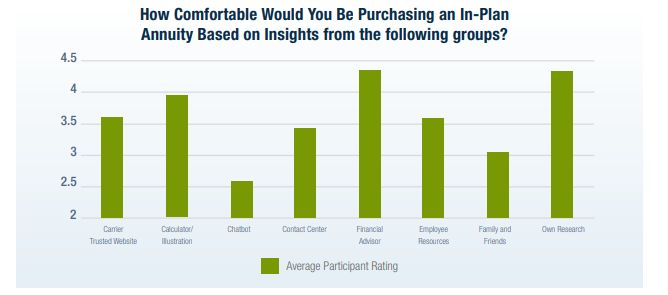

For asset managers prioritizing AUM growth over participant volume, the advisor channel offers access to higher-value clients despite greater complexity. Survey data shows financial advisors rank as the most trusted education source (4.35 out of 5) for in-plan annuity adoption.

High-net-worth segment characteristics reveal the opportunity:

These clients seek product flexibility and customization that advisor relationships can deliver, justifying more complex product architectures.

Bridging the Education Gap Through Technology

Asset managers can overcome their lack of direct customer relationships by leveraging technology to support both distribution channels:

Digital Education Solutions:

These technology solutions create scalable education platforms that support advisor distribution while building direct engagement capabilities.

Market Timing Advantage

The convergence of low current awareness (3%) with overwhelming latent demand (92%) creates a rare first-mover opportunity. Asset managers who establish clear strategic direction and market positioning now will benefit largely as the market scales to meet this demand.

Success in in-plan annuities requires early strategic clarity on target segments and distribution channels. The firms that move decisively while the market remains nascent will capture sustainable competitive advantages as participant awareness and adoption accelerate.

Originally published 1 December 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]