- within Finance and Banking topic(s)

- in Europe

- in Europe

- in Europe

- in Europe

- in Europe

- with readers working within the Law Firm and Construction & Engineering industries

- within Finance and Banking, Media, Telecoms, IT, Entertainment and Law Department Performance topic(s)

- with Finance and Tax Executives

SMART SUMMARY

The European PE fund landscape is experiencing a shift in carried interest waterfall structures away from the traditional single-tiered, whole-of-fund structures. From premium carried interest to deal-by-deal and hybrid waterfalls (either baked in or "on the menu"), there is a proliferation of innovative structures in the market. In this note, we highlight current trends, the justifications behind them and key practical considerations for managers contemplating such an alternative approach.

Current Trends: Flexibility and Divergence

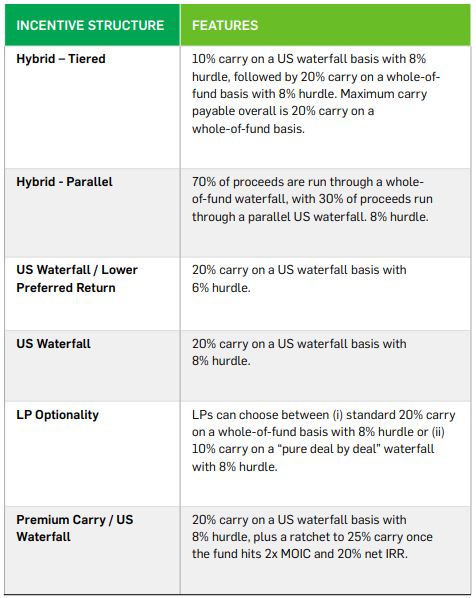

Across the European market, there is a visible increase in structural innovation at all levels. We are seeing a wide array of structures in practice, including structures with some (or a combination) of the following features:

- Hybrid models: blending whole-of-fund and deal-by-deal elements.

- Lower preferred return thresholds: often combined with US-style waterfalls.

- Premium or tiered/ratcheted carry: linked to performance in excess of "normal" target returns.

- LP optionality: giving LPs a choice between standard and alternate terms.

Recent Market Examples

What are the Justifications for Alternate Economics?

Incentivisation and Alignment. Carry waterfall structures with greater upside for outperformance, or where carry is distributable earlier, are highly attractive to executives and members of the investment team. These structures can be an important tool in attracting and retaining top-tier investment professionals, particularly in an industry with fierce competition for top talent. And ultimately, effective incentivisation of the team is fundamental to alignment with LPs.

The current macroeconomic environment of long hold periods and low DPI ratios has made this incentivisation argument even more potent for waterfall structures which incorporate deal-by-deal elements where early exits generate a portion of carried interest and reduce the wait time without increasing the overall quantum ultimately paid.

For emerging managers, deal-by-deal elements can be justified on the basis that these managers will often be competing for talent with European-style carry competitors who are able to offer carry in more mature predecessor funds, and these deal-by-deal elements can allow emerging managers to stay competitive. Earlier distributions can be vital in allowing emerging managers to build out and meet their working capital needs and "house" funding requirements in successor vintages.

For top-quartile fund managers, favourable supply-demand dynamics can give greater latitude to propose bespoke terms on the basis of incentivising deal team outperformance, which aligns with LP demand in the current market for "genuine" alpha and serves to attract and retain those capable of delivering such returns to LPs.

Practical Takeaways

Managers considering adopting premium or atypical economic structures should bear in mind the following:

- LP Due Diligence / Messaging: Transparency is key. Clear explanations and worked examples are increasingly expected by LPs. Managers should work with legal counsel and/or placement agents to craft and present a compelling rationale for their differentiated model (and address any potential concerns of LPs e.g. around potential overpayments).

- Clawback Protections: As deal-by-deal waterfalls heighten clawback risk, LPs may require enhanced clawback protections such as fundlevel escrow arrangements, interim clawbacks, house guarantees or other protections.

- Administrator Readiness: Complex waterfall mechanics must be modelled and administered with accuracy – in selecting administrators or amending documentation when existing administrators are already onboard, new modelling should be undertaken in advance of fundraising launch.

- Clarity in Drafting: It is important that these complex mechanisms are drafted clearly in the LPA with no room for ambiguity. Not only is this important to ensure LPs, the manager and the administrator are all aligned, but in a world of increased regulatory scrutiny, transparency from the outset is critical.

In a challenging fundraising and transactional market, premium and alternate performance fee structures can play an important role in ensuring incentivisation and alignment between managers and their LPs. As the European PE fund market evolves and these types of structures become more common, we expect LPs to become increasingly familiar with evaluating and underwriting such models, and for the divergence away from the "2 and 20" traditional model to continue.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.